Front page news about inflation and ongoing upheavals across Europe are driving commodity prices a lot higher, and it’s not just the energy complex, and precious metals.

Nickel, lithium, steelmaking coal, copper, and wheat (and probably a few others) hit all-time highs this month. Most pundits believe, and I agree, that events unfolding in Europe will have far-reaching consequences for years — not just weeks or months.

Nickel, lithium, steelmaking coal, copper, and wheat (and probably a few others) hit all-time highs this month. Most pundits believe, and I agree, that events unfolding in Europe will have far-reaching consequences for years — not just weeks or months.

Reverberations from Europe will lead to a comprehensive rethinking of security of supply, and ESG initiatives. End users will push for raw materials and finished goods to be sourced regionally. This will significantly reduce the time, cost, and logistics of transportation (addressing security of supply), while cutting emissions.

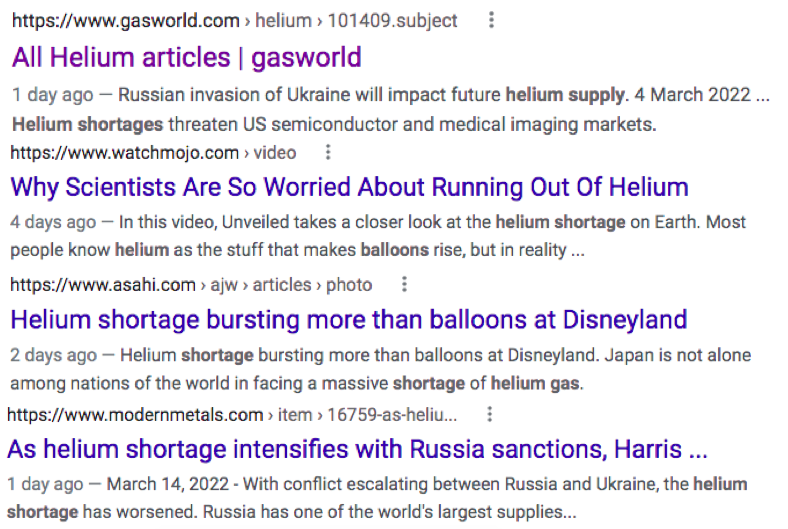

Helium Market As Tight As Any Industrial Commodity

Moreover, the source of critical materials needs to be carefully considered. Countries in the West can no longer rely on supplies originating from Russia and China (or countries they influence/control). This is nothing new, but to say this issue is taking on a new urgency would be an understatement.

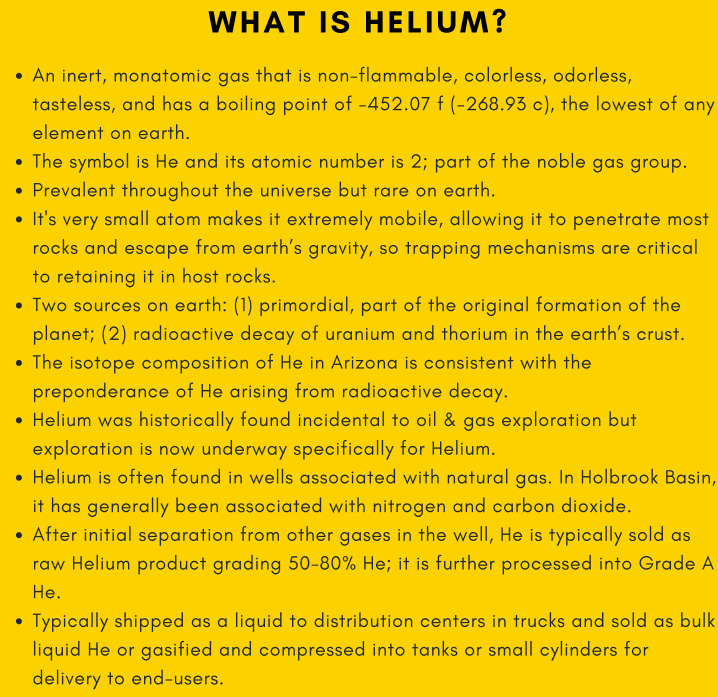

One industrial commodity that investors seem less familiar with is helium gas ("He"). It’s vital in a number of high tech applications. Helium is traded and consumed at grades ranging from ~90% to 99.999999% purity, but privately contracted prices are confidential.

