Silver Dollar Resources Inc. (SLV:CSE; SLVDF:OTCQB) executed a perfect Tax Loss Silly Season move in the last month. At $.80 a share in November five weeks ago, it plunged by 25% to $.60 on Friday on slack volume for the last week or so. For astute investors willing to pick up a 33% gain for two months, it’s a good bet into February regardless of what the rest of the market does.

The shares began trading in June of 2020 at about $.22 a share and rocketed higher with increasing silver prices to $2.29 for a 950% gain in seven months. The company may have gotten a little carried away with promotion. In the first week of January of 2021 they got slapped on the hand by the OTC Markets for price action on the OTCQB exchange.

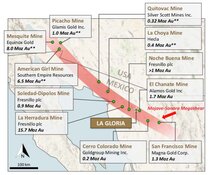

Actually, the Silver Dollar story is about as simple as silver stories get. First Majestic Silver owned the La Joya Silver project in the state of Durango in Mexico. The project came with a 2013 historic resource showing 199 million ounces of silver Eq at a cutoff grade of 15 grams.

I have a giant problem with the stupidity of the TSX on “Historic” resources. If someone generated a historic resource in 1980 on a project prior to 43-101, the numbers should be seriously questioned. But a resource done eight years ago with a listed Canadian company that passed muster from the TSX after 43-101 is “historic” only in name.

The rocks are exactly the same today as they were in 2013 but since the property has changed hands, the TSX pretends the composition somehow has changed. That’s total bullshit. If it was a valid 43-101 in 2013 and no one has moved the rocks, it’s just as valid today. Except to the bureaucrats ever mindful of creating work for themselves at the expense of junior mining companies.

The agreement between First Majestic and Silver Dollar signed in August of 2020 calls for Silver Dollar to spend $1 million in exploration over a three-year period, to pay First Majestic $1.3 million over five years and to give First Majestic 19.9% of the shares in Silver Dollar to gain 80% of the project. Should Silver Dollar complete the $1 million in exploration within three years of the agreement, the last $600,000 to be paid to First Majestic would be waived. To get the remaining 20% ownership of the property it would be necessary for SLV to issue an additional 5% of issued and outstanding shares to First Majestic. The project is subject to a 2% NSR to First Majestic.

So here is the story in simple terms. First Majestic didn’t have the bandwidth to exploit a major silver project in a silver mining country. They handed it over to a new junior. They get 19.9% of the company for 80% of the project and an additional 5% for the remainder. It is a big ass project well worth drilling and advancing. Insiders including First Majestic and Eric Sprott among others control about 37% of the shares.

Here is where it gets really interesting. The company has a couple of highly potential gold projects in Red Lake. They will probably spin them out or do some sort of JV with others in the area. They have some value to SLV shareholders.

SLV has about $9 million in cash and as of the close on Friday has a market cap of $25 million and an enterprise value of $16 million. If you divide the $16 million by 199 million ounces, you get just over $.08 an ounce for silver equivalent metals.

That is not going to last long once investors come back to the market on Wednesday. All it would take for the shares to blast higher would be for a single financial writer to point out the math.

The company has completed just over 1,100 meters of drilling in five holes. Assay results should be out around mid-January.

Silver Dollar is an advertiser. I was too stupid to buy shares and now it is too late. Do your own due diligence.

Silver Dollar Resources

SLV-V $.60 (Dec 24, 2021)

SLVDF-OTCBB 41.7 million shares

Silver Dollar Website

Bob Moriarty

President: 321gold

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosures:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. Silver Dollar Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.