Platinex Inc. (PTX:CSE; 9PX:FSE) doesn’t seem to be slowing down anytime soon, as it has been adding more claims to the highly prospective and strategically located district-scale Shining Tree gold project and recently acquired W2 Copper-Nickel-PGE project, both located in mining-friendly Ontario. As management and board of directors were strengthened, and a high-quality core investor base came in since, one of the last building blocks remaining was filling the treasury with adequate funding. As a first tranche of CA$1.5 million (M) was recently closed, with a final tranche coming up soon, it seems Platinex is ready to complete targeting and design drill programs for both Shining Tree and W2. In my view, strong drill results, positive metal price movements, and renewed enthusiasm in the Ring of Fire after the recently finalized acquisition of Noront by Wyloo Metals could provide substantial catalysts for share price appreciation in 2022.

Platinex Inc. (PTX:CSE; 9PX:FSE) doesn’t seem to be slowing down anytime soon, as it has been adding more claims to the highly prospective and strategically located district-scale Shining Tree gold project and recently acquired W2 Copper-Nickel-PGE project, both located in mining-friendly Ontario. As management and board of directors were strengthened, and a high-quality core investor base came in since, one of the last building blocks remaining was filling the treasury with adequate funding. As a first tranche of CA$1.5 million (M) was recently closed, with a final tranche coming up soon, it seems Platinex is ready to complete targeting and design drill programs for both Shining Tree and W2. In my view, strong drill results, positive metal price movements, and renewed enthusiasm in the Ring of Fire after the recently finalized acquisition of Noront by Wyloo Metals could provide substantial catalysts for share price appreciation in 2022.

It is no small feat for a tiny junior with a CA$8M market cap to raise CA$1.5M, but Platinex didn’t seem to have much trouble with it, raising this in a month. It was a non-brokered private placement, with a first tranche closed at April 5, 2022, consisting of 16M common shares at CA$0.05, and 12.2M flow-through common shares, both with a half warrant (three years at CA$0.07). The aforementioned second tranche will probably close within two weeks from now.

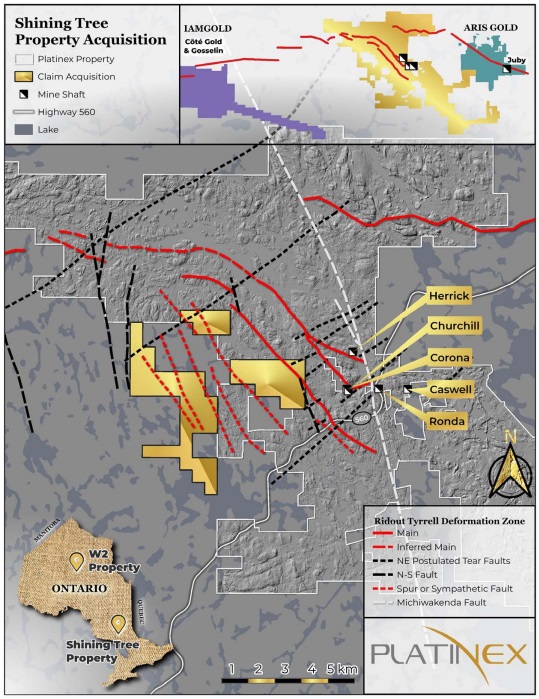

Right before the closing of this first tranche, Platinex was busy expanding their Shining Tree claim package, as it acquired another 1,372 hectares, bringing the total at 23,219 hectares. This came at limited costs of just CA$11,500 in cash and 400,000 shares. The claims are subject to a 2% NSR, of which 1% can be bought back for CA$800,000.

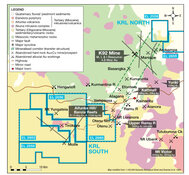

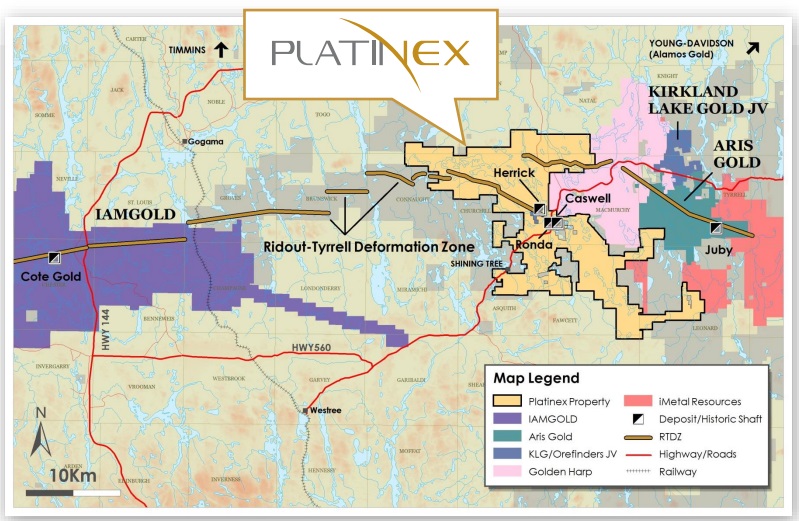

As can be seen, the new claims cover numerous faults, associated with the prospective Ridout-Tyrell Deformation Zone (RTDZ), which hosts several world-class gold deposits like Coté Gold (IAMGold) and Juby (Aris Gold):

