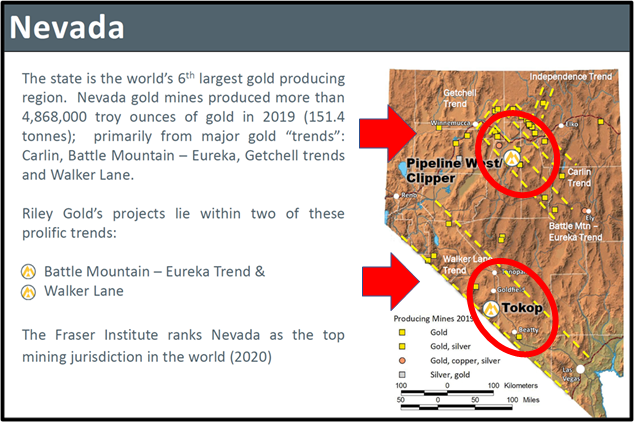

Riley Gold (RLYG:TSX.V; RLYGF: OTCQB) is a mining exploration and development company focused in Nevada, the world's #1 mining jurisdiction, according to the most recent Fraser Institute survey.

Drills have been turning at its Tokop Gold Project in Nevada's Walker Trend since April, with up to 3,000 meters planned. The assays for the first few holes have come in with some high-grade numbers.

The first three HQ3 oriented core holes, targeting near-surface quartz veins, shears, and mineralized fault zones, returned assay intercepts with highlights of:

- TKR-21C: 32 grams per tonne (g/t) gold over 2.6 meters (m) from 46.2 m

- including 1 g/t gold over 1.4 m plus an additional 235 g/t silver

- TKR-22C: 67 g/t gold over 5.1 m from 31.9 m

- including 0.4 m of 73 g/t gold plus an additional 82.2 g/t silver

- including 0.8 m of 02 g/t gold

- TKR-23C: 62 g/t gold over 5.94 m from 102.3 m

- 98 g/t gold over 2.92 m plus an additional 97.3 g/t silver over 1.40 m

"The results from our first three core holes confirmed our thesis that high-grade gold mineralization is present subsurface to surface-mapped veins," stated Riley Gold CEO Todd Hilditch. "Additionally, the first two drill holes encountered the anticipated target (vein) much shallower (30-40 m) than expected, providing valuable information as to the sub-surface environment."

