Maurice Jackson: Joining us for a conversation is Christian Easterday, the CEO of Hot Chili Ltd. (HCH:ASX). It’s a pleasure to be speaking with you, sir. Hot Chili Limited is having, simply put, a banner year, as throughout the year it's been one success after another. Hot Chili has released a string of successful press releases to advance the massive Cortadera Copper-Gold Project. Before we delve into the exciting news you have for current and prospective shareholders, Mr. Easterday, please introduce us to Hot Chili and the opportunity the company presents to the market.

Christian Easterday: Well, it's been a very exciting time, not just in the copper space, but for Hot Chili, as we really transform ourselves from a corporate exploration company on the coastline of Chile to a full-fledged very significant copper developer. We are now very pleased to be welcoming Glencore International Plc (GLEN:LSE) as our largest shareholder through its participation in our recent $40 million capital raising, which was just announced during the week.

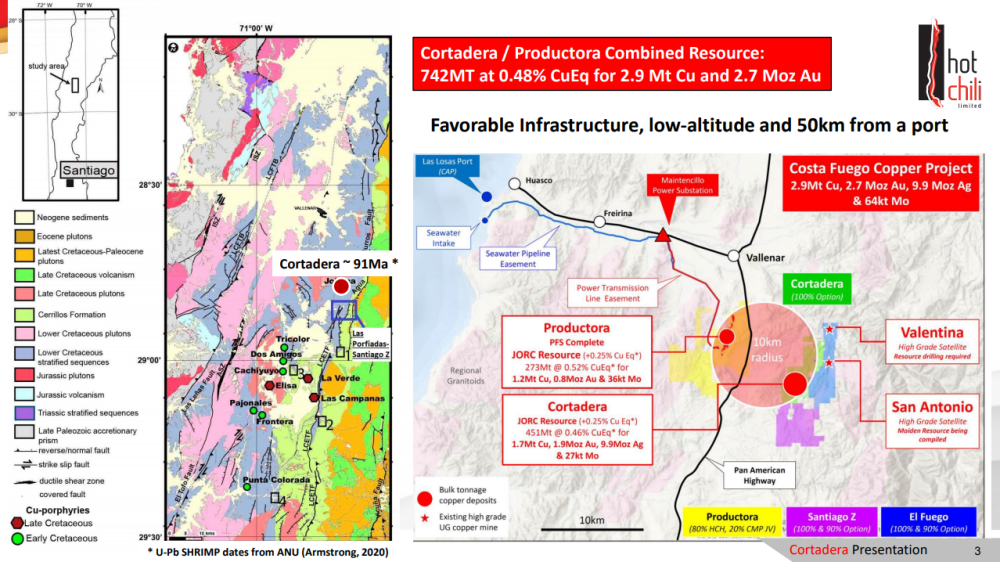

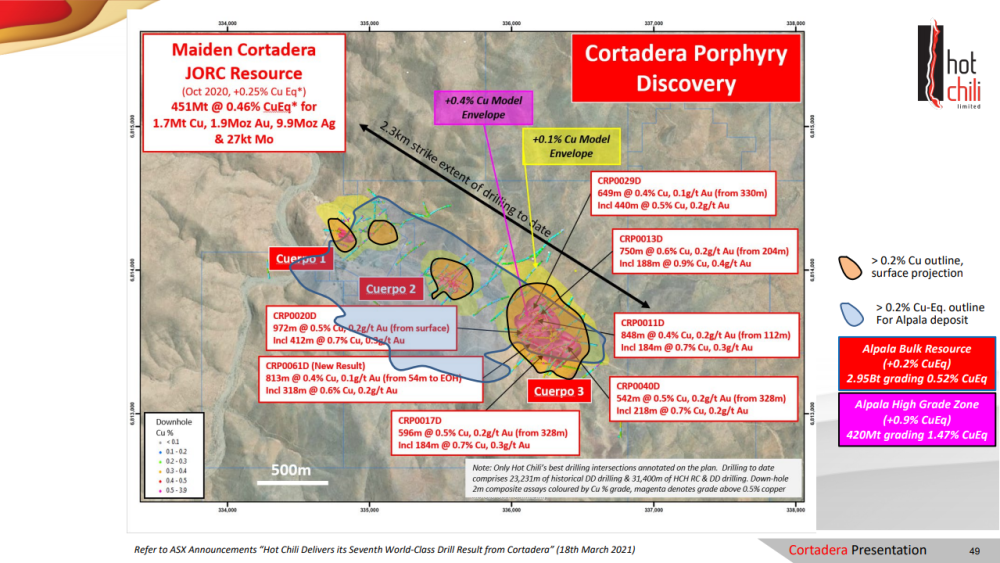

None of this has been possible without the string of successes that we've had at a world-class Cortadera porphyry discovery on the coastline, which has allowed us to consolidate a major copper development hub sitting on the Pan-American Highway, right next to a port 600 kilometers north of Santiago, Chile. We are certainly hitting our straps after announcing our maiden resource last year, when I did my last interview with you, Maurice. We now have some three-quarters of a billion tonnes at about half-a-percent copper equivalent in open-pit and underground resource space.

And that Cortadera discovery, which is one of only two major copper discoveries that the world has seen since 2014, is seeing some significant growth in our drilling. We've been able to put out some further world-class intercepts as we expand that resource base, and look to take our combined asset to over a billion tons. And hopefully, we'll be looking to put that out later in the year.

Maurice Jackson: Sounds exciting, sir. You referenced the $40 million funding. Can you go through the details for us on this landmark transaction, along with your new strategic partner, Glencore?

Christian Easterday: We have been very busy in staging the next steps for Hot Chili, as we seek to align ourselves with the rest of the copper porphyry developers in the Americas. Currently, we're the only major copper porphyry player that is not listed on the TSX and TSX.V. and we're looking to dual lis, the company in the coming months over on the TSX.V in Canada. So, a very exciting time as we transform the company and look to align to a set of copper developers, which are seeing market capitalizations in the range of $500 million to $1.4 billion, with some of the leaders over there in Canada being Filo Mining Corp. (FLMMF:OTCMKTS), Solaris Resources (SLS:TSX), SolGold plc (SOLG:AIM), and several resources that they control. Obviously, Hot Chili's resource base is comparing extremely favorably.