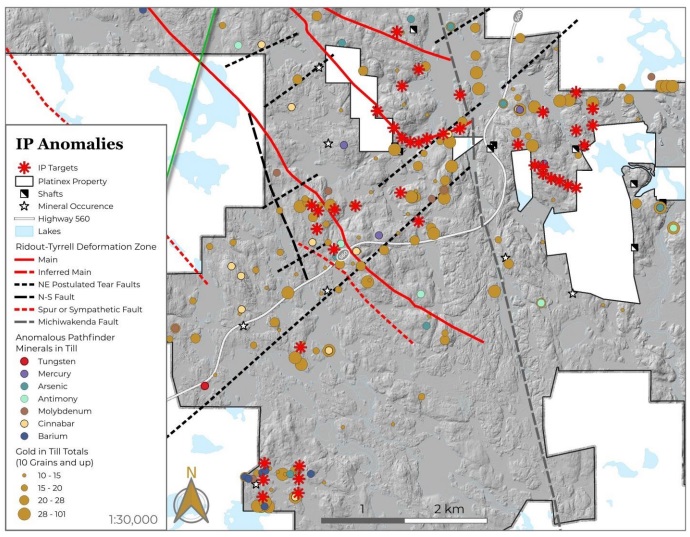

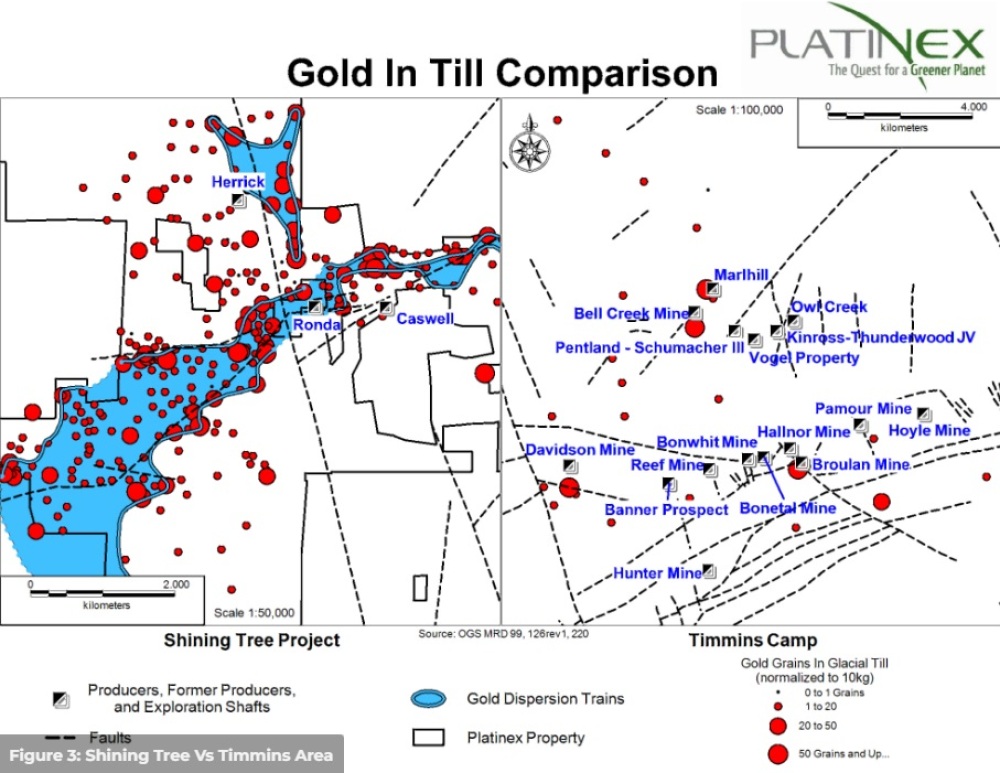

A lot of reconnaissance exploration has already been completed, and more recently results of an airborne magnetics survey and a LIDAR survey came in, enabling management to determine drill targets, so Platinex will be ready to go when the ongoing financing will be completed soon. The understanding of the project has improved considerably, and lots of IP targets have been defined, correlating with the RTDZ trend, high gold counts and/or high multi-element anomalies in the gold till fines:

