SiFT plant at Lanxess Project site

At a time where lithium product pricing has fully recovered, beating all-time highs again, Standard Lithium Ltd. (SLI:TSX.V; SLI:NYSE American; S5:FSE) is working diligently on its flagship Lanxess project, and its second South-West Arkansas (SWA) lithium project, both in Arkansas, U.S. Testing and optimization work is ongoing at the Lanxess project, and recently the company announced the strong results of a Preliminary Economic Assessment (PEA) for its SWA project. As part of this PEA, the brine resource area was updated to consider a potential unitized area of production, leading to a 49% increased total (global) in-situ resource of 1,195,000 tonnes Lithium Carbonate Equivalent (LCE) at the Inferred category enabling the company to define a 20-year life of mine, with a meaningful annual production of 30,000t of battery quality lithium hydroxide. The SWA PEA, the resource and the current state of affairs of the Lanxess project will be discussed in the following article.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise

Update

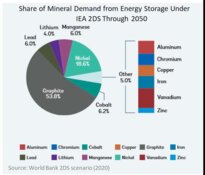

In a time where mass adoption of electric vehicles (EV) seems around the corner, with all the largest car manufacturers investing many billions of dollars in this paradigm shift, battery materials are more and more in demand, and the poster child in this regard seems to be lithium. Lithium product pricing recently broke through the all-time highs from the first wave of EV-enthusiasm and printed new records with no end in sight for the short term at least. With Standard Lithium steadily advancing its recovery technologies at its demonstration (pilot) plant at the flagship Lanxess project, and using their findings in its second South West Arkansas project PEA, more and more investors seem to be convinced that the company seems to be a well-timed, go-to US-based solution for lithium product feedstock:

Share price Standard Lithium 5 year period (Source: tmxmoney.com)

A fun fact for me is that my coverage for Standard started in September 2019, almost generating a 20-bagger from this point, my first client to do so. Sometimes you get lucky I guess, as junior mining is a high risk/high reward sector. The share price is doing very well in H2 2021, enjoying a strong catalyst by the recent upswing in lithium product pricing. It seemed the U.S. listing on the NYSE on July 11, 2021, could have been important for the stock, as it traded around C$5.50 back then.

Regarding the NYSE listing, Standard Lithium had no immediate intentions to raise money in the US, as it is cashed up sufficiently (C$27.99M as of the recently June 30, Q4 financials ) to fund ongoing projects, but management filed a shelf prospectus on August 20, 2021, as it sees this as a logical follow-up after the NYSE listing to gain more flexibility. Taken from the news release:

“The Shelf Prospectus has not yet become final for the purpose of the sale of securities. When final, the Shelf Prospectus would allow the Company to make offerings of up to US$250,000,000 of common shares, preferred shares, warrants, subscription receipts, units, debt securities, or any combination thereof, from time to time over a 25-month period. The Company has filed the Shelf prospectus for future financial flexibility and has no immediate intentions to undertake an offering. Management believes the filing of the Shelf Prospectus provides the Company with flexibility to pursue various strategic initiatives in accordance with the Company's growth strategy.”

Talking about the SWA project, I will briefly mention the highlights of the recently published results of the SWA PEA, which are pretty impressive, as they use a battery quality lithium hydroxide price of US$14,500/t (current spot price hovers around US$26,000/t):

- After-tax US$1.97 billion NPV [net present value] at 8% discount rate and IRR [internal rate of return] of 32.1%.

- 20-year mine-life producing an average of 30,000 tonnes per year of battery-quality lithium hydroxide monohydrate (LHM);

- Operating costs of US$2,599 per tonne of battery quality lithium hydroxide;

- AACE Class 5 Total CAPEX estimate of US$870 Million including conservative 25% contingency of direct capital costs; and,

- SW Arkansas Lithium Project PEA lithium brine resource is updated to consider the potential unitized area of production, leading to an increased total (global) in-situ resource of 1,195,000 tonnes Lithium Carbonate Equivalent (LCE) at the Inferred Category.

As the sensitivity shows an increase of US$211M for the NPV8 at each incremental step of US$1,000/t LiOH, at current prices the NPV8 would be much higher; however the company used a conservative approach. It was also good to see that through unitization of the brine leases Standard Lithium could expand the existing SWA resource by 49%, guaranteeing a long life of mine.

