- Introduction

Recently I used the proverb “in order to find a new mine, look in the shadow of the headframe of an old or existing mine”. However, there is not even the need to even find a new mine in the case of Omai Gold Mines (TSXV:OMG), as they are working on revitalizing the existing Omai gold mine in Guyana, which closed in 2005 due to low gold prices.

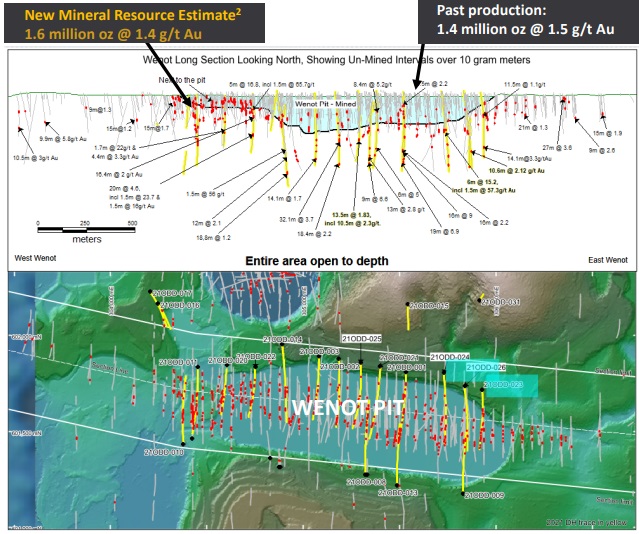

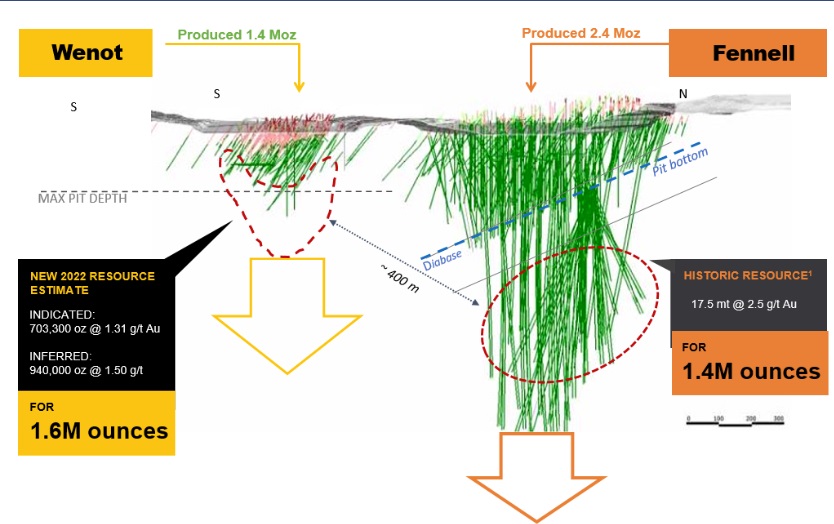

The current gold price is trading at all time highs, and although costs have increased over the years, the situation is much more profitable at the moment. As the mine closed with lots of gold remaining, Omai Gold Mines already has delineated one deposit with a 2022 NI43-101 resource estimate outlining 1.6Moz Au, and another mineralized envelope has a historic resource estimate of 1.4Moz Au.

Management believes there is much more gold to be proven up and found near surface and at depth.

