Though the province of New Brunswick in Canada has historically produced only base metals, stunning new assay results reported by Puma Exploration Inc. (PUMA:TSX-V; PUXPF:OTCBB) suggest that New Brunswick may host at least one significant gold deposit.

September 15th, 2021 Puma Exploration announced results from the six initial drill holes completed at its flagship Williams Brook Gold Project located in New Brunswick, the emerging new gold district of Atlantic, Canada.

“Discovery hole WB21-02 intersected 5.55 g/t Au over 50.15 meters from surface,” reported Puma, “The mineralized and altered zone drilled includes two main high-grade intercepts of 9.88 g/t Au over 8.60 meters and 46.94 g/t Au over 3.85 meters.

All the six first holes intersected significant high-grade gold quartz veins and quartz networks within the altered and mineralized rhyolite.

“We are all very excited about the initial assay results as they have far exceeded our expectations, especially with WB21-02 returning a metal factor of 278,” stated Marcel Robillard, President and CEO of Puma, “The drilling is validating the representativity of the high-grade gold samples collected at surface and the continuity of the mineralization at depth and laterally.”

“The additional results should improve our model as we continue to better understand the geometry of the mineralized envelope along this segment of the O’Neil Gold Trend (OGT), that remains open,” added Robillard.

“The beauty of New Brunswick is that the overburden is really thin,” Marcel Robillard, President and CEO of Puma told Streetwise Reports, “It’s often only about three feet to six feet. The best way to find mineralization is first to look for boulders and outcrop. Then we bring excavator to do trenching. If we find veins of high-grade gold, then the next step is to do the stripping”.

“The drill results, announced today, clearly demonstrates the tremendous gold potential of our Williams Brook Gold Project and confirms the appearance of a new gold district in New Brunswick, a mining friendly jurisdiction of Atlantic. Canada. It is no surprise that our technical team is anxious to begin the second phase of drilling to further test the easily accessible OGT and the other first priority targets,” added Robillard.

Significant Positive Observations From the Initial Drilling Results

- The gold mineralization starts at surface:

- WB21-01 intersected 1.30 g/t Au over 25.60 meters from 4.00 meters

- WB21-02 intersected 5.55 g/t Au over 50.15 meters from surface (0m)

- WB21-05 intersected 1.16 g/t Au over 48.70 meters from 1.50 meters

- The high-grade samples collected at surface are representative of the mineralization at depth:

- WB21-01 intersected 50.0 g/t Au over 0.50 meters

- WB21-02 intersected 59.68 g/t Au over 1.50 meters

- WB21-03 intersected 23.10 g/t Au over 0.65 meters

- WB21-05 intersected 16.07 g/t Au over 1.10 meters

- WB21-06 intersected 44.74 g/t Au over 0.70 meters

- Significant mineralized and altered thickness intersected:

- WB21-01 intersected 1.30 g/t Au over 25.60 meters

- WB21-02 intersected 5.55 g/t Au over 50.15 meters

- WB21-03 intersected 1.47 g/t Au over 12.10 meters

- WB21-05 intersected 1.00 g/t Au over 26.40 meters

- WB21-06 intersected 1.16 g/t Au over 48.70 meters

- The high-grade surface mineralization is extending at depth:

- WB21-02 intersected 59.68 g/t Au over 1.50 meters from 47.60 meters

- WB21-03 intersected 23.10 g/t Au over 0.65 meters from 56.85 meters

- WB21-04 intersected 2.84 g/t Au over 1.10 meters from 140.50 meters

- WB21-06 intersected 44.74 g/t Au over 0.70 meters from 47.60 meters

- The gold mineralisation is extending in the sediments:

- WB21-04 intersected 1.92 g/t Au over 0.70 meters from 16.80 meters

- WB21-04 intersected 2.84 g/t Au over 1.00 meters from 140.50 meters

Inaugural Drilling Program at Williams Brook Gold Project

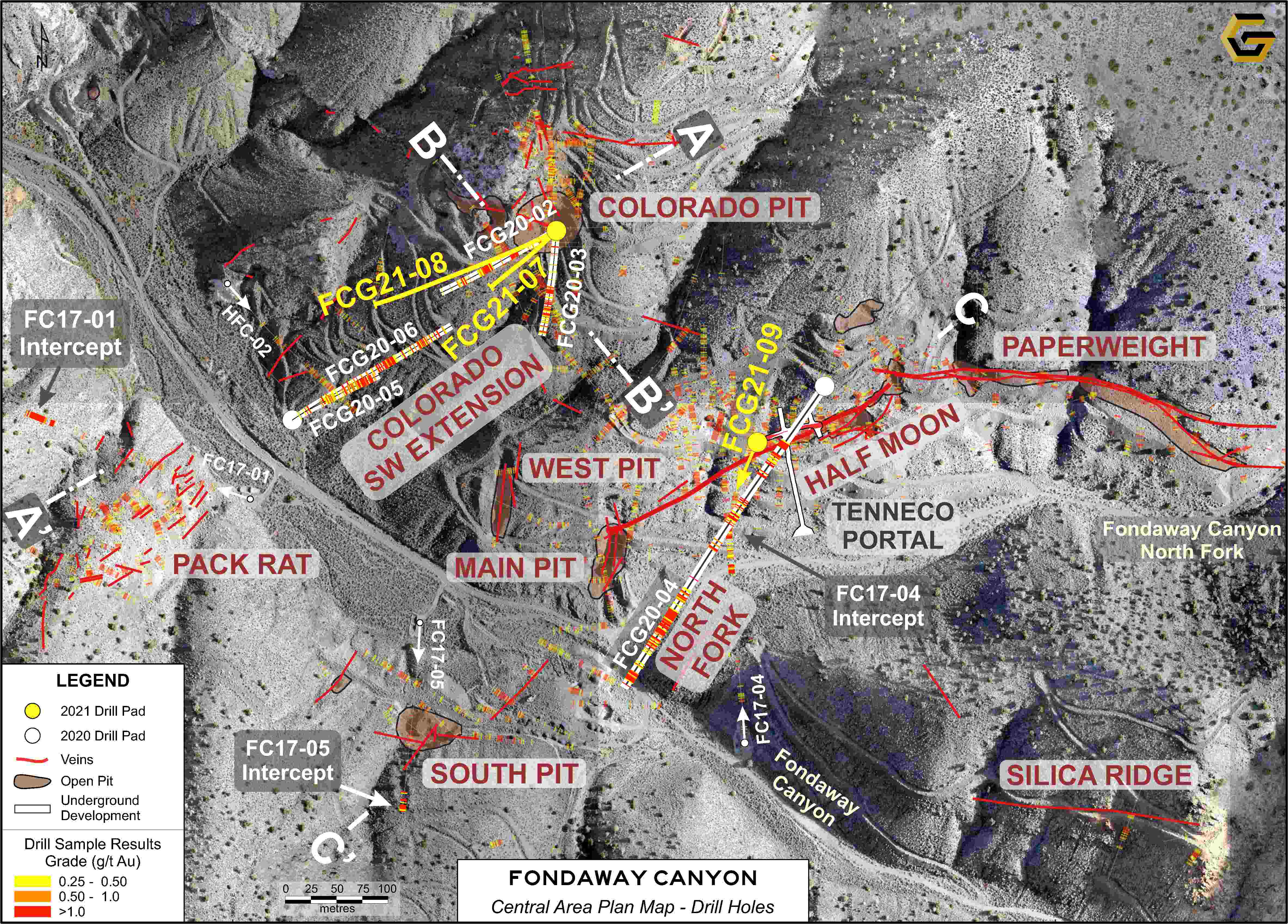

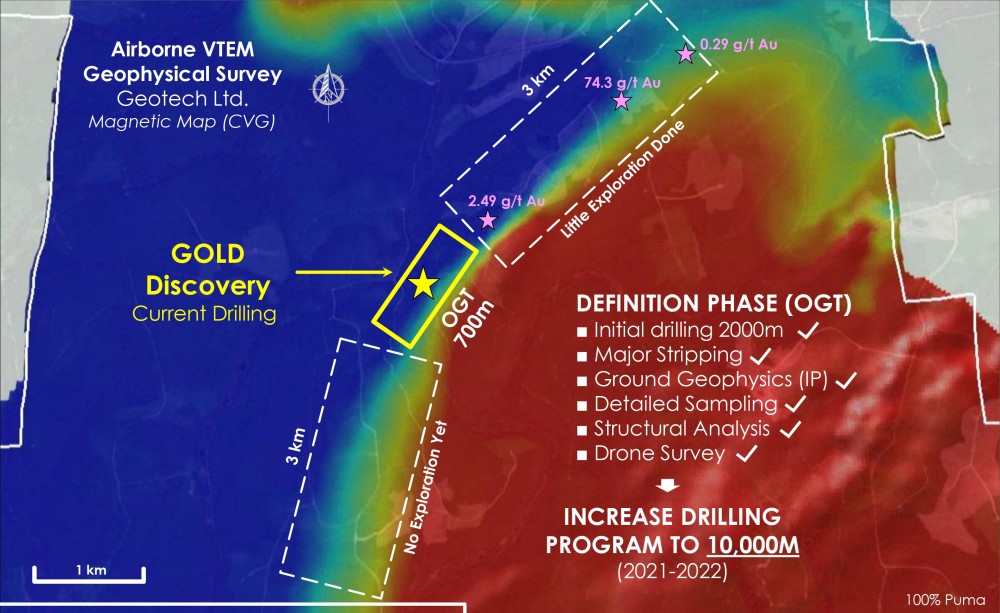

As planned, a total of 18 holes were completed for 2,360 meters. The NQ core oriented maiden drill program was conducted to test a segment of the 700-meter-long O’Neil Gold Trend (OGT), part of the Williams Brook Gold Project. The OGT shows a distinct 7-kilometer-long magnetic signature highlighted by the 2021 detailed VTEM airborne survey.

Each of the 18 diamond drill holes show consistent mineralization and pervasive alteration over core length varying between 10 m to 75 m starting at surface.

On August 19, 2021 Puma raised $1,600,000, issuing five million units at the price of 32 cents per unit. Each unit comprises one common share and one common share purchase warrant. Each warrant gives its holder the right to purchase one common share at a price of 50 cents per share until August 19, 2023.

Crescat Portfolio Management LLC participated in the offering by making a strategic investment of $960,000, representing 60% of the financing.

Crescat is a global macro asset management firm headquartered in Denver, Colorado. The company is advised by its Geologic and Technical Director, Dr. Quinton Hennigh, on gold and silver resource companies.

“There are about 83 million shares out, and about 30 million shares are controlled by management and close friends,” stated Robillard.

On August 3, 2021, Puma announced the signature of a Memorandum of Understanding (MOU) with Pabineau First Nation – Oinpegitjoig L’Noeigati (PFN) to collaborate on mutually beneficial initiatives in mining exploration in the traditional territory of Pabineau First Nation.

Drilling ended August 20th, 2021, with 18 holes totaling 2,360 meters having been completed. The average depth per hole ranged between 58 to 242 meters.

Drill core from 12 other holes has been sent to the lab and assays are pending.

“We believe this is a major gold discovery,” Robillard told Streetwise Reports, “We have first mover status here in New Brunswick. Not a lot of people believed in the potential for gold, so we've been able to acquire a major land package for a reasonable price.”

Based on the discovery of 50 meters of high-grade gold starting at surface, PUMA has made a decision to increase its planned drill campaign from the initial 2,000 meters to 10,000 meters.

[NLINSERT]

Disclosure:

1) Lukas Kane compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Puma Exploration. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Marcel Robillard: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Puma Exploration. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: Puma Exploration. I had the opportunity to review the interview for accuracy and am responsible for the content of the interview.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Puma Exploration, a company mentioned in this article.