As part of his annual forecast, sector expert Michael Ballanger is giving his top picks for 2022.

In another piece, Ballanger says at the start of the year he finds himself at an investing crossroads where the four roads are defined as cash to the south, gold to the north, growth stocks to the east and fixed income to the west. Standing in the middle of the intersection and pondering one’s choices creates an epic quandary, he says.

“Constructing a portfolio in today’s 'managed' economy (through 'managed' markets) has been a challenge,” he wrote. “The forces of a Fed-induced deflation, brought on by tapering first and tightening second, discourages stocks and gold while favoring cash and fixed income. The emergence of high inflation and shocks to the supply chain (in the event of policy failure) discourages cash and fixed income while favoring stocks and gold. Since the Fed has clearly signaled inflation as the new enemy (as opposed to maximum full employment and stocks), my inclination is to opt for capital preservation over capital appreciation. The problem remains, however, and with inflation running 'hot,' capital preserved gets eaten alive by currency debasement, leaving the cautious investor penalized for that very caution.”

Michael Ballanger on His GGMA 2022 Model Portfolio

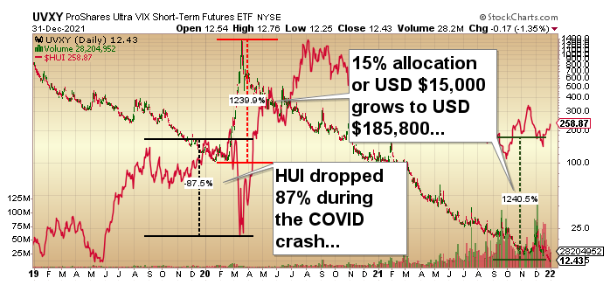

The major change to the model portfolio is reducing the size of all positions to create a 15% allocation to the Pro Shares Ultra VIX S/T Futures ETF. This will largely insulate the GGMA 2022 Portfolio from experiencing the type of drawdown which occurred in March 2020. If one assumes that a similar event occurs again in March 2022 and the gold miners and the UVXY perform in the same manner, one could theoretically experience an 87% drawdown in the junior miners while at the same time seeing a 1,240% advance in the “vol” trade. The portfolio would see $85,000 in junior miners shrink to $11,050 while the $15,000 hedge (UVXY) grows to $185,800. Now, these might be exaggerated numbers but you all get the drift.

I tried to put on the UVXY back in September and was stopped out at a 15% loss but market conditions are now as precarious as I have ever seen (and I went through the October 1987 crash, the 2001 tech wreck, and the 2008 subprime meltdown). Not once during those corrections did the Fed ever go “hostile;” in fact, they were standing there with liquidity safety nets every time the market let out a peep.

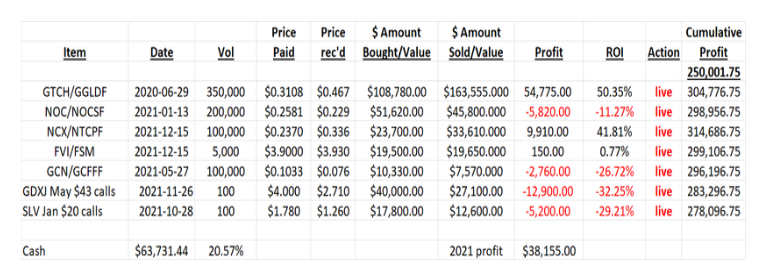

GGMA 2022 Trading Account

No immediate changes are pending. However, I will be adding UVXY to the trading account from the current $83,341 credit balance by mid-January. I will also be adding to Northisle Copper & Gold Inc. from cash as I see tremendous upside from the CA$0.42 level in 2022. Finally, I need to establish exposure to uranium in the trading account so Western Uranium & Vanadium Corp. is being acquired by way of the recent unit offering at CA$1.60 per unit (that includes the full three-year warrant at $2.50).

