- Introduction

Quebec is one of the best mining jurisdictions in the world, containing several of the largest gold trends worldwide, among those the giant Abitibi Greenstone Belt (180 million ounces [Moz] of gold production so far). When tiny junior Hawkmoon Resources (HM:CSE; 966:FSE) announced its IPO and its strategy to do exploration projects in exactly this region, I was curious to see what kind of projects it had in mind. I met CEO Branden Haynes much earlier, back in 2019, and it was already obvious he was extremely passionate about his dream to have his own exploration venture, which is something I like to see, and which we could easily discuss for hours, besides one of his other passions, which is European football, more specifically FC Barcelona and Dutch football (I am a Dutchman myself).

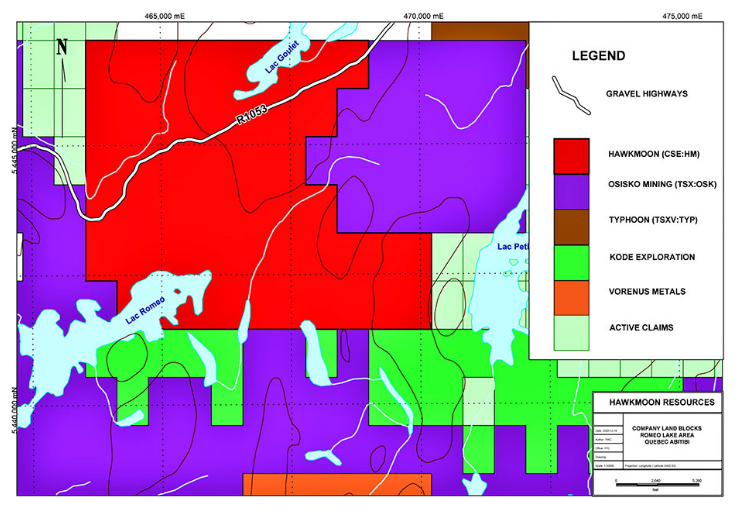

Since then we were both looking forward to the listing of Hawkmoon Resources in the summer of 2020, but it got delayed by COVID-19 unfortunately. The wait was finally over at April 19, 2021, when the common shares began trading on the Canadian Securities Exchange (CSE). The qualifying asset at the time was the Romeo gold property, but the company soon after released the acquisition of the Wilson property, and after raising another C$797k recently, exploration has commenced on both properties, with the focus clearly on the flagship Wilson property.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

- Company

Hawkmoon Resources currently has an extremely tight 45.3 million shares outstanding (fully diluted 65.16 million), 19.8 million warrants (the majority at @C$0.15 expiring in 2023) and several option series to the tune of 3.8 million options in total, the majority priced at C$0.13 and expiring from 2022 onwards. Hawkmoon Resources has a current, very tiny market capitalization of C$4.0 million based on the August 12, 2021, share price of C$0.09.

Hawkmoon Resources, 3 month timeframe (Source: tmxmoney.com)

The current cash position of Hawkmoon Resources is a healthy C$1.6 million, after raising C$797k very recently. The company raised C$321k flow-through units (C$0.10c and a full warrant), and C$475k non-flow-through units (C$0.07 and a full warrant), both warrants exercisable at C$0.17 with a exercise period of 24 months from the date of issuance. If the upcoming drill results at Wilson prove to be successful, the company is looking to raise more soon. Management and the Board hold about 16.9%, but the company also enjoys approx. 12.92% institutional ownership, for example AlphaNorth Asset Management.

- Management

CEO Branden Haynes: Venture Capital and IR specialist, guiding startups in the mining space at NOBO Capital from 2010–2018, before that working for 12 years as an investment advisor at Octagon Capital. Branden was also involved with Minefinders (MFL:TSX), which was acquired by Goldcorp Inc.

VP Exploration Thomas Clarke: professionally registered geologist (MSc), worked on gold, platinum group metals, copper and energy projects. As a director of Bonterra Resources (TSX.V:BTR), he coordinated all exploration, which led to the definition of the first NI 43-101 compliant gold resource of 1 Moz gold on the Gladiator deposit by Snowden. He has 16 years of experience as a successful geologist and has been a director of public companies continually since May of 2010.

- Projects

Hawkmoon Resources has a portfolio of three projects: Wilson, Romeo and Lava, with Wilson clearly being the flagship project.

