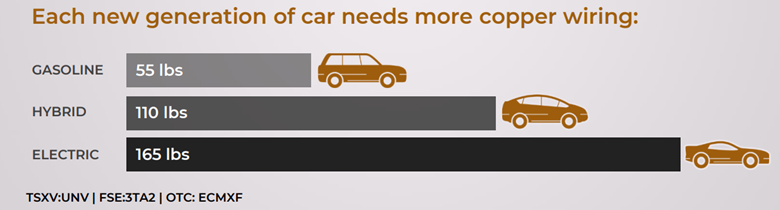

The typical electric vehicle (EV) contains 165 pounds of copper — three times the amount of copper used in an internal combustion vehicle. It is forecast that in two years, one out of five vehicles sold worldwide will be electric. This leads experts to predict copper demand will reach a whopping 25.5 million tonnes annually by 2030. Those same experts predict supply — 19.1 million tonnes annually — will fall short of expected demand.

As a result of these kinds of forecasts investment dollars are again flowing into the copper exploration industry, allowing companies like Universal to continue to expand their copper project, Universal Copper Ltd. (UNV:TSX; ECMXF:OTC; 3TA2:FSE) is doing in British Columbia.

The 2022 Spring drill program is now underway . . . with 2,000 meters of drilling planned in four holes.

“It is currently estimated that demand is outpacing supply by roughly 85,000 kilotons annually, and very little investment has been made in exploration over the last decade. These two reasons will drive both the shortfall in supply and the rising price of copper,” Universal Copper’s CEO Clive Massey told Streetwise Reports.

“In previous copper cycles, there have been very large copper deposits waiting for stronger prices enabling them to go into production. That is not the case today, the average age of the mines now in production is 19 years, and those mines are not getting any bigger,” he added.

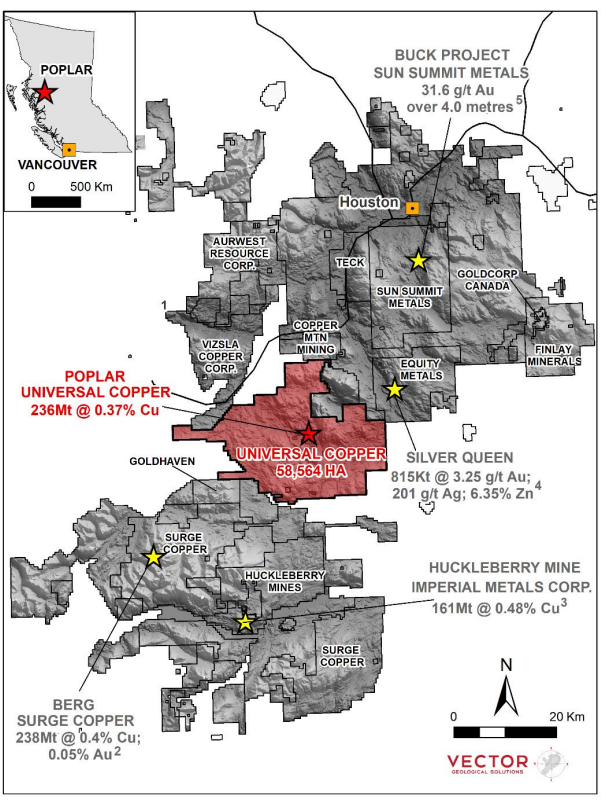

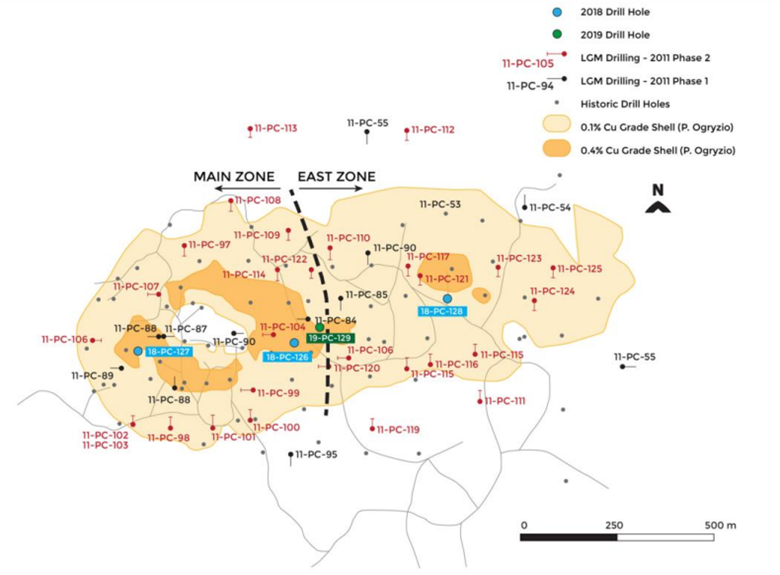

Universal Copper is a Canadian-based copper exploration company whose flagship Poplar Copper Project is one of the most advanced pre-production copper projects in British Columbia. Universal Copper acquired the project in 2017, and updated the 43-101 resource in 2021.

