“My name is opportunity, and I am paging Canada.“

—Joseph Hirshhorn, famed mining entrepreneur and member of Canadian Mining Hall of Fame 1933

If the adage in the mining business is "that the best place to find a mine is next to an old mine," there is no better place to look for gold than next to the three biggest mines in Canada. Metals Creek Resources Corp. (MEK:TSX.V) is a company that I believe deserves a closer look as it is working on the past producing Dona Lake project formerly operated by Placer Dome, and the highly prospective past producing Ogden property in the heart of the Timmins Gold Camp, the most prolific gold camp in Canada that rivals some of the best precious metals districts in the world.

Background

In an article on Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX), linked here, we saw a company that checked a lot of the boxes when looking at potentially investing in a gold exploration company. It was in a great historical gold-producing district, where discoveries have been turned into mines for the past century. It had great management and geologists. It is also helpful to have a tight share structure, with management owning shares, so that their goals are aligned with the other shareholders.

When I first started following Great Bear Resources, like most juniors, it was hard for it to raise money. The shares bounced around with the volatility that comes with the sector; the company did not have any big investors championing the story. While we researched the story, we had no idea that everything was about to change.

The now famous drill results came out, and the famed Red Lake investor and former Goldcorp chairman and founder stepped in and bought ~10%. Couple that with continuous better results, and the rest, as they say, is history. Great Bear’s share price went from $0.50 to $29.00 after the takeover by Kinross Gold Corp., and less than three years from the article we wrote. Great Bear Royalties Corp. was also spun out from the company.

So, I am motivated to look for other companies that could also mirror that kind of success, while recognizing that mineral exploration is a high-risk business, and replicating Great Bear’s success is a mighty tall order. However, it is also true that success in the discovery phase of a mining project’s lifespan has created the greatest shareholder wealth in the resource sector. We look for those companies for a part of our portfolio on mining companies, knowing the odds are 1 in 1,000. Our initial research led us to Metals Creek, and I decided to have a closer look.

Combining Fundamental and Technical Analysis Recap

I screen companies on both technical and fundamentals, but generally I am first alerted to a company by bullish chart patterns, and a decisive breakout over what we call “The Point of Recognition,“ or POR. I first identified Metals Creek in this chart below, and armed with the bullish series of price objectives in it I set out to look for the fundamentals to find the answers as to why the company’s chart looks so bullish to us, and I published the charts on LinkedIn and Twitter back in July 2020.

Metals Creek then followed up and hit and exceeded first targets, opening up new targets.

About Metals Creek Resources Ltd.

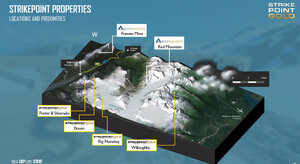

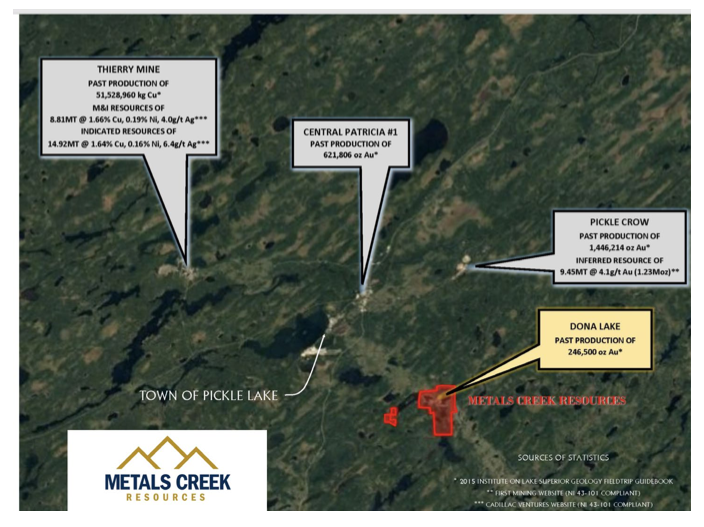

Metals Creek is a Canadian public company exploring world-class gold targets at the past producing Dona Lake Mine in the Pickle Lake area of NW Ontario and has signed an agreement with Newmont Corp. (NEM:NYSE), where Metals Creek can earn a 100% interest in the past producing Dona Lake Gold Project in the Pickle Lake Mining District of Ontario.

