Quinton Hennigh discussed three companies and their new drill results.

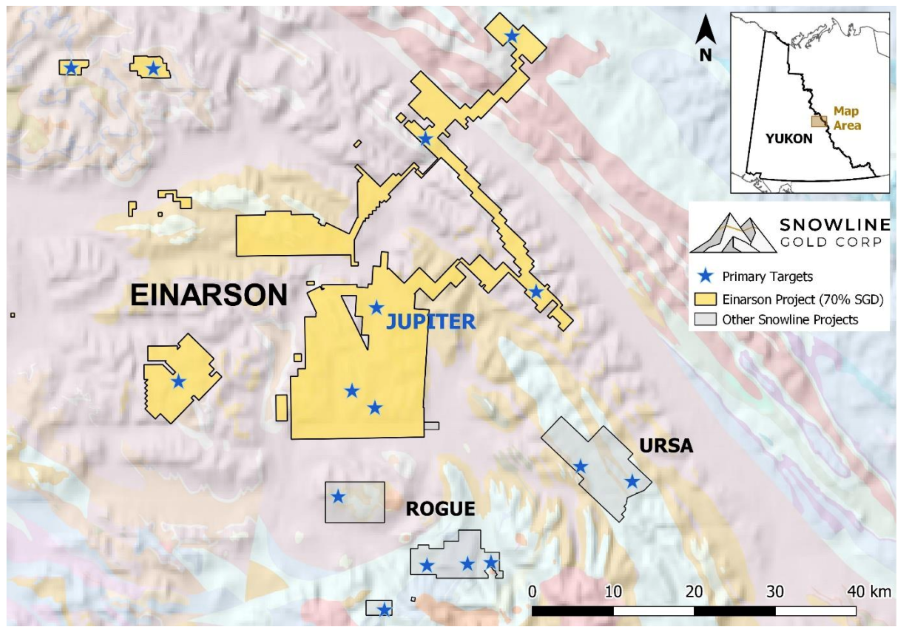

Snowline Gold Corp. (SGD:CSE: SNWGF:OTCQB)

In an exciting update, Snowline discovered a high-grade epizonal system in the middle of nowhere on its Yukon project early in drilling, Hennigh noted. Hole J-21-011 hit two zones, one 5 meters over 10 grams, the other 6.5 meters over 13 grams. To top it off, the company still has many targets to drill test.

"This is a bona fide discovery," Hennigh added. "This should be celebrated to the nth degree. I cannot tell you how exciting it is to see an early-stage discovery like this."

BCM Resources Corp. (B:TSX.V; BCMRF:OTCMKTS)

At its project in Utah, BCM is starting to see mineralization to a degree in the right setting, which it mentioned in its recent news release.

The company is now drilling a hole (indicated in pink on the slide) parallel to but deeper than its initial hole. BCM still needs to get into the potassically altered part of the porphyry-copper system buried under the area there and will likely need to drill more holes to do so. Also, BCM now has money to conduct geophysical work on the property.

