Canadian companies are interesting because they are much like cats; they seem to have nine lives.

I worked with Pacific Ridge Exploration Ltd. (PEX:TSX.V) 18 years ago when they were under totally different management drilling a gold project in Nevada that never went anywhere. The company pretty much faded away for many years but it’s back with a giant copper hit in British Columbia.

While the name of the company has been around for a long time, essentially the company is brand new starting to move forward in early 2020 when they entered into an earn-in with Aurico Metals on the Kliyul-Redton projects.

PEX can earn 51% of the two properties by paying Aurico $100,000 and issuing two million shares and spending $3.5 million in exploration. They can earn an additional 24% in the projects by paying Aurico an additional $60,000 in cash, issuing 1.5 million shares and spending $3.5 million more for exploration. Kliyul has an underlying 2% NSR while Redton has a 2.5% NSR that can be reduced to 1% for $2 million.

Early in 2021 the company got serious about moving forward with a financing of eight million Flow Through units at $.142 to raise $1.136 million. Gerald Carlson was appointed the Executive Chairman and Blaine Monaghan picked as President and CEO. In June of 2021 the company did another financing of $1.5 million by selling ten million shares at $.15 with a share and a half warrant good for two years at $.23. Crescat Capital took seven million of the unit in the financing.

The financing was intended to raise enough money to advance their flagship Kliyul copper project with a 2,500-meter diamond drill program. The property had been drilled with good results going back as far as 1974.

The company has additional projects in the Yukon but for today I’m going to focus on the Kliyul property because that is where they recently made the giant copper hit that has driven the shares from a low of $.11 two weeks ago to a high of $.37 on December 8th.

Prior drilling at the KMZ area of the Kliyul project was done for near surface skarn material with both copper and gold mineralization. In 2015 management of Aurico made the decision to drill deeper in the hopes of finding a porphyry gold-copper system. The results tapped into some excellent numbers including 20.4 meters of 0.39 Cu and 2.55 g/t gold in hole KL-15-34.

That was the last drilling at Kliyul until PEX began their 2,500-meter program in early August. Due to delays caused by a local wild fire the company was only able to finish three holes with a total of 1,544 meters of diamond core.

Pacific Ridge released the first of three holes from Kliyul on December 1st. The results were exceptional and as good or better than most of the copper/gold porphyry mines in the Quesnel Trough in Central British Columbia.

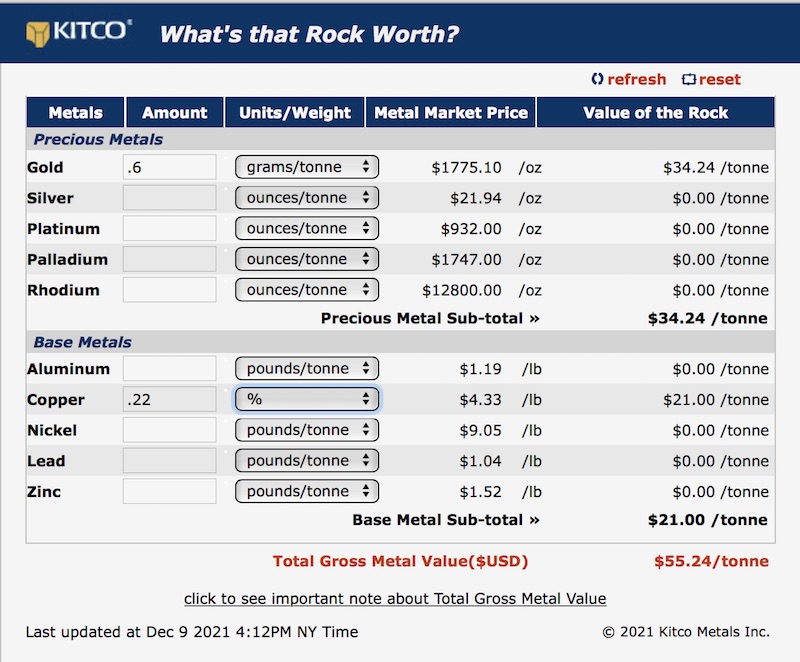

Company president Blain Monaghan reported the results as 437 meters of 0.61% CuEq or 0.96G/t AuEq starting from the top of bedrock at 12 meters.