Metals Creek also operates the Ogden Gold Project in Timmins, Ontario, as a 50/50 joint venture with Newmont. Metals Creek remains the operator and programs will be funded on a 50/50 basis going forward. Recent results from the TOG Zone have returned outstanding intercepts of 2,732 g/t Au over 0.93 meters within a broader zone of mineralization consisting of 210 g/t over 12.5 meters and 9.46 g/t Au over 18.55 meters with visible gold in core. Also, Metals Creek's agreement includes the past producing Naybob Gold mine, located 6 km south of Timmins, Ontario. It has an 8 km strike length of the prolific Porcupine-Destor Fault (P-DF).

Management includes Sandy Stares, president and chief executive officer; Michael MacIsaac, vice president of exploration; and Director Wayne Reid. Stares is a member of 2007 PDAC Bill Dennis Award-winning Stares/Keats prospecting family. Metals Creek is also engaged in the identification, acquisition, exploration, and development of other mineral resource properties, and presently has mining interests in Ontario, Yukon, Newfoundland, and Labrador. These other properties have given the company a stock portfolio in various junior mining companies worth about $2 million.

A seasoned veteran of mining cycles and born into one of Canada top prospecting families, Stares is pictured here below, along with the drills turning.

Share Structure

The company has more than $4 million in the treasury to complete the upcoming drilling at Dona Lake and the next phase of exploration and drilling at Ogden. The company is still expecting drill results as we write this article.

- Issued and outstanding: ~140,000,000.00

- Warrants: ~ 48,053,346

- Stock options: ~9,700,000.00

- Total O/S: ~200,000,000

- Cash and marketable securities: ~4.5 million

- Insider holdings: ~10.5% Friends and Family ~25%

- Institutions: Crescat Capital ~10%

Backstory: Timmins Founded on Dreams; Canada's Greatest Goldfield

“No prospectors, no mines, no civilization.”

—William Sulzer former governor of New York 1933

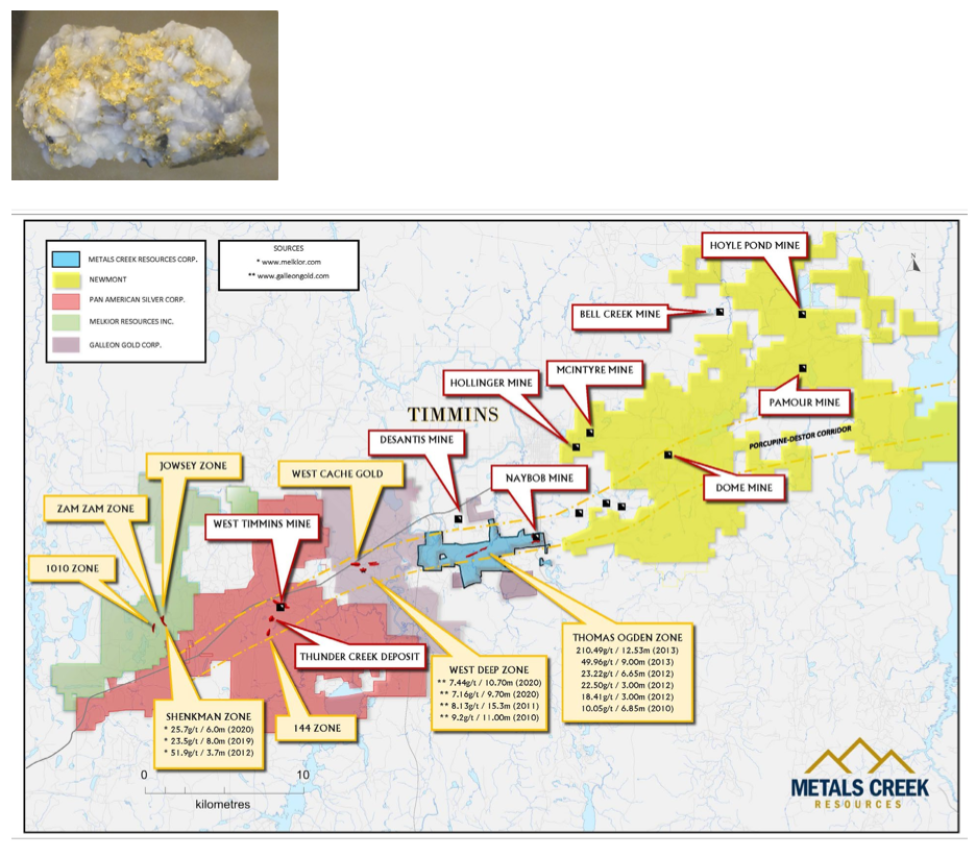

The Metals Creek past producing Ogden Property is in the Timmins area and is one of the richest goldfields in the world. Over the past century has produced more gold than any mining camp in Canada.

