British Columbia-based uranium explorer and developer Azarga Uranium Corp. (AZZ:TSX; AZZUF:OTCQB), announced in a news release that "it has filed its National Instrument 43-101 (NI 43-101) independent technical report and preliminary economic assessment (PEA) on its Gas Hills In-Situ Recovery Uranium project in Wyoming, U.S., following the company's press release dated June 29, 2021."

Azarga Uranium stated that it is now concentrating its collective efforts on growing the ISR-amenable resources at the Gas Hills Project and moving forward to the final stages of the permitting process.

The company indicated that the Gas Hill PEA calls for a total of 6.5 million pounds of U3O8 production over the course of 7 years with production being spread out fairly evenly at a rate of about 1.0 million pounds annually.

The PEA forecasts that the initial capital expenditures required for the Gas Hills ISR Project will total around US$26.0 million. The project is expected to be cash flow positive in the 1st year of production coming just two years following the start of construction.

The project's base case outlined in the PEA utilized an 8% discount rate resulting in an estimated pre-income tax net present value (NPV) of US$120.9 million and an after-income tax NPV of US$102.6 million. Over the 7-year production life, the project is expected to provide a pre-income tax internal rate of return (IRR) of 116% and a post-income tax IRR of 101%.

The company listed that the calculations used in the PEA consider a base uranium price of US$55 per pound. The report estimates that direct cash operating costs are expected to be US$11.52 per pound and that the combined total pre-income tax cost of uranium production is estimated to be US$28.20 per pound of production.

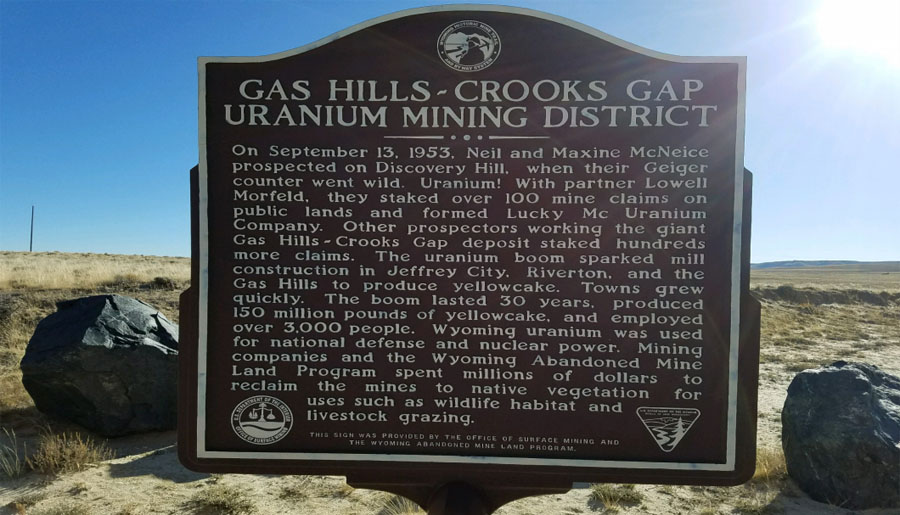

Azarga Uranium advised that historically numerous companies have explored and produced uranium in the Gas Hills area including on those lands that the company now controls. The company wrote that five uranium mills have been operated in or near the district and were fed by ore mined from the Gas Hills district. The firm noted that to date, greater than 100 million pounds of uranium have been produced from the Gas Hills district with the majority of it coming from open-pit mining, with a lesser portion coming from underground and ISR mining methods.

The company mentioned that both the NI 43-101 compliant technical report and PEA have each been filed and are available for inspection and review on both SEDAR and Azarga Uranium's website.

Azarga is a U.S.-focused uranium exploration and development firm that oversees 10 uranium projects and prospects in Colorado, South Dakota, Utah and Wyoming. The company concentrates its work on in-situ recovery uranium projects. The firm advised that its main objective is developing the South Dakota Dewey Burdock ISR uranium project. Azarga mentioned that it previously received the licenses and permits needed from the Nuclear Regulatory Commission and the Environmental Protection Agency and is now diligently working on securing additional permits needed to begin construction at the property.

[NLINSERT]

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Azarga Uranium Corp. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.