It seems Kenorland Minerals Ltd. (KLD:TSX.V; 3WQO:FSE) is doing very well at the summer drill program currently underway at their flagship Regnault project, as JV partner Sumitomo Metal Mining Canada was happy to do a strategic investment of no less than C$5.2M in Kenorland equity. This is not something you see very often, and I will discuss with CEO Zach Flood the potential meaning behind this move.

After a generally successful winter program, with most holes hitting mineralization at Regnault, Kenorland is looking to follow up on the already found R1 and R2 structures at Regnault with the aforementioned 18,000m summer drill program, which commenced in July of this year. The company is also busy with other exploration programs at many more projects, either fully owned, optioned or JV-ed, making this one of the busiest exploration juniors I know.

Drilling at Regnault target, Frotet project, Quebec

Notwithstanding all activities, the share price action doesn’t exactly reflect the myriad of opportunities for good exploration results, as can be seen here:

Share price 1 year period; Source: tmxmoney.com

As the June results at Regnault weren’t as stellar as the batch before (which included the impressive 5.72m @ 90.56 g/t Au (incl. 3.89m at 132.57 g/t Au) intercept), gold corrected and general sentiment dropped off, the Kenorland share price dropped off like most precious metals juniors, and started side ranging in the C$0.70-0.80 range. Most of the pre-IPO financing has been done at C$0.70, before lots of drilling and other exploration was completed, so Sumitomo acknowledged the increased value proposition, and was happy to fork out the substantial cash a nice premium of 33%.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Sumitomo acquired 5,2M shares at a price of C$1.00 per share for gross proceeds of $5,2M, resulting in a position of 10.1% of the company’s outstanding shares. The proceeds from the financing will be used 80% ($4,2M) for exploration expenditures on the company’s properties and 20% ($1M) for general and administrative expenses of the company. As is common with 10% positions, Sumitomo will have the right to appoint a director, subject to certain conditions described by an investor rights agreement. They have already chosen Eiichi Fukuda, who is a trained geologist and President of Sumitomo since 2016, and also a director of Teck Resources, so not a lightweight in my view. Several other terms are included as well, as for a period of two years, Sumitomo has also agreed not to:

- commence a take-over bid;

- acquire the company’s shares, or direct or indirect rights to acquire any of the company’s shares;

- make, or in any way participate in any solicitation of proxies to vote the company’s shares;

- make any public announcement with respect to, or submit a proposal for, or offer of (with or without conditions) any business combination, amalgamation or merger or similar transaction involving the company.

I like the fact there were no warrants attached, and as mentioned the investment was done at a substantial premium, but I wondered why Sumitomo had to be excluded from any type of take over attempt or further expanding their position for the next two years. CEO Flood stated that this actually is a fairly common provision in this type of transaction. I wasn’t aware of this, usually I see provisions like lock-up periods, pro rata participation in future financings, backstop rights, right to first offer on other types of financings, etcetc, but I’m never too old to learn, and there certainly is a lot to learn in this industry.