The September 1, 2021, news release mentioned the following progress regarding the installation of the SiFT plant at the Lanxess location, after extensive testing in Vancouver:

“The installation of the ‘SiFT’ lithium carbonate plant is completed, with all major connections made to the existing plant, and the installation of a new weatherproof enclosure. ‘Wet’ commissioning of the SiFT Plant is ongoing, and it is expected that fully integrated operations will commence during September. Standard Lithium has also installed and commissioned a novel osmotically assisted High Pressure Reverse Osmosis (HPRO) unit at the demonstration plant in El Dorado (see Figure 2 below). This unit sits between LiSTR and SiFT and is used to concentrate the lithium chloride product continuously produced by the existing LiSTR Direct Lithium Extraction (“DLE”) plant, so that it can then be converted to lithium carbonate. The HPRO unit is now operational and is being integrated into the overall process flow at the plant.”

According to CEO Mintak, the SiFT lithium carbonate process is part of the company’s technology portfolio but it is important to note the company intends to use an established OEM carbonation technology for its first commercial operations to reduce project execution risk while continuing to develop and de-risk the SiFT technology.

After this company update, let’s have a quick look at some fundamentals of the metal in question, lithium.

Lithium product pricing update

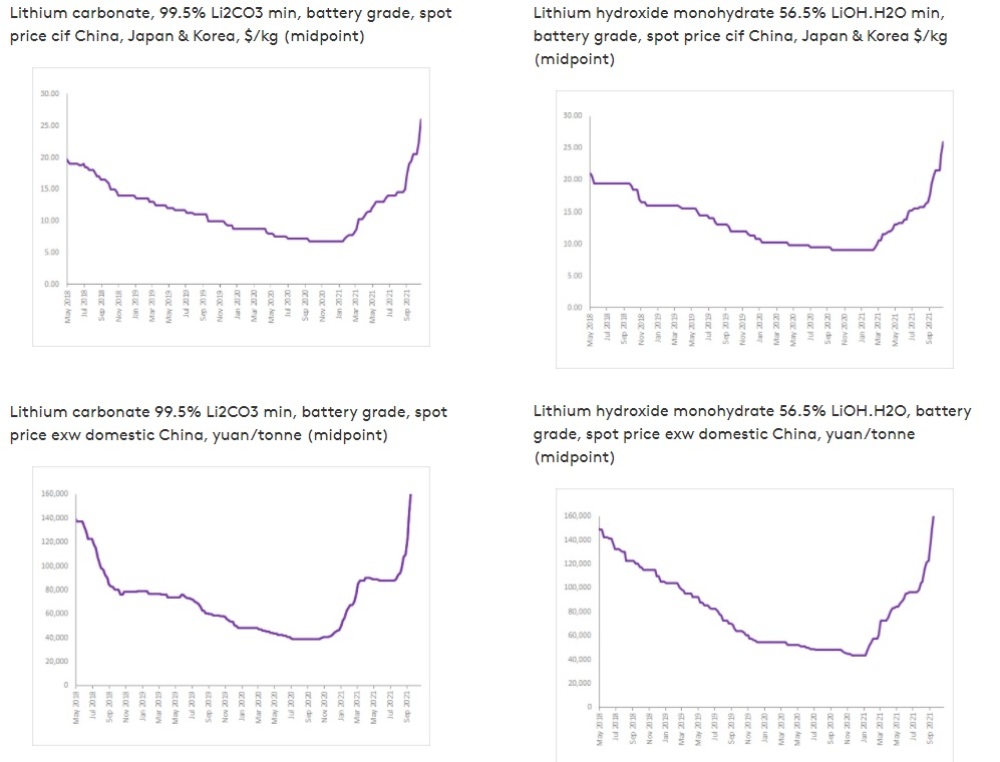

The recovery since the summer, and explosive upswing since the beginning of August of lithium product prices because of increasing shortages but at the same time increasing EV enthusiasm in China, has been remarkable. I remember when talking to CEO Robert Mintak in 2019 and the most part of this year, when prices were trading far below US$10,000, that he was a firm believer of a return to lithium product prices going past that threshold again sooner or later, and sure enough they did:

Lithium Carbonate in Yuan per tonne, domestic China (Source: Tradingeconomics)

The price of 182.5k Yuan is an all-time high for lithium carbonate, but also lithium hydroxide has reached heights never achieved before, not only in domestic China but also for international exports:

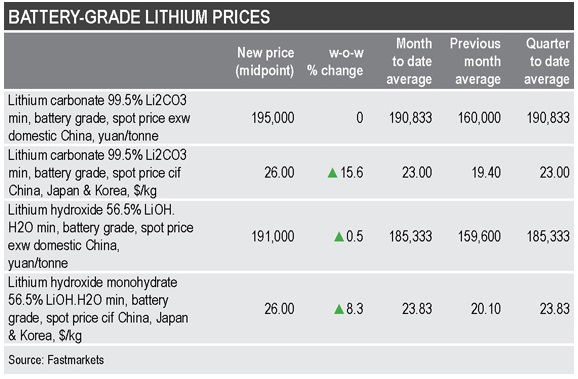

Lithium product prices for domestic China and exports (Source: Fastmarkets)

The following table, also sourced from Fastmarkets, shows pricing developments in numbers:

The prices of battery grade lithium carbonate and hydroxide established new records, as the former high for lithium carbonate of US$24,750/t Li2CO3, and the former high for lithium hydroxide was even below this. It is interesting to see lithium carbonate fetching a premium, which has a lot to do with LFP ( Lithium-Iron-Phosphate ) batteries that are seeing an increased preference for use in EV’s, particularly in China with even Tesla using LFP in some versions of its Model 3 versus the higher energy density more costly NMC (Nickel-Manganese-Cobalt) batteries. LFP batteries have a longer life-cycle and have lower cost advantages with raw material inputs (no nickel or cobalt).

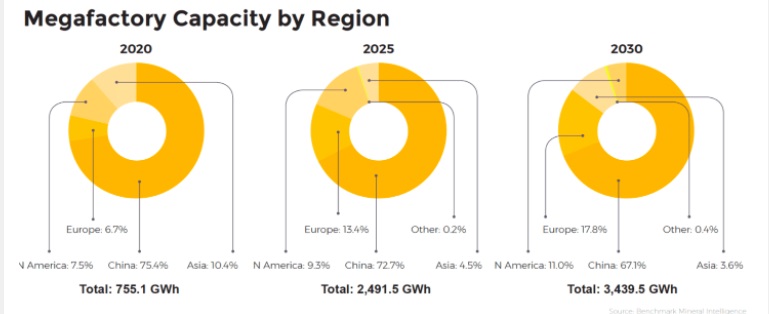

Whether the current intense shortages of lithium products are short-lived and caused by a COVID-related cocktail of low investments and strong growing demand is hard to say, consensus among analysts seems to be LCE pricing exceeding US$15,000-16,000 for years to come. A significant part of this is caused by increasing demand, initiated for the most part by worldwide EV development programs by the largest car manufacturers. As a result, dozens of battery-producing mega- and Gigafactories are being planned and developed at the moment, adding lots of capacity to the EV pipeline.

Gigafactory Tesla under construction, Brandenburg, Germany

A forecast by Benchmark Intelligence shows the following developments in this regard:

To put these huge GWh numbers into perspective, 51.7GWh battery capacity equals roughly 1M EVs, so the 2030 capacity would be sufficient to provide batteries for 66.5M EVs. To put this in perspective as well, global car manufacturing before COVID was at a level of 95-96M per annum, showing that EV is forecasted to take a significant chunk out of total car manufacturing production. This is in line with lots of announcements of large manufacturers to convert their entire fleet into EV by 2030-2035, supported by ongoing multi-billion-dollar investments. That being said, it seems Standard Lithium is positioned to perfection, with lithium product pricing at all-time highs and not looking to come down anytime soon, as shortages are here to stay for the foreseeable future

Conclusion

With lithium product prices hovering at all-time highs, Standard Lithium delivered excellent PEA results for its South-West Arkansas Lithium project. A PEA sounds more premature than it actually does in this case; the Lanxess project is a brownfield brine operation but is just waiting for sufficient operational data confirmation coming from the ongoing testing at the demonstration plants. The extensive permitting that is required at other projects is also not necessary in this case, so production for the first phase of three planned phases could be a reality 1-1.5 years after a construction decision. Combined with the very short recovery periods, ramping up will take many magnitudes shorter compared to conventional brine operations or hard rock mines, and as such the future Lanxess/Standard Lithium JV will likely be one of the first new operators coming online, providing the worldwide EV boom with new supply. Standard Lithium clearly has positioned itself at the forefront of lithium juniors now, and it will be very interesting to see what will happen next.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Standard Lithium is a sponsoring company. All facts are to be checked by the reader. For more information go to www.standardlithium.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.