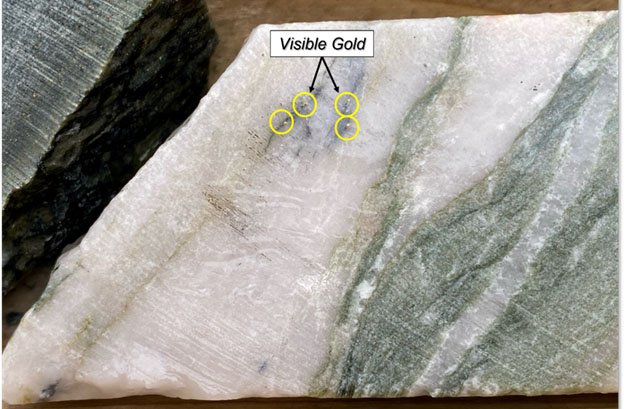

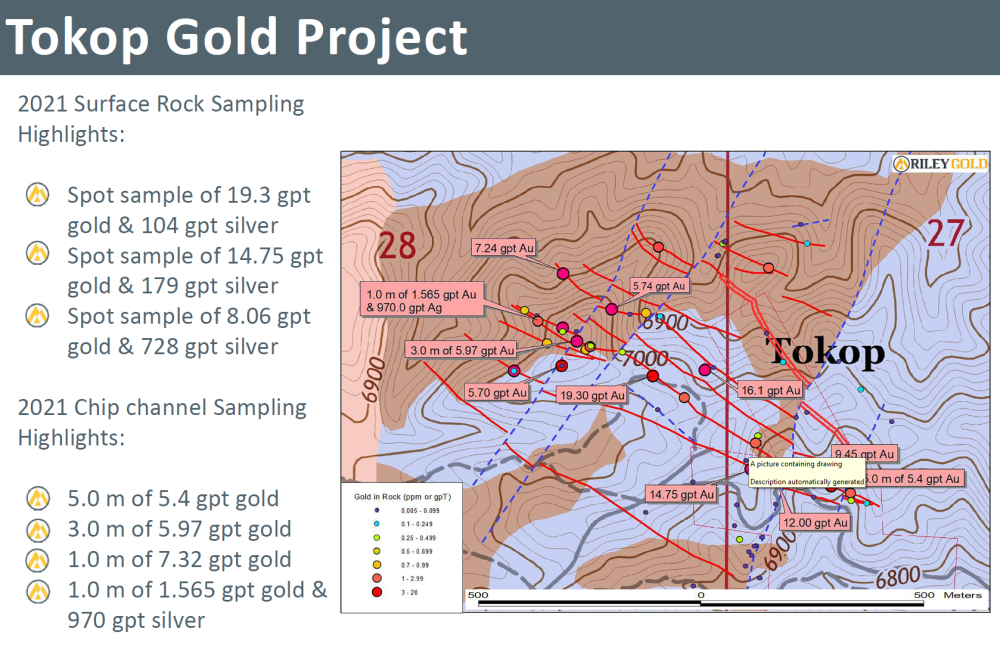

Riley's ongoing sampling program identified excellent gold grades at surface.

"High-grade gold over several meter widths have been collected from outcrop and grab samples from dumps around historical workings have yielded multi-ounce gold assays (up to 71.73 g/t gold)," stated Riley.

Riley Gold has caught the eye of Gwen Preston of the Resource Maven. In a June 16 report, she wrote, "Tokop is not a classic Nevada gold system. Instead, it's a granite-hosted gold system. That means it offers sheeted veins in granites, not a common gold setup in Nevada. Similar systems that you might know include the Fort Knox mine near Fairbanks, Alaska, and the Eagle mine in Yukon. The thing I like about the sheeted vein system at Tokop is that it seems to offer the best of both Fort Knox and Eagle: It seems to have both very high-grade gold and disseminated gold."

Preston notes that Riley "dug into the historic data and then did a massive sampling and mapping program. That effort returned some stellar results, including 19.3 g/t gold and 104 g/t silver, 15 g/t gold and 179 g/t silver, and 8 g/t gold and 728 g/t silver in grab samples. Chip channel samples returned 5 meters of 5.4 g/t gold, 3 meters of 5.9 g/t gold, 1 meter of 7.3 g/t gold, and 1 meter of 1.6 g/t gold and 970 g/t silver."

On June 30, after the first drill results were released, Preston wrote, "Riley had sampled a lot of high-grade gold at surface at Tokop. The first challenge with drilling was to demonstrate that mineralization continued at depth. These results say it does. With just three holes from two drill pads, it's way too early to have a sense of scale. But hitting 17 g/t gold over a reasonable vein width on a targeted vein in a first program is a win."

We asked Hilditch how Riley managed to acquire the Tokop Gold Project.

"Tokop was on the balance sheet of a company that drilled it 11 years ago," explained Hilditch, "They moved into a different commodity—lithium—and this sat on their books."

Editor's note: The price of gold was about $1,100/ounce at the time.

"We had the financial capability to go buy a half-million-ounce deposit," stated Hilditch. "But there's usually a reason why a 500,000-ounce deposit isn't moving forward. It could be a metallurgical issue, a permitting issue or it's sitting on top of a mountain, and too hard to get to."

Hilditch wanted to find an early-stage project that had been neglected, got lost on a balance sheet or one that had never been identified. One that had gold close to surface.

"You only find those projects through connections," explained Hilditch. "We didn't issue tens of millions of shares to acquire from the property owners."

"Our stateside lawyer called me and said, 'Hey, I've got a client with an asset that looks interesting. Do you want to look at it?'" added Hilditch. "We did our due diligence and discovered that 20 holes had been drilled back in 2010."

"The assay results included 12 meters at 2.5 grams per tonne gold," continued Hilditch. "That's a solid hit for an exploratory program. We assumed they followed that up with lots more drilling. But it turned out, the company moved in a different direction after the 20 holes they drilled. We felt there was an opportunity here."

Riley's current mandate is to understand the orientation of the gold vein sets at Tokop's surface. Having robust grades close to surface can radically change the economics of a project.

"The less rock you move, and the more gold you move in that ratio, the better the economics," confirmed Hilditch. "You don't need to spend half a billion dollars to get down to 1,000 feet."

"The geology / rock is very hard rock to drill here," reported Hilditch, "but we're getting reasonably good recoveries. I expect we'll be rolling all the way through the summer. We anticipate releasing assay results in batches of two to five holes at a time."

"Historical and recent surface rock sampling revealed gold mineralization up to 34.4 grams per tonne, and silver up to 970 grams per tonne in sheeted quartz veins, stockworks, and shear zones within the granites."

"We are very excited to begin coring at Tokop," stated Charles Sulfrian, consulting exploration manager. "Our boots on the ground field work over the last few months, in addition to a detailed data review and background research, helped us plan a coherent and very prospective drill program which we believe to be just the start of our work at Tokop."

Sulfrian spent 22 years at Barrick Gold Corp, and was part of team that lead to the gold discovery of Betze–Post, now Goldstrike (Barrick).

