News Flash, March 16: Canadian clean tech company Ecolomondo Corp. announced Wednesday that it had secured an offtake agreement for up to 80% of the recovered carbon black from its Hawkesbury, Ontario, facility.

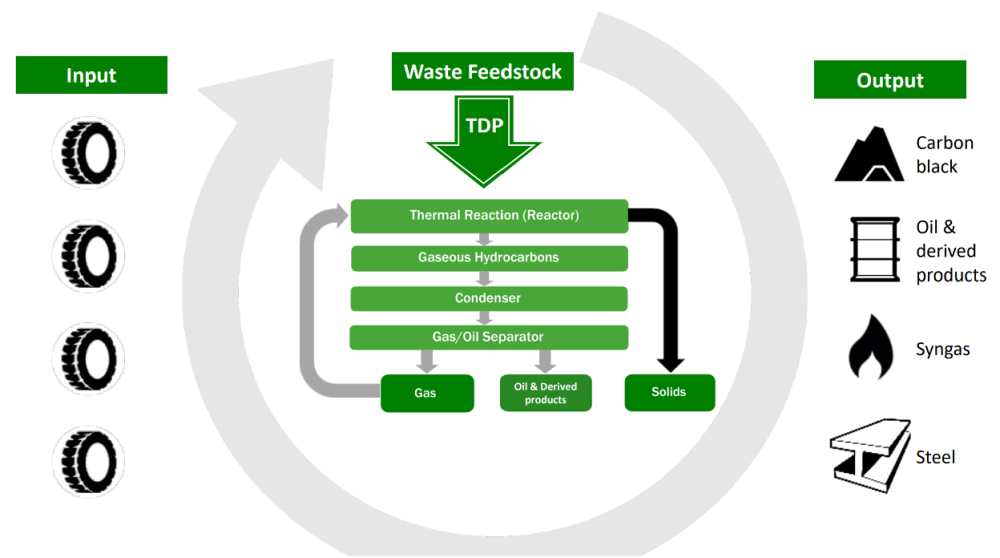

Recovered carbon black is produced by processing end-of-life tires using Ecolomondo's Thermal Decomposition Process (TDP) recycling technology.

Under the deal, the initial purchase order is for eight truckloads of recovered carbon black totaling 181 metric tons in April and May 2022, followed by 10 truckloads per month and growing to 20 truckloads a month over time, the company said. The transactions have a potential value of $7 million at the current market price.

For more information, click here.

On Monday, the company also announced an initial purchase order from a multinational corporation for pyrolysis oil produced at the plant. The order is for a full tanker carrying 262 barrels valued at about $25,000.

Click here for more information.

Every year, the U.S. disposes of about 300 million end-of-life tires, representing 30% of global tire waste.

Ecolomondo Corp. (ECM:TSX; ECLMF:OTC), a Canadian clean tech company, specializes in converting those tires, and other waste plastics and hydrocarbons, into marketable end products like carbon black substitute, oil, gas, steel, and fiber.

It does this through its Thermal Decomposition Process (TDP) recycling technology, which it says will play a critical role in the development of a sustainable economy.

Ecolomondo’s first commercial facility in Hawkesbury, Ontario, is expected to be fully operational in the coming weeks.

The company also recently announced an $80 million six-reactor facility in Shamrock, Texas, with annual revenues estimated at $31 million and EBITDA at $18 million (58% EBITDA margin). The announcement opens the door for further expansion in the continent and beyond, with its projected annual tire processing capacity set at 5 million to 6 million. Investors are expected to see value as the company announces more partnerships to scale the TDP technology, and we expect that would translate into higher valuation.

“We believe that the recent investment trends support clean tech financing, and Ecolomondo would have access to both asset-backed loans and equity markets to fund its future projects. Management and Board own a considerable portion of the basic outstanding shares, at 75.7%. We see this as a significant positive alignment of interests between management, shareholders, and stakeholders,” said Pooja Sharma of Volt Strategic Research.

TDP is a closed-loop, slow pyrolysis technology that operates in an oxygen-free environment using positive pressure and a batch rotary reactor. The process is largely energy self-sufficient. Ecolomondo’s exclusive automation system allows for strict control of cycle times, processing parameters, and consistent batch production, resulting in quality, commercial-grade recycled commodities and end products.

