I keep trying to make an especially valid point that gold and silver resource stocks are cheaper than they have ever been relative to both commodities and the S&P. Lots of other writers have woken up to the idea that the general stock market has already jumped off a very tall cliff. And it’s a long long way to the bottom. All that stupid money that flowed into NFTs and SPACs and cliptocurrencies is going to be looking for a new, safer home shortly.

The quality of juniors in the resource space is better than I have ever seen it. We don’t have five or 10 high quality companies, we have hundreds. All selling at the lowest relative prices in history. Regardless of what happens in Canada as Trudeau goes full Nazi or Ukraine as the U.S. goes tone deaf stupid, the overall markets are going to continue to crash for years. Gold and silver remain the only markets that have not been hitting new highs. But they will.

I wrote about Cabral Gold Inc. (CBR:TSX.V; CBGZF:OTCMKTS) as recently as two months ago. It continues to have outstanding drill results being released almost weekly. The company is in the midst of a 25,000 meter drill program at its 100% owned premier Cuiú Cuiú gold project in central Brazil. From 1978 until 1995, this region in Brazil had the biggest placer gold rush in history with estimates of production between 20 and 30 million ounces.

Cabral owns the richest part of that gold rush at Cuiú Cuiú where about 2 million ounces of placer gold was produced. The 2021 drill program consisted of just over 25,000 meters of drilling. As of the start of January, there were still 33 holes with assays pending.

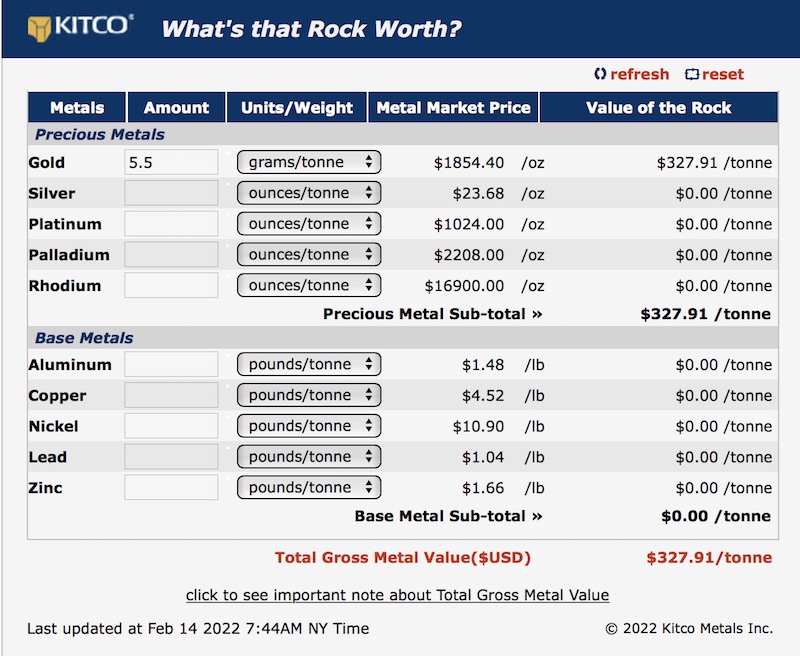

The holes that have been released have been excellent. When drilling gold projects you want to either get long intervals of low-grade material or shorter intervals of high-grade material. Cabral is getting both. In a press release dated Feb. 10, Cabral announced 23.8 meters of 5.5 g/t Au from hole DDH250.

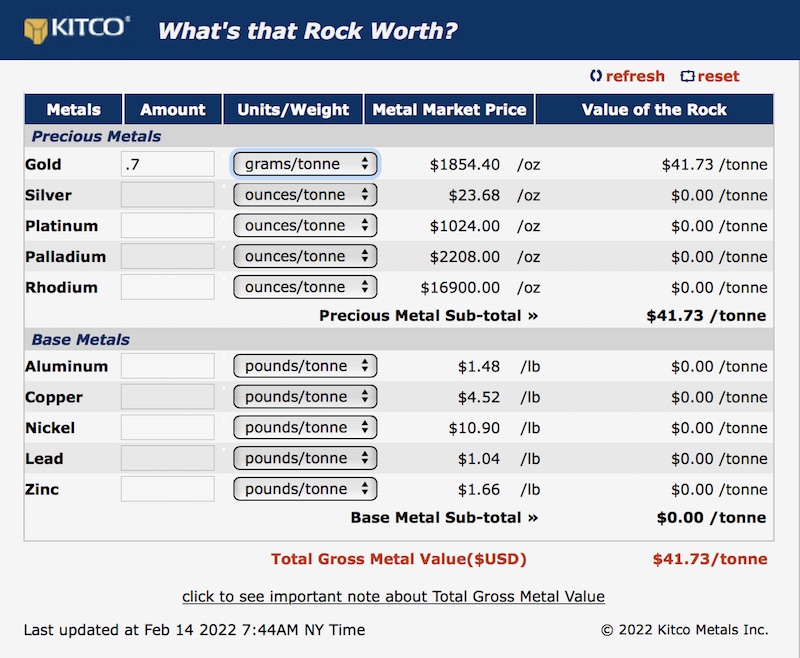

That of course is an excellent hole, but the same hole showed a remarkable 84.9 meters of 0.7 g/t gold as well. That hit was from surface in oxidized material directly above the unoxidized high-grade material I showed above. When dealing with oxide gold at surface, it is far cheaper to process than the hard rock but higher-grade material deeper in the system. Cabral has been using a 0.35 cutoff for their 43-101 released in June of 2021 for the open pit material, so 0.7 g/t gold is highly economic using simple and cheap gravity recovery.

Cabral has a next door neighbor named G Mining Ventures (GMIN:TSX.V) that offers some interesting comparisons. G Mining has a similar grade to that of Cabral but has slightly more than twice the 43-101 resources. G Mining bought the project from Eldorado Gold late last October for $110 million in shares. G Mining has raised $70 million in cash to put the project into production, aiming for starting construction in Q3 of 2022 and full-scale production in Q3 of 2024.

The G Mining project is named Tocantinzinho, however since only three people in Brazil can pronounce the name, for simplicity purposes everyone calls it the TZ project.

The Cuiú Cuiú property produced 2 million ounces of placer gold during the 1978-1995 gold rush, while the TZ property only produced about 200,000 ounces. The ratio of placer gold production to current resource at TZ is 1:10. The ratio of placer gold production to current resource at Cuiú Cuiú is a tiny 1:0.5. Since the placer gold began as hard rock, to have more placer production suggests also having more hard rock potential.

G Mining seems to have excellent institutional backers and is well cashed up to production. If for no other reason than having a rich neighbor next to you, everything that

G Mining does to tell its story will also rub off on Cabral.

Cabral does an excellent job of telling its story. Everyone interested in hearing about a real gold project in a safe jurisdiction with a lot of potential for growth, go to their presentation.

Cabral Gold is an advertiser. I participated in the last PP they did and bought some more shares in the open market lately. In my view, they are absurdly cheap. The stock has had a 60% drop in the last 12 months, yet the company is coming up with great assays every week. You should do your own due diligence.

Cabral Gold

CBR-V $.385 (Feb. 14, 2022)

CBGZF OTCBB 141.7 million shares

Cabral Gold website

Bob Moriarty

President: 321gold

Archives

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosures:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Cabral Gold. Cabral Gold is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.