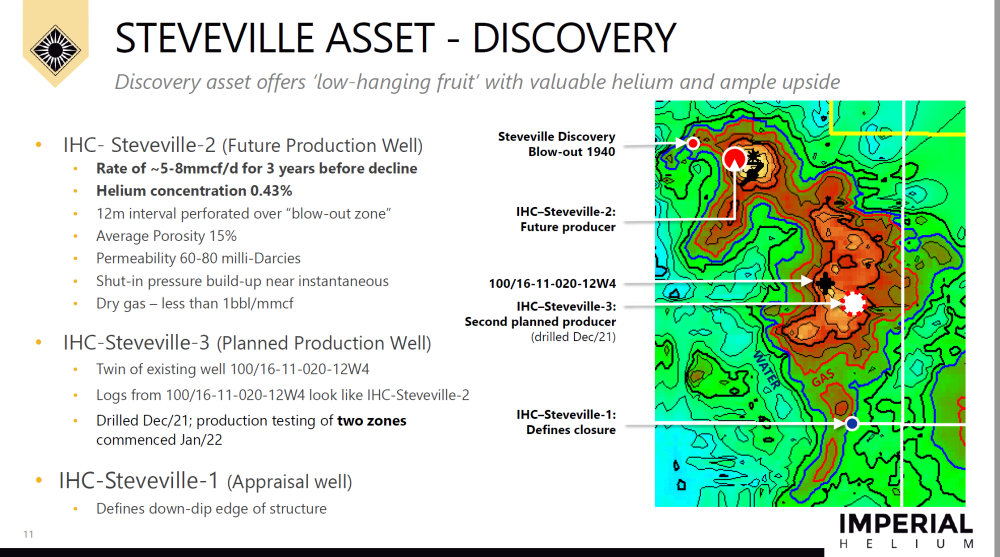

In late March, Imperial Helium Corp. (IHC:TSX.V; IMPHF:OTCQB) confirmed raw gas deliverability of 10-15 MMcf/d from its first two wells, IHC-Steveville-2 (10-22-020-12W4) and IHC-Steveville-3 (12-12-020-12W4).

Imperial Helium is focused on the exploration and development of North American helium assets, prioritizing the commercialization of its Steveville, Alberta, helium discovery.

Preliminary IHC-Steveville-3 BOZ Highlights

- Immediate strong gas flow to surface upon perforating 9m of pay in the Blow-Out Zone (BOZ).

- Helium concentration of 0.44% with overall gas composition consistent with gas from the BOZ at IHC-Steveville-2: This indicates the BOZ reservoir is communicating between wells. During the initial two-hour cleanup period, sustained pressure and flow was estimated at 5 MMcf/d.

- A subsequent 5.5-hour cleanup period, after acid stimulation, showed sustained pressure and flow estimated at 8 MMcf/d.

- Increasing pressure after the gas flow was restricted to 2 MMcf/d using a ¼-inch choke for the first of two restricted flow periods (recorded at surface and beside the reservoir).

In IHC-Steveville-2, an independent assessment of the October 2021 production test indicated deliverability of 5-8 MMcf/d for three years before decline at 15% for 10 to 15 years in the BOZ.

In IHC-Steveville-3, in addition to preliminary deliverability estimates from the BOZ, independent analysis of production test analysis of the new Sub-Salt Zone (“SSZ”) showed rates of 2.5 MMcf/d for three years before decline at 15% for 10-15 years.

Laying Out the Plan for Production

The March 23 results support an aggressive advancement toward commercial production. Previous production projections may have been too conservative.

Based on those results, “IHC is planning to construct a production facility at Steveville that is capable of processing a combined 10-15 MMcf/d of raw gas from these two wells,” stated Imperial Helium.

This gas rate is supported by production test results from the Blow-Out Zone (“BOZ”) in IHC-Steveville-2, which had rates of 5-8 MMcf/d, and in IHC-Steveville-3, preliminary deliverability estimates from the BOZ combined with production test analysis of the new Sub-Salt Zone (“SSZ”) of 2.5 MMcf/d.

Collectively, the results to date indicate that IHC has deliverability capacity of 10-15 MMcf/d of raw gas (see table below for additional details) for more than three years before experiencing a 15% per year decline over an estimated 10 to 15 years.

Upon completion of production testing, IHS-Markit will conduct an independent PT-Analysis of the data collected.

“We are incredibly excited by what we are seeing from IHC-Steveville-3,” stated Dr. David Johnson, president and chief executive officer of IHC. “The strong response of the BOZ and new SSZ in IHC-Steveville-3 confirms sufficient deliverability from both IHC-Steveville-2 and IHC-Steveville-3 to produce 10-15 MMcf/d of raw gas for three years before declining.”

Upon completion of production testing of IHC-Steveville-3, IHC plans to return immediately to IHC-Steveville-2 to begin production testing the SSZ.