The GDXJ May $43 calls are currently underwater, but I am expecting to see a seasonal rally in the juniors right into May with the caveat being that I must keep an eye on the Fed and the U.S. dollar in case the tapering/tightening starts a mass migration to the greenback. No matter what the gurus tell you, a strong dollar is not good for precious metals.

The List

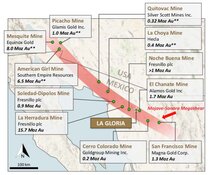

Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB); (CAD $.58 / USD $.4673): Having owned this deal since May of 2017, it has been a long journey filled with more than a few bumps in the road (including fouled-up listing procedures in early 2019, drill bit disappointment at Hot Springs Peaks, and more recently delays due to COVID, local staffing issues, and now a hacked assay lab) but what keeps this name at the front of the pack is the superb job being carried out by geologist/President Mike Sieb and Vice President of Exploration Scott Frostad in the interpretation and exploration of the rapidly-advancing Fondaway Canyon project in Nevada.

I am issuing a follow-up Special Situations report later this month after I get a look at the results from drill hole FCG2021-11, which should be spectacular but which have been delayed by a “hacked” assay lab. I fully expect that all of the results from holes 11 to 17 will be good holes but it is not the assay results that are the issue here. Valuation (or undervaluation) is a BIG issue, and it must change.

If I use the fully-diluted capital of the company at $110 million, the market capitalization is $51.4 million and when I divide that number by 1,069,000 ounces which represents the pre-2017 “historic” resource (before Getchell even drilled a single hole), it puts a value-per-ounce of $48 on the entire company based solely on Fondaway.

If this were the 1990s, analysts covering the junior miners would take one glance at that value-per-ounce number and be pounding the table because of the history of mergers in Nevada and the value-per-ounce commanded by the seller. Low-grade, open-pit (Carlin-type) resources usually go out at around $100 per ounce while high-grade get closer to $200 per ounce. Fondaway Canyon’s Central Zone is higher grade than most Nevada gold resources. In fact, the head grade mined by Barrick Gold in Nevada averages .87 g/t which is a fraction of the grade being found in not only the known portions of the deposit but also in two new high-grade zones that are NOT included in the “historic” resource number.

Thus far, the market refuses to believe that there is a much larger and potentially impactive story developing despite Sieb and Frostad’s brilliant interpretation and that is no fault of theirs but it is not simply to be sloughed off as being due to the “crappy junior mining market.” As an analyst and former corporate finance player, I refuse to accept this deeply discounted valuation for the asset and have warned management that they need to engage an independent engineering firm to upgrade the existing resource which entails the inclusion of 2017 drilling done by the former owner (Canarc Resources) and all of the Getchell drilling in 2020 and 2021 to date.

The old paradigm of the 1990s where analysts and investors did not require “spoon- feeding” has been replaced by one in which all one needs is a “story” and “an uptrend” in order to constitute “due diligence.” For Getchell shareholders, that is not an acceptable excuse for such dramatic underperformance relative to others whose results do not hold a candle to Getchell’s but whose share price has left it in the proverbial dust. That the stock closed at a year-to-date + 70.59% ROI versus negative numbers for the sector is a feather in their hat but in terms of being rewarded for such outstanding drill results, it is woefully inadequate.

Having gotten that off my chest, GTCH remains my largest holding and I will add on weakness.

BUY – Target: $5.00 in 2022

(Warning: I had a $5.00 target for 2021 as well.)

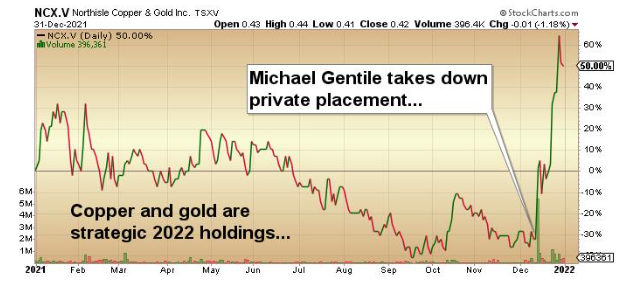

Northisle Copper and Gold Inc. (NCX:TSX; NTCPF:OTCPK); (CA$0.42/$.3361): Initially recommended in May 2021 at CA$0.25 ($0.1975), this name falls beautifully into the perfect storm of electrification and inflation protection. The North Island Project has scale and grade and proximity to infrastructure seldom present in the current environment for junior developers.