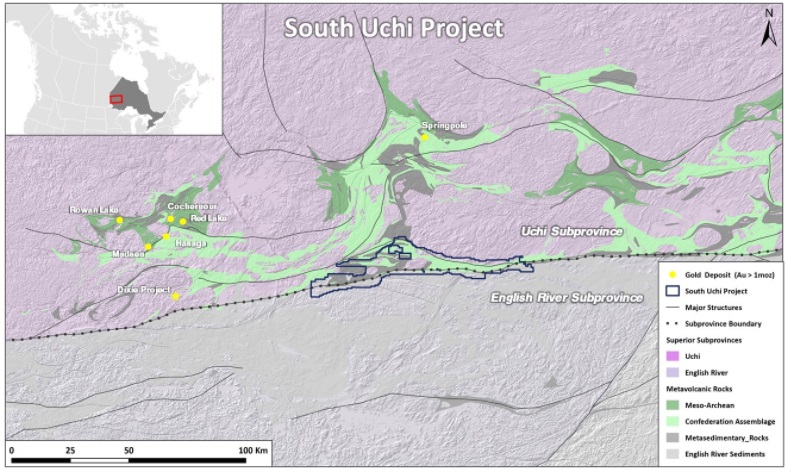

With this fresh cash, Kenorland has C$9M in the treasury, which will be sufficient to fund the upcoming drill program at Regnault/Frotet. As a reminder, Kenorland only has to fund 20% of exploration at this project, as JV partner Sumitomo pays for the other 80% of expenditures. This leaves Kenorland management with options to spend more cash on exploration at other flagship projects Healy (earning in for a 70% interest from Newmont) and Tanacross (100% owned), but also pipeline projects like Chebistuan (optioned to Newmont) and Chicobi (optioned to Sumitomo). Kenorland also optioned out their South Uchi Project to Barrick Gold on September 20, 2021, the third major it is doing business with.

Looking in hindsight, this could be seen as the first foray of Barrick into acquiring exploration assets in the Red Lake District of Nortwestern Ontario. More recently, Barrick also signed agreements with Red Lake Gold and Dixie Gold, two juniors which hold prospective land positions around potentially one of the largest gold discoveries of the last decade, the Dixie project owned by Great Bear Resources. Many analysts view these actions as an attempt by Barrick to buy Dixie, and consolidate all prospective land around it. We will have to see how this pans out, for now investors don’t see this as a mere coincidence, and caused the Great Bear share price to rise to levels not seen since the summer of last year.

In order to earn the first 70%, Barrick would have to spend C$3M on exploration in the first three years, and another C$3M in the three years after, and produce a NI43-101 compliant resource of at least 1Moz Au, after which a 70/30 JV will be formed. Barrick can earn an additional 10% in the project by funding a FS within 4 years, but Kenorland could also elect to go for a 2-3% NSR instead so they don’t have to contribute anything anymore. I found it interesting to read about the lithium pegmatite potential, and I wondered, as Barrick usually has no focus on lithium, who would be exploring this. CEO Flood answered that this indeed is not in the interest of Barrick.

As Kenorland put out a nice news release in September of this year, summarizing their exploration activities, it provided a useful overview of their busy year so far:

- Frotet Project, Quebec (Joint Venture with Sumitomo Metal Mining): 18,000m diamond drill program

- Healy Project, Alaska (Optioned from Newmont Corporation): 5,000m maiden diamond drill program

- Tanacross Project, Alaska (100% owned): soil geochemistry, UAV magnetic, and IP surveys

- Chicobi Project, Quebec (Optioned to Sumitomo Metal Mining): Geophysics (UAV magnetics, IP, EM)

- Hunter Project, Quebec (100% owned): Property-wide airborne VTEM geophysical survey

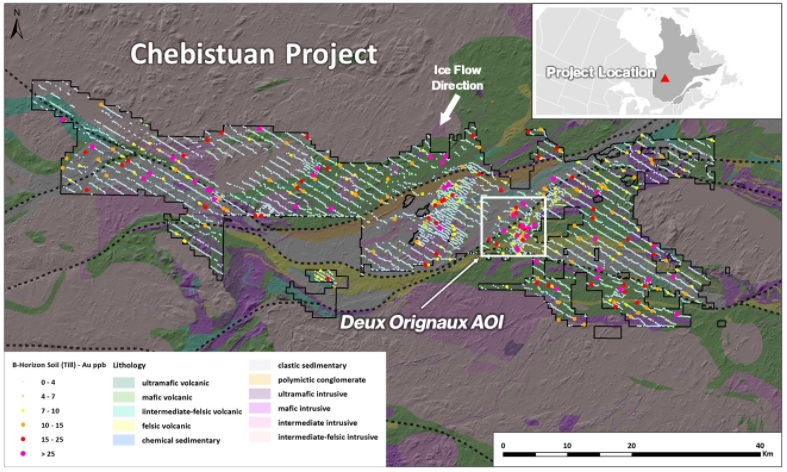

- Chebistuan Project, Quebec (Optioned to Newmont Corporation): Phase 2 soil geochemistry survey

- South Uchi Project, Ontario (100% owned): LIDAR survey and regional till sampling (planned for fall)

