Fabled Silver Gold Corp. (FCO:TSX.V; FBSGF:OTCQB; 7NQ:FSE) is making a new name for itself — Fabled Copper Corp. — as it spins off its Muskwa copper property in British Columbia, Canada while also making news at its Santa Maria silver and gold project in Parral, Mexico.

The spinoff, announced in May 2021, has already closed a $6.9 million private placement. That distributed the shares FCO owns in its wholly owned subsidiary Fabled Copper to current shareholders of FCO on the basis of one Fabled Copper share for every five common shares of FCO. This 5:1 ratio will hold for all FCO shareholders of record until the special shareholder meeting to approve the spinoff, anticipated no later than mid-October.

Muskwa Project

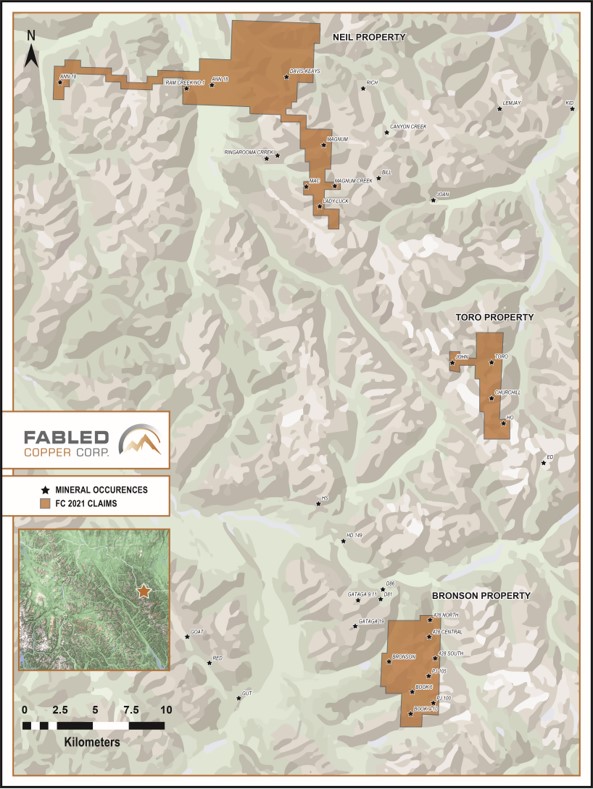

The Muskwa copper project is located in Northern British Columbia near the Yukon, in the Laird Division. There are 10 known deposits on the property; Fabled Copper plans to starts its exploration with the David Keay deposit.

“Field exploration is well underway with ‘boots on the ground’ sampling and mapping, supported by drone coverage,” said Peter Hawley, president and CEO of FCO. “This will be the first-ever comprehensive exploration program on the Muskwa property in over 20 years and will provide valuable data to facilitate planning for 2022’s drill program.”

A feasibility study done by the previous owners (non-NI43-101 compliant) detailed one million tons of proven 3.15% copper and more than 550 tons of probably 3.18% copper. If those estimates hold up in Fabled Copper’s planned NI43-101 compliant feasibility study, Hawley expects to find as much as 98 million pounds of copper are there, underground or at surface, ready for retraction.

Hawley will add the CEO role at Fabled Copper to his responsibilities after the spinoff. A geologist and professional engineer with nearly four decades of experience in exploration and mining, Hawley was a founder, CEO and president of Scorpio Gold Corp. (SGN:TSX.V). He previously filled the same set of roles at Scorpio Mining Corp. (now Americas Silver Corporation (USA:CA)) and was a cofounder of Niogold Mining (now Osisko Mining Corp. (OSK:TSX)). He has served as consultant to intermediate and senior mining companies such as Teck Resources Ltd. (TCK:TSX; TCK:NYSE), Noranda Income Fund (NIF.UN:TSE), and Placer Dome, which is now Barrick Gold Corp. (ABX:TSX; GOLD:NYSE).

Santa Maria Project

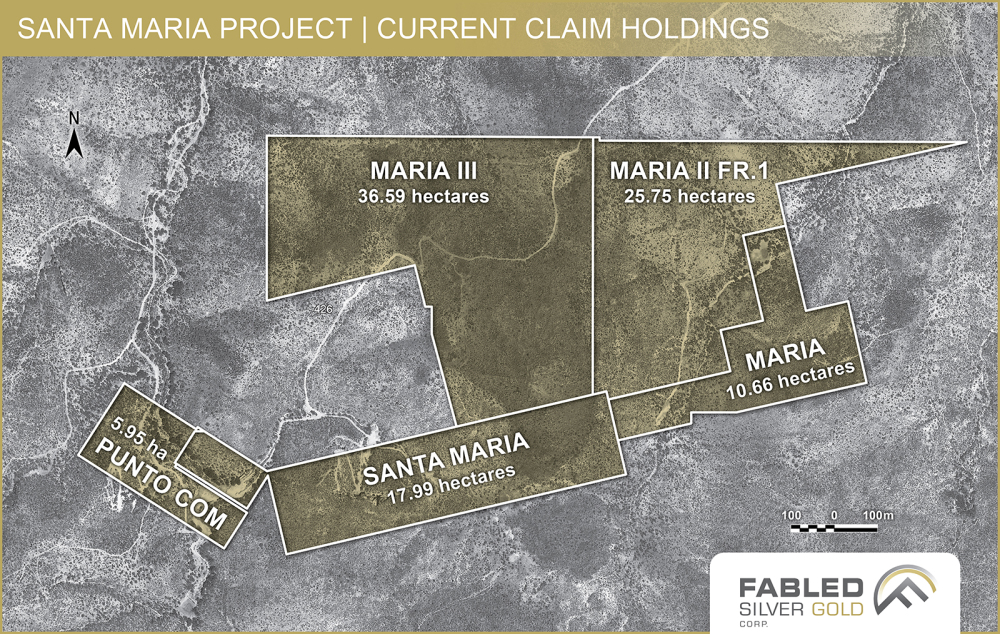

Located in the heart of Mexico’s prolific epithermal silver-gold belt near Parral in the state of Chihuahua, FCO’s Santa Maria property has never been systematically explored. Most of these epithermal projects have been mined out, as far back as the Incas,” said Hawley, who described Santa Maria as a “bonanza-grade project” of sufficient interest to lure him out of retirement.