"Nevada is a jurisdiction where you can move a project forward quickly. It's straightforward to get permits," Hilditch told Streetwise Reports. "Mining is a significant cash generator for the state of Nevada."

"There's a very strong work pool in the western United States, and specifically in Nevada," added Hilditch, "Quality of people is a big benefit. Our management team has spent a lot of time down there, so we have connectivity."

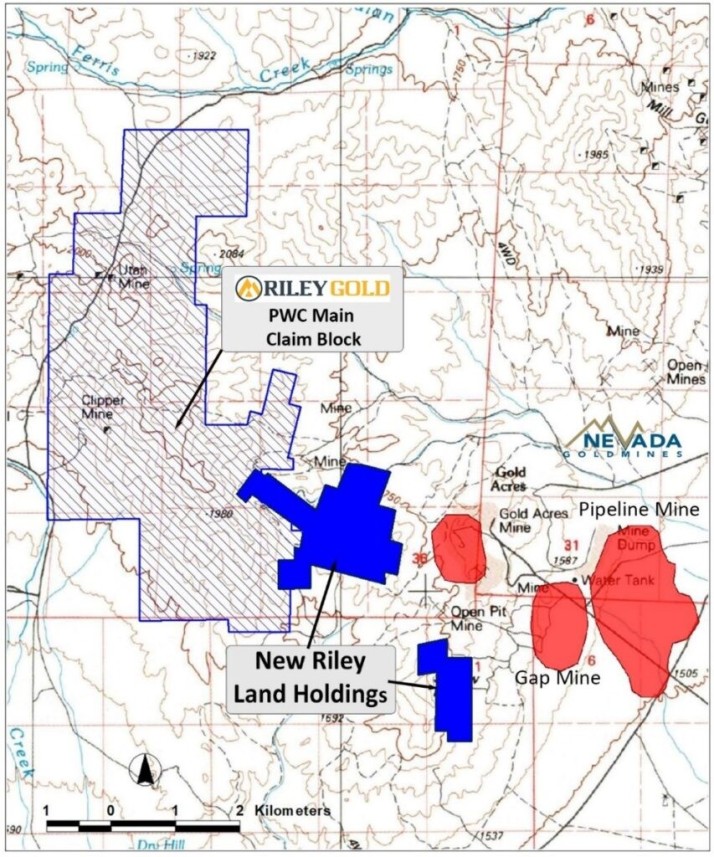

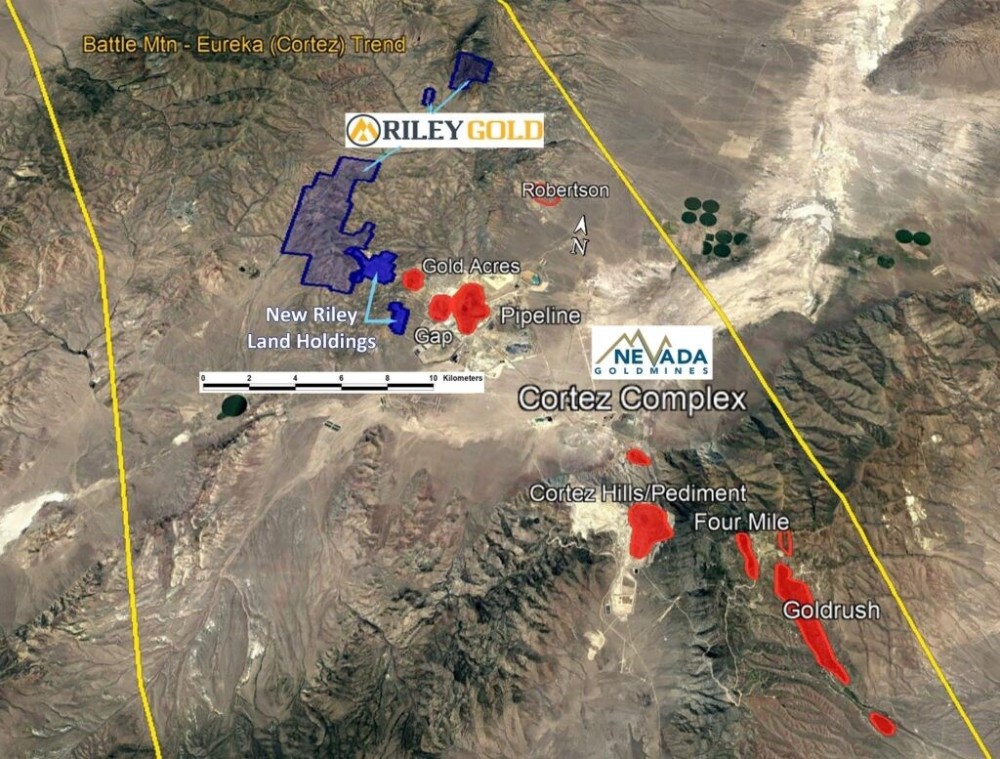

In addition to Tokop, Riley Gold also has a second Nevada property, the Pipeline West/Clipper Project (PWC), located 80 kilometers (80 kms) southwest of Elko, Nevada.