I like every aspect of this company: solid management with capital markets expertise and relationships, a strong technical team experienced in mine building and operations, a great jurisdiction (B.C.), and most importantly, the presence and involvement of strategic investor Michael Gentile, whose track record and market savvy are enviable.

In a world moving rapidly and forcefully toward total electrification, access to turnkey copper projects is a rarity these days and while I covered that in the earlier part of this issue, the main driver behind Northisle is management, where there exists substantial capital markets experience as CEO/Pres. Sam Lee brings knowledge from a 20-year career with CIBC World Markets to the table. Adding to the capital markets horsepower is strategic investor Michael Gentile whose fund recently threw down CA$1.9 million by way of a unit offering and whose interview and podcast sent the share price scurrying from the tax-loss doldrums sub-CA$.20 level to a 52-week and multi-year high of CA$.47. I picked this off last March in the CA$.25 range, but until a few weeks ago, had been less than thrilled with its performance. That the Gentile association triggered an avalanche of buy-side volume is not a surprise. A similar deal, Arizona Metals Corp. (AMC:TSX.V; AZMCF:OTCQX) received the Gentile blessing on Dec. 2, 2020, with the stock at CA$.70. Thirteen months later, it trades at CA$6.15 for a gain of 778%.

The tape action in NCX and the historic performance of AMC underscores the nascent advantage enjoyed by those juniors that have the endorsement of a powerful “influencer” so given my bullish assessment for the copper space, Northisle has all cylinders firing hard as we move into the New Year.

BUY aggressively using a CA$.50 / USD $0.42 limit price – target $1.15 (subject to revision)

Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX); (CA$1.87 / $1.47): As discussed earlier, uranium is truly the most asymmetrical trade in the universe as we head into 2022, and if there is one thing that stands out for Western U & V, it is the 55-million-pound uranium resource on their balance sheet. Favorable jurisdiction and access to infrastructure, zero CAPEX requirements and a tight share structure allows shareholders to have a 100% correlation to uranium pricing.

By comparison, Energy Fuels carries slightly under a 50-million-pound resource and trades at a $1.187 billion market cap versus Western’s $57 million. Surely, the ownership of a permitted mill (Pinion Ridge) should not make EF more valuable to the tune of a billion dollars.

Buy – Target price: New highs above CA$4.18/$3.28 by Q3/22. No stop.

Allied Copper Corp. (CPR:TSX; CPRRF:OTCQB); (CA$.22/$.1689): When I introduced the March financing to all subscribers, it was on the basis of the caliber of management with specific reference to Chairman Warner Uhl, a former Fluor Corp. engineering wizard with all of the necessary attributed as a mine builder. As the deal unfolded, he was awaiting the completion of the May subscription receipt funding in order to begin the process of sourcing out advanced exploration or pre-production assets. Unfortunately, this process was derailed in May as IIROC determined that the transaction that accompanied the funding was to be treated as an “RTO” (reverse takeover) resulting in a painful six-month trading halt. When it opened for trading in November, memories of the CAD $.68 all-time high for the year were soon forgotten and uncertainty prevailed, never a positive for any listed company.

Now, Uhl is still chairman and the new president/CEO, Richard Tremblay, during a number of conversations in late 2021, demonstrates a high degree of capital markets understanding and appreciation. While the trading halt hurt the near-term performance, it has not altered my bullish stance on CPR. The retrenchment in copper and the junior copper deals in the second half of last year has actually increased the availability of projects at lower prices so the six-month delay has actually benefitted them due to the excellent working capital position (CA$5.9 million).

