Maurice Jackson: Joining us for a conversation is David Cole, the CEO of EMX Royalty Corp. (EMX:TSX.V; EMX:NYSE.American), the royalty generator. Honored to have you with us today, sir, as you have some breaking news for shareholders. EMX Royalty has just consummated a watershed moment with the announcement of the royalty portfolio purchase agreement with SSR Mining Inc. (SSRM:NASDAQ) (press release). Mr. Cole, thank you for allowing me to be the first to say congratulations on a significant milestone, on what may be the biggest company event in the history of EMX Royalty.

David Cole: We are very pleased with this transaction, pleased to have SSR Mining as a shareholder in the company, and it's been a pleasure to work with them.

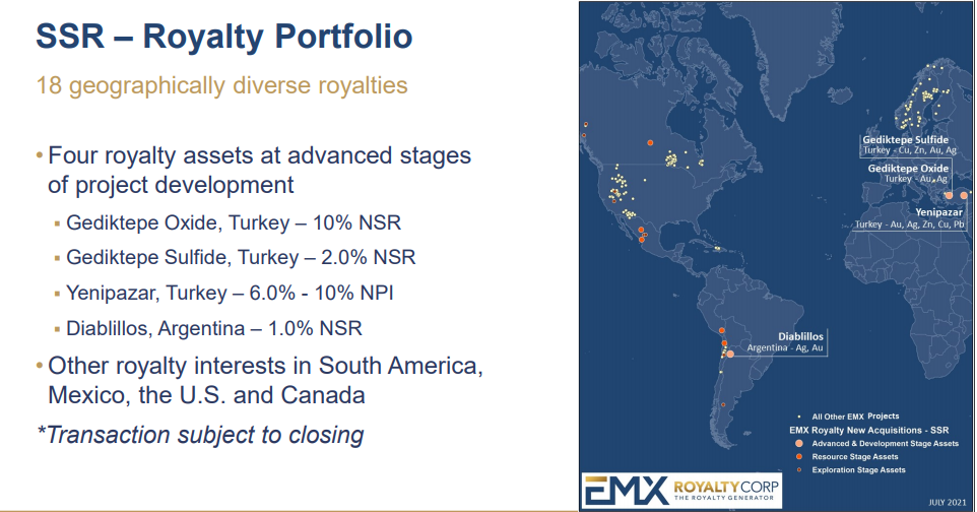

Maurice Jackson: Let's get right into the press release. The EMX Royalty acquisition consists of 18 geographically diverse royalties with four royalty assets at advanced stages of project development. Please provide us with the details of the royalty purchase agreement with SSR Mining.

David Cole: Well, we're paying $66 million upfront for this portfolio, $33 million in share capital and $33 million in cash, which are deferred payments depending upon the performance of the Yenipazar net profit interest royalty in Turkey. Those deferred payments accumulate up to $34 million, but that's not until that asset cash flows $20 million. We're pleased with respect to how this is designed. This gives SSR Mining a nice chunk of equity in EMX, which is one of the key things that they were looking for when they chose us to sell the royalty portfolio.

Maurice Jackson: What type of value creation will EMX derive from this transaction, and how will it impact the synergies with the existing EMX initiatives around the world?

David Cole: One of the key things here is immediate large cash flow. The Gediktepe mine, which is at the final stages of production and should be in production within a month or two, has a high-grade oxide cap that's gold enriched with a 10% NSR (net smelter return) and we'll see immediate gold royalty income over double-digit millions of dollars per annum from that royalty right out of the gate. We're very, very pleased with that.

This really propels the top of our pyramid forward, which is something that we've been working on for some time, as we've discussed previously with respect to synergies with our existing portfolio. One of the reasons why we were able to grab this is because of our relationships in Turkey and our comfort with Lydian International Ltd. (LYD:TSX) as an operator there. And that gave us an edge with respect to working with SSR to accomplish this deal.

Maurice Jackson: One of the key aspects of this transaction along with all of EMX Royalties is something you've covered with us and that is the value proposition of embedded optionality, which is just icing on the cake for each of your royalty properties. Can you please elaborate on the virtues of embedded optionality within royalties?

David Cole: It's one of my favorite topics, and it's the reason why royalties trade at such premium valuations—because of all the embedded optionality, commodity price optionality, discovery optionality, engineering advancement optionality, etc. And mining districts have a history of giving and giving, and it's always to the benefit of the royalty holder and at no cost to the royalty holder. So that's why royalties are so dear.