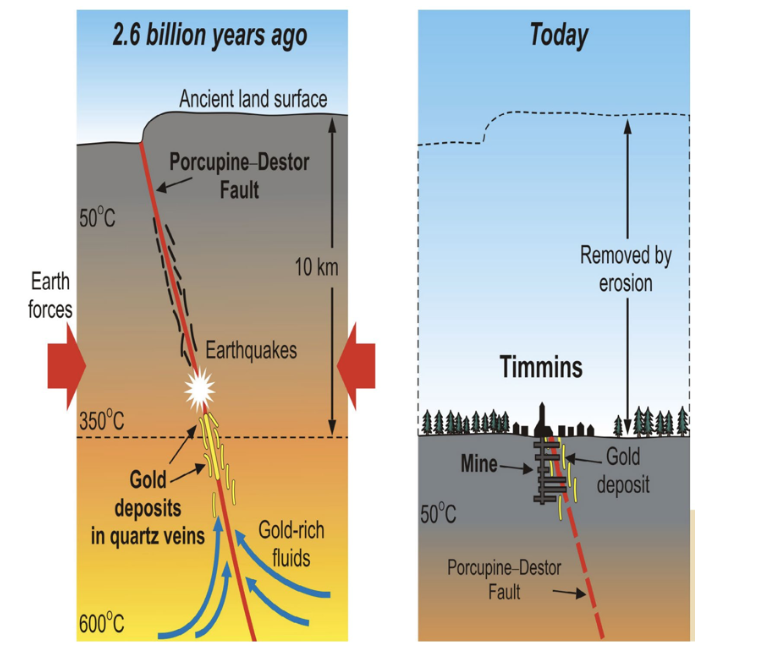

The Timmins-Porcupine District lies within the Abitibi greenstone belt and has been the most productive gold field in North America, having yielded more than 70 million ounces of gold and counting over the span of about 100 years, from mines such as Hollinger, McIntyre, Dome, Pamour, Hallnor, Hoyle, and Hoyle Pond. Provincial geologists first identified gold in quartz veins near Porcupine Lake in 1896. Virtually all the mineralization has come from quartz-carbonate lode systems hosted by greenshist facies metamorphics, and are found in a corridor up to 10 km wide, parallel and to the north of the major regional Porcupine-Destor Fault.

In the spring of 1909, a prospecting team led by Harry Preston and Jack Wilson discovered a hill of quartz full of gold and called it “The Big Dome,” later called the Dome Mine. As legend has it, Jack Wilson slipped on a rocky knoll that looked like a “dome” and his caulk boots stripped the moss away from the rock to reveal a large vein of gold, later called the Golden Staircase. This discovery set off the great Porcupine Gold Rush. Later the same year, the Hollinger and McIntyre gold deposits were discovered. The villages of South Porcupine, Timmins, and Schumacher sprang up to serve each of the “Big Three” mines developed on these gold deposits. During the next 100 years, over 50 mines produced 70 million ounces of gold, making the Porcupine mining camp (later referred to as the Timmins mining camp) Canada’s greatest gold producer.

Today, the city of Timmins is northern Ontario’s third largest city and remains one of Canada’s major centers of mining. Again, the most famous are the “Big Three” gold mines:

Today, the city of Timmins is northern Ontario’s third largest city and remains one of Canada’s major centers of mining. Again, the most famous are the “Big Three” gold mines:

- The Hollinger: ~20,000,000 ounces, discovery credited to prospector Benny Hollinger.

- The Dome Mine: ~18,000,000 ounces, discovery credited to prospector Jack Wilson.

- The McIntyre Mine: ~11,000,000 ounces, and $62 million in dividends paid to shareholders, discovery credited to prospector Alexander O. “Sandy” McIntyre.

Note to short term traders: None of the original prospectors ended up becoming wealthy based on their gold discoveries. Hollinger sold out his share to a group led by Noah and Henry Timmins; McIntyre sold his interest for $65,325.00, of which $60,000 was never collected; and Wilson was part of the Harry Preston crew and did not get a financial reward. It is rumored that Wilson's broker encouraged him to hit the bid when the private placement seed shares he received for his efforts became free trading.