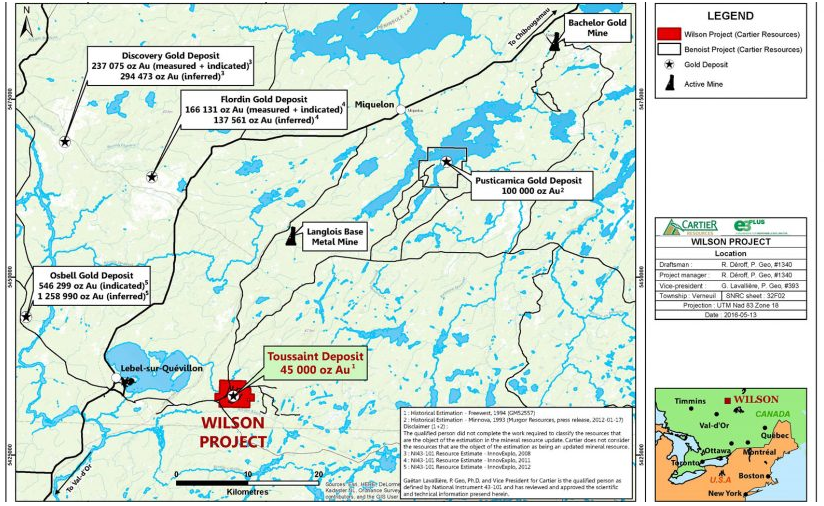

Wilson is located at the Abitibi Greenstone Belt, 150km east of Val D'Or, covers 1,660 hectares, is on trend with projects like Benoist and Moneta Porcupine West, and the company is earning into a 100% interest through a JV with Cartier Resources. The terms encompass a five-year period, 5 million shares, cash payments of C$2 million, and C$6 million in exploration expenditures (24,000 meters of drilling). Cartier will be granted a 2% net smelter return (NSR) production royalty on the Wilson property, of which half (1% NSR) is redeemable for C$4 million. There are two other small royalty holders: Viking Gold retains the following royalties NSR: i) a 0.50% NSR royalty on the Verneuil West Property, half of which (0.25% NSR) can be bought back for $250,000, and ii) a 0.35 % NSR royalty on the Verneuil Central Property, half of which (0.175% NSR) can be bought back for $175,000. Golden Tag retains a 0.15 % NSR royalty on the Verneuil Central Property, half of which (0.075% NSR) can be bought for $75,000.

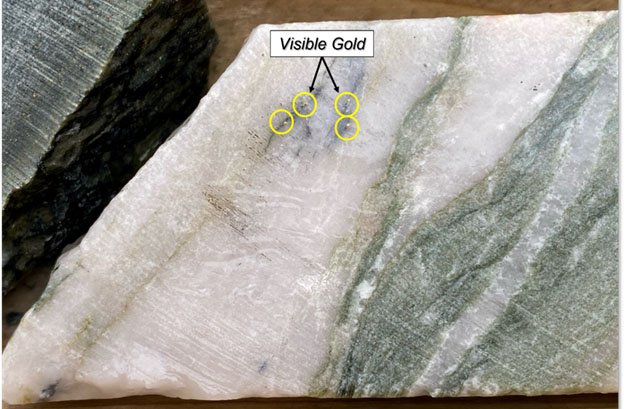

The project has already seen lots of drilling in the past under eight different operators since 1956, to be precise 133 diamond drill holes and 24,050 meters of drilling. Cartier as the last operator drilled 19 holes for 8047 meters in 2017. The focus has been on the Toussaint target, which was discovered in 1992 and sports a historical gold resource of 45 koz @ 7.1g/t Au (1994), and has seen the most drilling (60%) on the project. Highlights of other targets at Wilson are, to get an idea of property potential besides Toussaint:

- Midrim : 64.6 g/t Au over 0.4 m in drill core; 5.2 g/t Au over 4.6 m in drill core and 6.3 g/t au over 2.0 m in drill hole;

- T & M: 2.6 g/t Au over 0.5 m in drill core; 8.0 g/t Au over 0.8 m in a channel and 297.9 g/t Au in a grab sample;

- Benoist : 1.0 g/t au over 3.5 m in drill core; 2.3 g/t Au over 2.0 m in a channel and 31.3 g/t Au in a grab sample, and

- Moneta Porcupine North: 3.9 g/t Au over 2.0 m in a channel and 14.3 g/t Au in a grab sample.