As VP Exploration Francis McDonald describes, no less than C$17M will be spent on exploration this year, with C$11M funded through partners, generating over C$2M in operator management fees and cash payments. CEO Flood has stated a clear vision on how he wants Kenorland to operate:

“Our mission at Kenorland has always been to maximize shareholder return through exploration success. We take a long-term approach with multiple grassroots projects being advanced through the pipeline at all times. Some of our projects are sole funded, some are farmed out, while other assets are sold entirely for equity and royalty interests, depending on how a project fits within our risk profile. We believe that scale, creativity and flexibility are fundamental to building value and optionality within an exploration portfolio. Any of these projects may result in a significant discovery, as we have already witnessed at Frotet through the grassroots discovery of Regnault last year. With interest in over 1 million acres of ground, all which has seen various stages of systematic exploration and being actively explored, we are confident that our efforts will return significant gains to our shareholders.”

I like it how Flood treats exploration as a business in an extremely professional fashion. Everything, from projects to partners to financial backers to staff to exploration strategy, oozes the highest quality, and can easily serve as a blueprint for many other explorers. As the saying goes, only 1 in a 1,000 exploration projects turns into a mine, but one thing that Flood seems to be very good at is the methodological and concise narrowing down of this huge number, vastly increasing his odds for success.

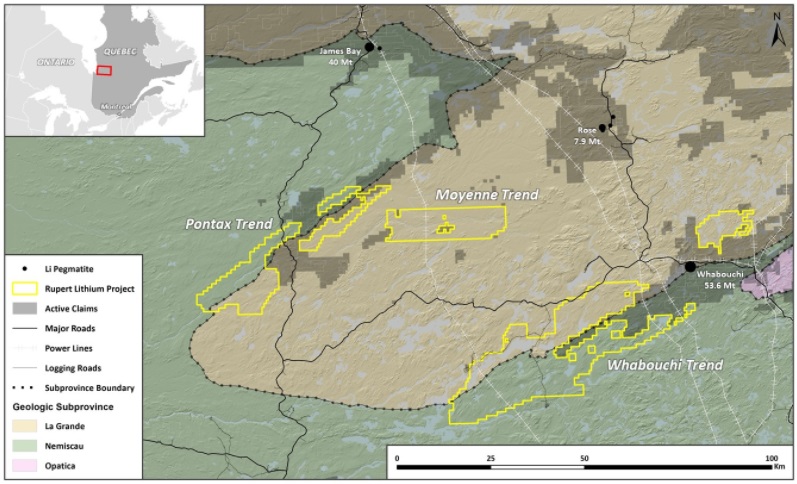

In the meantime, Kenorland also sold their Fox River property to Superior Nickel (private) for shares and a 2% NSR, and optioned out their Rupert lithium project to Li-FT Power (private), for C$200k in cash, 2% NSR, and 10% shares in Li-FT Power. For this last transaction, Kenorland will be the operator for the first 2 years.

The Rupert project is actually pretty interesting, as it is on strike with the world class Whabouchi lithium-pegmatite deposit (53.6Mt @ 1.45%Li2O), owned by one of my former sponsoring companies, Nemaska Lithium, which had to seek creditor protection in 2019, on a toxic combination of unexpected capex overruns in updated economic studies during construction, and lower lithium product prices because of temporary oversupplies just lasting long enough, preventing last resort financings from succeeding. In case you wondered what happened to them, in the end Nemaska was taken privately by a syndicate of Investissement Quebec, Pallinghurst Group and Orion Mine Finance, wiping out all existing shareholders unfortunately. Nowadays it is looking to start construction again, as it secured a plot of land at an industrial park in Becancour, Quebec earlier this year, in order to build a new chemical conversion facility. So far for the rocky story of one of the once best lithium juniors around, proving that investing in junior miners can be risky at every stage with every metal.

Kenorland Minerals is far from such scenarios fortunately. When the company can expose the same type and size of pegmatite dykes, the 2% royalty could be worth some serious money, as lithium product prices are at all time highs with no end in sight, as shortages seem to increase without lots of new production coming online soon. The company has completed a regional till sampling program, and CEO Flood had this to say about the results, and potential follow up exploration plans for Rupert: “We have not received the complete results of Rupert yet, so any follow up plans will be contemplated after this."

