The past year has been nothing short of transformational for Québec’s Arianne Phosphate Inc. (DAN:TSX.V; DRRSF:OTCQB; JE9N:FSE) After a seven-year downtrend (2013-2019), phosphate rock prices turned decisively positive from April 2020 as the cure for low prices is ... low prices.

More recently, demand from a specific electric vehicle (EV) battery type, lithium iron phosphate (LFP), has sparked the potential for competitive tension between auto/battery makers and fertilizer companies.

In addition to Tesla and a number of Chinese OEMs, Volkswagen, Daimler, BMW, Ford, GM, Stellantis, Volvo, and Hyundai are using or have expressed interest in LFP batteries. With Tesla leading the charge, research and development into enhanced LFP formulations and uses is sure to follow.

Moreover, Arianne’s high-purity product might also be useful in a range of hydrogen fuel cell technologies. Some believe that fuel cells will takeoff (for heavy-duty trucks) later this decade.

Equally exciting, management announced a research program in collaboration with an environmental and biotechnology research group aimed at developing a new breed of fertilizers using organic waste and Arianne’s high-purity, low-contaminant phosphate concentrate.

Although in early days, if successful, this initiative would cut out the middleman. Arianne could bypass companies like Mosaic and capture more of the economics of the fertilizer value chain.

This could be a game-changer for the company or for prospective acquirers and partners, especially companies looking to boost their ESG credentials with a greener product offering. From the Feb. 8 press release:

“The industry practice is to ship phosphate concentrate to a phosphoric acid facility, where it’s combined with sulphuric acid and other ingredients to make fertilizers like MAP and DAP. By working with both research and commercial organizations, Arianne is looking to alter the process and combine its concentrate with organic waste or other bacteria, allowing its concentrate to effectively be used in farming without the requirement of acidulated fertilizer products.”

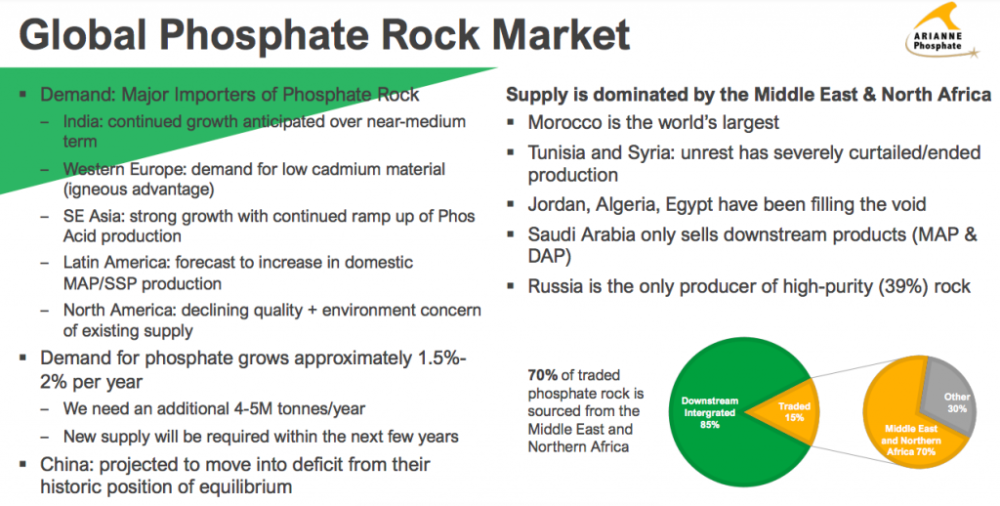

The security of phosphate rock supply has not been a big concern for fertilizer companies. When feedstock prices are falling (like in 2013 to 2019), few worry about the origin of, or long-term sustainability of, supply.

For decades, phosphate rock has come mainly from China, northern Africa (Morocco, Algeria, Egypt, Western Sahara, and Tunisia) and the Middle East (Saudi Arabia, Jordan, and Israel).

In the chart, notice that 74.6% of 2021’s production came from those three regions (plus Russia), and 86.3% of total reserves are held in those countries (plus Russia). Speaking of Russia — PhosAgro, a major phosphate fertilizer company based in Moscow, has suffered a greater than 75% decline in its valuation in the past two weeks.

The horrific war in Ukraine will change the geopolitical landscape in ways that no one can fully predict. Suffice it to say that this war underscores the critical importance of security of supply, not just regarding phosphate rock or fertilizers from Russia, but all essential commodities around the globe.

Notice also that 38.6% of production came from China and 70.4% of reserves are contained in one country: Morocco. Phosphorous in fertilizers is one of the most essential commodities on the planet. There’s no substitute, it’s a finite resource. Without enough of it, we get food riots and starvation.

