I've just returned from the back-to-back gold conferences in Colorado, the first focused on juniors in the spectacular Rockies, near Vail, resplendent at this time of year, and the second, with an emphasis on miners, at the luxury Broadmoor Resort in Colorado Springs.

The main attraction is the opportunity for private meetings with company CEOs. Although many companies backed out of attending at the last minute because of COVID concerns, I still had well over 50 meetings as well as listened to plenty of presentations. Meetings included most of the gold companies on our list and today I discuss impressions from some of these meetings.

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) (11.84) reported another strong quarter, with its assets performing well. The company said it expected performance of producing assets to continue for the rest of the year, with the Eagle Mine ramping up. The second-half should see increased gold-equivalent ounces (GEOs) to close the year at or above guidance.

Headline financial results were less satisfactory, a loss of CA$50 million due to a non-cash impairment at an Osisko Development (OD) project.

"With strong management, a solid balance sheet, and deep pipelines ... Osisko is Buy."

OR still consolidates results from OD, which distorts reported cash, revenue and costs of the royalty company. OR wants to get its ownership of OD below 50% of shares outstanding so that it no longer needs to consolidate its financials. It expects progress on this goal next year, but is in no hurry to sell its shares at depressed levels.

Osisko Development spinoff brings advantages to Osisko

As a development company, OD clearly has more costs than a royalty company. As we have discussed before, however, OD will be a tremendous benefit to Osisko, since it provides them with a built-in pipeline of royalties on development assets for which they do not need to contribute. In the highly competitive world that royalty acquisition and creation is today, this is an advantage that cannot be overstated.

OD expects a construction permit on its Cariboo project in British Columbia in the second half of next year, following a large-scale drill program.

Other projects are advancing, including San Antonio, in Mexico, which should see cash flow next year.

Osisko Gold also reported it had repurchased almost 1.3 million shares so far this year, and 920,266 of those in August. The company is authorized to buy up to 14 million shares through its normal course issuer bid.

Several mines to come on next year

Osisko is in a catalyst-rich period, with multiple projects expected to start producing before the end of next year, including the ramp-up at Eagle (to become its second largest earner); start-ups at Santana and San Antonio; and the start up of production from First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE), Ermitaño, on which another of our recommended companies, Orogen Royalties Inc. (OGN:TSX.V), also holds a royalty.

So we can expect significant growth in the 16 months ahead.

Osisko, meaningfully smaller than the Big Three royalties, has virtually all revenue from gold and silver (97% this year); 96% of its net asset value (NAV) is from these precious metals.

For the major royalty and streaming companies, the NAV that is not gold and silver ranges from 8% for Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) to 32% for Franco-Nevada Corp.

It also has the best political risk profile of the larger royalty companies.

At the Denver Gold Forum last week, I had the opportunity to meet new president and CEO Sandeep Singh for the first time; though I had spoken with him on the phone several times, we had not met due to travel restrictions.

My confidence in OR has been only enhanced by meeting him, and hearing his vision. With strong management, a solid balance sheet, and deep pipelines including several near-term development assets, and a low valuation, Osisko is buy.

Franco Sees Mostly Smaller Transactions Ahead; Looking for Gold Deals

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) Pn (135.98) continues to demonstrate why it is a core holding. Nothing in my meeting with Paul Brink, president and CEO for little over a year, changed that opinion.

He has, if I may say, really grown into the job following David Harquail, Pierre Lassonde and, much earlier, Seymour Schulich: big shoes to fill indeed!

Franco has made $800 million in acquisitions so far this year, the largest in iron ore debentures from Vale S.A. (VALE:NYSE). This acquisition, plus revenue from energy jumping 78%, means that the contribution from precious metals has dropped under 80%.

Brink pointed out that the Vale debentures had a "catch-up quarter," so on a steady-rate basis, the company's precious metals revenues remain at 80%.

The ongoing expansion at Cobre Panama would also help boost gold revenues. He did say, though, that the aim would be for the company's next major acquisition to be in gold.