Regarding asset deals, the company also disclosed on July 8, 2021 that it had sold the Fox River nickel property to Superior Nickel, a private company, for 2.66M shares of Superior, and a 2% net smelter return royalty. Kenorland also vended out the Napoleon project to another private company, J2, for equity and a 2% NSR.

The September 8, 2021 news release also contained an extensive update on all exploration projects. I discussed this with CEO Flood to get some additional color on proceedings.

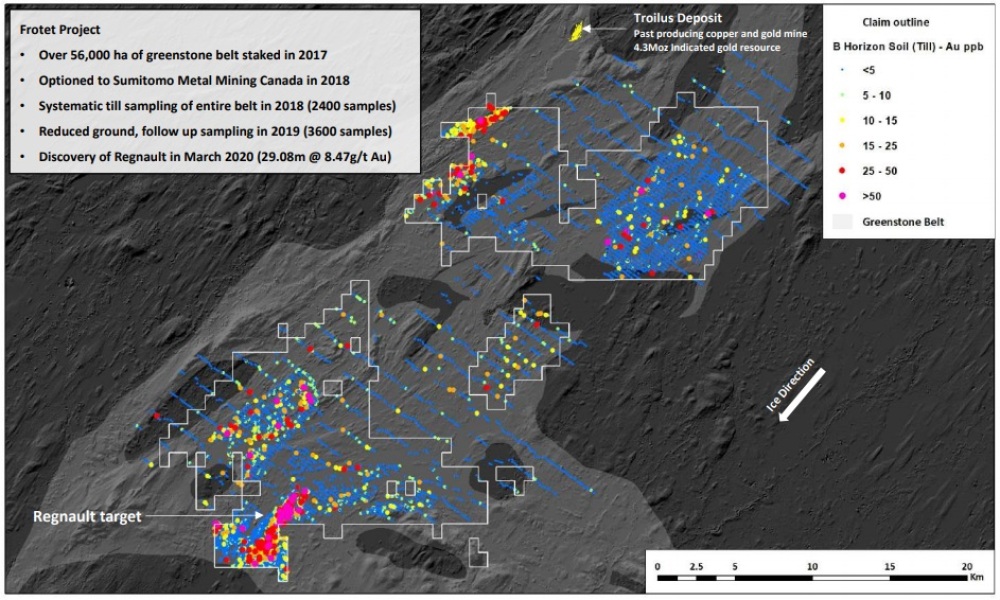

“Frotet Project, Quebec (80/20 Joint Venture with Sumitomo Metal Mining Canada Ltd.): The Company has completed 9,889 meters of diamond drilling from the recently announced program consisting of up to 18,000 meters (see press release date July 14, 2021) allocated for infill and step-out drilling along the R1 and R2 gold-bearing structures as well as follow-up on additional zones of mineralization within the Regnault trend. In addition to drilling at Regnault, till and soil geochemical surveys as well as prospecting campaigns were completed on several regional areas of interest within the Frotet Project. This work has yielded a number of robust geochemical anomalies which warrant follow-up exploration including detailed geophysics in preparation for drill targeting. Drill testing of these regional target areas is tentatively planned for Q1 2022.”

As over half the drilling has been completed, it can only be a matter of time before a large batch of drill results can be expected, in line with earlier announcements. According to Flood, the drill program wrapped up two weeks ago, and results for ¾ of the drilling have been recieved now that the SMM transaction has been completed (we asked lab to hold off on sending us any results during the negotiations for financing). The assays are being QAQC’d and if any QAQC issues we will need to re-run, if not, we may see assays in the next 2 to 3 weeks.

I also wondered if the company will publish geophysical/geochemical maps, indicating targets. Flood stated: “Geophysics was good at guiding us initally however now that we have more control on the vein structures we are using more geology than geophysics to guide our exploration.” Furthermore, I wondered what the distribution of drilling was regarding infill and step-out drilling: around half of the program was ‘infill’ and 25% step-outs, and another 25% targeting discovery of new veins.

