Maurice Jackson: Joining us for a conversation is Spencer Cole, the chief

investment officer of Vox Royalty Corp. (VOX:TSX.V). Mr. Cole, great time to be speaking with you as Vox Royalty continues to provide shareholders with a smart way to invest in commodities. Before we begin, Mr. Cole, please introduce us to Vox Royalty and the opportunity the company presents to shareholders.

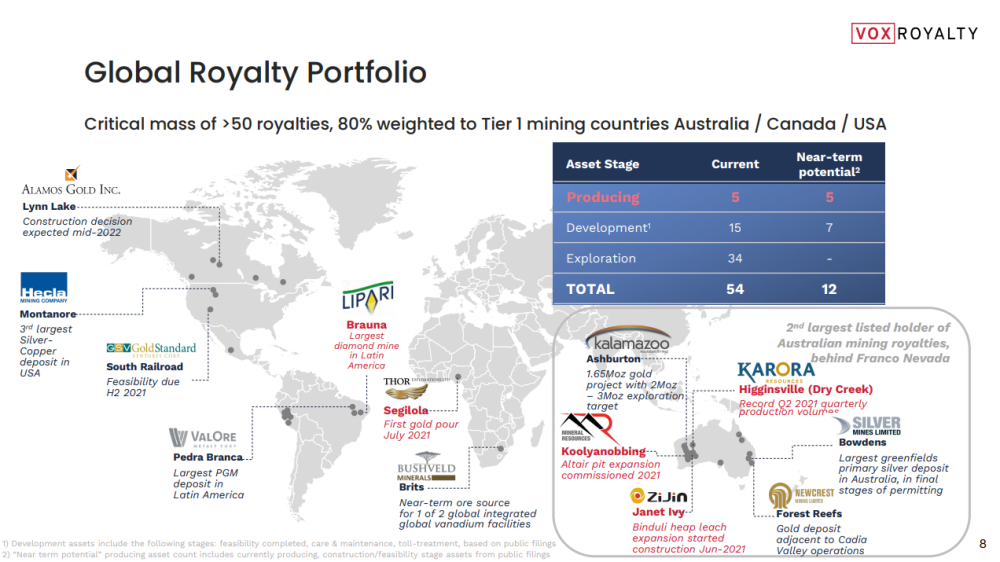

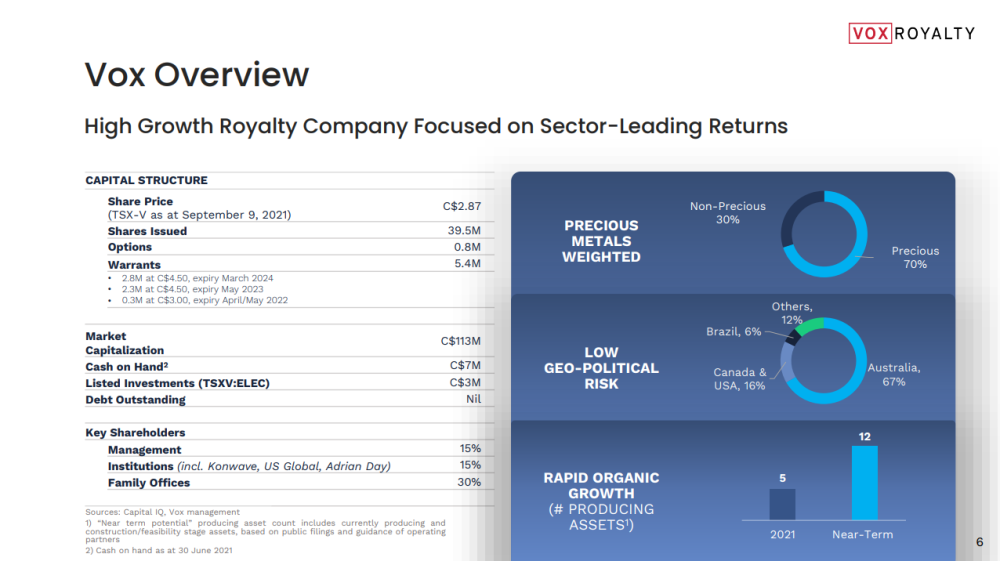

Spencer Cole: Vox Royalty is a high-growth, precious metals-focused, mining royalty investment company. The company's been around for eight years, and over those eight years, we've built what we believe is the most unique mining royalty investment company in our entire $70 billion industry. We're consistently delivering the highest rate of return on invested capital at what we believe is the lowest potential portfolio risk level. Particularly for some of your listeners who are concerned about inflation levels at the moment, we think Vox is a really attractive inflation hedge that offers investors high-organic growth with very low risk.

Maurice Jackson: Last month, Vox Royalty announced some exciting news for shareholders regarding development and exploration updates from your royalty operating partners. This month appears equally exciting, as Vox Royalty has just announced additional key developments which look to strengthen your royalty portfolio. Beginning in Nevada, take us onto the Gold Standard Ventures South Railroad Gold Project, and provide us with an update on the feasibility study, permitting, and construction financing.