When a project has seen a lot of drilling and different operators in the past, I always wonder why no previous operator succeeded, what the remaining potential could be, and what the current operator would do differently. And in this particular case what caused Cartier Resources to option it out after completing a fair bit of drilling. CEO Haynes had this to answer:

"Cartier Resources is focused on their Chimo Mine deposit. Chimo consumes the majority of Cartier's time and resources which leaves the Wilson property unworked since 2017. Hawkmoon's VP of Exploration Thomas Clarke is friends with Cartier's CEO, Philippe Cloutier, and therefore the opportunity arose for Hawkmoon to discuss an option deal with Cartier for the Wilson property."

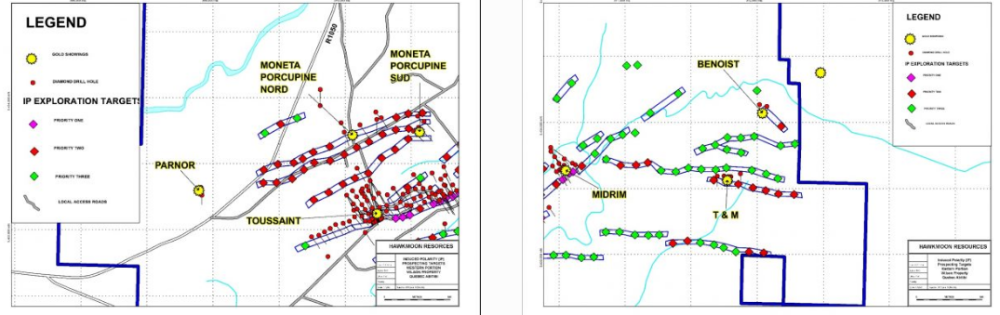

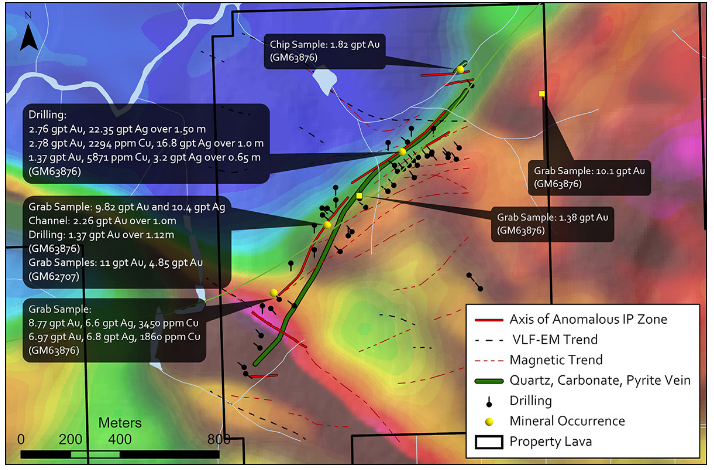

Among other things, Cartier Resources completed an IP survey, and delineated areas of moderate to high chargeability. For your information, chargeability is caused by elevated metals in the rock being surveyed. They defined a series of exploration targets that need to be followed up and examined. These anomalies are shown below in figure 6 (western portion) and figure 7 (eastern portion):

The upcoming 5,000 meter drill program at Wilson is currently in progress, and is targeting several historical drill intercepts from both the Toussaint and Midrim structures, connect the showings, drill under the trenches, seeking to extend the Toussaint showing to the west and the Midrim showing to the east and verify and expand the Moneta-Porcupine showing.

According to the news release of August 12, 2021, Hawkmoon has drilled, logged and sampled the first fourteen holes on the Wilson Gold Project so far, and seven of these initial fourteen holes have been submitted to ALS Labs in Val d'Or for fire assay. Holes 15 to 18 have been logged at the property and will be sent to Val d'Or to be cut and sampled. Hawkmoon is currently drilling hole HMW21-19 and anticipates drilling a total of 28 holes on Wilson. The company anticipates to complete the drill program at Midrim by the end of August, and depending on the turnaround time at the lab, assays should be coming in after Labor Day (first Monday of September, in this case September 6, 2021).