- Company

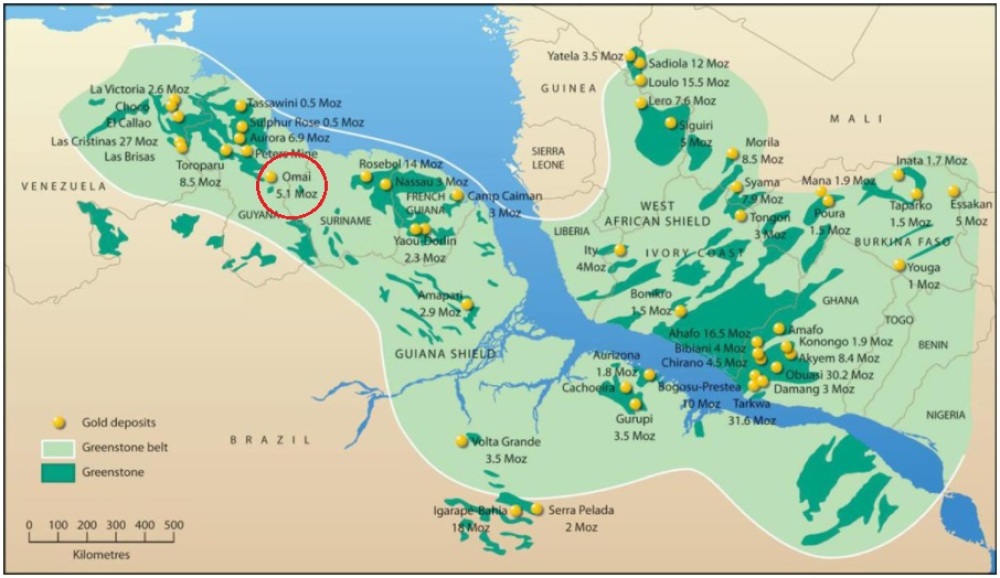

Omai Gold Mines Corp. (TSXV:OMG) is a gold focused exploration and development company with assets in Guyana, a South American jurisdiction that has seen noticeable M&A activity recently (Guyana Goldfields-Zijin $323M in 2020, GoldX-Gran Colombia $252M in 2021). The company’s primary project is the Omai gold project, located in the Guiana Shield, a prolific Greenstone Belt. This fully owned project includes the past producing Omai gold mine. This was once the largest primary producing gold mine in South America, generating over 3.7Moz Au between 1993 and 2005 from two large open pits, with a record annual gold production of 356,000oz Au in 2002.

As a result of the low gold price at the time (less than US$400/oz Au), the operator (Cambior Inc, acquired in 2006 by IAMGOLD> IAG.NYSE, IMG.TO) decided not to invest further in resource expansion or exploration at Omai, and relocated key equipment to another, much larger mine (Rosebel Mine in Suriname). The closure left a lot of gold resources in the ground, with lots of known targets to explore and the potential to use more modern exploration techniques to further expand resources. This is exactly why management believes it can prove up significant resources and build a mid-tier to Tier one asset.

The Omai management team consists of a very experienced group of executives and geologists, with the most notable names being Chairman Renaud Adams and President and CEO Elaine Ellingham. Renaud Adams is also the President and CEO of New Gold (NGD.TO). Both Elaine (as interim President and CEO) and Renaud (President and CEO) made an impact at Richmont Mines as both were instrumental in expanding the Island Gold Mine and the ultimate sale of Richmont Mines to Alamos Gold in 2017 for US$770M. Most interestingly, he also was the general manager of the currently producing 250koz Au per annum Rosebel gold mine in nearby Suriname for IAMGOLD from 2007 to 2011 (when Adams managed it the annual production was still over 400koz Au pa), so he knows a thing or two about operating gold mines in the region. Elaine and Renaud were also both senior executives at IAMGold during this period.

President and CEO Elaine Ellingham is a very experienced geologist with an MBA, having worked in various positions at junior and major mining companies, but also with the TSX in corporate finance. She is a director of Alamos Gold, Almaden Minerals and the PDAC. As interim President and CEO of Richmont Mines she led a successful exploration program at the Island Gold Mine in Ontario that delineated a new resource at depth, and consequently changed the focus of the company, which in turn led to Renaud Adams coming in to manage the following expansion of the mine. Ellingham has been working as a consultant since 2005, with clients ranging from mining companies to private equity groups. Besides Ellingham and Adams, somebody very familiar with the Omai project is exploration consultant Dr. Linda Heesterman PhD, who was the regional exploration manager at Omai from 2005 to 2010. Omai Gold Mines also has several experienced Latin American geologists working in their geological team, knowing everything about local situations, which is always a good thing to have.

Since the company seems to have a strong management team and lots of gold in a jurisdiction that has seen recent, substantial M&A activity and lots of mining in the past, one could suppose this should, combined with the catalyst of an all-time high gold price (US$2078/oz Au), lead to relatively high share prices. One look at the chart indicates this is not the case yet:

Share price 1 year timeframe (Source: tmxmoney.com)

It appears that Omai Gold Mines has been flying under the radar very effectively for the last 6 months or so. As every disadvantage has its advantage, I view this as an excellent entry point for investors, as for example Gold X with 7.4Moz @ 0.91g/t Au M&I and a 2019 PEA sold for A315M last year with gold trading at US$1750/oz Au. Omai is trading at just 10% of this at the moment, whereas management has set a goal of finding and proving up 4 to 5 Moz Au, which doesn’t seem unrealistic in my view, more on this later.

