Quebec Precious Metals Corp. (QPM:TSX; CJCFF:OTCQB) reported a high-grade interval of 69.6 grams gold per tonne (69.6 g/t gold) over 0.6 meter inside a longer intercept of 94 metres grading 1.32 g/t gold, in hole 187, part of its fall drilling program at the La Pointe Extension gold deposit.

Hole 188 also hit 1.51 g/t gold over 42.15 meters inside a longer intercept of 0.95 g/t gold over 100.8 meters. The La Pointe Extension is part of the company’s 100% owned Sakami gold project in the Eeyou Istchee James Bay territory of Quebec, about 600 km north of Val d’Or, Que.

QPM has a 142-square-kilometer land package along a greenstone belt and controls a 23-kilometre-long geological contact that is favorable for gold mineralization.

The junior continues to wait for assay results from hole 189 on the La Pointe Extension, but QPM CEO Normand Champigny says the drilling results suggest that the continuity of mineralization at the La Pointe Extension mean that it could be mined by open-pit methods — much cheaper than underground mining but often more difficult to permit.

“These results are the best to date at the La Pointe Extension and validate our belief that the central portion of the deposit continues at depth with greater mineralized widths. I would say to investors, the more we drill to the southwest to the South Point State extension, the better it gets. And that's why we keep focusing on that. We could be at the tip of the iceberg,” QPM CEO Normand Champigny told Streetwise.

The assay results from hole 189 could be published as early as next week, whereas the winter drill results are expected in April.

Those results will be the next catalyst for the share price, followed by the company’s maiden resource estimate in Q3. The resource calculation will use data gleaned from all 40 of the holes drilled to date into the La Pointe Extension and the total ounces for Sakami is expected to approach 2 million.

Some of that will come from the main La Pointe deposit, which is about 2 km northeast of the La Pointe Extension deposit. QPM has thoroughly drilled La Pointe at 50-meter spacings and knows it well. The company has done a lot less drilling on the La Pointe Extension but has a much higher discovery rate.

Quebec-based analyst Eric Lemieux sees promise in the latest results.

“I estimate a grade (multiplied by a) thickness of 26.9 g/t gold (multiplied by) meters for the 3 holes on La Pointe Extension, which is good. My overall estimate for the whole of the La Pointe zone is 16 g/t gold (multiplied by) meters (estimated true width). Not a slam dunk, but I think it does merit more drilling. I am more interested in the higher-grade depth potential,” Lemieux told Streetwise.

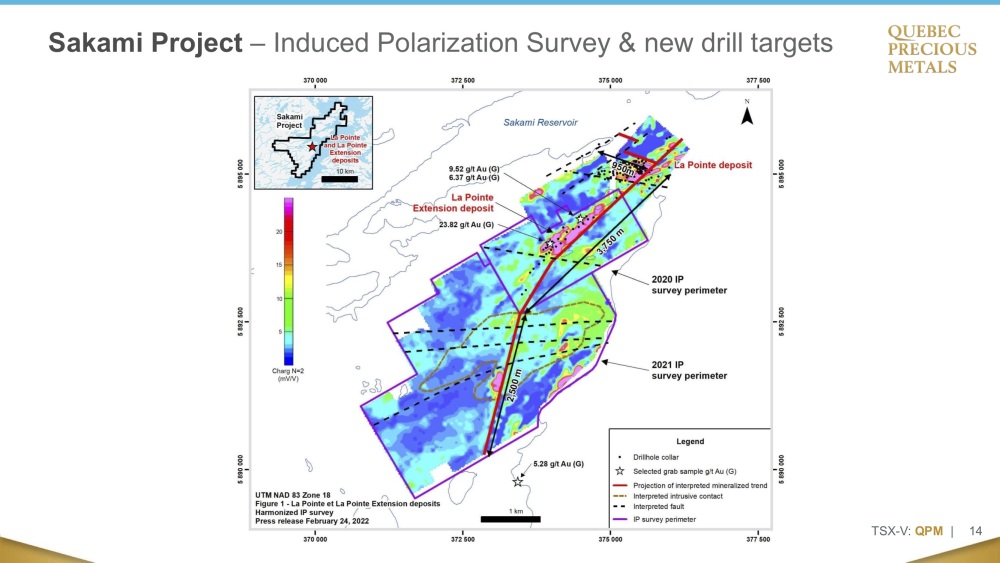

IP Surveys Lead to More Potential Mineralization

Induced-polarization surveys by QPM point to more potential along strike at the La Pointe Extension, including what Champigny describes as different anomalies 2.5 km along strike south of the La Pointe deposit that are associated with a “large intrusive body.”

QPM has traced the La Pointe Extension deposit over a strike length of 3,750 meters and to at least 400 meters below surface. The company’s 3-D model suggests the mineralization is about 41 meters thick at the edges, while as much as 75 meters thick in the central part of the deposit.

“We have expanded significantly the known volume of mineralization and are encouraged by the interpreted large intrusive body. The 2021 IP results indicate that the La Pointe Extension deposit continues to the south over a target area similar in size to the deposit that we are currently drilling based on the 2020 IP results,” said Champigny.

IP puts electrical current into the ground through electrodes to allow geophysics technicians to measure the voltage response. The measurements determine the chargeability of the hosting metallic minerals, particularly sulphide minerals like pyrite (known to host precious metals). A higher concentration of chargeable material will usually produce a stronger response.

Early Metallurgical Work Sees High Recoveries

QPM has also done some early-stage metallurgical work on samples taken from the La Pointe Extension.

“We have done a preliminary examination of the mineralogy, which showed that the gold was free, sometimes attached to sulphides. We did a test using conventional techniques. And we got recoveries from 90%, to up to 99%. No deleterious elements,” said Champigny.

One noteworthy event for QPM is that Jean-François Meilleur stepped down as president and director in late January. The role of president has not been filled, but Meilleur remains a significant shareholder. Champigny says he thanked Meilleur for his contributions to QPM and that it’s “business as usual.”

QPM is funding its exploration efforts in part through the sale of non-core assets. The last asset to go is QPM’s 50% stake in the Matheson joint venture, a gold exploration play near the Hoyle Pond mine in northern Ontario’s Timmins camp. Champigny expects the sale to close soon and will provide some non-dilutive financing.

“We've been very successful monetizing our non-core assets. We expect (Matheson) to close shortly. And we expect that to bring in around $500,000 cash and shares,” Champigny told Streetwise.

Institutional Support Remains Strong

QPM remains well supported by several large Quebec-based institutions and Newmont Corp. (NEM:NYSE).

Goldcorp — before it was acquired by Newmont in January 2019 — bought into the newly formed QPM with an investment of CA$3.7 million. Newmont, which operates the nearby Éléonore underground gold mine, has since participated in further financings and owns about 13%.

Government-backed Caisse de Dépôt et Placement du Québec bought in at the same time, at the same terms as Goldcorp. It and other Québec institutions own about 12%. QPM management owns about 2%.

QPM has about 82 million shares outstanding and trades in a 52-week range of CA$0.33 and CA$0.145.

Disclaimers:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Quebec Precious Metals Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Eric Lemieux or members of his family own shares of Quebec Precious Metals Corp.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Quebec Precious Metals Corp., a company mentioned in this article.