Although clearly not as tragic as the war’s impact on the people in the region, there’s the observation that global energy prices will increase and remain high, possibly for an extended period.

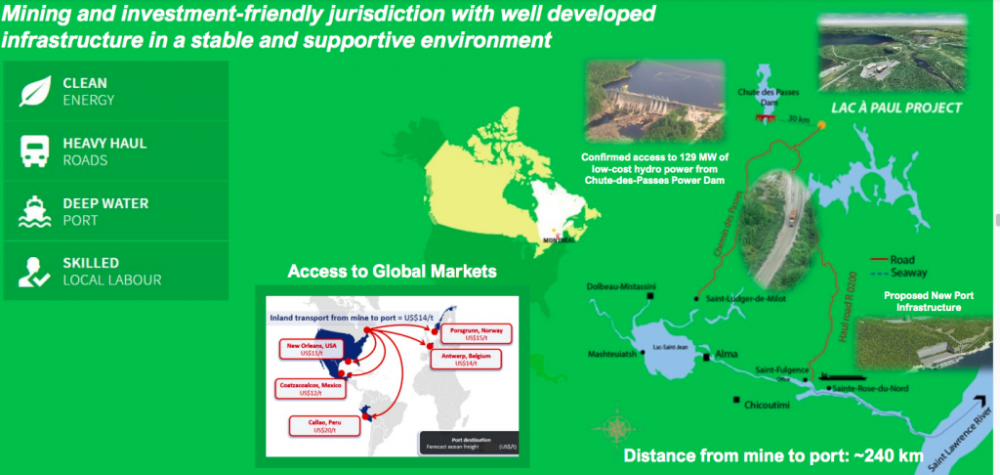

With energy prices soaring, the desire to source raw materials closer to end markets to minimize GHG emissions is even greater. Arianne’s 100%-owned Lac à Paul project is in Québec, proximal to North American markets for fertilizer, EVs and Li-ion batteries.

Québec is well known for its close collaboration with investment funds, provincial agencies, first nations, and universities on wide-ranging R&D initiatives, plus funding packages and loan guarantees for pre-revenue technology and mining companies.

The province plans to be a significant regional EV and Li-ion battery manufacturing/recycling hub. Québec’s hydroelectric power is among the lowest cost and greenest in the world, making Lac à Paul an even more compelling opportunity versus many peer projects.

I could go on and on about demand and security of supply, but an easier way to demonstrate these dynamics is by pointing to commodity prices.

Management believes that the benchmark price of high-purity rock is up $50+/Metric tonne in February. Since Arianne’s rock is of higher quality than the benchmark, I estimate the Company could possibly receive a price of ~US$280/Mt.

That’s a far cry from the 2020 COVID-19 low of $70.75/Mt. Readers are reminded that Arianne’s Bank Feasibility Study (BFS) used a price of $213/Mt. According to the BFS, each $1 increase in the long-term price assumption equates to ~$17M in after-tax NPV. So, greater than $1 billion in incremental NPV (all else equal) is on the table.

And that doesn’t account for a significant move in the US$/CA$ FX rate in favor of the project’s economics. Marking the FX rate to market would add hundreds of millions of dollars to the NPV.

Importantly, not only are phosphate prices up a tremendous amount, food commodities are up as well. In the chart below, one can see the 10-yr price charts of corn, soybeans, and wheat. Note also crude oil at $100 a barrel. Ukraine and Russia are top exporters of several grains and vegetable oils, including wheat, corn, and sunflower oils.

The stars are truly aligned for Arianne Phosphate. It’s difficult to imagine a more bullish backdrop for management to secure new off-take agreements and arrange project funding.

I believe we could see new off-takes in the coming months and a substantial portion of the funding package announced a few months later.

Arianne has two off-take arrangements, a fully-permitted project and a signed Cooperation Agreement with the Innu First Nations. This is a shovel-ready project that could be in production within three years.

Management believes that up to 75% of the project’s cap-ex can be raised through a combination of debt, royalty/streaming, equipment financing, and advanced payments (forward sales) of products.