In the past 10 years, the junior mining market has been a dog fight to be sure, however Stares and his team show no sign of giving up on their dreams of finding and/or expanding a mine in Timmins and/or reactivating the past producer, the Dona Lake Mine, in contrast to the prospectors in earlier days that stopped short and sold out just before all their hard work paid off. They have had to raise funds at times of market weakness, and the share count is higher than I normally like to see. That said, Great Bear was taken over at almost $2 billion without a resource, and our back of the envelope calculation can conservatively get non-compliant 43-101 of 500,000 ounces between the two properties now, and that is before any additional drilling that I feel is bound to add more ounces over time.

The Properties: Ogden and Dona Lake

Metals Creek has two flagship properties, Ogden in Timmins and Dona Lake in the Pickle Crow District, both in Ontario. The company also has properties across Canada with many under option agreements, in which it holds shares and get cash payments.

Ogden is in the heart of the Timmins gold camp and one of the major centers of mining in Ontario. Ogden should also see some exposure as that area has heated up with the recent consolidation of the Premier’s Hardrock Deposit in Timmins by the rapidly growing Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A). The Ogden property sits just a few short miles from the “Big Three Mines” in Timmins and a short distance from Tahoe’s (Lake Shore Gold) West Timmins Project (now Pan American). Metal Creek’s drilling is in the shadow of of the head frames of these giants.

Metals Creek formed a 50/50 partnership with Newmont in 2008, where Metals Creek is the operator. The property has over 8 km (~4.5 miles) of strike length along the Porcupine-Destor break, and six mineralized zones, which is the key conduit for gold mineralization in this gold bearing district. It has not seen any significant exploration since the 1980s. The property was acquired in November 2008 when Metals Creek signed an Option Joint Venture Agreement with Goldcorp, now part of Newmont. Metals Creek has earned into its 50/50 joint venture with Newmont.

Previous work on the Ogden property shows that it hosts a historical non-compliant 43-101 of 250,000 ounces. Metals Creek did get outstanding results in 2010-2013 from drilling the Thomas Ogden Zone, but poor markets and declining gold prices put this property on hold until 2020 when successful investment fund Crescat Capital LLC saw the potential of this property and put up capital with others to ensure that it would get some drilling attention and become a possible source of ore to feed the mills in the area. Selected results from these earlier drill programs include: 6.08 g/t Au over 21.85 meters, including 11.76 g/t Au over 9.00 meters, 9.46 g/t Au over 18.55 meters and 6.17 g/t Au over 6.62 meters, 2732.64 g/t Au over 0.93 meters, which was a part of a broader zone of mineralization of 210.19 g/t Au over 12.53 meters.

Ogden 'In the Shadows of Headframes' of the Big Three

Gold in Quartz from the Hoyle Pond Mine is pictured below.

Metals Creek is using some of the same technology that Great Bear Resources incorporated in their exploration success.

At the Ogden Gold Project, Metals Creek completed a spatiotemporal geochemical hydrocarbon ("SGH") gold survey. SGH is a deep penetrating geochemistry that involves testing for specific hydrocarbons that are a result from the decomposition of bacteria and microbes that feed on the target commodities, as they require inorganic elements to catalyze the reactions necessary to develop hydrocarbons. These residues subsequently migrated to the surface as a flux of different classes of hydrocarbons.

During Phase 1 of the SGH program, Metals Creeks collected 235 samples spread over two separate areas, targeting the Porcupine Destor Fault stratigraphy East and West of the Thomas Ogden Gold (TOG) zone. This program was initiated to determine if SGH could be used as an exploration tool to identify gold targets below the extensive overburden coverage on the Ogden property. The survey was successful in delineating buried gold targets over prospective stratigraphy.

Phase 2 continued to complete the gaps between TOG and South Zone, as well as the western property boundary and TOG, and east of South Zone to the eastern property boundary. With greater than 97% of the project covered by overburden, SGH can greatly expedite the target generation process, potentially resulting in substantial cost savings when evaluating and ultimately delineating these potential targets. All samples were collected on 100 meter spaced grid lines with sample spacings of 25 meters.

With drilling on the Thomas Ogden Zone down to the limits of conventional geophysical surveys, a new more high-powered system Deep Section IP survey was utilized to explore deeper. This survey will better enable Metals Creek to target the down plunge extension of the Thomas Ogden Zone, as well as further evaluate highly prospective gold bearing secondary fold structures both east and west of Thomas Ogden. With 97% of the property overburden covered, a new exploration survey was needed to better target areas of high exploration potential.

