Newrange Gold Corp. (NRG:TSX.V; NRGOF:OTCQB) President and Chief Executive Officer Robert Archer is going big picture with the company in 2022, expanding its search for results from one major project to three — and analysts are taking note.

The historic Pamlico Mines in Nevada remains the company's flagship property; but its scope has recently been enlarged, and Newrange is also exploring new acquisitions in the Red Lake Mining District in Ontario. It recently closed on an acquisition that gave it 100% of the past-producing Argosy Gold Mine and exercised its option for a 100% interest in its North Birch property there.

Archer hopes the moves will pay off for the company and attract new investors.

"I like to think of myself as kind of an optimistic realist, so I don't like to overpromise and under deliver," Archer told Streetwise Reports. "However, the two Ontario projects compliment each other very well and are only 10-12 kilometers from the Springpole Deposit, one of the largest undeveloped gold deposits in Canada, so I think we are well positioned for success in that area."

"I like to think of myself as kind of an optimistic realist, so I don't like to overpromise and under deliver," Archer told Streetwise Reports. "However, the two Ontario projects compliment each other very well and are only 10-12 kilometers from the Springpole Deposit, one of the largest undeveloped gold deposits in Canada, so I think we are well positioned for success in that area."

In December 2021, Newrange also released an updated outlook for Pamlico, which, with new claim staking, has more than doubled in size to over 5,700 hectares. Geologists have identified a multi-phase intrusive system there with locally strong copper/zinc and gold mineralization at the surface.

On Tuesday, the company announced a new mapping and sampling program in Pamlico’s Central Mine area has found widespread gold mineralization with an average of 4.33 g/t and values up to 47.34 g/t. Of a total of 67 grab samples taken of quartz breccia material, 55 returned gold values greater than 0.1 g/t, and 29 samples were greater than 1.0 g/t.

The company's news is catching the eye of analysts.

The new model looks past the area's historical gold district and looks at new areas "containing a gold-copper system with oxide gold near surface, lower-grade bulk tonnage gold mineralization, skarn and porphyry copper-gold targets," a recent research report from Noble Capital Markets noted. Based on the exploration update, the small-cap investment firm rated the company Outperform.

"We have been pleasantly surprised by Pamlico's growing resource potential and believe the company's exploration and drilling efforts will lead to greater delineation between precious and base metal opportunities. Additionally, we are excited about the company's growing presence in the Red Lake District in Ontario which is attracting investor interest based on recent discoveries."

—Noble Capital Markets analyst Mark Reichman

“Our field geologists are making great progress on the evaluation and understanding of the geological setting of the enlarged property,” Archer said. “We are starting to build a district-scale framework for the gold and copper mineralization that we are seeing, incorporating a re-evaluation of known zones with recently discovered ones. This approach is allowing us to groom several significant target areas for drilling in 2022.”

Archer said focusing too much on drilling one particular zone at the project was not the way forward because early success had led to unrealistic expectations “and gold isn't always like that," Archer said. "You get high-grade zones, you get low-grade zones. … You sort of recognize that you have to step back and look at the big picture, which is more my forte anyways."

That's what Newrange has done at Pamlico, he said, conducting a large-scale survey and more than doubling the property's size. They’re now covering a lot of area that had not been previously mapped or prospected.

As such, the company has identified six new target areas there and is working to put them together to form that big picture, like pieces of a jigsaw puzzle, he said.

"In the coming weeks and months, we will be in a better position to set new drill targets and increase our odds of success," Archer said.

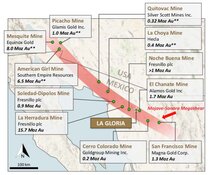

Archer's focus on a broad view dates back to his time as president and chief executive officer of Great Panther Silver Ltd., a company he co-founded in 2003. The mid-tier producer, now Great Panther Mining Ltd. (GPR:TSX; GPL:NYSE.American), has operations in Brazil, Mexico, and Peru and a market cap of CA$142 million. He left the firm in 2017, in part because he preferred the entrepreneurial startup atmosphere of a smaller company.

"I also wanted to get back to my roots … because I am an exploration geologist by training," he said.

He initially joined Newrange as a director in 2018, becoming CEO in 2019. He added the role of president upon the retirement of co-founder Robert Carrington in October 2021.

One lesson he learned at Great Panther was not to have "all our eggs in one basket," which is why he's expanded Newrange's reach to the other projects in Canada. The North Birch property is a "blue sky" investment in its early stages, while Argosy, by contrast, is a legacy mine with the potential to expand beyond its vertical depth of about 270 meters. Both properties also have the advantage of being very close to each other so they can share equipment easily.

In Noble's research report released last month, analyst Mark Reichman said Newrange's diversification in its exploration projects led to its Outperform rating.

"We have been pleasantly surprised by Pamlico's growing resource potential and believe the company's exploration and drilling efforts will lead to greater delineation between precious and base metal opportunities," Reichman said. "Additionally, we are excited about the company's growing presence in the Red Lake District in Ontario which is attracting investor interest based on recent discoveries."

The Red Lake District of northwest Ontario "has been heating up in recent years," Archer confirms, with exploration successes by others, such as Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX), which is currently the subject of a CA$1.8 billion takeover offer from Kinross.

Newrange had planned to drill at North Birch in summer 2021, but then wildfires hit the region. It had to evacuate the crew and put everything on hold. The effort will resume in late January 2022. "Which isn't necessarily a bad thing," he said. "It's often easier to get around in the wintertime up there when everything's frozen."

Archer said his big picture view will continue further into 2022 as the company looks to its new drill results. With success, he also plans to spend more time bringing past investors with him to the company.

But old-fashioned luck still comes to bear.

"You can't choose where you find the gold," he said. "It's where it is. So, our job is to try and figure that out. That's the challenge: to set realistic expectations. I think analysts and shareholders appreciate that."

Fully diluted, Newrange has 173 million shares outstanding. It trades in a 52-week range of CA$0.22 and CA$0.06.

Disclosures

1) Steve Sobek compiled this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Newrange Gold Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newrange Gold Corp., a company mentioned in this article.