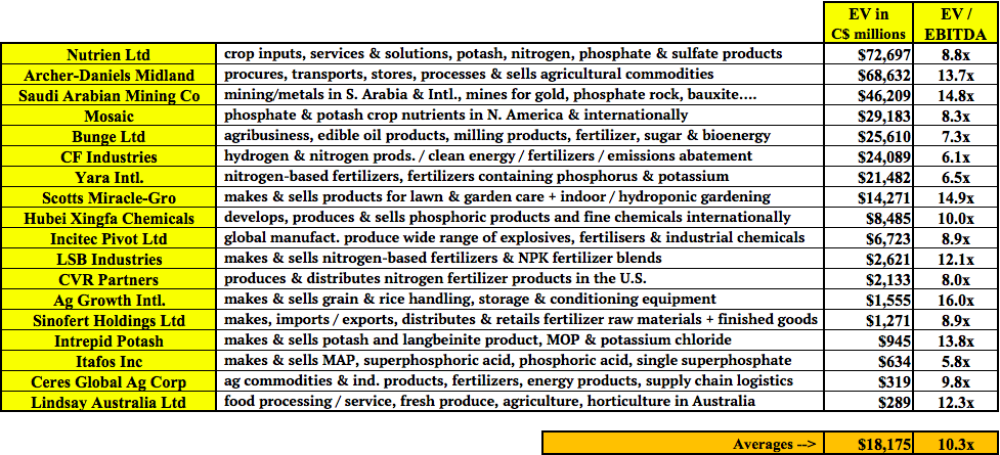

In addition, a strategic partner might be found to invest at the project level (no new shares issued) or at the corporate level (new shares would be issued). Why is Arianne so attractive to an acquirer? The 18 companies listed above trade at an average EV/EBITDA multiple of 10.3x (trailing 12 months EBITDA).

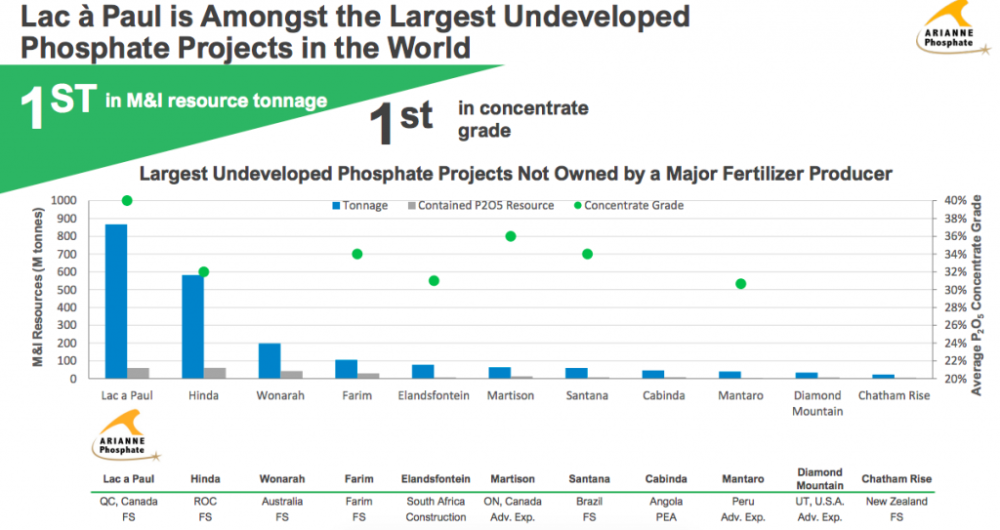

At today’s phosphate rock prices, Arianne’s 3 million tonnes per year would generate more than CA$500 million in EBITDA. Yet its enterprise value (market cap + debt – cash) is just CA$110 million.

By inviting a strong partner, Arianne’s equity requirement would be greatly reduced. A partner could cover some or even all of Arianne’s share of upfront cap-ex in exchange for a direct economic interest in the project or an equity stake in the company.

Instead of a dozen global fertilizer/Ag companies potentially interested in partnering with, obtaining off-take from, or acquiring all of the Lac à Paul project, there are now a handful of LFP battery makers and perhaps another handful of global OEMs in the hunt.

Talk about competitive tension, it’s going through the roof.

Despite these undeniably positive fundamentals, and what appears to be pretty good visibility into the future of phosphate rock and grain commodity prices, Arianne’s share price has barely moved. It is down 4% in the past three months. By contrast, Soybeans, wheat, and corn are up (on average) nearly 30% over the same period.

Make no mistake, Arianne Phosphate is a high-risk investment opportunity, but a company with a lot of the heavy lifting behind it, and enjoying some risk mitigation by being in the Tier-1 jurisdiction of Québec.

There are well over 1,000 (gold, silver, copper, lithium, and uranium) juniors across Canada, the U.S., and Australia, but only a few dozen fertilizer juniors. Half are only listed in Australia, many are potash plays.

Arianne offers excellent diversification from the typical natural resources portfolio and substantial blue-sky potential that could play out as soon as this year.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures / Disclaimers:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Arianne Phosphate, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Arianne Phosphate are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Arianne Phosphate was an advertiser on [ER] and Peter Epstein owned shares in the company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the alidity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.