Recent success in utilizing SGH Gold survey to target prospective areas and identify new gold anomalies, including with Great Bear Resources, has added this survey type as a tool to help identify prospective targets in areas that are extensively covered by overburden.

MEK conducted two phases of sampling resulting in the identification of five new gold targets over prospective stratigraphy. Some of the anomalies are currently a part of the ongoing Deep Section IP survey that will help further expedite the target generation process. In addition, the company recently completed six diamond drill holes using a specialized oriented core logging tool focused on obtaining structural orientation data in the Thomas Ogden zones of mineralization. These holes were logged and sampled with special emphasis on acquiring core orientation data on relevant structures, veins, and mineralization. Determining the exact orientation of these cross-cutting veins and structures will better enable MEK to target these zones of mineralization in future drilling.

Also at the Ogden Gold Project

The company has also initiated a Deep Section IP survey to target the Naybob South, Thomas Ogden (TOG) and Thomas Ogden West (TOGW) Zones to help further define down-plunge mineralization associated with fold structures at TOG and TOGW as well as further defining the plunge direction of known sulfide mineralization within Naybob South. Both the Naybob North and Naybob South zones have been subject to differing degrees of development and production. The Naybob North was the focus of underground development down to 411 meters, including 11 levels with the majority of production taking place within the upper six levels.

In addition, the company recently completed six diamond drill holes using a specialized oriented core logging tool focused on obtaining structural orientation data in the Ogden area mineralized zones. The holes were logged and sampled with special emphasis on acquiring core orientation data on relevant structures, veins and mineralization. Assays are pending on this drilling. Drilling was paused until assay results from these holes have been received and structural data has been interpreted. Results from the SGH survey, the Deep Section IP survey as well as core orientation data, are being combined and compiled to generate a comprehensive drill program targeting the projected down-dip and on-strike trends.

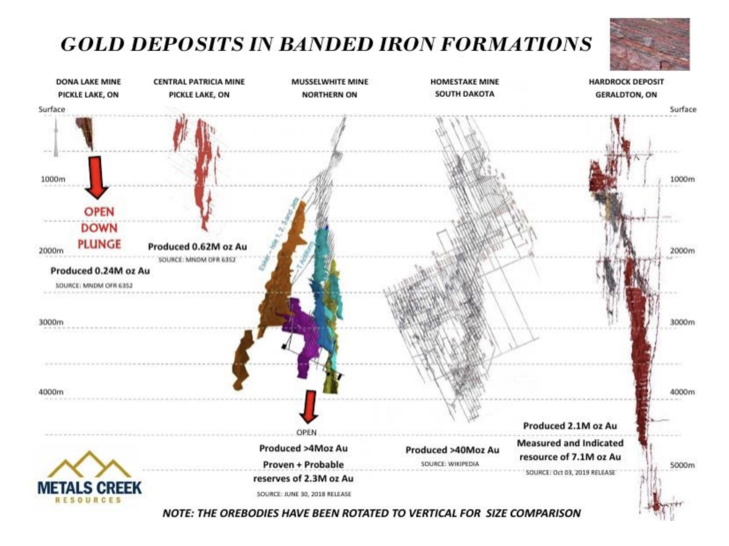

Flagship Property #2 Dona Lake

The Dona Lake Gold Project was optioned from Newmont and is in the Pickle Lake Greenstone Belt, which is host to several historical mines including the Dona Lake mine, the Central Patricia mine, and the Pickle Crow mine. The project was a past producer of 250,000 ounces in the late 1990s, operated by Placer Dome. However, the mine was shut down when gold fell from $700 to $300 (that's a half a billion dollars at today’s prices). Until now, Dona Lake has not seen any exploration activity since 1994. A renewed focus in the industry to explore within established mining camps has meant a greater emphasis has been put on exploring deeper, which means substantially more expensive drilling or utilizing more exploration tools to help in the target generation process, potentially resulting in significant cost savings.

With gold at $1,800, it appears that MEK.V is going after the gold that was left behind in the Main Zone and adding addition ounces in the B zone, plus drilling deeper in both areas to potentially add ounces and become a significant deposit for a major to develop. Dona Lake is accessible by an all-weather road southeast from the Town of Pickle Lake. The property consists of 32 patented and leased mining claims and 35 map-staked claims totaling approximately 1,063 hectares and covers the past producing Dona Lake Mine.