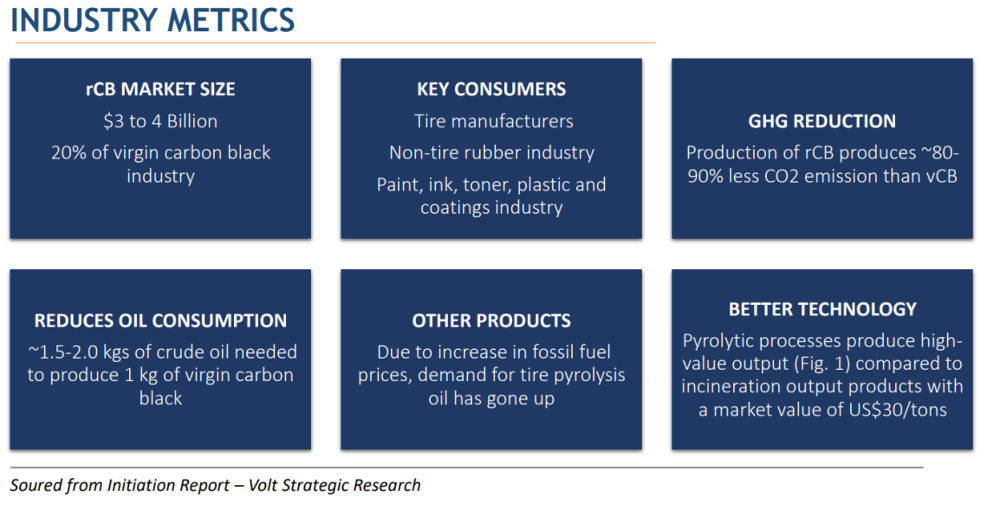

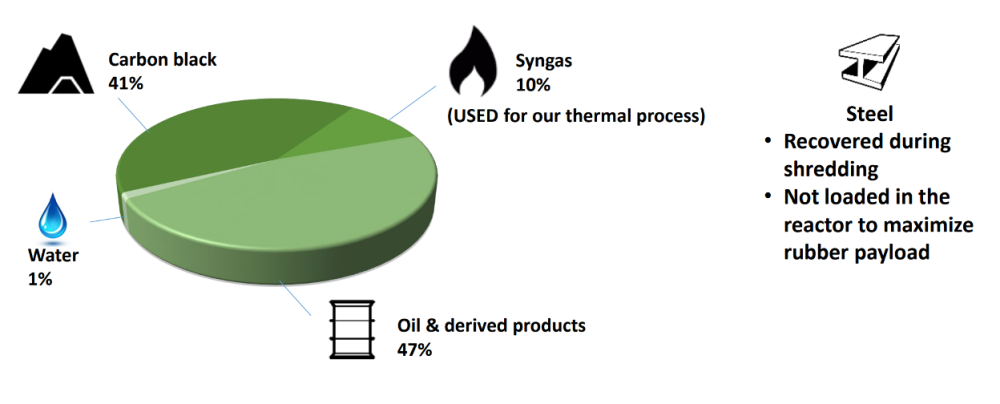

The Hawkesbury plant will operate two reactors, each with a capacity to process seven tons of end-of-life tires in one batch. It can process 14,000 tons of tires, or 1.4 million tires, in a year. The sale of output material recovered carbon black (rCB) is a top revenue source for the company. Other output materials include pyrolysis oil and #2 busheling steel, which can be conveniently sold in the open market.

The company generates revenue in the form of tipping fees for its key raw material "waste tires." Ecolomondo Process Technology (EPT), a fully owned subsidiary, offers engineering services to the client, adding further revenue generation capabilities to the existing business. The company has seen an encouraging response in the initial phase of the launch.

Probable expansion into the United States represents a significant market to source feedstock and capitalize on output materials.

“Over the years, we spared no expense and cut no corners during the development of the Thermal Decomposition Platform.”

—Board Chairman, Chief Executive Officer Elio Sorella

In a stroke of luck 15 years ago, entrepreneur and business magnate Elio Sorella bought all the assets of Ecolomondo from cofounders and inventors of the company’s proprietary process, the late Richard Bouziane and Rodier Michaud. Shortly after, Sorella developed a team of technical experts, engineers, and investors that worked on refining the technology at their full-sized pilot facility located in Contrecoeur, Quebec.

“Over the years, we spared no expense and cut no corners during the development of the Thermal Decomposition Platform,” said Sorella, who is chairman of the Board of Directors and chief executive officer of the company.