We see a real value gap that exists with being the only non-TSX/TSX.V player in our peer space. The $40 million capital raise that we've just completed was well supported out of Australia and also overseas, with significant support seen from North America. But most importantly, when we put that capital raise together, that was all about our last real key milestone, which is the purchase of Cortadera itself. We had one remaining payment that was due in one year of US$15 million, or roughly AU$20 million. The asset has grown so rapidly, and we were really sitting on a world-class discovery here, so there was significant interest in taking out that final ownership payment, which we'll be making immediately, once we close this raise in the coming week or two. That's some color on the reason for the raising outside of the purchase of Cortadera.

The rest of the money is going in to continue our aggressive resource growth drilling program, and also to start stepping out and start testing some very exciting growth potential in what looks like an opportunity to unlock a cluster of high-grade porphyry targets in and around our two key assets at Productora and Cortadera.

Through this raising, as you well said, we've now attracted the support of one of the largest mining companies in the world, in Glencore. And, as is being announced, they're coming in now as a 9.99% shareholder in Hot Chili, which will make them the largest shareholder in Hot Chili. And we'll be shortly welcoming their support with a board member, coming onto Hot Chili's board technical steering committee. This will allow us to tap in and utilize the strong capability and experience of Glencore in developing large-scale copper assets in jurisdictions, such as Chile.

I'm looking forward to the new relationship, and our new large shareholder in Glencore. They've certainly given the company a significant endorsement of our assets. Effectively, the due diligence by the world has just been completed by one of the largest copper producers in the world—one of the largest mining companies in the world—and a really key aspect of that is where we're looking forward to negotiating over the coming months, which is an off-take arrangement for the first eight years of our targeted 25- to 30-year mine life, which we're trying to build out on the coastline. That will be for about 60% of the off-take out of our combined Costa Fuego project. We really look at that as a significant de-risker for the company in terms of actually having a partner there to take a benchmark component on the pricing of our off-take. We view this a strong hedging position: the company is putting in place with the largest global trader of copper concentrates, and now our largest shareholder.