Spencer Cole: The South Railroad Project is a rapidly advancing gold project in Nevada, which is obviously arguably one of the most pro-mining, particularly pro-gold mining jurisdictions on the planet. The operator just provided an update to the market that they're rapidly approaching completion of the feasibility study, which is targeted for the first quarter of 2022. Upon the completion that feasibility study, they're going to move straight into construction financing.

Gold Standard Ventures already has one of the world's largest mining private equity funds, Orion, who's given them a $200 million term sheet to fund the construction of the mine. They'll be looking to go back to other investment groups to see where the best source of financing is so going into early 2022, we expect a huge amount of exciting news flow as to how this project is going to be constructed, and then their management has also provided an update that they expect to receive their final permits to start construction of this project within 18 months, so a really exciting gold project that's rapidly moving towards production over the coming years.

Maurice Jackson: Speaking of exciting news for next year, let's go to Black Cat's Bulong Gold Project, where they're looking at a first production guidance in 2022. What can you share with us?

Spencer Cole: This is an exciting royalty within our portfolio for a few reasons, as you mentioned, the Black Cat Syndicate, which is the operator of this Bulong Gold Project, they just reiterated guidance. They're expecting this gold mine to be in production in the second half of 2022, so investors can look forward to the royalty revenue possibly late next year. But a cherry on the cake, so to speak, with this royalty, is not only is the company actively moving this project forward towards production next year, but they're aggressively drilling out the land package. On an annualized basis, they're drilling over 80,000 meters on this land package. So not only are investors looking forward to, I guess, near-term royalty revenues on this property, but also, there's likely to be a huge volume of discovery news flow over the coming months and quarters as they continue that drilling campaign.

Maurice Jackson: We've covered gold. Let's discuss silver and platinum group metals, beginning with silver at the Bowdens Silver Project by Silver Mines. How's their drilling and development campaign coming along?

Spencer Cole: It's coming along extremely well. For readers who aren't aware of the Bowdens Project, it's the largest primary silver project in all of Australia. On a silver equivalent basis, there are approximately 275 million ounces of silver equivalent resources in the ground here, so just an extremely large ore body. The operator, Silver Mines, is working through final permitting at the moment. They're also progressing an expansion case, looking at a high-grade underground that would go on top of the open pit operation. We expect that this project is rapidly heading towards a construction decision with final permits in hand next year. The managing director of the operator was recently quoted on Bloomberg as saying he personally believes there's potential for this ore body to triple in size. So what is already a monstrously large silver deposit, the managing director of the operator thinks there's a multiple of this potential in the ground, which is even more exciting for our investors.

Maurice Jackson: Finally, my favorite metals, the Platinum Group Metals. What are the latest developments coming from ValOre?

Spencer Cole: This is another exciting royalty within our portfolio of 54 royalties, The Pedra Branca Project, is ValOre's flagship asset, it's also the largest Platinum Group's metal project and deposit in all of South America. ValOre has been aggressively drilling this property out, so they've been doing approximately a 10,000-meter drilling program this year, and our expectation from management is that they're preparing for a resource update in the coming months. We look forward to seeing the size of this resource grow, and then for this project to continue to move along down the development pathway towards production over the coming years. So all eyes are on the resource update that we expect in the next few months.

Maurice Jackson: Mr. Cole, as you look back at 2021 and then forward onto 2022, Vox Royalty, in many regards, has exceeded expectations in terms of your development, discovery drilling, and bolstering your royalty portfolio. Vox Royalty is on track for a record year on moving projects into production. Can you comment further on that?