On May 19, 2021, Riley Gold announced that it has increased its land holdings near and adjacent to PWC. The project is an early-stage exploration property with Carlin-type disseminated and replacement gold deposits.

- 7-square km land package

- Unpatented mining claims and patented (fee) lands

- Adjacent to properties controlled by Nevada Gold Mines JV.

This strategic acquisition includes two claim blocks totaling approximately 3.25 square kms between the already well-positioned PWC and the Nevada Gold Mines JV—operated by Barrick and Newmont—boundary, just west of the Gold Acres and Pipeline deposits on the west side of the Cortez complex portion of the Battle Mountain-Eureka Trend.

We asked Hilditch why Nevada Mines would not have already purchased the new Riley land holdings.

"Nevada Mines is a joint venture amongst two massive gold producers being Newmont and Barrick and have a massive endowment of gold and they're in production," explained Hilditch. "They've got their hands full. At some given point, if we identify a resource here, maybe they will be interested in our findings."

"This property transaction was important in order to enhance Riley Gold's district scale land package and cover the west to east extension of the Wenban geological unit that is known to be the host of gold mineralization in this district, including gold production at the Nevada Gold Mines JV, Pipeline and Cortez facilities," stated William Lamb, Riley Gold's executive chairman.

Lamb is a useful guy to have in your corner.

"The former CEO of Lucara Diamond Corp, Lamb played an integral role in taking Lucara's flagship mine (Karowe) from feasibility to production," reported Riley, returning more dividends to shareholders than equity raised in the company."

"Under Lamb's leadership, Lucara's flagship Karowe mine has evolved into one of the world's highest margin diamond mines and the foremost producer of large, Type IIA diamonds in excess of 10.8 carats," stated The Mining Review.

"Lamb galvanised Lucara's reputation as an innovator, championing its technologically advanced mine design to optimize revenues and minimize diamond losses," added The Mining Review.

"An exploration program will be designed to enhance the known information within the district as well as garnered from previous historical work, where Riley Gold believes that the Wenban target was not tested adequately," added Lamb about the new Riley land holdings.

The principal targets for exploration at PWC include units within the lower plate of the Roberts Mountains Thrust Fault system, primarily the Devonian Wenban and Siluro-Devonian Roberts Mountain formations.

The Wenban is the primary host for a lot of the gold mineralization in the Cortez area.

Target depths to this lower plate unit within Riley's PWC property are "reasonably thought to be within 300 to 600 meters of the surface."

We asked Hilditch about Riley Gold's share structure.

"When we put this company together, we started off with 10 million shares—a very tight structure," explained Hilditch.

On October 16, 2020, Riley Gold issued 15,001,125 units at CA$0.20 per unit for total gross proceeds of CA$3,000,225.

"A large chunk of that October 2020 financing was through Haywood Securities," explained Hilditch. "Not a standard institutional investment, but more for a brokerage firm accounts and for their clients."

"We do have a couple of toehold subscribers from the institutional side," added Hilditch. "One is Paul Stephens in San Francisco, a long-standing resource investor. The second is Extract Capital, also very resource oriented."

On August 3, the company announced a non-brokered private placement of up to 4 million units at CA$0.40 each; each unit consists of one common share and one half warrant. The full warrants are exercisable for 24 months at CA$0.60.

"We are raising additional capital, within our tight structure, to expand our exploration and knowledge base at Tokop with additional geophysics, mapping and drilling beyond our first program. Additionally, we want to accelerate initial work at our Pipeline West/Clipper Project that adjoins the Nevada Gold Mines JV (joint venture amongst Barrick and Newmont) in the Battle Mountain-Eureka Trend. Our projects have very promising mineralization signatures within world-class precious metals trends in the mining-friendly State of Nevada,” commented Hilditch.

Riley Gold currently has approximately 25.6 million shares outstanding and 7.5 million warrants. There are also 2.4 million stock options granted. Fully diluted the company has 35.6 million shares outstanding. Riley management owns about 18% of the company.

[NLINSERT]

Disclosures:

1) Lukas Kane compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Riley Gold. Please click here for more information.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Riley Gold, a company mentioned in this article.

Disclosures from Resource Maven

Companies are selected based solely on merit; fees are not paid.

The publisher, owner, writer or their affiliates may own securities of or may have participated in the financings of some or all of the companies mentioned in this publication.