NevGold team inside the Golden Butte pit at the Limousine Butte Project in Nevada. From left: Senior Geologist Robert Springs, President and CEO Brandon Bonifacio and Chief Geologist Derick Unger. Source: NevGold Corp.

Drill results from NevGold Corp.'s (NAU:TSX; NAUFF:OTC; 5E50:FSE) Limousine Butte Project in Nevada are driving up the company’s share price as the Nevada-based gold explorer continues to find long intercepts of oxide gold mineralization.

NevGold shares closed out March at CA$0.57 apiece but popped to close at $0.82 on April 6 after telling the market drill hole CV22-001 intercepted 0.86 gram per tonne gold (0.86 g/t Au) in oxide mineralization over 175.2 meters, between 212 and 387.2 meters down-hole.

CV22-001 includes a higher-grade, 58.2-meter interval grading 2.13 g/t Au, and an even sweeter interval inside that interval of 12.32 g/t gold over 5.9 meters. The company says the gold is contained in oxide mineralization, which would make recovering the gold easier, and more importantly, cheaper.

“This is an excellent start of the program, and as NevGold has added a second drill rig to the 10,000-meter drill program, we should now see a rather continuous news flow of additional assay results with the next batch of drill results being released within the next few weeks,” wrote Thibaut Lepouttre in his Caesars Report newsletter.

The good news doesn’t end there.

Sister hole, CV22-002 — some 700 meters away — hit a strikingly similar 0.83 g/t Au in oxides over 126.2 meters, between 127.4 meters and 253 meters down-hole. And CV22-03 hit 94.4 meters running 0.23 g/t gold, starting at roughly 60 metres down-hole.

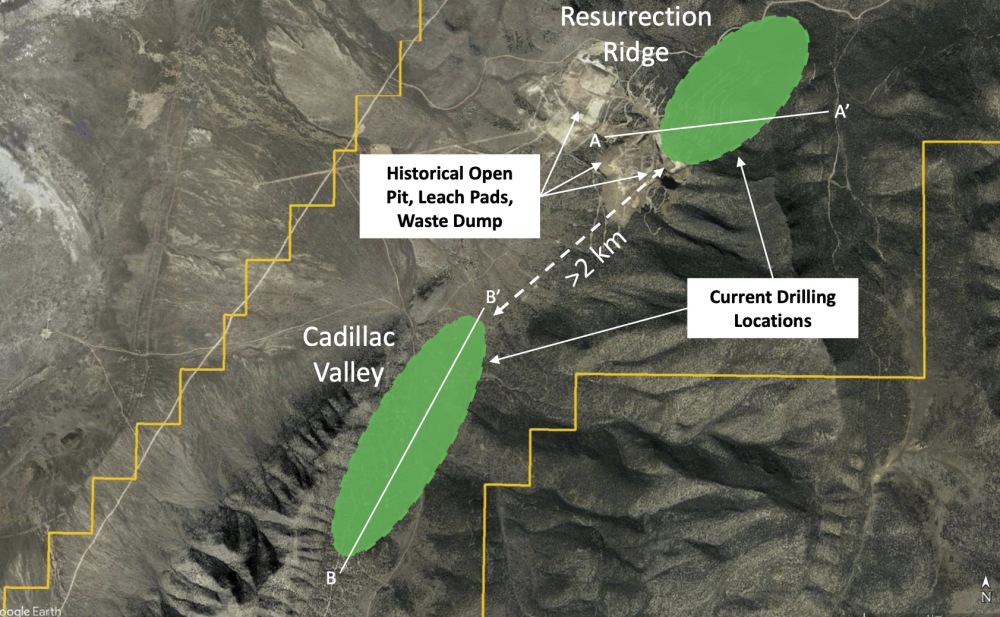

These encouraging holes from the Cadillac Valley target area at Limousine Butte now extend the mineralization over 1 kilometer along strike and another 400 meters laterally. The mineralization is also trending shallower, which again simplifies gold recovery.

So far, all the holes drilled at Cadillac Valley have hit oxide mineralization. That shouldn’t come as a surprise given that Limousine Butte sits in Nevada’s prolific Carlin Trend, which produces the lion’s share of America’s gold annually.

More drill results from NevGold’s initial drill program at Limousine Butte will be released in the coming weeks.

Clear Near-Term Goals

Chief Executive Officer Brandon Bonifacio has clear near-term goals for the project.