The Poplar copper project is a porphyry deposit, porphyries typically occur in clusters. “We already know that our known area of discovery hosts 2 billion pounds of copper. Through soil sampling, mapping and ground and air geophysical surveys, we have identified what we believe are at least nine other porphyry targets. Any one of these other targets could host a deposit the same or similar to that of the Poplar,” Massey added.

“Rather than building a mine, we are building shareholder value by leveraging our exploration model and expanding the Poplar Project as well as exploiting our other exploration targets making us a candidate for an M&A event with another mining company. This is always the fastest path to profits for investors,” he told Streetwise.

'Significant Copper' in Poplar

The results of the 2021 fall drill program, released in March, encountered very significant copper intersections, including:

- 479.75 meters at 0.56% copper equivalent (CuEq) – 0.408% copper, 0.013% molybdenum, 0.13 g/t (gram per ton) gold and 2.89 g/t silver; and

- 432.8 meters at 0.57% CuEq – 0.432% copper, 0.011% molybdenum, 0.15 g/t gold and 1.80 g/t silver; and

- an open 129 meters at 0.685% CuEq – 0.546% copper, 0.15 g/t gold and 6.94 g/t silver at the base of 21-PC-135.

The 2022 spring drill program now underway will build on those results, with 2,000 meters of drilling planned in four holes. Specifically, Massey said, efforts will focus on the 21-PC-135 intersection, “where recent re-interpretation of the historic drilling mineralization plunges to the northeast.”

That current indicated mineral resource includes 152.3 million tonnes (MT) grading 0.32% Cu, 0.009% molybdenum, 0.09 g/t gold, and 2.58 g/t silver and the undiluted current inferred mineral resource of 139.3 MT grading 0.29% copper, 0.005 per cent molybdenum, 0.07 g/t gold, and 4.95 g/t silver.

Results from the current drill program are expected in late May or June.

The fall 2022 drill program will test Copper Pond, the most advanced of the peripheral targets, and one that has already had some groundwork done. That work is forecast to start in November, with results early in 2023.

The 61,600-hectare Poplar project sits between the Huckleberry Mine, owned by Imperial Metals Corp., 35km away, and 42km from Equity Silver’s Sliver Queen Mine . All three projects are in the highly prospective Kaselkwa Hazelton rock package, which in the past has drawn the interest of mid-tier and larger mining companies, including Mitsubishi’s Mineral Resources Group and Sumitomo Metal Mining Company, according to Massey.

The property is accessible by road all weather haul and rail heads are near by; only 88km from Houston and 400km to the deep-water port at Prince Rupert. It is bisected by a hydroelectric power line and, thanks to little annual snowfall, can be worked year-round.

Universal Copper’s strategy to explore the property and position it for purchase by a larger firm for development into a mine relates in part from Massey’s experience over a 35-year career in exploration. He was on the team that developed the Lisbon Valley copper project in Utah into a mine, a 10-year process that Massey describes as “brain-damaging.”

At Magistral copper project in Peru, he watched the project be taken over by the Peruvian government. And at Lumina, which once held the world’s largest copper reserve, Massey worked with the team that developed and sold the enterprise for $450 million.

The Power of Good Relationships

The relationships Massey and his management team and advisory board have built up over the years are just as valuable as the assets the company has underground at Poplar.

Massey considers the low share price a primary incentive for investors.

“Tim Henneberry and Dr. Alan Wainwright, Dan McNeil, and Ray Waldichuk all have extensive experience as geologists in the field as well as very strong relationships in industry,” Massey said. “These are the kinds of guys whose phone calls and emails get returned. Those connections are invaluable.”

On the financial front, Universal Copper completed a financing in March totaling just under 2.5 million. Of the 89 million shares outstanding, management owns approximately 30%. The stock has been trading in the 9-cent neighborhood.

Massey considers that low share price a primary incentive for investors. As a frame of reference, he offered the all-time high copper price: “If you believe copper is going higher — and everybody does — we're the cheapest call on copper out there. Furthermore, if you give copper an in-situ value of a dime a pound, and we have at least 2 million pounds of copper, that equates to a $200-million valuation. So, with 89 million shares out, it gives us a pretty attractive valuation, significantly higher than where we are today. We know our deposit is going to get larger, the question is how much larger?”

| Want to be the first to know about interesting Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Diane Fraser compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. They or members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None. Their company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Universal Copper Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Universal Copper Ltd., a company mentioned in this article.