“This year’s underground drilling is taking place in the ramp, previously mined areas where earlier miners took bulk samples. We know from previous holes drilled in our program that Santa Maria and Santa Maria Dos veins are the footwall and hanging wall of a mineralized structure. The purpose of the program is to determine the widths of this structure,” said Hawley.

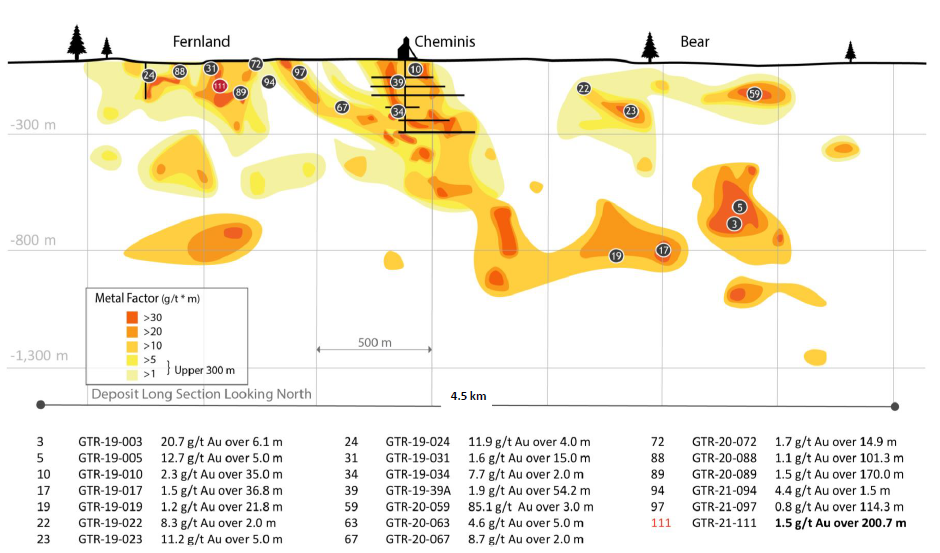

Of the 27 holes FCO has drilled at Santa Maria to date, 22 returned high-grade gold and silver mineralization. The drill program now extends to 14,200 meters of a hydrothermal, gold-bearing sheeted vein structure at a true width of 150 meters.

The latest results, released September 1, 2021, detail three underground holes Hawley said will “have a major effect on new resource calculations, at greatly improved quality, perhaps in the measured category.”

- SMUG21- 11, drilled at a dip of -30 degrees, intercepted a low-grade interval of 37.46 g/t Ag Eq over 0.50 meters followed by 1.30 meters of breccia which reported 101.96 g/t Ag Eq and the Santa Maria hanging wall structure which returned 107.54 g/t Ag Eq over 0.32 meters.

- SMUG21-12 was drilled flat. It intercepted the Santa Maria hanging wall structure and a new quartz breccia located outside the boundaries of the Santa Maria structure not previously encountered before. Its collar reported 3 meters of 82.59 g/t Ag Eq in the footwall of the Santa Maria structure.

- SMUG21- 13 was drilled in the same plane as SMUG21- 12 but at -45 degrees. Designed to target the new vein breccia and intercept it at a vertical depth of -125 meters below SMUG21- 12, it did that and intercepted 345.73 g/t Ag Eq over 1.5 meters and 541.40 g/t Ag Eq over 0.80 meters.

In the surface drilling program, drill hole SM21-20 intercepted gold with no silver. “We have indications of a porphyry,” Hawley said, “and a gold domain system with grades as high as 22g/t gold.”

This is among a steady stream of drilling results released in 2021 that Hawley said, “continue to add to our understanding of the robust multiphase plumbing system that is the driver of the Santa Maria mineralization. With $4.6 million in cash on hand, FCO is well-positioned to complete its 2021 drilling program at Santa Maria. Hawley anticipates the “robust series” of results from both surface and underground drilling will continue through December

Conclusion

Considering the promising Santa Maria results, Hawley noted that FCO is “undervalued compared to our peers. Whereas many junior mining stocks have lost as much as one-third of their value this year in a bad market, we limited our loss to no more than 9% and have returned a 34% gain to our investors. And now, we offer the opportunity to get free shares in a new copper venture in a safe, proven jurisdiction, run by an experienced team.”

As of September 1, FCO’s market capitalization stood at $34 million; shares were trading at $0.14 (52-week high, $0.40).

[NLINSERT]

Disclosure:

1) Diane Fraser compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor/employee. He/she or members of his/her household own securities of the following companies mentioned in the article: None. He/she or members of his/her household are paid by the following companies mentioned in this article: None. His/her company has a financial relationship with the following companies referred to in this article: None.

2) As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Fabled Silver Gold Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fabled Silver Gold Corp., a company mentioned in this article.