This record gold price doesn’t come for free: there is a war going on in the Ukraine, initiated by Russia who doesn’t seem to fancy lofty Ukraine ambitions to swiftly join the EU and NATO too much. Gold as a fear trade is on again, as the stock markets are correcting viciously now the conflict appears to be evolving into a pretty destructive affair, instead of quickly overthrowing the Ukraine government by Russia, with limited casualties and destruction. The current, extremely high inflation environment reinforces the negative real rates, being the main (at least for me) sentiment driver for gold, so it looks like these factors could push the gold price above US$1900/oz for some time to come, as the extensive Russia sanctions not only cripple Russia itself, but also numerous supply chains which are effecting the rest of the world.

Some basic information on share structure: Omai Gold Mines has 271.1M shares outstanding, and trades at an average daily volume of 112k shares. There are 76.6M warrants (36.9M @CA$0.44 expire at July 3, 2022) and 16.4M options (weighted average price of CA$0.16 with an average remaining life of 3.9 years), meaning the fully diluted number of shares stands at 364.5M shares now. The company recently adopted a 10% rolling stock option plan on March 8, 2022, and announced the granting of 5.2M options @CA$0.11 for 5 years, with 4.3M of these options granted to directors and executive officers.

The share structure isn’t exactly perfect, but keep in mind the company is already very advanced in its exploration, and doesn’t need lots of dilution to prove up multi-million ounce deposits. Management and BoD hold 3.1%, Sandstorm holds 7.4%, Silvercorp Metals holds 12.7%, HNW’s a combined 8.3%, institutionals like Mackenzie own 13.1%, and retail holds the balance of 55.4%.

The cash position is estimated at CA$3M, with no debt, and management is looking to raise more depending on drill results. For the last 12 months ended December 31, 2021, G&A was CA$3.3M, which was substantial, but still acceptable as exploration expenditures for the same period came in at CA$5.2M.

The government of Guyana has a policy for a 5% NSR on producing gold mines, and Sandstorm owns a 1% NSR on the project.

The current share price is CA$0.11, resulting in a current market cap of CA$29.9M, and this is part of the reasons I believe this little junior could become a genuine multi-bagger in a year or two. Let’s have a look at their project to see why I believe this kind of potential could be there.

- Omai Gold Project

The company’s primary project is the Omai gold project, located in Guyana, in the Guiana Shield, a prolific Greenstone Belt. This Belt used to be united with the West African Shield millions of years ago, which is also well-known for its rich gold endowments.

Guyana is ranked 53 out of 77 jurisdictions in the Fraser Institute Survey of Mining Companies which isn’t impressive, but since there are many mining operations and projects, the permitting process doesn’t obstruct projects and the country has seen recent M&A as mentioned, my guess is it is more a case of knowing your jurisdiction and local people. And this is exactly what Omai management is all about. CEO Ellingham had this to add about the low ranking, and how they deal with it: “The Guyanese government are very knowledgeable on mining and extremely committed to seeing mine development. When the Omai mine was in production it employed over 1000 people – very significant in a country with only 750,000 people. They recognize the benefits responsible mine development brings. Guyana is the former British Guyana, so they are english speaking with the legacy of British law and business practices.”

The fully owned Omai gold project includes the past producing Omai gold mine. This was once the largest primary producing gold mine in South America, generating over 3.7Moz Au between 1993 and 2005 from two large open pits (Wenot and Fennell), with a record annual gold production of 356,000oz Au in 2002. As a result of the low gold price at the time (less than US$400/oz Au), the operator (Cambior Inc, acquired in 2006 by IAMGOLD> IAG.NYSE, IMG.TO) decided not to invest further in resource expansion or exploration at Omai, and relocated key equipment to another, larger mine (the aforementioned 14Moz Au Rosebel Mine in Suriname).