Where royalties and streams can be competitive

In our discussion, we focused mainly on the overall royalty/streaming environment, as well as Franco's changing shareholder base.

Brink noted that cash was cheap right now, so there was very little distress around. It was the broken balance sheets among major copper producers following the peak in 2012 that enabled Franco to acquire gold byproduct streams on some of the world's largest and long-life copper mines.

Nothing like that exists today and Franco (and other streaming companies) can't compete, he said, with the current price of debt.

The main opportunity now is in assisting single-asset development companies obtaining financing to construct projects. In that space, royalty and streaming companies are competitive, since the main alternate financing is private equity which can be expensive.

Bank debt tends to be heavy on covenants. But, he added, "anything we do now is going to be small."

Deep portfolio offers opportunities

I had known that Franco has been becoming more attractive to generalist investors, those wanting some exposure to gold but cautious of big miners with their (mostly) disastrous long-term records. Franco pitches itself as "the gold investment that works." But I was surprised to learn that 70–80% of its shareholders now are generalists.

This certainly explains why Franco's stock often moves more with the broad market than with other gold stocks.

Franco has the deepest portfolio of any royalty company, with 403 assets now, of which 60 are producing and 30 are in development (with the rest under exploration or dormant). Interestingly, Brink notes that Franco has about 250 royalties that it does not include in its resource calculations at all. That deep portfolio has hidden gems, assets that had long been "forgotten" and come to the fore with new management or nearby discoveries.

The huge portfolio, and diversification, as well as solid balance sheet, top management and organic growth, all add up to why Franco is a core holding. We have not bought it for a few months now, but if you do not own, the recent price decline (from over $160/share at the end of July to the lowest price since April) presents an opportunity.

Pan American's Long-Term Potential Is on Several Fronts

Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) (24.39) has nine operating mines, with large near-term potential and further-out optionality. Each time I meet president and CEO Michael Steinmann, I become more impressed both with his deep technical knowledge and broader market analysis.

He ran me through the potential at La Colorada, a relatively small mine of Pan American's until the discovery of a large skarn deposit below the current ore. (The existence of a skarn was not unexpected, but the size came as a pleasant surprise.) An underground ramp is being constructed following a new ventilation shaft.

Ultimately, a new plant will be required. So far, the skarn deposit has added 141 million ounces of silver, with more to come after additional exploration. The skarn will run for decades, he told me.

Two large mines await political decisions

Pan American also has two very large deposits currently not being mined, the suspended Escobal Mine in Guatemala, where the government is currently undertaking consultations with the local indigenous peoples; and Navidad in Argentina, where the province recently rejected a firm ban on all mining. Escobal was in operation before it was ordered suspended by a judge, while on a technical basis, Navidad is ready to proceed. Escobal would be the fourth-largest silver mine in the world, while Navidad would be one of the, if not the, largest open-pit silver mines—something of a rarity.

Silver contribution to increase

This year, Pan American sees nearly 60% of its revenue come from gold and only 27% from silver. The underground silver mines in Mexico and Peru have been more affected by COVID restrictions, and the silver price has also underperformed this year. On a reserve basis, almost 50% is silver and under 30% gold; the current reserve numbers do not include Escobal (or Navidad).

With strong management, a solid balance sheet (nearly three-quarters of a billion dollars in available liquidity), a diversified mine portfolio with upside as COVID restrictions end, and significant longer-term upside, Pan American is a strong buy.

Nevada Continues as a Focus for Barrick, Which Also Enters New Regions

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) (18.35) recently undertook a mine swap in Nevada with junior i-80, acquiring the minority interest in the South Arturo mine in exchange for the Lone Tree mine, currently in care and maintenance.

The transaction was undertaken by the Nevada Gold Mines joint venture with Newmont Corp. (NEM:NYSE), which Barrick manages.

This reinforces Nevada Gold Mine's control of the Carlin Trend.

The win-win transaction illustrates Barrick's flexibility and deal-making skills.