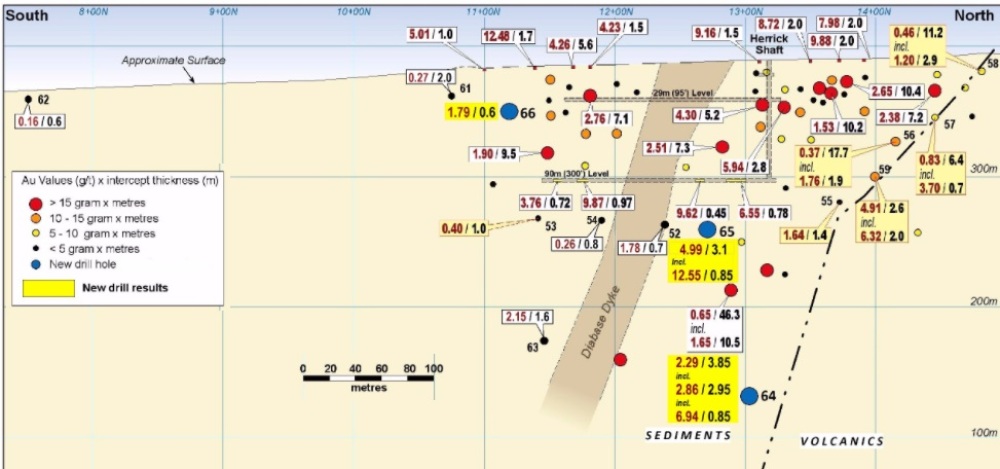

What to expect from drilling? As a reminder, Platinex already completed a 51 drill hole program a while ago at the important Herrick target (one of seven to eight target zones within Shining Tree), and hit gold at almost every hole, with highlights accounting for 7.15 meters at 2.76 g/t Au, 46.3 meters at 0.65 g/t Au, 7.2 meters at 2.38 g/t Au, 14.1 meters at 1.2 g/t Au and 12.2 meters at 1.47 g/t Au, all within open pit depths.

Mineralization at the Herrick target is open at depth, and management hopes to find more mineralization at depth, as lots of deposits in the Abitibi show these characteristics. There are many more targets to be drill-tested, and management is currently outlining plans for this at the moment as mentioned. According to the presentation, a Phase 1 program has already been completed (1,270m), confirming Vein 109 on the Caswell target. The intended but still preliminary Phase 2 could see 5,000 meters of drilling, of which a part is thought to be deeper drilling, and another part could be definition drilling on the Herrick, Churchill, and Ronda targets. Through this program, management intends to complete a maiden NI43-101 resource estimate for Herrick.

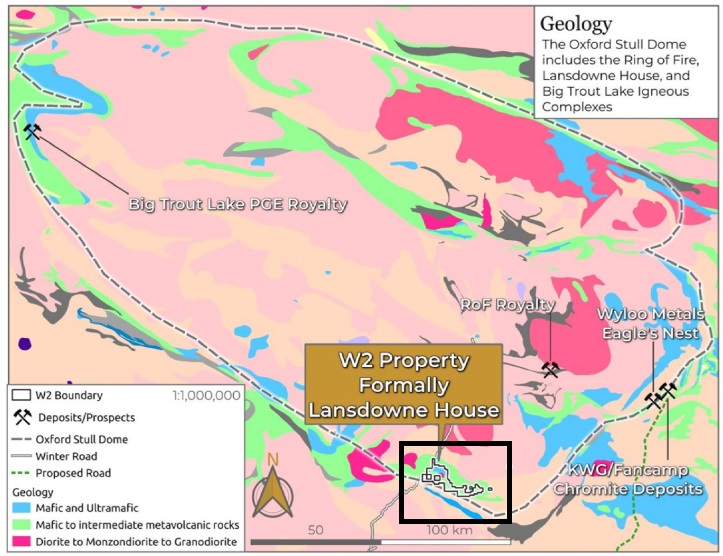

Besides Shining Tree, Platinex is also active on the W2 front, as it expanded this project two times since my last article in January. On March 17, 2022, it acquired 2,932 hectares, bringing the total claims to 15,973 hectares. The staking fees were CA$7k as the claims just lapsed.The W2 Project now covers approximately 80% of the layered mafic-ultramafic Lansdowne House Igneous Complex (“LHIC”) which is highly prospective for copper-nickel (Cu-Ni) and reef-type platinum group element (PGE) deposits.

Keep in mind, Wyloo recently acquired nearby Noront Resources Ltd. (NOT:TSX.V) for its high-grade Eagle’s Nest Ni-Cu-PGE deposit, for CA$616.9M after a bidding war with a formidable competitor: BHP. As BHP is known for doing extremely thorough due diligence on its transactions, it seems certain it saw compelling reasons to bypass the usual Ring of Fire objections, as this area still has been underdeveloped due to lack of infrastructure. The Ring of Fire has been viewed as one of the most promising mining opportunities in Ontario for more than a century.

