In this article we are going to look at a range of copper stocks that are believed to be at good entry points, the main reason being that after a long period of consolidation, copper itself looks set to break out soon into another major upleg against the background of surging inflation that should drive most commodities much higher, especially gold and silver.

On copper’s 2-year chart we can see that after a vigorous bull-market uptrend from its pan selloff panic lows in March of 2020, copper settled into a long period of consolidation from last May that has taken the form of a bullish Bowl pattern. With the Bowl boundary now rising at an increasing rate towards the resistance marking the upper boundary of the pattern, a breakout into a major new uptrend is looking increasingly likely soon, especially as upside volume is starting to build and the Accumulation line is already making new highs. Such a breakout would “light a fire” below the best copper stocks, so we will now proceed to look at a range of them.

Allied Copper Corp. (CPR:TSX; CPRRF:OTCQB), C$0.23, $0.176

Allied Copper is believed to have been basing since mid-December, and with some largish white candles starting to appear on the chart this month and its Accumulation line also picking up nicely, it is well placed to advance out of this potential base.

"Copper itself looks set to break out soon into another major upleg against the background of surging inflation that should drive most commodities much higher, especially gold and silver."

Libero Copper and Gold Corp. (LBC:TSX.V:, LBCMF:OTCQB), C$0.50, $0.39

A rather neat Cup & Handle base appears to be completing in Libero beneath a line of resistance in the C$0.54 – C$0.57 zone.

With the Handle part of the pattern being rather small in relation to the Cup, we are aware that this Handle could become larger before breakout occurs, but that said the bullish volume pattern and strong Accumulation line coupled with copper looking like it wants to “get on with it” soon suggest that it won’t be long until it breaks out the top of this base pattern, and it is accordingly rated a strong buy in this area.

Libero is a copper stock that we have looked at in the not too distant past.

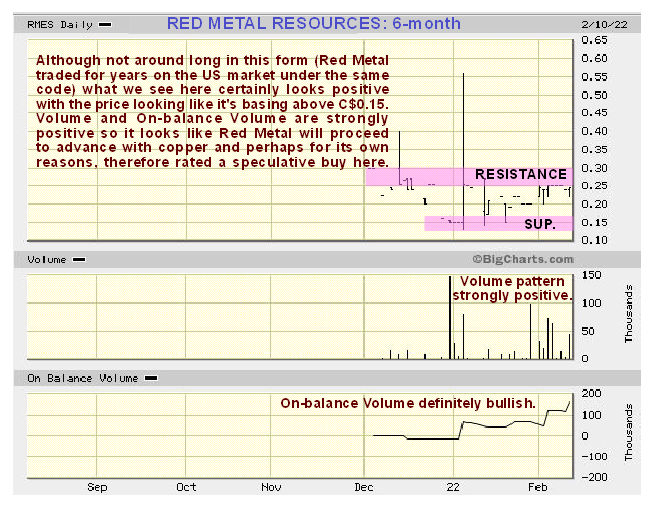

Red Metal Resources Ltd. (RMES:OTCBB; RMES:CSE), C$0.245

Although Red Metal hasn’t been around long in its present form as a stock, what chart history there is looks decidedly positive with a bullish volume pattern and strong On-balance Volume making new highs.

It is therefore expected to break out of its current trading range into a bull market soon and is rated a speculative buy here.

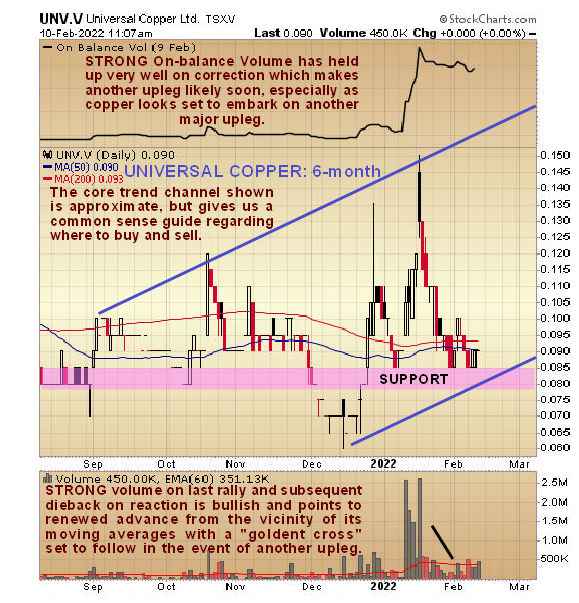

Universal Copper Ltd. (UNV:TSX;3TA2:FSE), C$0.09, $0.08

Although Universal Copper has given back all of the gains resulting from its sharp rally in the middle of January, the volume pattern remains strongly bullish with the persistent heavy volume driving that rally giving way to a reaction back on much lighter volume which is why its On-balance Volume line has held up so well, which suggests that it will soon start higher from the support level that it is now hovering above.

The wide trend channel shown is provisional but gives us a general idea of how overbought / oversold it is, and right now with it close to the lower rail of this channel, it is rated as oversold and ready to advance.

World Copper Ltd. (WCU:TSX; WCUFF:OTCQB), C$0.85, $0.695

World Copper has a very positive chart with a fine strong uptrend clearly still in force, and right now it appears to be beginning a new upleg following a reaction back to important support and to contact the lower rail of the channel.

The Accumulation line is already close to making new highs and we can expect the price to do likewise and by a comfortable margin if copper breaks out and takes off higher again, as looks increasingly likely soon.

End of article.

Originally posted on 11 February 2022.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosures

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Additional Clive Maund disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Allied Copper Corp., Libero Copper & Gold Corp., Red Metal Resources, and World Copper Ltd. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Allied Copper Corp Ltd. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of World Copper Ltd., a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosures:

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.