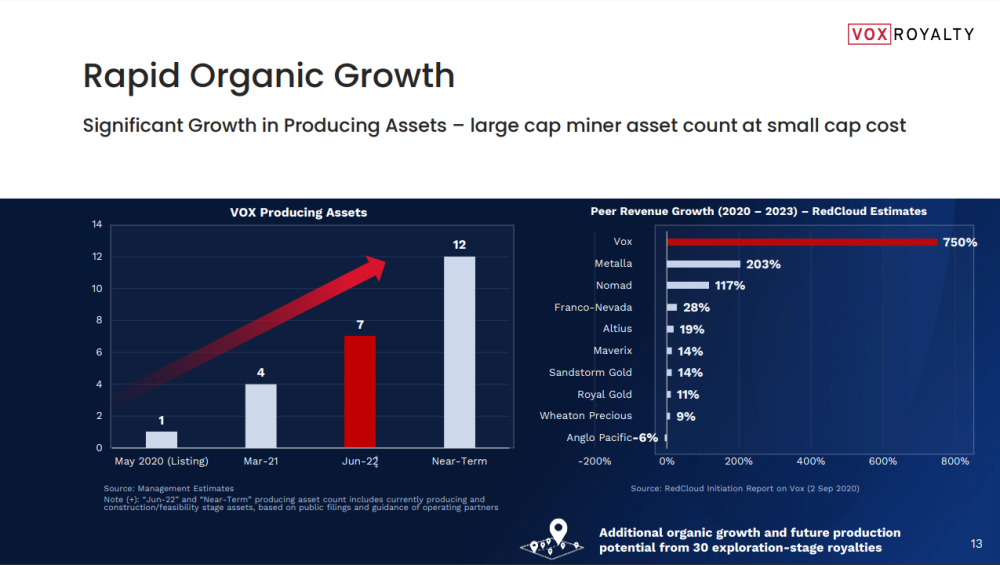

Spencer Cole: 2021 has been a transformational year in Vox's eight-year history. We've increased the number of producing royalty assets that we have in our portfolio to five. We've had record volumes of partner-funded drilling on our royalty properties. We've had a record number of projects, I guess, moving forward into sort of development stage as well, supporting the near-term growth potential as well. But then importantly for investors, as we look ahead towards next year, 2022, we expect that a lot of that key organic growth is even going to be outpaced and set to continue going into next year.

Just by way of example, there are three additional projects that we expect to commence production next year that are in varying stages of construction currently. There are four separate feasibility studies that we expect to be released next year. The volume of drilling on our royalty properties, we expect that will achieve a new record in 2022 as well. So for Vox shareholders, they can look forward to a huge volume of organic growth in revenue and underlying development within our royalty properties without any additional capital required to acquire those royalties.

Maurice Jackson: Now, before we leave the property bank, what is the next unanswered question for Vox Royalty? When can we expect a response and what determines success?

Spencer Cole: I think as we touched on in our last interview, I think the main catalysts that investors continue to be excited about in Vox is just the organic growth within our portfolio and what that means for our revenue projections. As I touched on, we've seen a huge volume of growth on a number of our producing royalties. When we went public last year, we only had one producing royalty asset. And look, that was one criticism of the company, that people wanted us to have more producing assets, and where we stand today, we've now got five producing royalty assets. Organically, without spending any additional capital on new royalties, we expect that will increase from five producing royalty assets to 10, and north of 10 by late 2023.

Spencer Cole: What is the unanswered question is how soon will those new royalty assets come into production and what does that mean for revenue, which has already been growing at quite a substantial rate? I think the great news for our investors is they don't need to wait a very long time. This is a matter of months and quarters as they continue to see that growth organically within the portfolio, the incremental revenue that's going to come from those producing operations.

Maurice Jackson: Let's look at some numbers. Sir, please provide us with the capital structure for Vox Royalty.

Spencer Cole: We have a very tight capital structure at Vox with less than 40 million shares on issue. We are in a net cash position on our balance sheet. Our total working capital is about nine million on the balance sheet between cash and listed investments. Vox has very strong balance sheet and we are very, very careful about not issuing stock. We, as management, own about 15 percent of the company, and our family members own additional stock on top of that, so this is very much an investor-led and managed business, where management is fully aligned with our investor group.

Maurice Jackson: In closing, Mr. Cole, what would you like to say to shareholders?

Spencer Cole: Thanks for the shareholders' and listeners' time today. I'd strongly encourage you to have a look at the Vox Royalty website. We're on the cusp and continuing to deliver on a strategy that is high growth but low capital intensity, where we're offering incredible returns at very disciplined prices. Particularly in this inflationary environment that we find ourselves in today, getting exposure to a portfolio of base and precious metal assets, such as Vox has in its portfolio, is a really smart way to hedge inflation risk. So I strongly encourage investors, particularly those that are worried about inflation, to seriously consider having a look at Vox Royalty in more detail.

Maurice Jackson: Last question, sir. What did I forget to ask?

Spencer Cole: I believe we’ve covered it all today.

Maurice Jackson: Mr. Cole, for readers that wish to learn more about Vox Royalty, please share the contact details.

Spencer Cole: Please visit our website www.voxroyalty.com.

Maurice Jackson: Mr. Cole, it's been a pleasure speaking with you. Wishing you and Vox Royalty the absolute best, sir.

Before you make your next bullion purchase, contact me at 855.505.1900 or email maurice@milesfranklin.com. I'm a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery to offshore depositories and precious metal IRAs. Finally, we invite you to subscribe to www.ProvenandProbable.com, where we provide Mining Insights and Bullion Sales.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Disclosures:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Vox Royalty Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Vox Royalty Corp. My company has a financial relationship with the following companies referred to in this article: Vox Royalty Corp. Proven and Probable disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) do not own securities of Vox Royalty Corp., a company mentioned in this article.

Disclosures for Proven and Probable:

Please disclose all companies that are mentioned in this article that you or members of your immediate household or family own securities of: Vox Royalty Corp.

Please disclose all companies that are mentioned in this article that pay you: Vox Royalty Corp.

Please disclose all companies that are mentioned in this article that your company has a financial relationship with: Vox Royalty Corp., sponsor/partner.

Do funds/accounts that your firm controls own securities of any of the companies you wrote about in this article?: N/A.

Standard Disclosure:

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Proven and Probable LLC does accept stock options and cash as payment consolidation for sponsorship. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on or through this forum AT YOUR OWN RISK.”

All Rights Reserved.

Images provided by the author.