Each reactor in the pilot facility in Contrecoeur can handle 6.5 tons of tire waste in less than eight hours. The company, through intensive research and development over 10 years, was able to repeatedly validate and improve reactor payloads, cycle times, and production yields. The company has onsite lab capabilities and engineering ability to test and format their end products.

Today the company’s TDP technology can process end-of-life tires in an entirely circular fashion, turning them into recovered carbon black (rCB), oil, gas, steel, and fiber, producing end products in formats that are accepted by industry buyers.

“After many years of dedication, hard work, and investment, our technological teams were able to overcome all technological uncertainties associated with processing hydrocarbon waste. These technological breakthroughs now position Ecolomondo among industry leaders,” said Sorella.

At full operation, the Hawkesbury plant can produce 5,300 metric tons of recovered carbon black, 42,700 barrels of oil, 1,800 metric tons of steel, 850 metric tons of fiber, and 1,600 tons of syngas per year.

The flagship TDP facility in Hawkesbury contains state of the art automation systems not seen in any other tire pyrolysis plant worldwide. Plant operators are in place much like today’s commercial aviation pilots, for safety and troubleshooting. This ensures a consistent and quality product all while minimizing the risk of human error, inherent in many other pyrolysis operations.

“The Hawkesbury facility contains over 100 proprietary process improvements and trade secrets,” said Sorella.

The feedstock for the Hawkesbury plant is a mix of 20% light truck tires and 80% passenger tires. The tires are offloaded from transport trucks automatically and then pneumatically conveyed to the plant's shredding and crumb rubber processing department. End-of-life tires are processed by a primary shredder and then pass through raspers reducing the material to crumb rubber. After additional processing, the resulting crumb comes out 99% steel and fiber-free. Finished crumb rubber is conveyed and top loaded into a holding tank with enough capacity to hold five days' worth of production. It's then loaded into thermal processing reactors and recovered carbon black is vacuumed out the side of the reactor. Recovered oil and gas are separated and processed separately into syngas and high-quality marketable oil products.

Colby Mintram is the President of of Volt Strategic Partners.

Disclosures:

1) Colby Mintram: I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: Ecolomondo Corp. I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: Ecolomondo Corp. My company has a financial relationship with the following companies discussed in the broadcast: Ecolomondo Corp. Colby Mintram, director of Volt Strategic Research and Volt Strategic Research's disclaimers and disclosures listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Ecolomondo Corp., a company mentioned in this article.

Colby Mintram's Disclosures

Disclosure, disclaimer and waiver of liability: Prior to using, reading, or accessing any other information contained within this report, you should review and understand the terms of the disclosure, disclaimer, and waiver of liability. By using this report, you are deemed to have fully understood and accepted the terms of the disclosure, disclaimer, and waiver of liability referred to at the end of this report. Ecolomondo Corp. is a paid client of Volt for equity research.

Investment banking and fees for services: Volt does not provide investment banking services, nor has it received compensation for investment banking services from the issuers of the securities covered in this report or article. Volt has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm engaged by the issuer for providing non-investment banking services to this issuer and expects to receive additional compensation for such non-investment banking services provided to this issuer. The non-investment banking services provided to the issuer includes the preparation of this report, investor relations services, investment software, financial database analysis, and organization of non-deal road shows. Fees for these services vary on a per-client basis and are subject to the number and types of services contracted. Fees typically range between ten thousand and fifty thousand dollars per annum. The fees paid by this issuer are $15,000 CAD to Volt for annual research services.

Policy disclosures: This report provides an objective valuation of the issuer today and expected valuations of the issuer at various future dates based on applying standard investment valuation methodologies to the revenue and eps forecasts made by the Volt analyst of the issuer’s business. Volt analysts are restricted from holding or trading securities in the issuers that they cover. Volt does not make a market in any security followed by Volt, nor do they act as dealers in these securities. Each Volt analyst has full discretion over the valuation of the issuer included in this report based on his or her own due diligence. Volt analysts are paid based on the number of companies they cover. Volt analyst compensation is not, was not, nor will be, directly or indirectly, related to the specific valuations or views expressed in any report or article.

