Porgera. Lihir. Vatukoula. These are the names of some of the “elephants” on different islands in the chain of nation-state archipelagos that form the South Pacific’s Ring of Fire. Kalo Gold Holdings Corp. (KALO:TSX.V; KLGDF:OTCQB) is hoping to add another name to the list: Vatu Aurum, a gold project in Fiji.

Porgera is a 25-million-ounce (25 Moz) alkaline gold deposit owned by Barrick Gold Corp. (ABX:TSX; ABX:NYSE) and the government of Papua New Guinea (PNG); the mammoth 40 Moz Lihir, also in PNG, is the crown jewel of Australia’s Newcrest Mining Ltd. (NCM:TSX). While, in Fiji, the 11-Moz Vatukoula (meaning Emperor), the smallest of these golden pachyderms, has been in production for decades and is now in the hands of Chinese company Vatukoula Gold Mines Plc (VGM:AIM).

“We know that this is elephant country and that this part of the world — the Ring of Fire — really bodes well for large, significant gold deposits,” Kalo Gold Director & President Kevin Ma tells Streetwise Reports. “Fiji has been quite a prolific mining jurisdiction for the past 50 to 60 years… It's a very mining friendly jurisdiction.”

Vancouver-based Lion One Metals Ltd. (LIO:TSX-V; LOMLF:OTCQX) thinks so. The junior has spent about a decade in Fiji developing the advanced-stage Tuvatu project, a district scale alkaline gold system on Viti Levu (South Island). It’s what Kalo management sees when it looks in the mirror — only bigger.

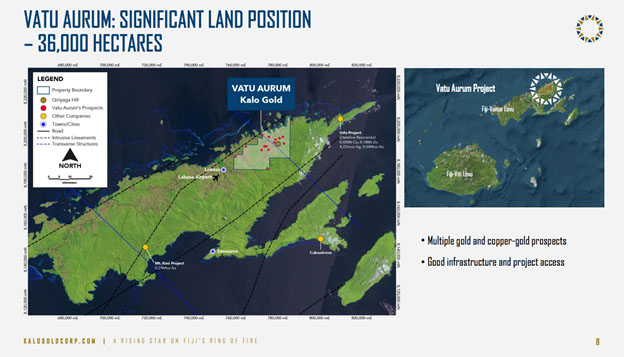

“Kalo Gold has a significant land package that is relatively under-explored. When compared with Lion One, Vatu Aurum is almost one-and-a-half times their land package. We've already identified near-surface mineralization; and this area has seen some significant high-grade results in the past,” Ma says. “So now it is really about hunting in elephant country and outlining the extent of the gold deposit that we have.”

To that end, Kalo launched its phase 2 exploration program in January. One drill rig came with the concessions when the company bought the project from the Nesbitt family, which has been operating in Fiji for about 30 years.

The Nesbitts now own slightly less than 25% of Kalo, while Michael Nesbitt serves as director and in-country manager.

The frugal junior recently added a second drill to the mix at a favorable cost.

“Prior to this we experienced some difficulty in moving equipment and people around. So, having that equipment on site allows us to be more flexible with our [drill] program. Adding a rig is something that's really a good fit for us,” Kalo Director & CEO Fred Tejada, a geologist by trade, tells Streetwise.

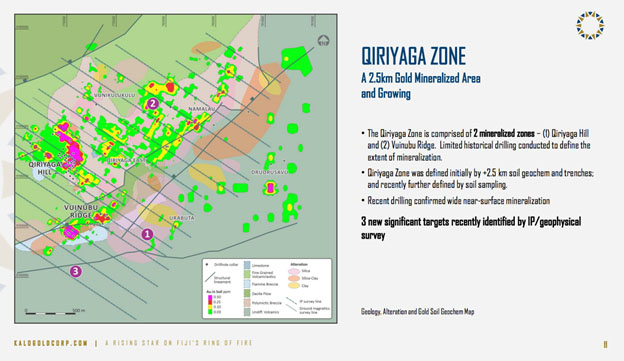

Drilling and surface work will focus on the Qiriyaga zone, which delivered some promising results during phase 1 drilling last year.

Hole KGD 01 hit 101 meters grading 0.94 grams per tonne gold (0.94 g/t gold) from surface, including a 2-meter hot spot running 6 g/t gold between 6 and 8 meters below surface.

Hole KGD 03 hit 24 meters grading 1.01 g/t gold from 21 to 45 meters below surface, including 2 meters of 6.27 g/t gold between 37 and 39 meters.

And KGD 04 intersected 69 meters of 0.96 g/t gold from 21 to 90 meters downhole, including a 2-meter interval running 5.11 g/t gold between 34 and 38 meters.

Phase 2 will explore several drill targets outlined during an airborne induced-polarization (IP) survey flown in 2021, as well as from another using ground magnetics.

Geophysical results indicate that past drilling was too shallow and missed a considerable IP geophysical anomaly that would have been hit had Kalo drilled deeper.

Tejada says Qiriyaga Hill has the potential to be a much larger system.

“The drilling program that we did last year was to confirm the Qiriyaga Hill mineralization. And the drilling confirms the presence of widespread, near-surface mineralization with high-grade zones. If we continue in that direction, I believe that we will continue to significantly expand the near-surface resource potential. However, the fact of the matter is that we stumbled into something that looks a lot better, because — based on the geophysics — we now have the potential of mineralization that's deeper than what we initially looked for,” Tejada explains. “Potentially, we’re looking at a deeper resource.”

Kalo owns two mineral exploration licenses on Vatu Aurum’s 36,700-hectare footprint on Vanua Levu, Fiji’s North Island. Qiriyaga Hill and Vuinubu Ridge, both mineralized zones, host a combined historical inferred mineral resource of 158,831 oz gold.

Ma says Kalo needs to boost resource size to attract a major gold producer.

“Their criteria is three to five million ounces, right? That's what they're looking at. I think we're already on their radar, and I think we're probably one or two holes of positive results away from getting some really decent players in here to support Kalo,” Ma says. “We've got a very strong cap structure with a very nice shareholder base, and it's been positioned to some very reputable investors in the capital markets (in Canada).”

The company announced a $3 million brokered private placement in November and has enough funding to complete its current drill program. It will have to raise more money afterward.

Kalo Gold trades in a 52-week range of $0.59 and $0.17.

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Lion One Metals. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kalo Gold Corp., Lion One Metals and Barrick Gold, companies mentioned in this article.