Wenot pit in its final year of operation (2005)

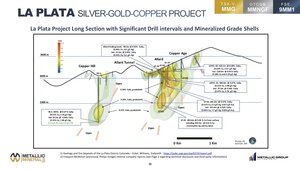

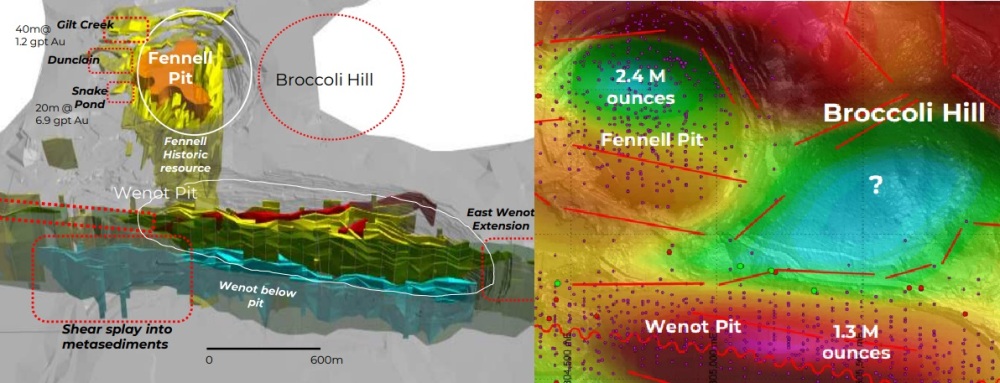

The Omai project not only contains the former Omai gold mine, formerly producing from the Wenot and Fennell open pit deposits, but also the Broccoli Hill and Blueberry Hill targets nearby, and a land package containing many more exploration targets. The Wenot deposit hosts a NI43-101 compliant, 1.6Moz Au deposit consisting of a pit constrained 703.3koz @ 1.31g/t Au Indicated and 940koz @ 1.50g/t Au Inferred resource estimate, which was announced recently on January 4, 2022. This resource is located directly under the existing open pit, and runs about 400m deep:

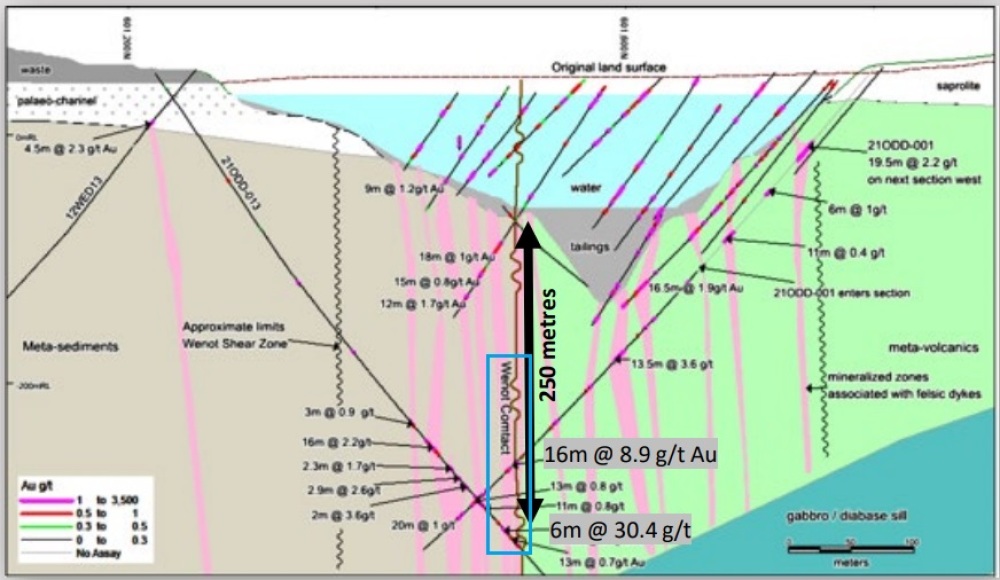

Although deeper than a normal open pit (about 200m), the surrounding rocks are sufficiently competent according to management, implying a 200m deeper open pit is very well possible. For reference, open pits can actually get much deeper, like for example Bingham Canyon in Utah, US, being more than 1.2km deep.The company drilled 16 holes to define this resource, but was also able to tap into the huge historic database to integrate 21,541m of drilling spread out over 549 diamond drill holes. Notwithstanding this, the Wenot drilling is far from completed, and a few deeper holes also showed that this initial resource is open along strike and at depth, as results like 16m @ 8.9g/t Au and 6m @ 30.4g/t Au close to the so-called Wenot contact (contact zone between meta-volcanics and meta-sediments) indicate high grade potential:

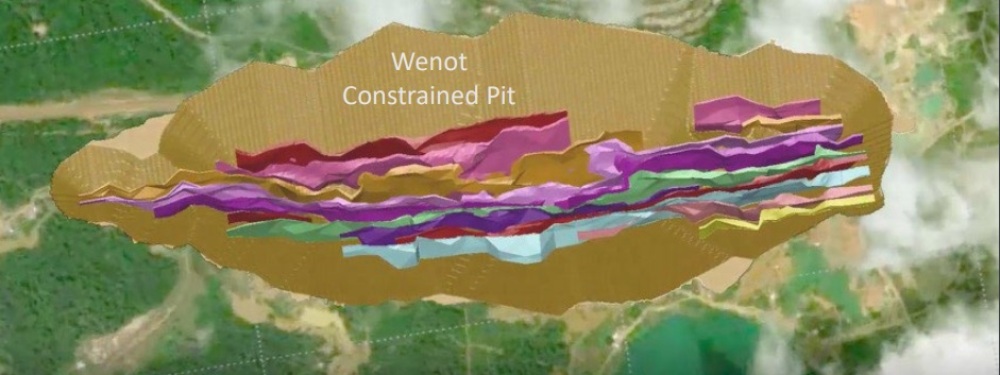

As can be seen, mineralization consists of series of lenses/vein systems running east-west, which potentially run very deep closer to the contact zone. A 3D visualization of the lenses looks like this:

Interestingly, the sensitivity to a higher cut-off grade shows the deposit to be very robust. When the cut-off grade is increased from the current 0.35g/t Au to 0.75g/t Au, the ounces decrease only 12.5% (going from 1.6Moz Au to 1.4Moz), but the average grade increases to 1.84g/t Au (from 1.43g/t Au), which would increase profitability a great deal.

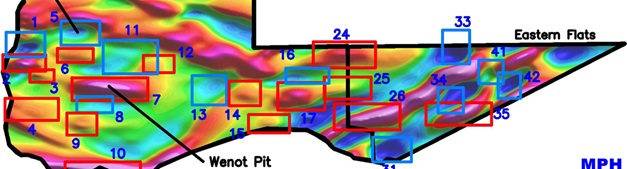

Current exploration strategies for Wenot focus on filling in some of the gaps in the drilling of the resource below the existing pit (management anticipates an exploration target there of 170-290koz Au), and extending along strike to east and west of the Wenot pit. This West Wenot potential wasn’t drilled and pursued at the time of production due to constraints of mine infrastructure at the time, such as the ramp and haulage road which are now gone. For the East Wenot target, historic drilling already delineated near-surface mineralization, as shallow drilling from the past only went 50-75m deep. Management is looking to verify this drilling, and extending mineralization to 200-300m depth whenever possible, depending on drill results. According to CEO Ellingham, the current drill program will include testing selected exploration targets as well as initiating some additional Wenot extension drilling. This program is initially set at 3,000 meters and will likely consist of 15 to 20 holes and a budget of CA$800k, and commenced in late February. Trenching of additional exploration targets will proceed concurrently in order to prioritize some of the additional potential.

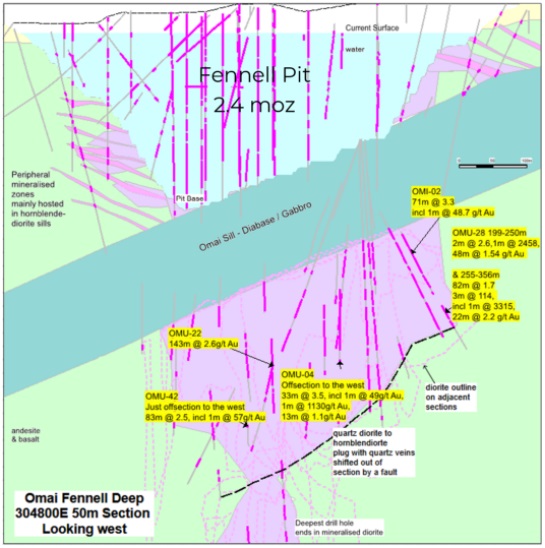

The Fennell deposit sports a non NI 43-101 compliant historic resource estimate completed on it in 2007, containing about 1.4Moz Au @ 2.5g/t Au, conservatively capped at 15g/t Au to exclude high grade intercepts. Interestingly, when uncapped, this historic resource number rises to about 2.5Moz Au @ 3.95g/t Au. As the old Omai mine operation produced much more gold than anticipated (3.7Moz vs 2.7Moz based on the FS at the time), and intercepts came in as high as 1m @ 2458g/t Au (see below right), management expects to prove up a robust underground NI43-101 compliant resource at Fennell later in 2022, only needing 4-5 verification holes as the quality of historic drilling and sampling was excellent.

