One of Riley Gold's two gold projects in Nevada, Pipeline West/Clipper, sits between a massive open-pit gold mine/complex and a property that seems to sit above the carbonate host rocks of the Wenban formation — the geological home to all the major gold deposits in the region, while its other project, Tokop, has returned 17 g/t gold below where geologists have found surface samples at grades up to 34 g/t. It’s all very exciting but it’s still early stages.

Riley Gold Corp. (RLYG:TSX.V; RLYGF:OTCQB) President and CEO Todd Hilditch is happy to be the “meat” in a gold property “sandwich” in Nevada.

One of the projects [Pipeline West] is very important not just because of what they have but because of who lives next door.

—Bob Moriarty, 321 Gold

Riley’s Pipeline West/Clipper gold project is conveniently wedged between the Ridgeline Minerals Corp. (RDG:TSX.V; RDGMF:OTCQB) Swift gold project and the Gold Acres/Gap/Pipeline/Crossroads/Cortez production, part of a 35 million ounce gold mining complex owned by Nevada Gold Mines JV (NGM), a joint venture between Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and Newmont Corp. (NEM:NYSE) in the prolific Cortez district of Nevada’s Battle Mountain-Eureka Trend.

NGM recently optioned the 75-sq.-km Swift project and must spend at least US$20 million on qualifying exploration work over the next five years to earn a 60% stake in the property, including US$4 million in the shorter term of the next 2 years. NGM will act as operator and could take its stake to 70% if it spends another US$10 million on further work by Dec. 31, 2029 and to 75% for arranging mine finance.

Just four weeks ago Ridgeline and NGM announced a $20 million USD deal where NGM can earn up to 75% of Ridgeline’s 75-km Swift project.

—Bob Moriarty, 321 Gold

“What that (option agreement) did was situate Nevada Gold Mines gold mines on each side of us. And so our project is the ‘meat’ in the sandwich. Whichever way you want to look at it, we are on trend and between both of the projects that NGM controls,” Hilditch tells Streetwise Reports.

Nevada Gold Mines’ interest in Ridgeline was piqued when the junior’s 2020 drill program hit what are thought to be the carbonate host rocks of the Wenban formation at roughly 1,394 feet below surface. This 2,000-ft. thick carbonate sheet hosts all the major gold deposits in the area.

Hilditch adds, “You've got the Wenban formation on trend to the south/southeast, in the lower plate, that has been the host rock of gold that Nevada Gold Mines has been producing from for many years next door. And based on what Ridgeline has announced on our west/northwest side, they have intersected the same Wenban host, so it’s pretty cool that we're in the middle of both companies and it is highly unlikely the Wenban gold host rock is not within our property, the dots will be connected.”

If NGM thinks the Swift project of Ridgeline is valuable, they also will want to do a deal with Riley before Riley starts to drill.

—Bob Moriarty, 321 Gold

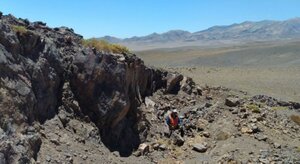

The junior has yet to drill or conduct much exploration work on Pipeline West/Clipper, the border of which sits 1,800 ft. from the edge of the Gold Acres pit. Hilditch expects to complete a geophysical review and program this fall to help outline structures and other rock characteristics to help develop some drill targets, between roughly 1,000 ft to as much as 2,100 ft. deep or more.

About 5 Moz of gold are mined annually in Nevada or about 5% of all the gold mined worldwide.

Riley has spent most of its exploration time to date on its Tokop gold project, also in Nevada.

Tokop first underwent drilling about 11 years ago. Of the 20 or so drill holes conducted by the previous owner, Global Geoscience, the best result was about 2.5 grams per tonne gold (2.5 g/t gold) over 12 meters.

Should Riley drill a major hit, the price for Pipeline West will go up a lot. NGM can throw pennies at Riley now or they can throw hundred dollar bills at them next year.

—Bob Moriarty, 321 Gold

But soon after drilling the property, the junior, assumingly due to gold market conditions, moved into the lithium space (something Hilditch also knows something about but we’ll get to that later). That left Tokop sitting on a balance sheet until it was acquired, as part of a property consolidation, and folded into Riley Gold, along with Pipeline West/Clipper.

In late fall 2020, Riley started exploration work at Tokop, which is along the Walker Lane Trend. Riley has collected more than 300 rock chip samples in the 22.5 sq. km land package, of which a third have been released. Additionally, some chip channel samples returned up to 5 meters of 5.5 g/t gold and 3 meters running 6 g/t gold.