In a meeting with CEO Mark Bristow, one cannot fail to be impressed by his energy as well as his grasp of the details of every project of Barrick's portfolio. He continues to emphasize the ongoing exploration potential in Nevada, where, he says, "it is difficult to find gold, but once you find it, you find a lot."

"Barrick is ... a strong buy at the current price."

He also discussed opportunities in new geographic areas into which Barrick has stepped, including Egypt and Guyana, and neighboring countries in northeast South America. The latter's geology is the same as West Africa's, but far less explored and exploited.

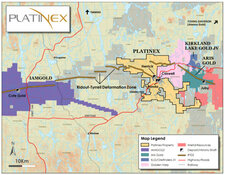

He also intriguingly mentioned again that Barrick is under-represented in Canada, where it has significant tax losses. Market speculation suggests Barrick may try to buy Kirkland Lake Gold Inc. (KL:TSX; KL:NYSE) among others.

Barrick is trading at its lowest price since March last year, and historically low valuations, making it a strong buy at the current price.

Orogen Sees Drilling on Two Far-Out Royalty Lands, as Well as Near-Term Revenue

Orogen Royalties Inc. (OGN:TSX.V) (0.34) discussed progress on its main royalties.

First Majestic is to publish a pre-feasibility on the Ermitaño project, adjacent to its Santa Elena mine, next month, with production still expected to commence in the first quarter. At nearby Cumobabi, First Majestic has recently drilled 30 holes, something of a surprise given its priority well behind Ermitaño.

Lastly, at Silicon in Nevada, AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) just announced the purchase of Corvus Gold, with land adjacent to Orogen's, indicating a strong interest in developing the Silicon area.

Local intelligence indicated that the major has six rigs on Orogen royalty land.

I was also pleased to meet Marco LoCascio, who recently joined Orogen as head of business development.

He was an analyst and portfolio manager with Equinox Partners for 11 years, and brings new ideas as well as a wealth of knowledge and contacts.

With strong management and balance sheet, and near-term catalysts, plus a very active property disposition program, Orogen is buy.

TOP BUYS NOW

In addition to those above, include:

Altius Minerals Corp. (ALS:TSX.V) (15.69)

Midland Exploration Inc. (MD:TSX.V) (0.60)

Lara Exploration Ltd. (LRA:TSX.V) (0.65)

Ares Capital Corp. (ARCC:NASDAQ) (19.90)

Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) (4.22)

Conferences

The New Orleans Investment Conference, Oct. 19–22, will be presented live (though you have the option of attending virtually, and some speakers will be presenting remotely).

Among live speakers, keynotes include James Grant, Peter Schiff, Dave Collum (a first!), and Danielle DiMartino Booth.

It promises to be a memorable conference.

EARNINGS BEFORE ALL SORTS OF COSTS

It is not new for companies to exclude costs that they do not like. Earnings before interest, taxes, depreciation and amortization—pesky things that get in the way—has become a standard measure of a business's underlying growth.

WeWork—remember them?—took this to new depths with "community related earnings," whatever that means.

Now major French yogurt firm Danone is reporting "climate adjusted earnings per share."

It is apparently spending billions on efforts to cut its plastic use so these costs of running the business are removed before reporting "climate adjusted earnings."

Originally published Sept. 19, 2021

Adrian Day, London-born and a graduate of the London School of Economics, is editor of Adrian Day’s Global Analyst. His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."

Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Orogen, Franco-Nevada, Altius, Midland Exploration, Lara Exploration, Ares and Fortuna Silver. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management, which is unaffiliated with Adrian Day’s newsletter, hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Osisko Gold, Orogen, Franco-Nevada, Barrick Gold, Altius Minerals, Midland Exploration, Lara Exploration, Wheaton Precious Metals, First Majestic Silver Corp., Fortuna Silver Mines Inc., and Pan American Silver Corp., companies mentioned in this article.

Adrian Day's Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor's opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2021. Adrian Day's Global Analyst. Information and advice herein are intended purely for the subscriber's own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.