It was interesting to see that the deeper mineralization at Fennell was separated from the open pit mineralization by a so-called diabase sill (subvolcanic dark gray to black intrusive rock, extremely hard and tough) of about 180m thickness. Exploration drilling (46 holes totaling 27,000m) in 2006-2007 by IAMGold at depth found a continuation of mineralization, and a few of the deepest holes ended in mineralization.

Contrary to Wenot, the vein systems at Fennell were horizontally oriented. On top of this, management has seen strong indications for a similar geologic scenario as can be found at the Aurora Mine, 200km from the Omai project, more specifically the Rory’s Knoll gold deposit, which extends to 2km depth. Both Rory’s Knoll and Fennell, the host rock is a quartz diorite stock, which is a cylindrical intrusive body with deep roots. This is the conceptual diagram of Fennell (and Wenot), based on drill hole trajectories, indicating the intrusive body:

At the moment the company geologists are optimizing the 3D model, in order to finetune targets for verification drilling, in order to upgrade the historic resource into a NI43-101 compliant one. The drill program for Fennell is scheduled for Q3/Q4, 2022, and consists of 4-5 holes and 6,000m in total.

Wenot and Fennell aren’t the only exploration targets management is focusing on. Omai just completed a small drill program and trenching on Broccoli Hill, has been busy recently with a trenching program at Blueberry Hill (west of Fennell), with 29 out of 60 samples returned gold values greater than 1g/t Au, with trenching at Gilt Creek (all 15 samples returned > 1.5g/t Au), and is currently also drilling an initial 2-3 holes at Blueberry Hill, with the first results expected to return from the labs before the end of this month.

Broccoli Hill was the first exploration target besides Wenot and Fennell, as geophysics indicated a huge magnetic low target over there. Trenching was successful as they identified a quartz-rich shear zone with samples assaying 29.3 g/t Au, 7.8 g/t Au, 5.0 g/t Au and 2.2 g/t Au along a 40-metre strike. The following drill program, consisting of 6 holes totaling 690m, was aimed at revealing some of the bedrock geology as it is concealed by a saprolite cover. Although the gold values aren’t impressive, these holes were intended more to test the nature of the geology so they actually exceeded expectations for a first pass with with 1.5m @ 1.3g/t Au, 6.8m @ 0.91g/t Au and 1.5m @ 2.4m Au. The company is continuing with another trenching program at Broccoli Hill at the moment, as it is still early days for this target, and management has enough reasons to believe that there could be economic mineralization at depth.

Also interesting is the fact that an airborne magnetics survey showed a large amount of magnetic lows and highs close to each other. As Wenot is a magnetic high, and Fennell is a low, every target could very well pan out to be mineralized in some shape or form. According to CEO Ellingham, the highs are caused by magnetite seen within Wenot-style of gold mineralization, and the lows can be the quartz diorite intrusions that host gold, such as at Fennell.

Fennell Pit

Fennell Pit

Another indication of gold potential are the extensive artisanal workings in the direct vicinity of the Wenot pit and a few other areas on the property as well. Several major gold discoveries were made on the Guyana Shield when testing areas of artisanal workings in the past. Management is looking carefully at these workings, and is planning sampling and mapping in the areas, but likely some form of shallow drilling will be the best tool.

It will hopefully be clear by now, that Omai Gold Mines has lots of opportunities to create value for their shareholders, ranging from expanding Wenot to quickly verifying Fennell to exploring over 20 greenfield targets. Wenot and Fennell are company makers in itself, but finding a new deposit could be a gamechanger as a total gold endowment of over 5Moz Au could become a reality in that case, increasing attractiveness for mid tier producers even more.

- Conclusion

Not often do I come across a junior that not only flies completely under the radar, but also seems to have a relatively easy path to prove up 3Moz Au, and might be able to expand this number to 4-5Moz Au if all goes as planned, and all this for a current market cap of just CA$29.9M. Omai Gold Mines is putting the pieces of the Omai exploration puzzle together now in an efficient and strategic way, guided by an impressive management team, who knows how to explore, develop and mine deposits in areas very much akin to Guyana, where experience is very important. The ongoing exploration programs could provide investors with a genuine wild card, and with the current high gold prices a near term re-rating seems realistic.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Omai Gold Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Omai or Omai’s management. Omai Gold Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and has a long position in this stock. Fancamp Exploration is a sponsoring company. All facts are to be checked by the reader. For more information go to www.fancamp.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosures

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.