After drilling a stellar intercept of 136.8 meters at 1.49 g/t Au three weeks ago from the California Zone at their majority owned and operated (65/35 JV with Kootenay Silver) Cervantes gold project in Sonora, Mexico, Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) continues to publish more goodies, this time somewhat more normal highlights of 138.3 meters at 0.58 g/t Au and 54.7 meters at 0.88 g/t Au. Keep in mind most of the mineralization is oxidized, as Aztec is drilling the oxide cap of a porphyry target model, and anything over 0.40-0.45 g/t Au oxidized with a decent strip ratio could be pretty economic at gold prices over $1,500/oz Au. Combined with other results reported in February like the 88.4 meters at 1.1 g/t Au and 167.2 meters at 1.0g/t Au intercepts, Aztec seems to be firmly on its way to a significant maiden resource later this year.

It seems the 2021-2022 Phase 2 drill program aimed at the California target at Cervantes is going as planned, as all assays coming back from the labs deliver strong results. The program itself has been completed now, with 26 RC holes totaling 4,649m drilled, assays of 10 holes reported, four holes were drilled at the Purisima target with limited success, with the balance of assays of 12 holes pending. The latest highlights are:

- 54.7 meters at 0.88 g/t Au in mineralized quartz feldspar porphyry and hydrothermal breccias, including 13.7 meters at 1.965 g/t Au in CAL22-008, located at the southern edge of the eastern part of the mineralized zone.

- 86.6 meters at 0.50 g/t Au in mineralized porphyries and hydrothermal breccias in CAL22-009 located at the southern edge of the central portion of the mineralized zone.

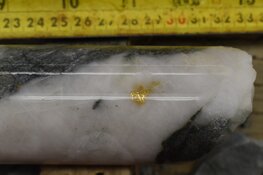

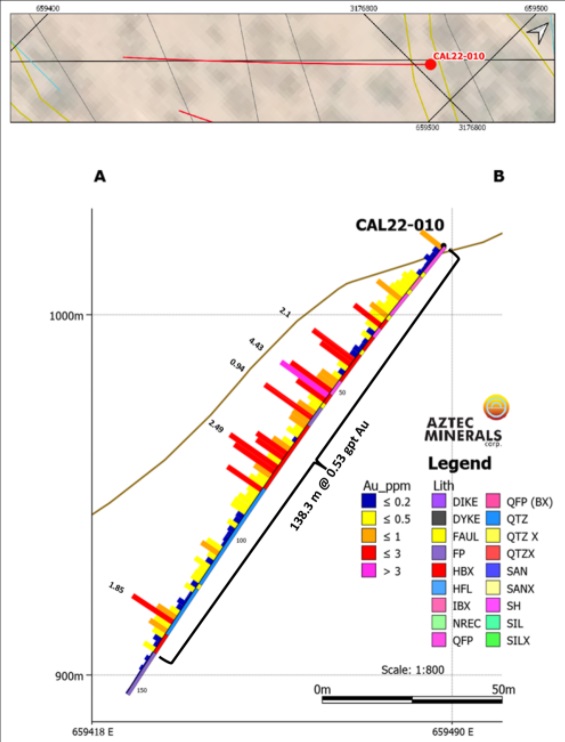

- 138.3 meters at 0.53 g/t Au in mineralized porphyries and hydrothermal breccias, including 10.67 meters of 1.622 g/t Au in CAL22-010, located in the central portion of the mineralized zone.

Reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures, and veinlets within quartz-feldspar porphyry, feldspar porphyry stocks, and related hydrothermal breccias. A section of CAL22-010 is shown below:

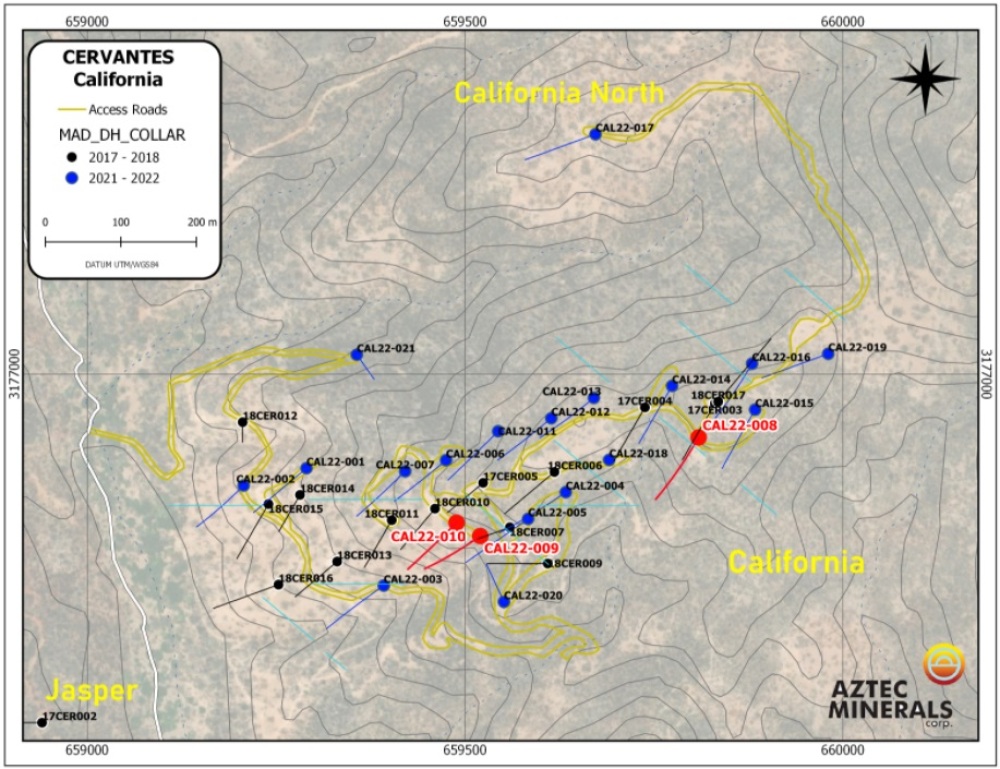

The goal is to expand the known mineralized envelope, resulting from the Phase 1 2017-2018 drill program. Old (black collars) and new drilling (blue and red collars) can be seen on the following map:

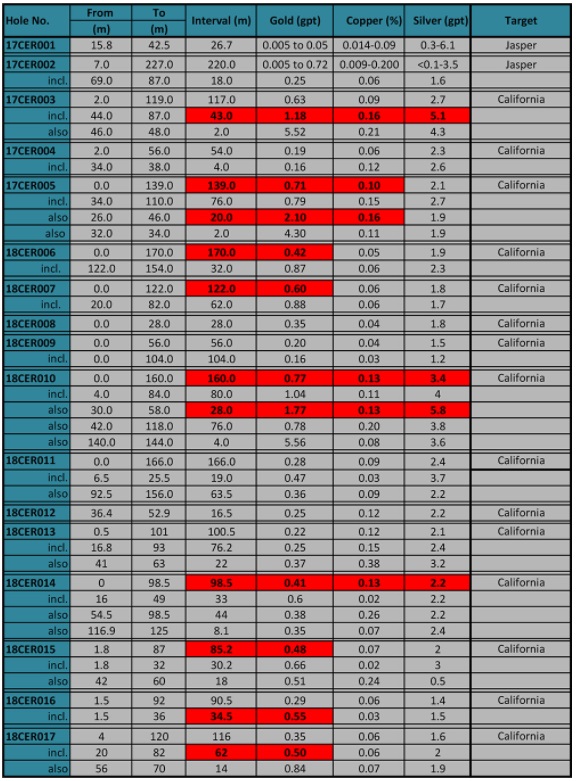

As can be concluded, the Phase 1 program more or less focused on the top of the ridge, whereas Phase 2 is expanding north, south and east of this. The aforementioned stellar hole was CAL22-005, not too far away from CAL22-010. Gold mineralization in 010 was also extensive over 138 meters, but at almost one-third of the average grade of 005. The result of 005 was a surprise, as the nearby hole 18CER007 returned 122 meters at 0.60 g/t Au, and another hole close to 005, hole 18CER006, returned 170 meters at 0.42 g/t Au. For your convenience, here is the table of the Phase I program again, for comparison:

I wondered how these differences in grades could happen within a 30-50 meter distance, as oxide deposits are usually more continuous, and where this relatively high grade could come from, as the combination of length and average grade for 005 is unique. Could this be a local vein structure alongside a fault, or a feeder system? Chief Executive Officer Simon Dyakowski had this to say: “Further drilling is definitely required to understand the zonation and structural controls of the mineraliziation.”

Since the most eastern holes (CAL22-015, 016 and 019) haven’t returned results yet, it is arm waving at best, but with the recent and historic drill results I believe it is possible to conservatively estimate a mineralized envelope of 800x250x80x2.7=43.2Mt, and using an estimated average grade of 0.6 g/t Au we would arrive at a hypothetical 833koz Au. If the remaining holes return intercepts alongside my estimated average range of 80 meters at 0.60 g/t Au or better, then the envelope could increase to a hypothetical 900x300x80x2.7=58.3Mt, generating an arm waving 1.125Moz Au. Let’s wait and see, as the results of 12 holes are on its way.

Besides going after more oxides, let’s not forget Aztec is also hunting large porphyry targets at depth at Cervantes. Deeper tests were planned at California target as part of this drill program to test the large IP chargeability anomaly at depth, but Aztec wasn’t able to get a deep test unfortunately, as the RC drill rig failed below the water table. Because of this the next round of drilling will include core drilling. The balance of the Phase 2 program tested a gold-in-soil anomaly at California Norte, and an outcrop at the Jasper target. The results are expected in the coming weeks.

Aztec is carrying out channel sampling and geologic mapping of the new drill roads at the moment at California, California Norte, and Jasper, as well as expanding surface sampling and mapping on the property in general, in order to continue the 2021 Phase 1 surface program. After this, all exploration results will likely be released, it will be most likely time to do another raise, and, contingent on the current program results, and available funds, management could plan additional drilling this spring season. As the results at California don’t exactly disappoint, it seems only logical to follow up with another drill program. Dyakowski had this to say about it: “We are in the planning stages, but early thinking is to drill again in May-June, with a combination of RC step outs, and Core deep drilling, approximately 5,000 meters.”

As a reminder, the Cervantes oxides aren’t the only thing Aztec is looking to explore, as it is also planning a drill program for their Tombstone gold-silver oxide project (subject to a 75/25 JV with Aztec as the operator) in Arizona for the summer, also enabling them to go after large porphyry/CRD potential at depth at both projects. A diamond drill program is planned for the summer of this year, again contingent on available funds. This upcoming Phase 3 drill program will be designed to target deeper epithermal gold-silver mineralization below the contention pit, and the coveted deep CRD silver-lead-zinc-copper-gold mineralization in Paleozoic limestones underlying the Bisbee Sediments.

Conclusion

Aztec Minerals is going from strength to strength with its Phase 2 drill program at the California target at Cervantes. Hole 004 already was much better than expected with 167 meters at 1 g/t Au from surface, but management surprised investors further with hole 005 (136.8 meters at1.48 g/t Au), and continued to deliver very solid results as for example hole 010 returned 138 meters at 0.53 g/t Au. Since most mineralization appears to be oxidized and/or heap leachable with a very low strip ratio, and my hypothetical back of the envelope estimate points towards 800koz – 1.1Moz Au resource potential at a pretty economic grade, it seems Aztec is on its way to delineate their first company making asset. Which is not all, as they have three other opportunities. Stay tuned.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Fancamp Exploration is a sponsoring company. All facts are to be checked by the reader. For more information go to www.fancamp.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.