I also asked Flood if he already had sufficient data to create a geological model for Regnault, and if the Troilus-like disseminated bulk-tonnage lower grade mineralization still is a concept they are investigating, besides the high-grade veins. He answered that they have now began modelling the system, including the various vein structures, and this work should be completed over the winter. There is broadly disseminated lower grade mineralization in the system and this will also be taken into account during geologic modelling.

After Regnault we move over to the second flagship project, the Healy project in Alaska, optioned from Newmont. A total of 4,821m has been drilled out of over 5,000m planned, and according to Flood they should be recieving all of the results toward the end of November or early December. Then they will need to QAQC the data. If there are no QAQC issues (re-runs), it is possible to see results toward the end of December, however more likely they will see results in January. The labs have been longer waits than expected.

Kenorland also completed IP and magnetotellurics (MT) surveys, and results will be announced along with the drilling, as they are an important guide for Kenorland’s interpretation of structure, mineralization, and alteration.

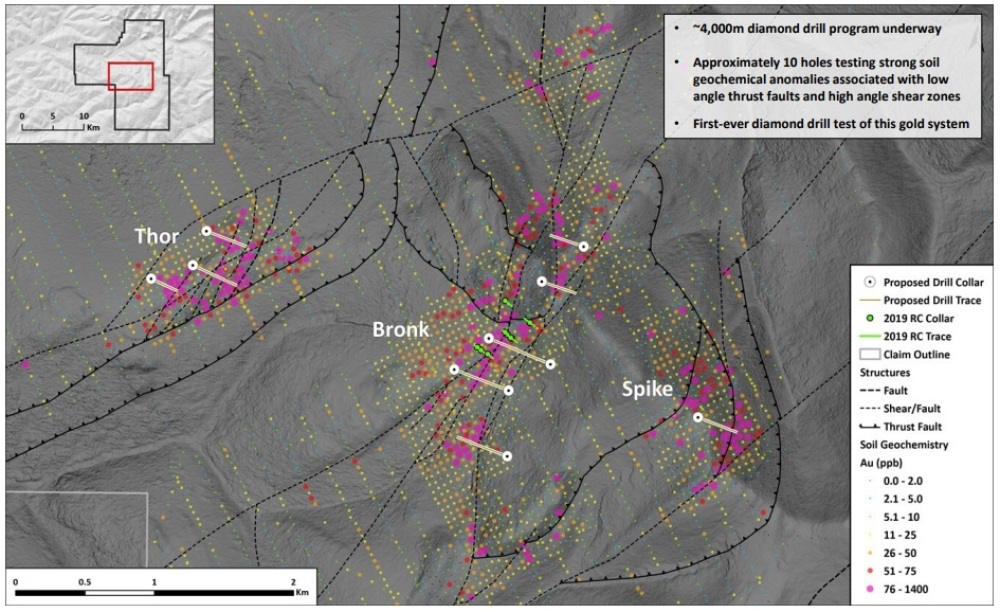

Healy Project; proposed drilling/sampling results

Tanacross is the third most important project, located in Alaska and fully owned. Extensive soil sampling program has been done, a 5km IP and MT survey was completed, and an airborne magnetics survey was flown over several targets. The assays are expected back toward the end of this month. Analysis, interpretation and targeting will likely take Tanacross to the new year for reporting.

As several of the surveys were delayed, previously announced drilling has been put on hold, and the assigned budget was reallocated for additional drilling at Healy. According to Flood, Tanacross will potentially see drilling next year.

Kenorland also completed a VTEM survey at their Hunter project in Quebec (fully owned), a LiDAR survey and mapping at South Uchi (optioned to Barrick), completed a soil sampling program at Chebistuan in Quebec (optioned to Newmont), and completed a sonic drill-for-till geochemical program at their Chicobi project, also in Quebec. A map with the sampling results for Chebistuan looks like this:

The company systematically screened over 170,000h of ground in just over a year, which is impressive, and collected no less than 2,121 soil samples and 225 till samples. As a result, the focus will be on the Deux Orignaux AOI target zone, where most anomalies were found. The company just wrapped up prospecting and a magnetic survey, and radiometrics and induced polarization (IP) will take place in January, in preparation for drill targeting. After asking Flood if he wouldn’t contemplate using a sonic drill for till program here like he did at Chicobi, as there is likely also glacial till, he answered that there is exposed till at surface here so there's no need for sonic: Although, he conceded, it would be a better method, albeit 10x more expensive, especially with no road network like they have at Chicobi.