I am taking the view that electrification will bring investors to junior copper developers and that Mr. Uhl’s considerable contacts in the global copper space will result in multiple high-quality projects crossing his desk and ultimately driving valuation. With only 38 million shares issued and a CA$8.37 million market cap, there is a great deal of room for appreciation.

BUY – Target Price: CA$1.25 in 2022.

Norseman Silver Ltd. (NOC:TSX.V); (CA$0.29/$.221): Despite having a difficult 2021 after a barnburner start, Norseman is my top junior explorer. The Taquentren Project (nicknamed “Son of Navidad”) in Patagonia, Argentina was assembled by Daniel Bussandre, the prospector/geologist that put together the Navidad discovery acquired by Pan American Silver in 2009 for CA$630 million. Early reports have revealed a great many similarities between the two projects but were it not for the presence of Bussandre, I would not be as optimistic.

The company needs to focus on marketing the Taquentren Project because this is the kind of junior mining market that will only reward major discoveries (but not always, i.e., Getchell’s Fondaway Project). The Gastre Fault region of Patagonia is an under-explored geological province due to what has been a harsh regulatory environment for junior explorers but despite that, it is highly prospective from a geological perspective. Also adding to my bullish view was the recent ruling out of Chubut Province that would allow open-pit mining in certain zones of the Gastre Fault region which will allow investment capital to flow more freely into projects located in Patagonia and Argentina as a whole. Chairman Campbell Smyth has been a colleague/friend of mine for over a decade and knows the mining business as well as anyone I have encountered in my 45-year investment career.

The permitting process is ongoing and I am optimistic that a drill program will be announced this year but surface work including geochemical and geophysical surveys should continue to draw parallels between Navidad and Taquentren and it is the marketing of these very important similarities identified by the man who discovered that 800-million-ounce silver deposit in the adjacent province that will drive the share price.

BUY – Target Price CA$0.75 in 2022 (subject to revision).

Goldcliff Resource Corp. (GCN:TSX.V; GCFFF:OTCBB); (CA$.09/USD $.075): Goldcliff has made an early-stage gold discovery by way of sampling and trenching on the Kettle Valley project located in southern British Columbia. The company announced that they have pinpointed drill targets that will be prioritized once the weather clears but everything being executed by Goldcliff is systematic and cost effective. CEO and major shareholder George Sanders was a founding director of Silvercrest Metals, so given that George owns over 35% of the issued capital, he is not going to spend money unless he sees potential for an exit, which will not happen unless he comes up with something major.

At a CA$5 million market cap, there is significant leverage here and while junior explorers are a tough sell right now, I like the risk-reward ratio.

Full Metal Minerals Corp. (FMM:TSX.V); (CA$.165/$.158): I bought the $0.08 secondary offering in mid-2020 and then watched the stock trade up to CAD $0.65 last May while waiting for the private placement to receive regulatory approvals which arrived in late April with the shares free to trade in very late August. Due to delays in landing the project, which we originally thought was “in the bag,” investors have decided to dump their cheap stock followed by December tax-loss selling resulting in a profitable trade but a disappointment, nonetheless.

I am giving Full Metal until mid-month and if no project is forthcoming, I will take profits above CA$.15 and move on.

Hold. No target.

This completes the initial assessment of the 2022 list of portfolio components. Good luck in 2022.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp., Northisle Copper and Gold Inc., Arizona Metals Corp., Western Uranium & Vanadium Corp., Allied Copper Corp., Norseman Silver Ltd., Goldcliff Resource Corp., and Full Metal Minerals Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp., Northisle Copper and Gold Inc., Arizona Metals Corp., Western Uranium & Vanadium Corp., Allied Copper Corp., Norseman Silver Ltd., Goldcliff Resource Corp., and Full Metal Minerals Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Allied Copper Corp. and Goldcliff Resource Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Allied Copper Corp. and Norseman Silver Ltd. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Western Uranium & Vanadium Corp., Allied Copper Corp., Norseman Silver Ltd., Goldcliff Resource Corp., and Full Metal Minerals Corp., companies mentioned in this article.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

All charts and graphics are provided by the author.