In addition to its widespread use in MRI machines and other medical equipment, the gas is critically important in semiconductors, fiber optics, data centers, LCD displays, hard drives, quantum computing, small nuclear reactors, rocketry, lasers, and more.

Essentially, it is vitally important in public and private scientific, research and development, manufacturing, high tech, aerospace and military applications. The U.S. Departments of Defense (DoD), Energy (DoE), and NASA increasingly use He.

The past several months have been a perfect storm for higher He prices. To be clear, I’m not happy with a major reason WHY the price is rising (Russia’s war on Ukraine), I’m just reporting the facts.

Before the recent hostilities, a major new source of He supply (the Amur Complex) was supposed to come online in Russia’s Far East. Amur was slated to ramp up in phases reaching roughly a quarter of global supply by 2030.

When Will Investors Notice Desert Mountain Energy?

Unfortunately, fires and an explosion (or two) occurred during the commissioning of Phase 1, setting everything back nine to 12 months. Now, with severe sanctions in place, a major economic downturn is underway in Russia. Experts think He supply out of Russia will be largely cut off for years.

In Texas, the Federal Helium Reserve operated by the BLM has been out of service since July 1, 2021, due to serious safety issues. No one knows how much He remains in storage as there have been leaks. And, there’s no telling when He will flow again or at what rate.

Industry participants report that end-users are experiencing force majeures and/or cutbacks of contracted volumes. Many are desperate to replace lost supplies.

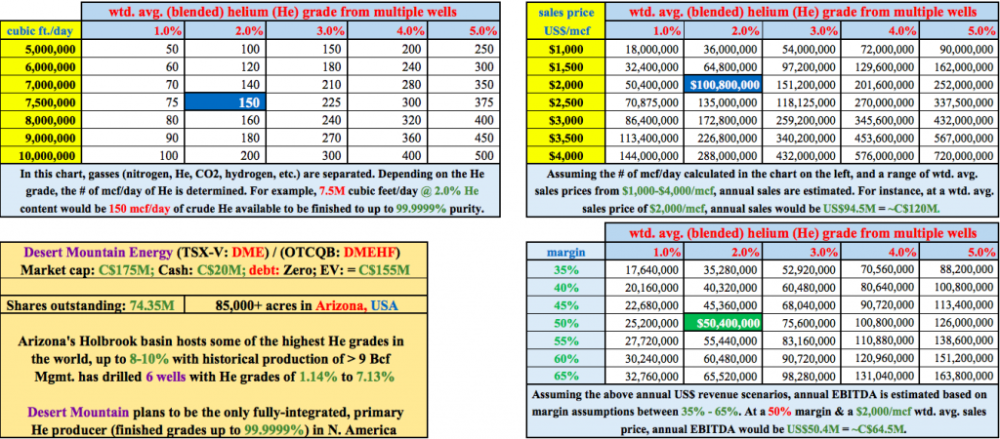

As a result, prices are soaring. In late January, I was quoted a range of $1,000 to $3,000/mcf for Desert Mountain Energy Corp.'s (DME:TSX.V) anticipated top grades (99.9999% purity). Today that range is reportedly $2,000 to $5,000/mcf.

Readers should note that none other than natural resources legend Robert Friedland is onboard the helium train as his company Ivanhoe Mines just invested in Australian-listed developer Renergen Ltd. Friedland is hugely successful, famous for his longtime very bullish views on copper, cobalt, palladium and now helium.

Readers should note that none other than natural resources legend Robert Friedland is onboard the helium train as his company Ivanhoe Mines just invested in Australian-listed developer Renergen Ltd. Friedland is hugely successful, famous for his longtime very bullish views on copper, cobalt, palladium and now helium.

A few months ago there was strong interest from three dozen prospective customers in DME's upcoming production. Today the interest level is off the charts, it’s becoming a frenzy. This is a company that has been impressively de-risked and management is sitting on ~$20 million in cash — more than enough to reach positive free cash flow.