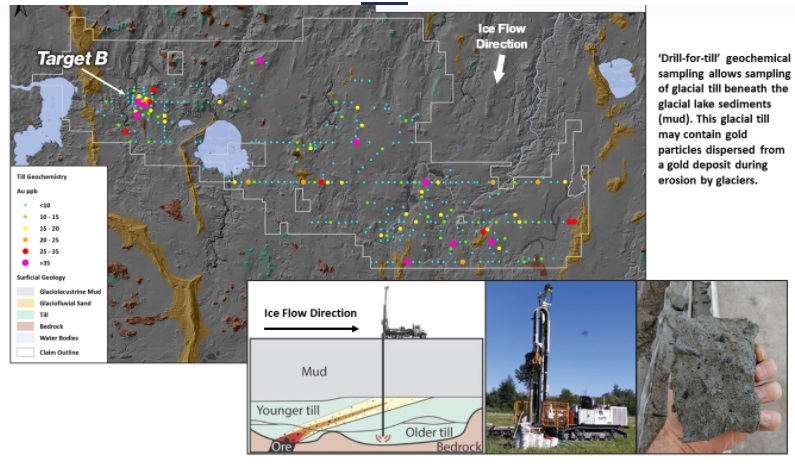

The exploration at the Chicobi project generated the following results, visualized on this map:

CEO Flood was happy with these results, as it isn’t easy to sample under a cover of overburden:

“We’re very excited to announce the results from our extraordinary efforts to effectively explore in what we consider the frontier of the Abitibi. The clay belt presents a unique challenge to exploration which can only be overcome by applying methods such as ‘drill-for-till’ sampling, which has been effective at detecting mineral systems in other deep glacial cover environments.”

This type of exploration doesn’t only look very advanced and interesting to a non-geologist like me, but also extremely difficult to find the mineralized source of the samples, as the company is dealing with several layers of overburden/glacial till, all capable of moving gold particles from the underlying bedrock source over quite a distance by for example ancient glaciers or other erosion events, maybe each even moving gold particles in different directions. On top of this, the sampling grades looked extremely low to me (35 ppb Au is 0.035g/t Au), so it looked like a needle in a haystack to me. I asked CEO Flood if he could explain the significance of these results to me, and if it was less far fetched than I thought. He answered that the results might look uninteresting at first sight, but 35ppb+ was a similar anomaly to what we initially found at Frotet/Regnault. Glacial till is much more diluted than a typical soil sample which is residual from weathering of bedrock.

Very interesting indeed, and it shows why it is important to keep asking the uninformed questions, there could be so many layers of information to a subject.

The company is still working diligently at Chicobi, as detailed geophysical surveys are being planned now for November, including drone magnetics, IP and electromagnetics (EM). Diamond drilling for Chicobi is scheduled for Q1, 2022.

Finally, the company holds a significant equity position in Kingfisher Metals (KFR:TSXV) to the tune of 4%, and a 2% NSR on their Goldrange and Thibert projects. Kingfisher has completed a 5,000m drill program at Goldrange, which tested a large gold-in-soil anomaly. Results from the labs are expected back within the next few weeks.

Sampling at Goldrange (Source: Kingfisher Metals)

Conclusion

Of course, you never know, but since Sumitomo showed strong confidence in Kenorland by completing a C$5.2M strategic investment, it seems the ongoing follow up drill program at Regnault might prove to be successful, as such investments aren’t made lightly by a JV partner. Drill results are expected in the next 2 to 3 weeks, and I’m curious if Kenorland can deliver the same type of results again as they did in May of this year, confirming a spectacular discovery. In the meantime, the company is conducting exploration programs at several other projects, and some are providing results soon as well, so I expect multiple chances for Kenorland to re-rate to more appropriate share price levels instead of pre-IPO levels, since the amount of successful exploration only increased the value of their asset base, metal prices including gold are rising, and general mining sentiment seems to be turning for the better.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and currently has a long position in this stock. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Kenorland Minerals. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.