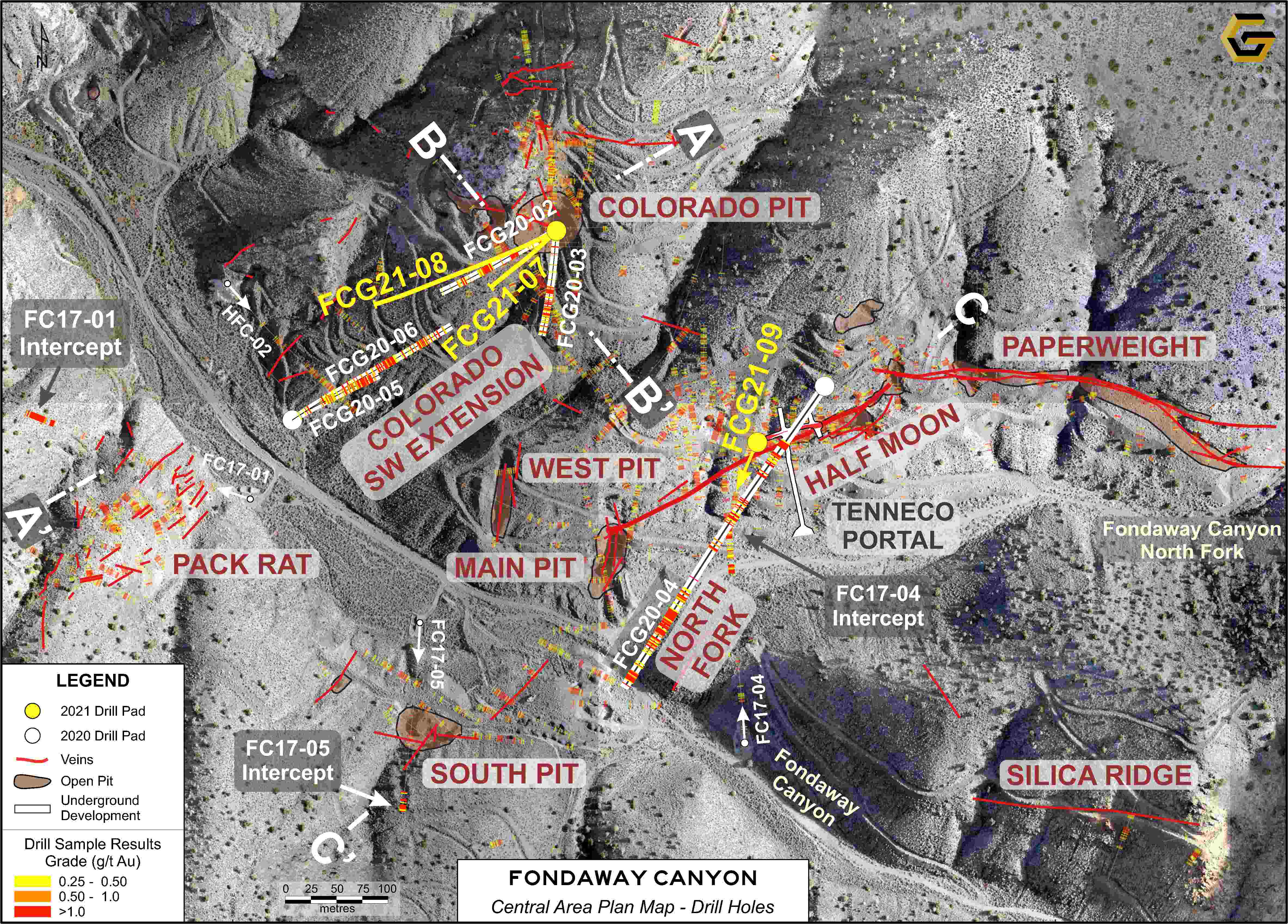

NuLegacy Gold Corporation (NUG:TSX.V; NULGF:OTCQB)

The investment thesis for NuLegacy's project in Nevada's Cortez Trend is that the other half of the mineralized system being mined at Nevada Gold Mines' Goldrush is on NuLegacy's property. New drill results there were not impressive, Hennigh said, but there is a good profile from all of the holes drilled, between Drift Anticline and Serena. Given that, Hennigh said NuLegacy's area of focus may need to be between those two targets.

"There is definitely gold here," Hennigh said. "There's lots of anomalous gold. This is definitely a system."

Assays for a set of holes drilled at Drift Anticline are pending. Once NuLegacy receives those, it can determine where next to drill. It has plenty of cash to continue its program.

Hennigh provided a status update on seven other exploration companies of note.

Condor Resources Inc. (CN:CVE)

Peru-focused Condor is concentrating on Pucamayo, a Pierina-like high-sulphidation target with the potential to contain 5,000,000-plus ounces, Hennigh said. The company has been having trouble arranging access to drill targets for various reasons, including protracted negotiations and COVID-19.

