After Libero Copper and Gold Corp. (LBC:TSX.V:, LBCMF:OTCQB) released partial assays for its 100%-owned Mocoa property in Colombia, the company's stock soared from $0.54 a share to $1.05 before falling back to $0.78.

After Libero Copper and Gold Corp. (LBC:TSX.V:, LBCMF:OTCQB) released partial assays for its 100%-owned Mocoa property in Colombia, the company's stock soared from $0.54 a share to $1.05 before falling back to $0.78.

On Tuesday, Libero released the complete results from hole MD-043, which was dug to 1,236 meters. The assay returned 1,229 meters of 0.74% copper equivalent, including 557 meters of 0.89% copper equivalent and 251 meters of 1.12% copper equivalent.

Before Tuesday's results, Bob Moriarty, founder of 321.gold.com, said the situation with Libero reminded him of 2020 when Solaris Resources Inc.'s (SLS:TSX) share price rose exponentially on the strength of copper intercepts in Ecuador.

"Depending on the value of the remaining 785 meters, … (it) could make the first hole from (Libero) a giant home run similar to that of Solaris," Moriarty wrote.

Two years ago, Solaris reported 567 meters of 1% CuEq from surface from its first hole at the Warintza copper/molybdenum project. The company went public at $1.38 a share, and it has now increased to just over $13.94 on April 21.

Taylor Combaluzier, a mining analyst with Red Cloud Securities Inc., agreed with Moriarty. The site "compares favorably to Warintza," Combaluzier wrote in a research report on April 20. "Mocoa is located within the same porphyry belt that hosts Solaris Resources' Warintza deposit," but the company trades at a fraction of Solaris' value.

Red Cloud maintained its Buy rating of Libero with a target of $1.40 in the update note.

A Question of When, Not If

As we move toward the adoption of electric vehicles (EVs) and renewable energy, the red metal is becoming more important. Each EV has as much as three times the amount of copper found in an internal combustion engine, and one out of five vehicles sold worldwide could be electric in less than two years. Demand could reach 25.5 million tonnes of copper by 2030, with supply falling short of demand, experts said.

"The world has made its decision to transition to sustainable energy," Libero Chief Executive Officer Ian Harris told Streetwise Reports. "It's not a question of if, it's a question of when. And so, you have a combination of a significant new amount of demand combined with a dramatic lack of supply. There just aren't enough mines, or there isn't enough exploration being done in the copper space."

"The world has made its decision to transition to sustainable energy. It's not a question of if, it's a question of when. And so, you have a combination of a significant new amount of demand combined with a dramatic lack of supply. There just aren't enough mines, or there isn't enough exploration being done in the copper space."

—Libero Chief Executive Officer Ian Harris

Mocoa, which Libero said is the largest copper resource in Colombia, is about 10 km from the town of Mocoa in the country's Putumayo department. It was discovered in the late 1970s and early 1980s when the United Nations and the Colombian government carried out a regional stream geochemical survey.

It's a pit-constrained resource with 636 Mt of 0.45% copper equivalent, containing 4.6 billion pounds of copper and 511 million pounds of molybdenum, the company said. Drilling started in February 2022 and will continue through the rest of the year.

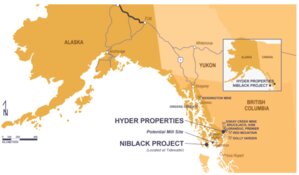

Mocoa is Libero's flagship property, but it has others in British Columbia and Argentina. Harris said he joined the company in January 2021. He said he believes in the Mocoa project so much that he is moving his family there for a year.

"I'm a mining engineer," he said. "I really enjoy being highly involved in the projects. This is where I can create the most value for the company."

Colombia Is Strong on Mining

Colombia is a mining-friendly country, with around 80% of the GDP of 12 of its 32 departments (which are similar to states), excluding the capital district, generated by mining. It's aiming to become the third-largest copper producer in Latin America by 2030.

While Harris said one possible goal was to be acquired by a producer, he said the company was moving forward with much of the preparation work at Mocoa and its other sites as possible, such as permitting and de-risking.

"The best way to be acquired is having that mentality that you're going to construct it yourself," Harris said. "I see a lot of companies get to a point that someone's going to buy something, (so they can) just sit around the couch and kind of flounder."

Libero does not plan to do that. Additional drilling at Mocoa is planned.

"Broad intercepts of (copper) and (molybdenum) mineralization, along with similar brecciated porphyry and alteration, continue well beyond the 450 meters of assay results reported," Combaluzier from Red Cloud wrote. "Additional confirmatory and expansion drilling should also help confirm the geometry and nature of the mineralization within the leached cap."

Libero's top shareholders include Anglo Asian Mining Plc, which holds 19.8%; management holds 10%; B2Gold Corp. holds 5%; and US Global holds 5%. Libero's market cap is $49.65 million.

| Want to be the first to know about interesting Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Steve Sobek compiled this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Libero Copper & Gold Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Libero Copper & Gold Corp., a company mentioned in this article.