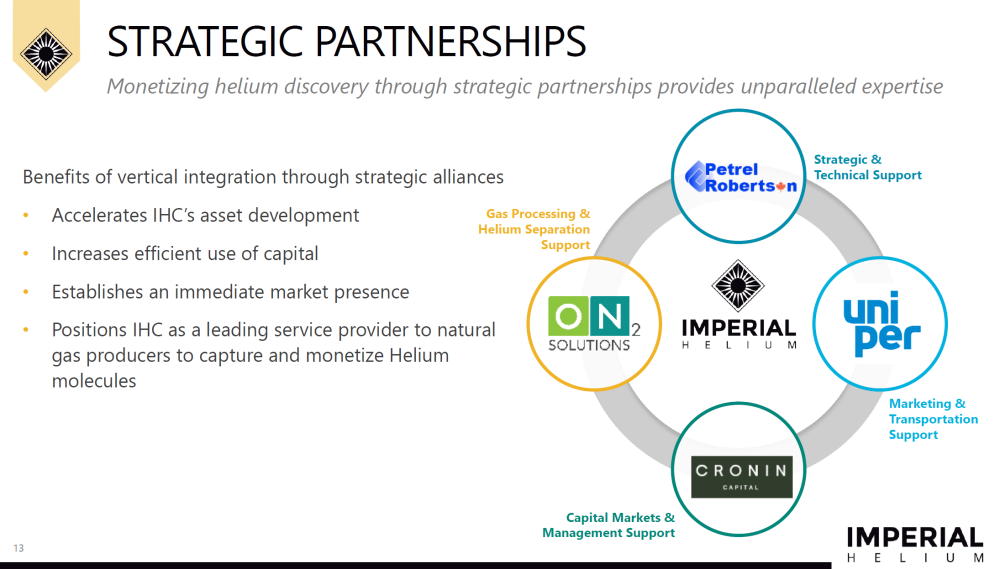

“We've created a vertically integrated structure that includes the upstream and the downstream,” added Johnson. “And we've done that in order to create capital efficiency for our shareholders. We find helium inexpensively by looking for it where it's already been found. Our plan is to bring our first helium to market by the end of 2022.”

What the Experts Are Saying

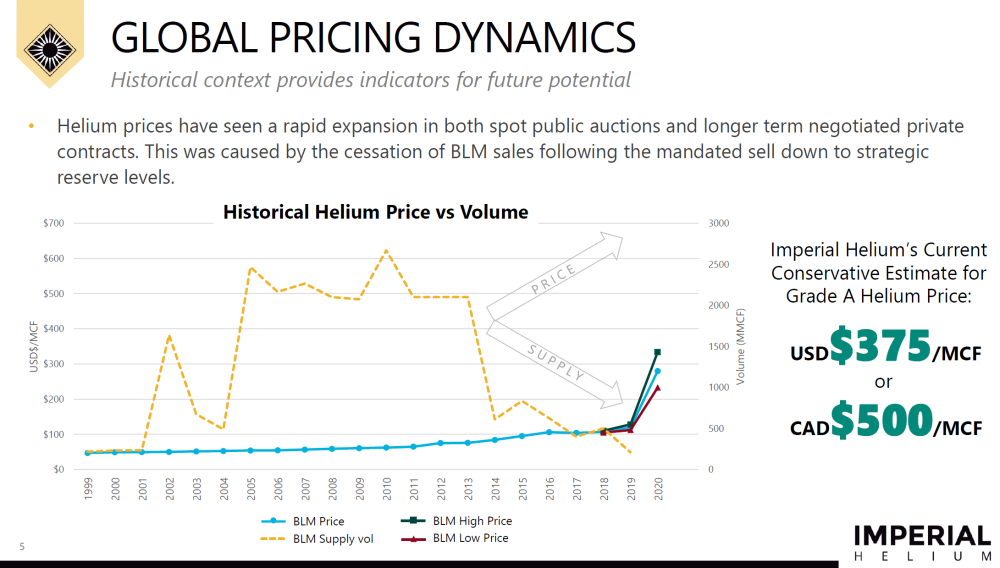

“The gas mixtures associated with helium are unique to each resource accumulation and IHC’s prototype plant is an important step to confirm the preferred plant design (and reduce risk) before fabrication for both the Steveville asset and other future assets,” reports Auctus Advisors.

“In addition, it would allow Imperial to capture the 100% to 200% price premium associated with Grade A helium compared to raw helium,” added Auctus.

IHC has 88.5 million shares outstanding, with 137.3 million shares fully diluted. Approximately 8.5% of the stock is owned by insiders.

Auctus Advisors and Eight Capital have each issued a target price for Imperial Helium of CA$1.00 per share.

The company's shares trade under the symbol IHC on the TSX Venture Exchange and last closed at CA$.24/share with a market cap of ~$21 million.

| Want to be the first to know about interesting Helium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Lukas Kane compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. They or members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None. Their company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Imperial Helium Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Imperial Helium Corp., a company mentioned in this article.