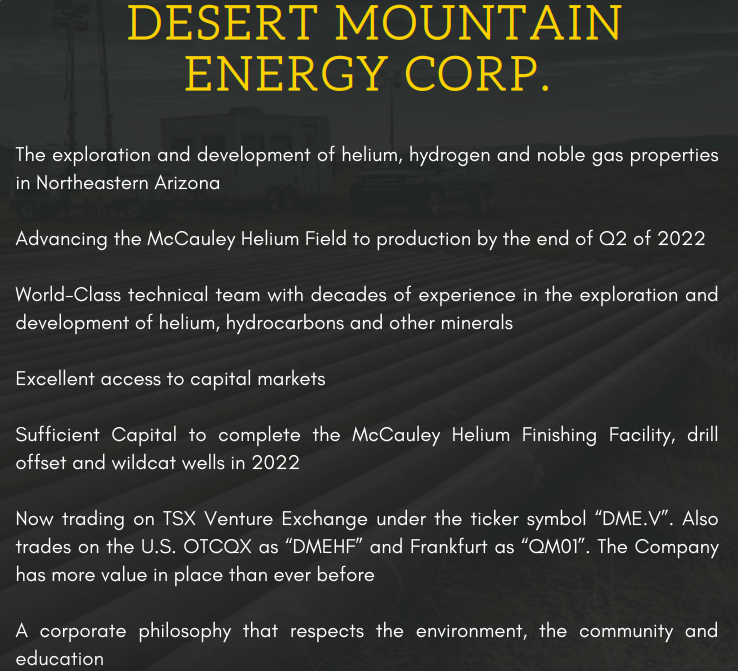

Desert Mountain Energy Has Competitive Advantages

Chief Executive Officer Robert Rohlfing received about 50 calls last week alone from companies looking for supply. Importantly, he believes the calls he’s getting are from end users who could take most or all of DME's entire output in 2023 to 2024.

Production by North American juniors couldn’t possibly come at a better time. DME's prospects have improved by leaps a bounds, but its share price is down about 10% since mid-January.

Of about a dozen juniors with market caps greater than CA$3 million, nine are pure-play He companies. Some have lower market caps than my favorite, Desert Mountain. However, the differences between DME and its peers are substantial.

Most others are planning to produce crude He and sell it (without upgrading) to major industrial gasses/chemical companies like Linde plc & L’Air Liquide. (Note: Total Helium just announced initial production of He in the midwestern state of Kansas, they’re selling it for $212/mcf.)

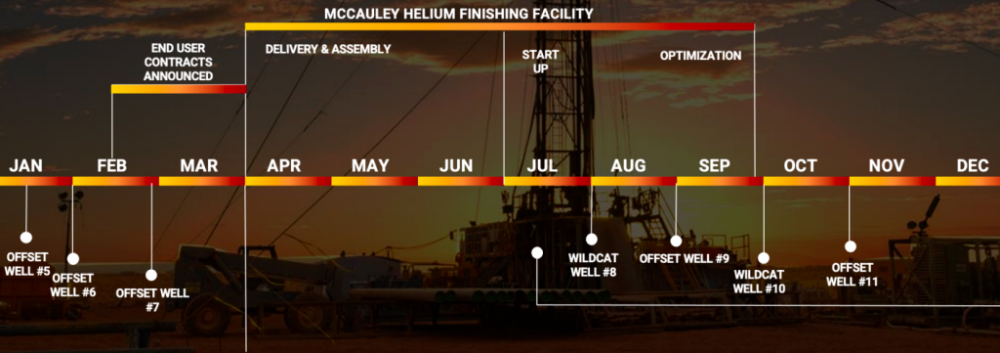

By contrast, management expects to have its 10.5 mcdff/day McCauley Finishing Facility built by June 30, commissioned in the third quarter and ramping up in the fourth quarter. That makes DME head and shoulders above the rest as they will start selling grades of up to 99.9999% this year.

Both stronger prices and a larger portion of the sales mix coming from higher-margin He sales could drive DME’s blended average price to $2,000-plus/mcf. In that scenario, the EBITDA margin would be spectacular. Still, readers are reminded that risks remain considerable, especially the timing of starting operations.