I will point out that royalty companies that have large numbers of royalties trade at a much higher valuation per royalty than royalty companies with a lower number of royalties. This is a phenomenon that's existed in the royalty sector now for some time—where the portfolio effect impacts the overall valuation of that portfolio, and that's because of this multiplicative optionality of the entire portfolio. You never know where the big success is going to come from years out.

As you know, our goal here is to continue to grow this portfolio through organic methods, which we're good at and have had a track record for 18 years of doing, but also through acquisition. And we've been challenged, quite honestly, to accomplish big, creative acquisitions because it's a competitive space. We've been very patient. We stood at the plate, and they kept throwing more pitches at us and we found one to hit and hit it out of the park.

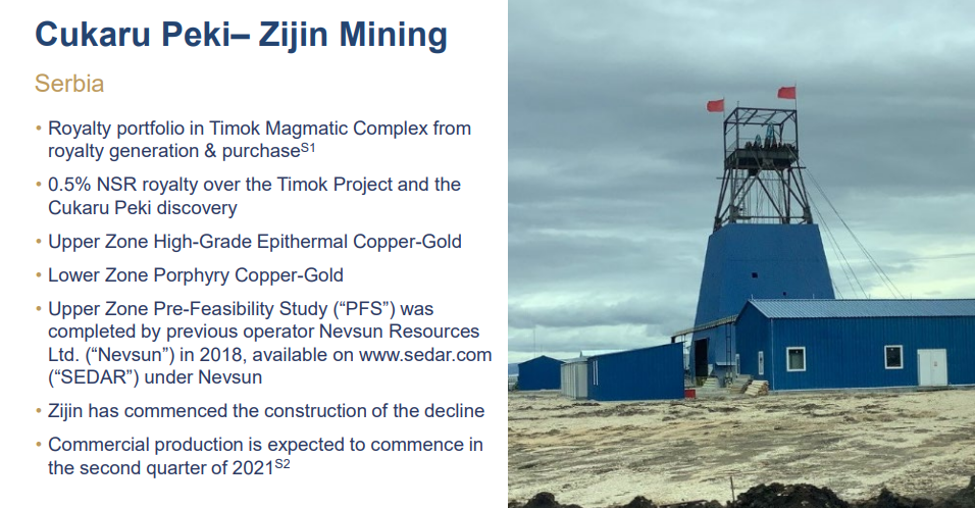

Maurice Jackson: Great way to put it, sir. I referenced a watershed moment. Where does today's press release rank with relation to the Malmyzh and/or the Timok?

David Cole: Well, that's interesting. Certainly the value proposition of the Timok acquisition is unbeatable because we paid CA$200,000 for a royalty that's going to pay hundreds of millions. So that one's astonishing, but that had to do with the fact that we were in that district and understood what was going on there very early in the history of the discovery and were able to acquire that royalty early on thanks to our geologic understanding of the region. That's a tough one to compare.

With respect to the Malmyzh transaction, that was a fantastic deal that cashed-up EMX and put us in a position where we could do this deal.

Step by step we're building this company. [We are] very pleased with these transactions. Malmyzh was super accretive for us. As you know, we booked US$67 million out of that deal and have put those monies to excellent work. This being the top example.

You and other folks have asked me many, many, many times, "What are you going to do with the money, Dave, what are you going to do with the money?" We just kept looking and turning down opportunities and losing sales processes, because our bids weren't as high as our competitors, until the right one came along. One of the key aspects that made this deal happen, as I mentioned, is the fact that SSR specifically wants to be a shareholder in EMX. And I've said before that the right transaction that'll really advance this company is going to be one where the major companies selling their royalties understand the value proposition that EMX offers and want to be a contributor, want to be a member of the team.

Maurice Jackson: Speaking of the Timok, which is a company-making event in and of itself, what are the latest developments there?

David Cole: It's going into production. I do believe that they had a couple of delays. So they were originally talking about an opening ceremony in June. I believe that's been pushed back to August at this point, maybe September, but that's still ahead of the original schedule. The Chinese have been very aggressive. It's advancing into production.

