I normally start these missives with a theme that is unrelated to precious metals investing but usually, at a minimum, rhymes with it. Because we are at the all-important midpoint of the month of August, I choose to do away with stories about my beloved Fido or hockey or rock avoidance (otherwise known as "boating") in northern Georgian Bay, and instead address one crucial question: "Where are the precious metals headed for the balance of 2021?"

I was rather fortunate that I was limping home from the Bustard Islands on only one mighty Volvo-Penta engine on the Thursday prior to the Aug. 6 non-farm payrolls report because it saved me the task of addressing the noise of an orchestrated two-session "takedown" in the paper precious metals pits, which are dominated by bullion banks and opportunistic large traders. This also meant that I could avoid the hundreds of messages from followers in need of guidance after such a violent, unnatural move threatened to shatter their undisputed resolve in the efficacy of owning gold, silver, and the associated explorers, developers, and producers, all of which got thoroughly trashed last Monday.

That is not to say that I was hiding under my desk; having been long a 50% position in the junior gold miners exchange-traded fund (ETF; GDXJ:US), I added Tuesday and Thursday at the lows and am now 100% invested in what is my largest trading position since March 16, 2020.

As we look back at the events of Friday and Sunday evening after the jobs report, I must say that while I frown upon dwelling ad nauseum on the criminal actions of the bullion banks and their henchman (which includes all media formats including Twitter), I could no longer roll my eyes when the term "manipulation" was used several hundred thousand times over a four-day period. While I have seen these stunts — these shenanigans — hundreds of times over during my 45-year journey into the malodorous pits of the Crimex Exchange, the Sunday, Aug. 8 raid was nothing short of insanity. Four billion dollars' worth of notional gold sold "at-the-market" in a flash crash interval, with nary a whim as to price or execution, which can only be classified as an order with a "designated price objective" — which, by the way, is illegal.

The June decline from above $1,900 to $1,760 was a pretty easy call because the relative strength index (RSI) had lingered above 70 for most of May and then abruptly reversed downward, first on June 3, then again on yet another Freaky Friday on June 11. In a bizarre reactionary twitch, the recent crash appeared out of thin air, with nothing closely resembling an overbought condition nor any major policy event to account for the indiscriminate dumping. It was as if someone at the Fed decided that a $1,900 gold price was getting in the way of their "transitory inflation" narrative and ordered the takedown so they could use the gold puke as a validation of sorts. As warped as that sounds, events of the past 18 months have forced me to accept even the inane as possible, and that is a sad state of affairs.

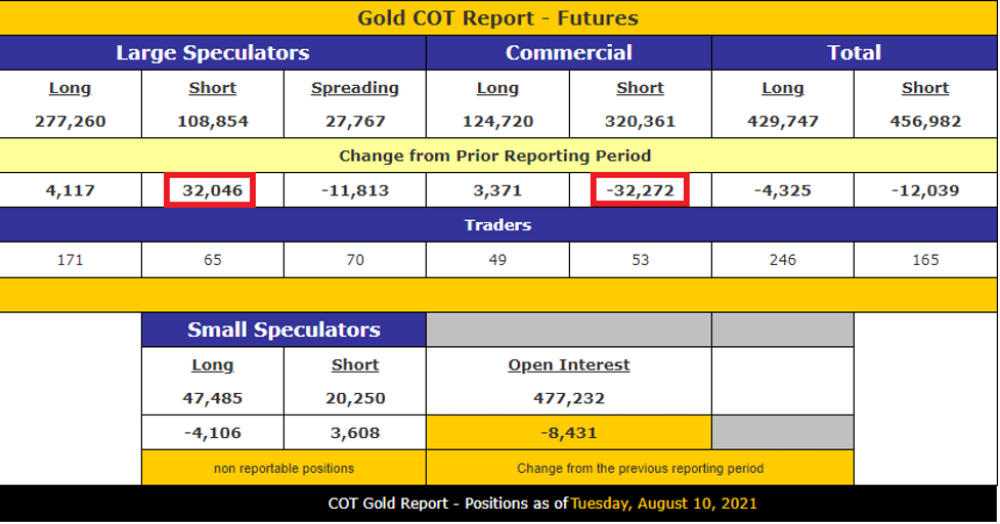

In trying to explain these raids in terms of motivation and strategy, there was an interview recently with Andrew Maguire in which he discussed the Basel III changes, and despite protestations over exemptions being granted to the bullion banks, it would seem that the banks holding large-short positions in unallocated gold and silver have until Jan. 1, 2022, to cover. The just-released COT report for the trading week ending Aug. 10 provides the "smoking gun" as to whom the perpetrator of the raid might have been because, as the legendary Richard Russell taught us years ago, one must always "follow the money."