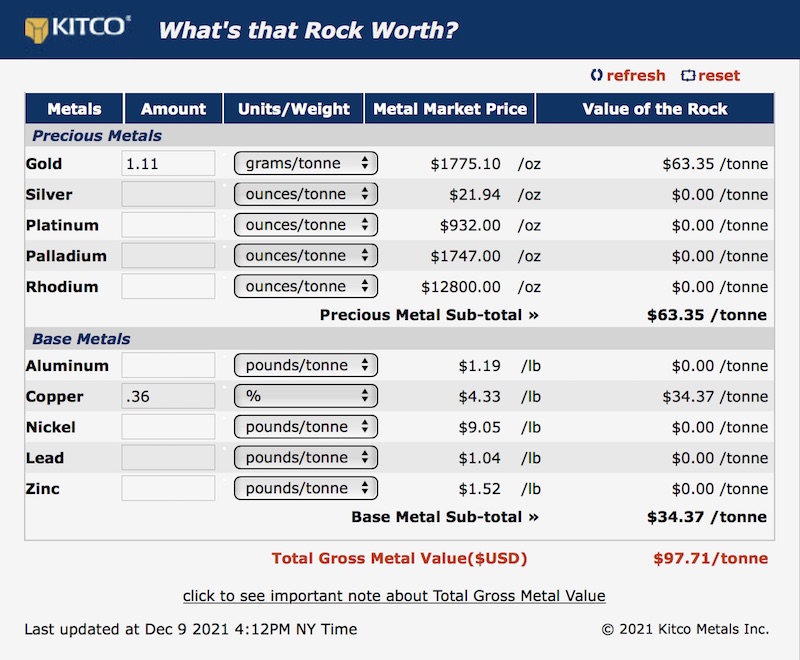

The top of the hole was in skarn. Typically that is higher grade than an underlying porphyry. Indeed the assays showed the first 53 meters of 1.17 AuEq. But much to the surprise and pleasure of existing investors and management, the last 141 meters of Hole KLI-21-036 produced numbers of 0.36% copper and 1.11 G/t Au and was stopped in in a dike due to stability issues with the drill rig. The company believes mineralization would continue once through the dike.

A 437-meter intercept of $55 rock is outstanding but a 141-meter intercept of $98 rock in BC in the safest mining jurisdiction in the world is exceptional.

There is always a calendar issue with drilling projects in BC and the Yukon. Typically the results would come out in a month after completion of the drill program but the Covid stupidity has beaten up all junior resource companies everywhere will delays of three to four months at times. With the BC and Yukon projects, the news is sparse from the release of assays in the fall until drilling begins in the last spring of the next year and investors are looking for action.

Pacific Ridge will need to raise money for a bigger drill program next year. They don’t want to do it at current prices. There are two more holes still to be released. Holes 37 and 38 look visually to have hit the porphyry and should the results be as good or better than hole 36, look for the stock to run. There is an overhang currently from the investors from a year ago with shares bought in 2020. The shares were as cheap as $.05 one year ago so a lot of investors will be happy to take a 500% profit. But once the overhang is removed, I expect the shares to move higher, perhaps much higher depending on the next two holes.

Pacific Ridge’s partner in these two projects is a holding company owned by Centerra. They are described as a mining royalty and development company with a 1.5% NSR on the Young-Davidson Gold Mine and 2% NSR on the Fosterville Gold Mine in Australia. I don’t see them wanting to be a junior partner with PEX on Kliyul so there is a good chance they might redo the deal to enable PEX a larger share of the pie in exchange for a more serious drill program. A 2 or 3% NSR on a big high-grade copper/gold porphyry in BC would be right up their alley.

When I first saw the results from the one hole released a week ago I made my mind up to buy some shares. I picked some up at $.23 and more at $.35 and was thrilled to get them. Pacific Ridge has become an advertiser so naturally that makes me biased. Please do your own due diligence.

Pacific Ridge Exploration

PEX-V $.32 (Dec 09, 2021)

PEXZF-OTCBB 53.9 million shares

Pacific Ridge Website

Robert J Moriarty

President: 321gold

Archives

321gold

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosures:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Pacific Ridge Exploration Ltd. Pacific Ridge Exploration Ltd. is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.