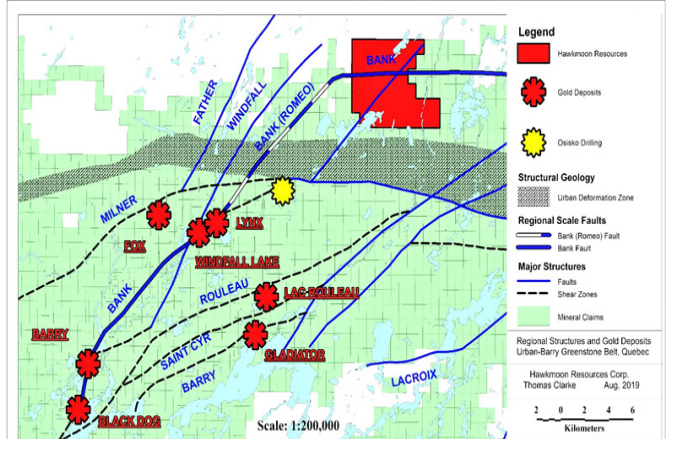

The second most important project is the Romeo project, which is optioned from North American Exploration, for a 100% earn in. The terms include a three-year earn in period, a C$150k cash payment, the issuing of 1.5 million shares, and C$1 million exploration expenditures. This project is also located in the Abitibi Greenstone Belt in Quebec, but this time in the Urban Barry Belt. Well-known deposits over there are Windfall (Osisko), Gladiator (Bonterra) and Barry (also Bonterra). The property covers 2,984 hectares, and is located close to the Windfall deposit of Osisko Mining.

Hawkmoon Resources already conducted a local electromagnetic and total magnetic survey in 2019, and followed up with a soil sampling and channel sampling program in 2020.

Soil sampling at Romeo project, Quebec

The 2021 exploration program will focus on the area where the company discovered a series of five parallel shear zones in August of 2020. The southernmost of these shears, the Forty-Foot shear, appears to be a possible surficial expression of the regional scale Bank Fault identified by Osisko Mining on its neighboring Windfall property.

Management is focusing on the area between the Forty-Foot shear and the property boundary to the south. The current program will include outcrop clearing, trenching and sampling in this prospective area of Romeo, and the company also intends to explore an outcrop just east of Romeo that appears to be prospective.

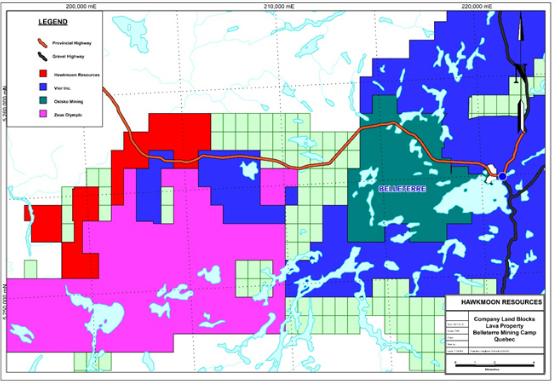

The third project is the recently acquired Lava property, also in Quebec. Hawkmoon has the option to acquire 100% of the property from Breakaway Exploration. The company has the exclusive option to earn a 100% interest in Lava by paying C$115k in cash, issuing 1.32 million shares and completing C$500k of work expenditures over a period of three years. The vendors will retain a 3% net smelter return royalty. One percent of the NSR may be purchased by Hawkmoon for C$1 million.

Lava consists of 2,061 hectares, and is located closely to the Belleterre project, focused on exploration around the historical Belleterre Mine, done by VIOR (VIO.V).

The property has seen exploration in the past; historical results look like this, with most results occurring along a south-west to north-east trending corridor, called the Lavallée Shear Zone or LSZ:

The project will see more targeted sampling and 1,000m of drilling in November 2021, as a consequence of management being able to charter the drillers doing Wilson at a very cheap rate (C$100/m all in) for Lava in that period. The company is looking to reinterpret previous work on the property. This includes 2D inversion studies on the 2007 induced polarization and resistivity data and 3D modelling of historical diamond drilling. Management intends to conduct a trenching and rock sampling program to develop drill targets at the LSZ.

- Key points

- Management recently raised C$797k, and is well financed to do exploration on all three projects, which are all at very interesting locations, often on trend with known deposits

- Quebec is one of the busiest jurisdictions for mining and exploration, and also has seen one of the largest gold productions worldwide, and still has numerous operating mines, lots of development projects and exploration

- Drilling on the flagship Wilson project has commenced, sampling, etc. at Romeo has already started. Results are expected in 3–4 weeks.

- Hawkmoon is looking to expand on earlier exploration work done by Cartier and others on the Wilson property, with lots of targets to follow up

- Romeo and Lava could provide two more chances on exploration success in 2021

With a super tiny C$4.0 million market cap, any drilling success at Wilson could potentially propel Hawkmoon Resources to (much) higher levels in my view, and Romeo and Lava exploration could return interesting results as well. Stay tuned!

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]

Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Hawkmoon Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.hawkmoonresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.