The Dona Lake Mine is gold in Banded Iron Formation (BIF). It was only mined to a depth of 450 meters, producing ~250,000 ounces at an average grade of 8 g/t, when gold was ~$350. Most gold mineralized BIF ore bodies run deep as is shown on Figure 2 below. This current drill program will test the Main Zone, B Zone, and drill below the existing mine to verify gold extension at depth.

Dona Lake has similar geology to Newmont's Musselwhite Mine, which has produced greater than 4 million ounces of gold. No modern exploration techniques have been used on the property over the last 25 years. After acquiring the project, an extensive compilation took place transforming the existing maps, sections, and level plans to a digital format enabling the company to generate a 3D model of the defined gold mineralization and existing mine workings.

In an effort to modernize the exploration database for Dona Lake, a detailed airborne magnetometer survey was flown to help map out any important geological features, including structures and iron formations that will be the main targets going forward. This survey resulted in the identification of two new prospective iron formation targets out the of the four known gold-bearing iron formations on the property.

Recent drilling on Dona Lake by the company has focused south and below the mine workings. With drilling becoming deeper and more expensive, MEK embarked on using a geophysical survey that will be able to look below conventional surveys. Conventional surveys look down to 400 meters to 500 meters, which isn’t as deep as current drilling being performed at Dona Lake. Therefore, a Spartan Magnetotellurics (MT) Deep Imaging Survey was performed to target Dona Lake mine stratigraphy at depth below the current mine workings.

The MT survey can potentially see down to the 1200 meter to 1,500 meter level. This deeper penetration than conventional ground geophysical surveys highlights areas of enhanced conductivity, maps potential fold flexures, and determines the depth extent of the gold-bearing iron formations below the current drilling and mine infrastructure. This will greatly enhance the target generation process for a more cost-effective deep drilling program.

Upon completion of the final interpretation of the survey, this data will be utilized in the target generation process to continue to extend the mine stratigraphy at depth and further evaluate peripheral prospective iron formation targets.

Metals Creek is advancing Dona Lake toward a potential reopening on exploration.

The current chart of MEK.V is challenging highs not seen in six-plus years. While the chart went sideways during the past nine months, it still appears to be continuing to build a solid base, which could break out on positive news with the company’s efforts over the past few years. About 140 million issued and outstanding shares gives it a market capitalization of <~$30 million, of which 50 million shares appear to be closely held by loyal shareholders that believe in the work being done here. This chart reminds us of of Great Bear before the move above 50 cents that set off one of the greatest share price appreciations in this space in the last 10 years. The company’s chart appears to be completing its first wave targets that could set in motion the next set of targets.

Summary

The philosophy of Metals Creek's geologists and management is to search in the shadow of the head frames of past producing mines, and this is especially true with both past producing Dona Lake and Ogden. The company has made a concerted effort to utilize modern exploration techniques at Dona Lake and Ogden to aide in the target generation process. Both projects prior to being acquired by Metals Creek had not seen any significant exploration over the previous 25 to 30 years. Over this time, many advances in technology within the exploration industry have been developed to further explore to greater depths than previously thought possible.

With the price of gold showing signs of renewed strength and the shares on the verge of a potential chart breakout, any additional exploration success that results in building or expanding a resource at both properties should reward patient shareholders handsomely over time.

John Newell is a former precious metal portfolio manager at Fieldhouse Capital Management. He has over 38 years of experience in the investment industry acting as an officer, director, portfolio manager and investment advisor with some of the largest investment firms in Canada including Scotia McLeod, CIBC Wood Gundy and Richardson Greenshields (RBC Capital Markets). Newell is a specialist in precious metal equities and related commodities, and follows a disciplined proprietary approach incorporating equity research, analytical frameworks and risk controls to evaluate and select long and short stocks primarily from the Canadian small and mid-cap coverage. Many large, midcap and junior precious metal companies use his technical charts.

Disclosure:

1) John Newell: I, or members of my immediate household or family and friends, own shares of the following companies mentioned in this article: Metals Creek Resources Corp., Equinox Gold Corp., Golden Sky Minerals Corp. and Great Bear Resources Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. Additional disclosures/disclaimer below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Metals Creek Resources Corp., Equinox Gold Corp., Golden Sky Minerals Corp. and Great Bear Resources Ltd., companies mentioned in this article.