“We wanted to test the work (Global Geoscience) had completed and re-drill test some of the veins that we see over about a kilometer and a half stretch. And in our first three drill holes, we were able to get up to 17 grams per tonne gold subsurface,” Hilditch says. “We completed 12 drill holes and we're waiting for the remaining essay results to come out.”

Riley also recently initiated geophysics (magnetics) and expects to complete gravity surveys as well at Tokop and Hilditch says the interpretation of that data will help decide where to drill next.

“We see the veins at surface, we've drilled them subsurface, we know they exist, but now let's look at the next iteration of drilling information from our remaining nine drill holes, together with all the geophysics mapping and sampling results, and let's go find the underlying deposit that these veins stem from,” Hilditch explains.

The company announced on Oct. 20 that it has discovered two new prospective zones at Tokop, one kilometer south and east of the main Tokop claim block, and the other 1km south and west of the site of its recent drilling. Soil geochemistry and mapping are currently underway at both areas.

Riley’s geologists believe the gold-bearing system at Tokop is akin to Kinross Gold Corp. (K:TSX; KGC:NYSE) Fort Knox gold mine near Fairbanks, Alaska, or Victoria Gold Corp. (VGCX:TSX; VITFF:OTCMKTS) Dublin Gulch mine in Yukon. They are intrusive-related systems with stacked gold veins. Riley is also seeing some geologic signatures similar to deposits closer to home in Nevada very near down the Walker Lane trend. This Beatty gold district has been very active recently and is well known with many major mining companies currently exploring and mining there including Coeur Mining Inc. (CDE:NYSE) and Anglo American Plc (AAUK:NASDAQ) as well as past production at the Bullfrog Mine, previously operated by Barrick Gold.

With two promising gold properties in Nevada, Hilditch might not be living the life of Riley for long. Hilditch has a track record of guiding publicly traded companies that have either merged with or were taken out by larger players.

Hilditch had served as the CEO and director of Salares Lithium for about 18 months when it merged with Talison Lithium in August 2010. Talison paid $1.25 per share for Salares, a 98% premium to the junior’s 20-day volume-weighted average share price before the deal or about CA$340 million. (Talison was acquired late in 2012 by China’s Chengdu Tianqi Industry Group for about CA$847 million.)

“The market went really quickly in the right direction,” Hilditch recalls. “They paid us a nice premium, and then they went on to sell it. So that was a bit of a purple unicorn.”

He was also chairman of URZ Energy before it was sold to Azarga Uranium Corp. (AZZ:TSX; AZZUF:OTCQB) in a 2-for-1, all-share deal in 2018. He remains on the Azarga board, which recently announced it will merge with enCore Energy Corp. (EU:TSX.V) in an all-share deal.

And in April 2019, Sailfish Royalty Corp. (FISH:TSX.V; OTC:SROYF) bought Hilditch’s Terraco Gold, a gold exploration and royalty company based in Nevada. Terraco shareholders ended up with 37.2% of Sailfish.

If that doesn’t paint a picture, perhaps a glance at the Riley Gold board might change your mind.

Director Cyndi Laval is a partner at Vancouver-based law firm Gowling WLG (Canada) LLP. She specializes in mergers and acquisitions and was named mining “lawyer of the year” in the 2017 edition of an annual legal directory.

Another director, Richard Delong, is the chairman of the Nevada Commission on Mineral Resources, a position appointed by the governor. His bio says he specializes in the “assessment of properties to determine permit acquisition strategies and critical paths forward.”

And Chairman William Lamb helmed Lucara Diamond from inception until stepping aside in 2018. Lucara’s share price more than quintupled during his time guiding the precocious junior.

Management owns nearly 20% of the 32 million shares of Riley so their interests are certainly aligned with that of shareholders.

—Bob Moriarty, 321 Gold

“You put good people, good shareholders together with good projects, and eventually, if you stick to your guns, (a merger or takeover) can work. It’s happened three or four times now with us,” Hilditch says.

“We're not knocking it out of the park with home runs every deal. We're hitting singles, we're hitting doubles, and in the odd case, a triple, but it's just longevity in the business and trying do it right,” Hilditch concluded.

Riley Gold trades in a 52-week range of $0.23 and $0.74. It has 32.5 million shares outstanding, with management owning about 17%.

Note: Read Bob Moriarty's full assessment of Riley Gold here.

Disclosure:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Riley Gold Corp., a company mentioned in this article.