Wyloo certainly thinks so too, as it has already laid out a comprehensive strategy and budget to advance Eagle’s Nest towards production, as part of their overall battery-related commodity strategy. Wyloo is owned by Australian mining billionaire Andrew Forrest, who is betting heavily on green energy of late. When such powers seek to speed up slow moving ventures like the Ring of Fire, it might be safe to say that such initiatives will likely attract much more investments, and advance the Ring of Fire as a mining district much faster.

It seems Platinex has timed their W2 acquisition well, and could very well enjoy the benefits of renewed interest in the nearby Ring of Fire.

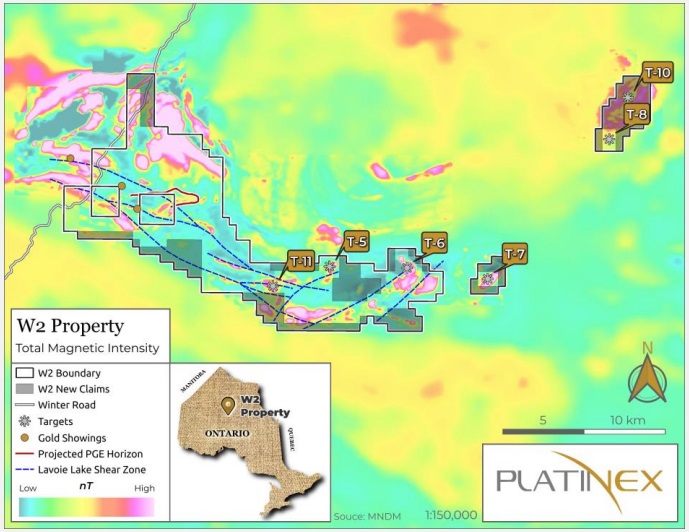

The widespread Cu-Ni-PGE mineralization of W2 is delineated in at least seven significant mineralized zones within a 7.5 kilometer long folded corridor. The new claims add 10 kilometers of strike length to the project, with W2 extending 35 kilometers along the Lavoie Lake Shear Zone System and tying on to Northern Superior Resources Inc.'s (SUP:CVE) TPK Project. The grey areas are the new claims:

As a reminder, the W2 project has seen significant exploration so far, ranging from sampling to airborne surveys to 8,772 meters of drilling. Drill results for the property were impressive:

- 220.6 meters at 0.56% CuEq or 0.96 g/t PdEq (LH-01-06)

- 151.6 meters at 0.45% CuEq or 0.771 g/t PdEq, including 17 meters of 1.08% CuEq or 1.86 g/t PdEq (LH-01-05)

- 42 meters at 1.02% CuEq or 1.8 g/t PdEq, including a high grade 4.5-meter section of 4.52 g/t PdEq (LH-01-02)

- 61 meters at 1.01% CuEq or 1.73 g/t PdEq

- 20.91 meters at 1.63% CuEq or 2.80 g/t PdEq

- 42 meters at 1.02% CuEq or 1.76 g/t PdEq

Please note holes LH-01-05 and LH-01-06 are 4 kilometers apart with no intervening drill holes. The apparent correlation of widely spaced holes suggests a high level of continuity in the Cu-Ni-PGE mineralization. Most results were intercepted close to surface, indicating substantial open pit potential. Numerous targets have already been identified, and the T5 target appears to have the same geophysical signature as Eagle’s Nest (Noront/Wyloo).

Management has designed a two-phase drill program for W2, although this is still preliminary: Phase 1 might see 2,500 meters of drilling, focusing on infilling areas of high grade near surface PGE mineralization, and among others filling in between holes LH-01-05 and LH-01-06. Phase 2 could also see 2,500 meters of drilling, but will likely be more greenfields, as conductors with coincident magnetic anomalies will be drill tested for the first time. It will mainly focus on the T5, T6, T7, T8, and T11 targets. It will be a busy summer for Platinex, with a decent amount of drilling planned, and with management looking for further acquisitions.

Conclusion

It will be interesting to see how much Platinex will be raising in total in the ongoing financing, as they already landed CA$1.5M, which already goes a long way when exploring in Ontario, where drilling cost are pretty cheap (CA$200/meters). The second tranche will add more to the treasury, so Platinex will have enough to complete lots of exploration for this year. I am looking forward to the finalization of exploration programs, and expect a lot from both projects, as historic drill results were already impressive and consistent. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Platinex’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Platinex or Platinex’s management. Platinex has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Tectonic Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.tectonicmetals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

| Want to be the first to know about interesting Gold, Base Metals and PGM - Platinum Group Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.