Maurice Jackson: Having Glencore as a strategic partner is a big, big feather in your cap and puts Hot Chili in the driver's seat — I would say on the autobahn. You've really done several things here for shareholders. Just this off-take; it's something that may be minor when you look at all the successes here, but that off-take agreement as well is just another strategic step. And it just demonstrates the business acumen and the leadership here. And I have to just give you a big kudos, sir.

Switching gears, let's look at some numbers. Please provide us the capital structure for Hot Chili.

Christian Easterday: Look at the moment. Our pre-capital structure was about 3.1 billion shares. We'll come over the 4 billion mark after this raise, where we have about 1.1 billion shares that we'll be issuing to Glencore and to other institutional investors. We've also been able to give the shareholders of Hot Chili a slice of the capital rising at $0.032. I suppose that's sort of something really important from the board, that we wanted all of the shareholders to be able to participate at the same level of investment that Glencore and the institutional investors are coming in at. And that's certainly seen a very good response day one, day two, day three in the market over here in Australia.

We've not just a raising an 11% discount to our closing price pre-capital raising, but we've been able to get the stock to have a very positive lift after that announcement. We're trading at around 40% or 50% higher than the issue price for the raising. We are very pleased to be able to allow all of our shareholders to participate in a share purchase plan.

We now have a firm opportunity to rewrite Hot Chili into the billion-dollar-plus market capitalization space. And we believe that we can do that in short order, particularly with our realignment now, and being able to take Hot Chili into the North American market with a dual listing on the TSX/TSX.V—and to be able to compare ourselves very favorably with some of the names I've mentioned, the Oracles, the Filos, the Solarises, which have seen spectacular increases in their share prices in association with the lifting copper price environment.

When you have a copper price environment over $4 per pound, and you have an upper-tier copper asset that is rapidly approaching a tier-one asset, and there's very few of those available in the world to be able to leverage that value, and you are able to come into a dual listing, and now with Glencore on our register—we believe that we have a significant rewrite ahead of the company. We now have the ability, in the market's eyes, to be able to execute and transition Hot Chili into a large-scale or major copper producer.

Maurice Jackson: In closing, sir, what would you like to say to shareholders?

Christian Easterday: I'd like to thank all of our shareholders for ensuring that Hot Chili was one of the survivors of the last downturn in copper, to support our vision, to build out a new copper player of substance globally with the project that we're positioning in the plus-100,000 tonne per annum copper production space. Very few of those are available in a world where there's very few major copper discoveries being made.

Now our shareholders, undoubtedly, will start to reap the rewards of what has been a 13-year vision by myself and our founders to build out something that you don't see very often. The last time the Australian stock market had anything in this space was, of course, Equinox Resources. And we all know knew that a real key element in the rewrite of that company from a $400 million company to a $7.2 billion takeover was their ability to be able to transition into production — and most importantly to be able to position Equinox into the North American markets at the right time.

They did that in the last copper cycle, and they were able to extract that significant rewrite in valuation. And we were simply following a very well-worn path that has already been done before.

Maurice Jackson: Last question, sir: What did I forget to ask?

Christian Easterday: I'm sure we'll have plenty of time for further questions down the road, Maurice. We've got some pretty exciting drilling results coming out of our expansion program that we'll now be able to start getting out to market, now that I'm out of a blackout period following about four or five weeks of no sleep completing the transaction that we've just announced.

But most importantly, we've got a lot of very exciting news flow in the lead-up to our dual listing on the TSX.V, which is scheduled for around late October, and then shortly to follow that, hopefully a significant upgrade at our Cortadera porphyry discovery.

Maurice Jackson: Mr. Easterday, it's been an absolute delight to speak with you today. I'm wishing you and Hot Chili the absolute best, sir.

As a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRA’s. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]

Disclosures:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Hot Chili Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Hot Chili Ltd. is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Magna Gold, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.