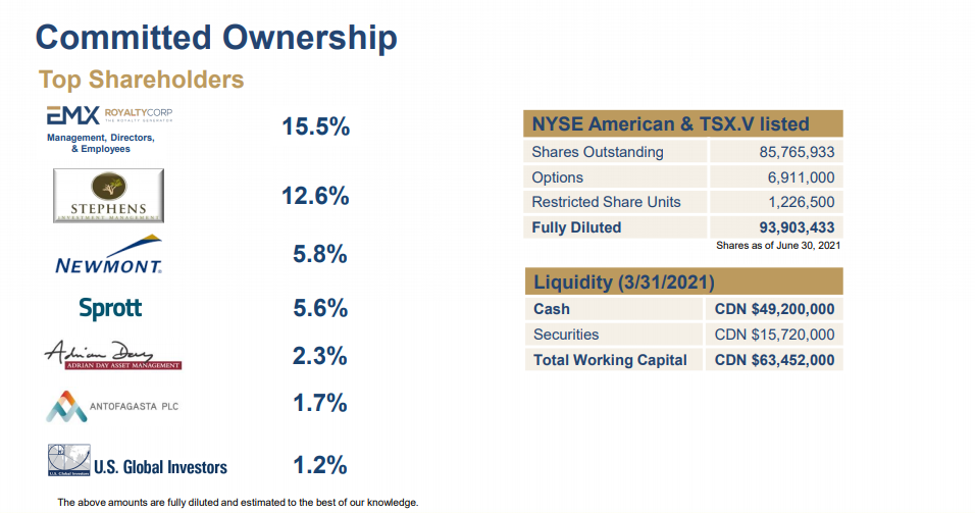

Maurice Jackson: Leaving the property bank, Mr. Cole, please provide us with the capital structure for EMX royalty.

David Cole: Well, we're sitting here today with 84 million shares issued and outstanding, and a few over 90 million shares fully diluted. That's not including the shares that we will issue to SSR, which on a pro forma basis will be approximately 12% of the company. So that'll push us up toward 95 million issued and outstanding, and over 100 million fully diluted at the completion of this transaction, which should hopefully occur within four to five weeks, in my opinion. Sitting here today with about US$30 million in cash. Of course, those monies get paid to SSR as part of this transaction as well.

We have about $20 million in tradable securities and long-term investments in our portfolio as well, and no debt at this time. However, we will be taking on a small, $10 million debt from Sprott. We appreciate their support as a capital partner for EMX. They've helped us out in the past as well. That puts us in a situation where, even though we're putting out US$33 million to SSR for this transaction, thanks to Sprott we'll still have a nice cushion here with respect to money in the treasury, to continually advance our organic growth, which is our number one job, as you know.

Maurice Jackson: Just for the record, ladies and gentlemen, I plan to match my bullion purchases with shares and EMX Royalty. I believe the company has the potential to melt up. And I'm talking about the stock price of course. The stock price, in my opinion, is at a fire sale. And that is Maurice Jackson's opinion, but not really just my opinion. Mr. Cole, you and I both know some of the most prominent names in the natural resource space. They share the same sentiment about EMX Royalty.

David Cole: Happy to have those guys on as contributors.

Maurice Jackson: Yes, sir. In closing, what would you like to say to shareholders?

David Cole: EMX Royalty is in a situation here today with a 4% royalty on the Bayla lead, zinc, silver mine in Turkey that is coming into production. Zijin Mining Group Co. Ltd. is advancing the teamwork project and in production.

And we have an immense amount of optionality within our pyramid that is bubbling up toward the top. And these names I'm throwing out are just examples of that. We've talked about the potential for this to become a cash cow over time. We've just poured fuel on the fire. We put gasoline on the fire here with this one, and the Gediktepe 10% NSR, and the oxide gold cap will just propel our gold income in the company here, substantially, over the next three years. We're very excited.

Maurice Jackson: Mr. Cole, for readers that want to get more information about EMX Royalty, please share the website address.

David Cole: www.emxroyalty.com. The contact details for myself, Scott Close and Isabel Belger, managing European investor relations, and Scott here in North America, are embedded in the website and on the press release. Feel free to reach out to us.

Maurice Jackson: Mr. Cole, it's been a pleasure speaking with you. Wishing you and EMX Royalty the absolute best, sir.

David Cole: Thank you, Maurice. Always appreciate your support.

Maurice: And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at (855) 505-1900 or you may email Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: EMX Royalty. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: EMX Royalty is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of EMX Royalty, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.