By the fourth quarter, if DME’s first refining facility has been successfully commissioned and is on its way to processing thousands of mcf/day, the company’s valuation should move up, possibly by a lot.

With underlying fundamentals so strong for (at least) several more years, DME could comfortably generate CA$10’s of millions in EBITDA/year from refinery #1 (the McCauley Finishing Facility) alone, before doubling production with the addition of refinery #2 (probably in 2H 2023 or 1H 2024).

DME’s EBITDA Margin Could Be Well Above 50%

Even if/when prices deflate moderately (pun intended), Desert Mountain will still have had the opportunity to expand its McCauley Facility and build a second facility. At that point, margins would be lower, but production would be higher.

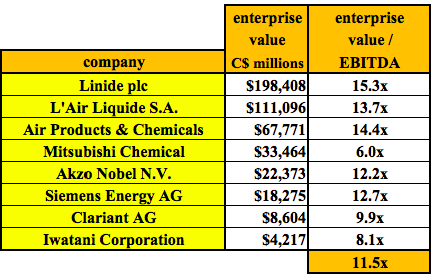

Assuming management can execute on its operational plans and continue to drill productive wells, an industrial gas or specialty chemical company should be willing to pay a substantial premium to partner with or acquire the Company.

Potential acquirers include very profitable multi-billion dollar companies. In the chart below are some of the publicly-traded names.

Potential acquirers include very profitable multi-billion dollar companies. In the chart below are some of the publicly-traded names.

Rohlfing & President and Director Don Mosher are planning to drill and bring online 60 to 70 primary He wells over the next five years. With producing well lives of 12 to 16 years each, cash flow from DME’s existing 85,000-hectare footprint in the Holbrook basin of Arizona should be quite exciting.

As bullish as I’m on Desert Mountain Energy, other He juniors could also be successful. But most others are six to 12 months behind in terms of meaningful production, and a further 12 to 24 months (if ever) from designing, permitting, funding, building, commissioning, and operating a facility like the one that DME will start commissioning in July.

Compared to peers, DME has a more experienced management team, Board, and advisers, and is fully funded through positive free cash flow. The company expects toe one of the cleanest/greenest mining operations on earth by using an onsite solar farm plus its own produced hydrogen for backup power.

Another factor in favor of DME is that its wells have no wastewater to deal with. This saves on permitting, logistics/time, and operating expenses. The company believes it will be the only independent, fully integrated, and upgraded (refined) dry helium producer in the world.

Management Looks at Hydrogen

It should be noted that management is studying the feasibility of selling pure, clean hydrogen. A recent press release revealed the discovery of what could be a large hydrogen deposit, but this opportunity is a few years off.

According to the press release, “in three hydrogen bearing zones, the thickest is ~32 feet. of extremely high-quality hydrogen without sulfur or other elements which would create issues with production.” The hydrogen field is safely trapped underground, it’s not going anywhere — like money in the bank.

In summary, He demand is growing robustly but supply is not — in fact, it has declined. The He required in key industries cannot be substituted for other commodities. Helium is both finite and non-renewable.

Arizona is a growing high-tech industrial hub; home to semiconductor, EV, and Li-ion battery manufacturing, aerospace companies, and giant data centers. The demand for reliable, regional, 99.9999% He will be virtually insatiable for years to come.

Arizona is a growing high-tech industrial hub; home to semiconductor, EV, and Li-ion battery manufacturing, aerospace companies, and giant data centers. The demand for reliable, regional, 99.9999% He will be virtually insatiable for years to come.

Desert Mountain Energy is ideally positioned to meet soaring He demand in the U.S. It’s situated within a day by truck or rail of dozens of significant southwestern U.S. end-users. This is a key strategic advantage vs. peers near the U.S./Canadian border.

Every junior that crosses the finish line, delivering consistent He supply, will be rewarded. However, why not choose the one that’s vertically-integrated with an operating margin that will be far superior to peers not upgrading their produced helium?

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures / Disclaimers:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Desert Mountain Energy, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Desert Mountain Energy are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Desert Mountain Energy and the Company is a former advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosures:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the alidity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.