"Over the next couple of months, based on what we're hearing, they should be able to get in there and start drilling this target," said Hennigh. "It's going to be quite exciting once they do."

The investment thesis for this company operating in Bolivia is that its Iska Iska is one of the biggest silver and tin discoveries in many years. The system's footprint spans about 2 kilometers north-south and over 1 kilometer east-west.

"There is huge potential remaining to unlock value here, based on the current drilling," Hennigh said.

Eskay Mining Corp. (ESK:TSX.V)

With four rigs working on the property, Eskay Mining is nearly halfway done with its planned 30,000 meter drill program. Most of the holes it drilled this season have visible mineralization, Hennigh said. The recently hit mineralization looks much like that encountered in the early days at Eskay Creek.

"We see this as one gigantic, ore-forming system of volcanogenic massive sulphide type. It's precious metals rich. We think that there are a lot of targets that will deliver on this property," said Hennigh.

New Found Gold Corp. (NFG:TSX.V)

Cashed up New Found Gold has drilled 38% of its planned campaign. The Keats target, which has been drilled the most, remains open downplunge. Newfound is starting to systematically drill the Lotto target. Both are likely to return more high-grade results, Hennigh said.

"This thing has a lot of room to grow from here," he added.

White Rock Minerals Ltd. (WRM:ASX; WRMCF:OTCQF)

Problems with drilling, including an inexperienced crew, has hampered White Rock's drill program in Alaska. This season, White Rock will likely complete only two-thirds of it planned meters, which means Last Chance will not get drill tested, a disappointing development according to Hennigh.

Cabral Gold Inc. (CBR:TSX.V; CBGZF:OTCMKTS)

Cabral has cash and "is doing the right thing," Hennigh noted, as it is going to grow its resource at its district-scale Cuiu Cuiu project in Brazil.

Defiance Silver Corp. (DEF:TSX.V; DNCVF:OTCBB)

Previous drilling at Defiance's large Zacatecas project in Mexico showed high-grade, big, fat vein systems at depth, so the company will aggressively drill there over the next few months. Along with Zacatecas, Defiance has Tepal, a copper gold porphyry system that "could end up being a multimillion-ounce of gold equivalent project," Hennigh said.

The plan is to drill Tepal soon as well, but permitting is taking longer than usual in Mexico due to COVID-19.

[NLINSERT]

Streetwise Reports Disclosures:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor/employee. He/she or members of his/her household own securities of the following companies mentioned in the article: None. He/she or members of his/her household are paid by the following companies mentioned in this article: None. His/her company has a financial relationship with the following companies referred to in this article: None.

2) Dr. Quinton Hennigh is Crescat Capital’s full-time Geologic and Technical Director. You should assume that as of the publication date, Dr. Quinton Hennigh has a position in the securities discussed and therefore stands to realize significant gains in the event the price of security moves.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Cabral Gold Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cabral Gold Inc. and NuLegacy Gold Corp., companies mentioned in this article.

Important Crescat Disclosures Provided by Crescat Capital

Please read Crescat’s important disclosures.

Nothing herein should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies are included for informational purposes only and are provided as a general overview of Crescat’s general investment process, and not as indicative of any investment experience. There is no guarantee that the case studies discussed here are completely representative of Crescat’s strategies or of the entirety of its investments.

Crescat has compiled its research in good faith and while it uses reasonable efforts to include accurate and up-to-date information, it is provided on an “as is” basis with no warranties of any kind. Crescat does not warrant that the information on this site is accurate, reliable, up to date or correct. In no event will Crescat be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of its data.

You should assume that as of the publication date, Crescat has a position in any securities discussed and therefore stands to realize significant gains in the event the price of security moves. Following the publication date, Crescat intends to continue transacting in the securities, and may be long, short, or neutral at any time.