General disclosure: This report and the information contained herein is intended to be viewed only in British Columbia, Canada, and in jurisdictions where it may be legally viewed, and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations, or which would require any registration requirement within such jurisdiction. Where the reports are made available in a language other than English, any inconsistencies or ambiguities between the English and translated versions of the reports shall be resolved in favor of the English version. Volt Strategic Research Ltd. (“Volt”) does not guarantee the accuracy of the translation. The information and opinions expressed within are based on publicly available information that Volt believes to be reliable, and opinions are subject to change without notice. This report and its analysis have not been submitted to, or received any approval from, the British Columbia Securities Commission, or any other regulatory body. While Volt has exercised due care in compiling this analysis, Volt expressly disclaims all warranties, representations, covenants or conditions, express or implied, arising out of operation of law, course of performance, or course of dealing, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and Volt assumes no liability with respect to the consequences of relying on this information for investment or other purpose. Any reliance on this report is expressly prohibited. This report is not a substitute for professional advice of any kind, including, without limitation, legal, accounting, financial, or business advice. Any opinion or statement made in this report is not made with respect to any particular investor or type of investor. Securities, financial instruments, or strategies mentioned herein may not be suitable for all investors and this material is not intended for any specific investor. It also does not take into account of an investor’s particular investment objectives, financial situations or needs. You should always consult a professional, including but not limited to, a financial professional, or such professional to the extent applicable, to assess your risk tolerance, objectives, situation, return on other assets, and other relevant factors, for a complete analysis of the suitability of a particular security to be included in your portfolio.

Forward-looking statements and forecasts: This document may contain forward-looking statements and forecasts. Such statements and forecasts are not a reliable indicator of future performance, as past performance is not necessarily indicative of future results. There are many factors that may cause or contribute to differences between actual results and such forward-looking statements or forecasts. By making such forward-looking statements and forecasts to such extent applicable, volt and the analyst(s) or author(s) of this report undertake no obligation to update these statements for revisions or changes after the date of this report. This report is not intended to, and does not, constitute an offer or solicitation to buy or sell securities or engage in any investment activity. This report is for informational purposes only, and it does not intend or purport to provide a comprehensive description of any company referenced in this report, industry, securities, or developments referred to in the material. Any forecasts or statements within this report were independently prepared, unless otherwise specified, and have not been endorsed by any management of the report’s subject company. Nothing contained in this report is investment advice and a reference to a particular investment or security, a rating or any observation, comment, or opinion, made concerning a security or investment made by the analyst(s) or author(s) of the report is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions.

Other disclaimers and notices: You may not modify, disseminate, reproduce, or distribute this report in any form without prior express written permission of volt. Any distribution of this report shall be inclusive of the terms of this disclosure, disclaimer, and waiver of liability. The report shall not be used for any unlawful or unauthorized purposes. Volts, as well as their directors, officers, shareholders, employees, and agents do not guarantee the accuracy, completeness, timeliness, or availability of the report. References and links to third-party websites or content providers are for information purposes only. Volt is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites, content providers, or their respective sponsors. Volt is not responsible for the content on any third-party websites or content providers or with the collection or use of information regarding any website’s or content provider’s users and members. From time to time, volt and its directors, officers, employees or members of their families, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise. Volt gives no express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use and all Volt information is provided on an as-is basis. Volt shall not be liable for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or profits and opportunity costs or losses caused by negligence), in connection with any use of this report, information or content, including any ratings and third-party references. Any credit ratings, or other methods ratings, found in this report are statements of opinions and not statements of fact or recommendations to buy, hold, or sell securities. They do not address the suitability of securities or its applicability for investment purposes and should not be relied on as investment advice. The limitations, exclusions, and disclaimers above will apply irrespective of the nature of the cause of action, demand, or action by you, including but not limited to, breach of contract, negligence, tort, strict liability or any other legal principle and will survive a fundamental breach or breaches or the failure of the essential purpose of this agreement or of any remedy contained herein. The terms contained in this report will be governed by and construed in accordance with the laws of the province of British Columbia, Canada, without giving effect to its conflict of law’s provisions. Any matter arising from this report shall be submitted to the personal and exclusive jurisdiction of the courts located in the province of British Columbia, Canada. The report is physically maintained and operated by Volt from the province of British Columbia. If any terms in this disclosure, disclaimer, and waiver of liability is held invalid, void, or unenforceable, then that provision will be deemed severable from the disclosure, disclaimer, and waiver of liability and will not affect the validity and enforceability of any remaining provisions.