“Based on our market cap today of approximately CA$30 million, if we can get to that one-million-ounce mark and beyond — our peers are trading at CA$85 per ounce — so from where we are today, that's a clear three times re-rating from a valuation standpoint. That's our goal for the next couple of months, to extract that value based on the current drilling and driving to that resource,” Bonifacio told Streetwise Reports.

He added that a 1-million-ounce resource would not “bake in any resource expansion or exploration upside.”

Bonifacio plans to advance Limousine Butte through to a prefeasibility study in the next 12-18 months, which is when the story will start to attract the eyeballs of potential suitors looking at gold projects in Nevada.

About 2 kilometers northeast of Cadillac Valley, NevGold is also drilling its Resurrection Ridge target. Both targets are part of Limousine Butte.

One drill hole at Resurrection Ridge, published by NevGold earlier this year, hit 61.6 meters running 2.19 g/t Au, including 11.6 meters at 8.51 g/t Au; another hole hit 44.4 meters grading 1.30 g/t Au, including about 11 meters at 3.11 g/t Au. Once again, the gold was in oxide mineralization.

The 67-square-kilometer Limousine Butte project is about 100 kilometers northeast of Ely, Nev., and came with a historical resource of 292,000 oz (241 Koz in the measured and indicated category, and 51 Koz inferred) at an average grade of 0.77 g/t gold (using at cut-off grade 0.41 g/t Au).

The past-producing Golden Butte mine on the property produced 91 Koz gold between 1989 and 1990.

Royalty giant Franco-Nevada owns a 2.5% royalty on any production from Limousine Butte, while McEwen Mining Inc. (MUX:TSX; MUX:NYSE ) holds another 0.5% royalty.

At Home in Nevada

The team at NevGold should feel at home in Nevada.

Giulio Bonifacio, father to Brandon, founded Nevada Copper in 2005 and served as president and CEO as the junior de-risked and developed the Pumpkin Hollow iron-oxide copper project, near Yerington, Nev., into a producing asset.

The elder Bonifacio is joined at NevGold by director Victor Bradley who was chairman of Nevada Copper. Bradley founded Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) in 1995 and was chairman of Osisko Mining before Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and Yamana bought it for CA$4.1 billion (CA$4.1B) in 2014.

“A lot of the group has worked together before and we have decades of experience advancing mining projects in the state of Nevada. This gives us a significant competitive advantage compared to our peers as we know how to get things done in an efficient, low-cost manner when you consider the assay labs, drill rig operators, permitting officials, etc.,” Bonifacio told Streetwise.

Cedar Wash and Ptarmigan

Elsewhere in Nevada, NevGold holds the Cedar Wash gold property, a grassroots discovery made by McEwen Mining in 2015. McEwen Mining still holds a 2.5% royalty on the property but that can be bought down to 1% in 0.5% increments totalling $1.75M.

About 7,000 meters of shallow reverse-circulation drilling were completed at Cedar Wash by McEwen Mining in 2016-2017. The best result returned 10.7 meters running 2 g/t gold but a lot of the drilling was only down to about 30 to 40 meters below surface. NevGold will look to drill the project in Q3 after it completes surface exploration work.

And in Canada, NevGold is looking forward to drilling its 9,300-hectare Ptarmigan gold-silver-copper project, 30 kilometers west of Radium, B.C. The property includes the past-producing Ptarmigan underground mine.

A chip sample taken on Level 3 of the former underground workings assayed 4,024 g/t Ag, 2.9 g/t Au, and 1.9% copper (Cu).

Roughly 14,000 meters of historical diamond drilling at Ptarmigan included bonanza-grade intercepts such as 3.65 meters grading 2,455 g/t Ag, 1 g/t Au, 0.91% Cu. Another hole returned 6.8 meters at 452 g/t Ag, 0.52 g/t Au, 0.26% Cu.

Adequate Liquidity

Management currently owns more than 50% of NevGold but Bonifacio says liquidity is not a problem.

“We have a tight structure, but there's about a 40% free-trading float that works out to give or take 20 million shares of the outstanding 50 (million). We've had good volume for a smaller company after putting out our drill results,” Bonifacio said.

NevGold started trading June 2021 and since then has traded in a range of CA$0.34 and $0.84.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: NevGold Corp. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NevGold Corp., a company mentioned in this article.