The money points directly at the commercials who had been aggressively shorting gold for weeks above $1,800. With the cover story of a "better-than-expected" jobs report (900,000 vs. 800,000 jobs created), a 12.5% upside surprise in jobs caused a US$130/ounce crash in gold, during which the commercials covered 32,272 contracts in gold, representing 3,227,200 ounces with a notional value of $5.7 billion at today's prices but only $5.4 billion at the Sunday night lows. That leaves a difference of $300 million for four days of work, a masterful stroke of trading genius by the bullion banks and abject stupidity (to the point of dereliction) by the managed money gang, including hedge funds and CTAs (commodity trading advisors).

Silver was not nearly as remarkable as gold, but the net result is that the managed money gang piled on new shorts and is now offside by a fair margin as we move into the seasonally strong months of the year for the metals. I have been neutral-negative on silver since the February #silversqueeze lunacy began, and because of its amateur hour result that buried any chance of revival of the worst-acting of all the commodities I follow for 2021.

One thing that hit me between the eyes about last week was that if there ever was a possibility of a squeeze, a massive and sustained period of forced buying by any entity, it has a much better chance to develop in a commodity that is universally held and loved by central banks around the world, and that commodity is gold. Now, I do not need to waste your (and my) time by rambling off a list of central bank holdings, but you all know the drill. Where I think my theory gains traction is if we get a sustained degree of forced buying of unallocated contracts held short by the bullion banks coupled with continued aggressive purchases by the Russian and Chinese central banks. I could wake up one morning and see a new moniker flooding the blogosphere and Twitterverse that reads "#GoldSqueeze," with club memberships being offered in "Wall Street Gold." After all, whether it is really there or not, the U.S. Treasury allegedly holds 8,133 metric tonnes of gold, not silver, so if I have to choose one versus the other, I choose gold. That has been my favored metal for most of 2021, with copper assuming second place, and quite deservedly given its performance.

Another factor favoring ownership is the daily sentiment index for gold, which last week was detonated down to an "8" reading, an even lower number than on March 16, 2020, when both gold and the miners represented a "generational buying opportunity" for those with strong stomachs and ample testosterone. I submit to all followers that uniquely profitable bull markets are borne out of conditions of deep despair and unanimously bearish consensus, both of which were there in spades early last week. Sprinkle in a few shards of shenanigans, including collusion and price-fixing, and you arrive at an absolute optimum time for loading both barrels with physical gold and/or your favorite junior gold developers.

Everywhere I go these days, I run into a "shakedown." The term was derived from the practice whereby organized crime thugs would grab a store owner and physically shake him until he agreed to pay protection money, and, while those days are now somewhat removed from our day-to-day experiences, the practice of "sanitized extortion" is still rampant and in ascent everywhere we turn. I feel like the victim of a shakedown.

Watching the real estate markets climb to the skies in every major country has been maddening for a great many people, particularly those who decided to avoid the bubble that truly is the Canadian residential property market. Again, in following the money, you are led directly into the lap of the lenders — the big five banks — whose residential mortgage book is now not only "too big to fail" but also "too big to manage," and the Bank of Canada and all Canadian politicians know it.

So, rather than raising borrowing cost to make homes more affordable for the young people, they allow the banks to essentially own Canadian housing and all of the attendant interest income they are earning. There are very, very few Canadians with the resources to buy a 3,500-square-foot home on a two-acre lot for cash these days, which plays right into the hands (and wallets) of the big banks. As I have written about for ages, central bank policy is designed to protect the banks, not the public, but any time you bring it up real estate owners just shrug it off, because they are members of "The Club" while the average Joe is not. This is the very crux of the societal crossroads looming on the immediate horizon, and it lunges at the heart of the wealth discrepancy issues that dominate the generational narrative.

The silver lining in all of this is that in order to protect the collateral backing all of those mortgages, the central banks are going to err in favor of inflation, allowing for the continuation of increasingly negative real interest rate regimes across the globe, which in turn is a fertile environment for precious metals incubation and growth. Once the short positions of the banks are finally onside, I see new highs for gold and copper, after which the rest of the metals tag along. Perversely, it is the anti-gold protestations of the central banks that, in fact, created last week's upside reversal, because the blatancy of the media fanfare created a stench through which even the unwashed could cut with a dull butter knife.

I will have my "mid-August shopping list" completed by the end of the weekend and, to no one's surprise, top-ranked Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) will remain as my top pick as it did last August and in 2019. The company reported on Tuesday a 33-meter interval of 3 g/t Au at its Fondaway Canyon project in Nevada, which makes this company's share price a coiled spring in terms of potential valuation increases. I see "Tier Two Asset" status coming quickly for Fondaway, with the distinct potential for "Tier One" classification in 2022. If Mother Nature and Lady Luck decide to bless them, shareholders are in for a life-changing event probably some time in 2022. What I like is the lack of risk in the resource when measured against a US$46.4-million market cap.

Originally published Monday, Aug. 16, 2021.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Getchell Gold. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold, a company mentioned in this article.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.