After the nice batch of results released at the end of May, beautifully complementing the first sets of strong intercepts, Kenorland Minerals Ltd. (KLD:TSX.V; 3WQO.FSE) was hoping to find more of the same when targeting the more southern parts of the discovered Regnault structure, potentially growing this into a district scale discovery. The final drill results from the 8,59-meter (m) diamond drill program, being the remaining 15 holes (5,104m) were not of this high standard unfortunately, but for a greenfield exploration venture this project has already been a resounding success, with most holes hitting mineralization. The share price reacted substantially to the May results, which included the impressive 5.72m @ 90.56 g/t Au (incl. 3.89m at 132.57 g/t Au) intercept, as can be seen here:

Share price 6 month period; Source: tmxmoney.com

Unfortunately the price of gold dropped from US$1900/oz to US$1750/oz during June, and this affected almost every gold related stock including Kenorland Minerals, giving back most of the gains. The positive here is that this last news didn't have much of an effect as the stock sold off already, and general sentiment is somewhat subdued anyway, and investors are looking forward to a further from COVID-19 recovering world economy, potentially increasing inflation, which in turn could devalue the U.S. dollar, which in turn could increase metal prices in general, and in particular the price of gold, of course.

Let's see what the last drill result meant for the potential of Regnault, what CEO Zach Flood had to say about it, and what further activities the company is involved in at the moment.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

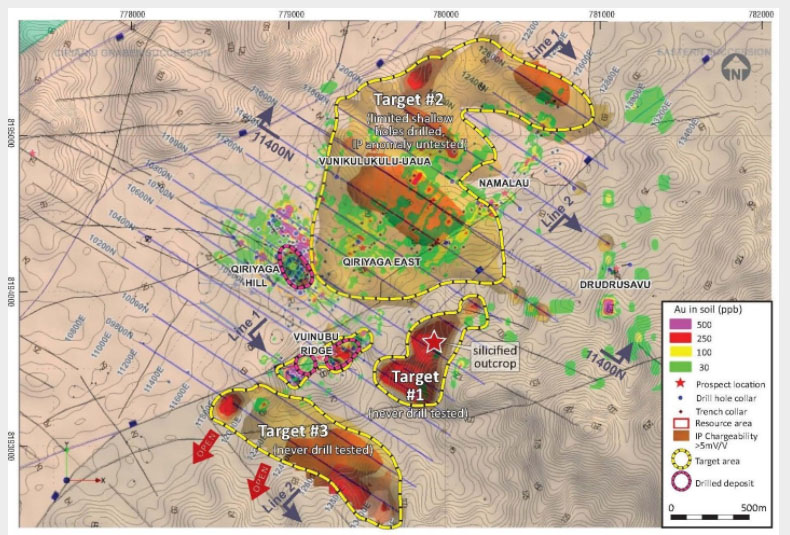

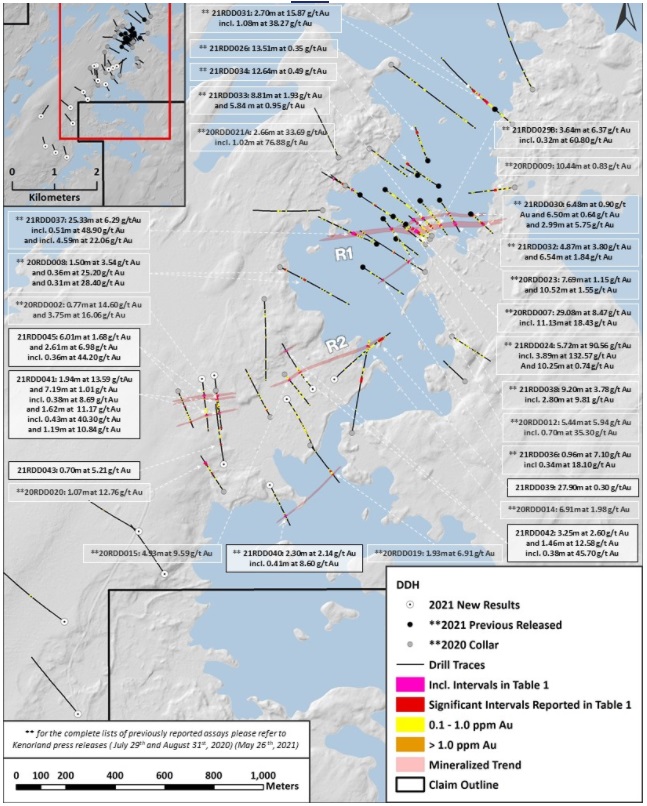

Kenorland management had two goals in mind with the last 15 holes of the now completed drill program. Seven of these holes were targeting the R2 structure, which can be interpreted as a somewhat offset mineralized zone 500 meters southwest of the already established R1 structure:

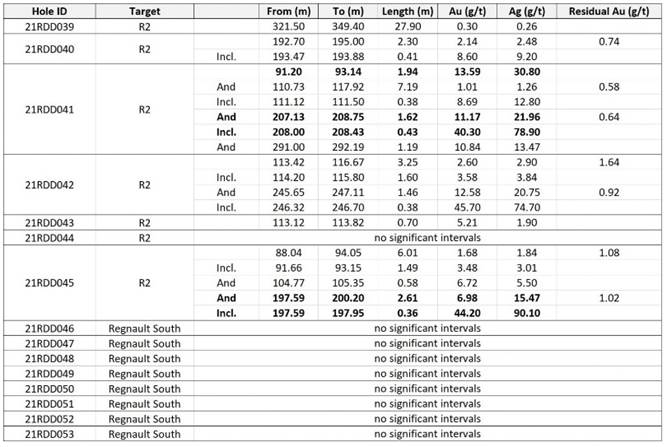

As can be seen, this part was successful. The assay results are probably hard to decipher from this map, here is the following table with all results clearly readable:

As the best result in this last batch was hole 21RDD0041 including a few narrow high grade intercepts varying almost 100m in depth along the core, it is obvious these results, although economic, didn't resemble the wider intercepts from the 15 hole batch before this one, with these highlights as a reminder:

- 21RDD024: 5.72m at 90.56 g/t Au incl. 3.89m at 132.57 g/t Au

- 21RDD029B: 3.64m at 6.37 g/t Au incl. 0.32m at 60.80 g/t Au

- 21RDD031: 2.70m at 15.87 g/t Au incl. 1.08m at 38.27 g/t Au

- 21RDD037: 25.33m at 6.29 g/t Au incl. 0.51m at 48.90 g/t Au and incl. 4.59m at 22.06 g/t Au

- 21RDD038: 9.20m at 3.78 g/t Au incl. 2.80m at 9.81 g/t Au

For illustration purposes, here are some pictures of high grade samples and drill cores:

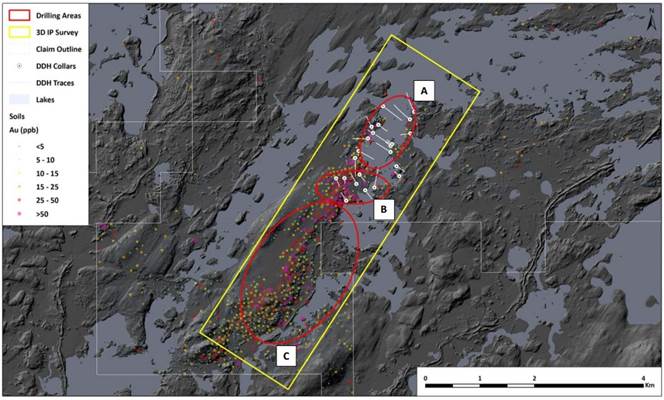

It was a bit of a disappointment regarding the second part of the last batch, to see the last eight holes, testing regional targets outside the Regnault discovery zone and to the south, were not able to deliver any mineralization. These targets were located in Zone C:

Solid hits in Zone C clearly had the potential to double the mineralized zone delineated by Zones A and B, but unfortunately this didn't pan out into a reality. According to CEO Zach Flood, they will test other targets in zone C as some of the geochemical anomalies, including gold bearing boulders, have not been explained and the first pass was a very limited test. Despite the encouraging soil sampling programs, it is absolutely not a guarantee to hit mineralization with the drill bit, as I have seen this many times before. Promising geophysical surveys, sampling and mapping can only enhance chances on actual mineralization. This is confirmed by Flood, he told me when for example all these reconnaissance methods deliver positive outcomes, in his experience the actual success with drilling varies dramatically.

Notwithstanding this, Flood was happy about what they encountered at Zone B:

"We're thrilled to announce the remaining results from the winter drill program at Regnault. This concludes another successful exploration campaign at the Frotet Project, which we are advancing with our joint venture partner, Sumitomo Metal Mining. These results demonstrate an additional continuous structure (R2) of high-grade gold mineralization, over 500m to the south of R1, highlighting the potential for additional parallel mineralized structures within the area. We're very excited to begin drilling again in mid-July with a planned program consisting of up to 20,000m of drilling at Regnault, along with a significant amount of follow-up exploration on other regional targets within the Frotet Project."

The step-outs from this program increased the strike length of the R1 structure, and delineated the R2 structure, both of which remain open to the east, west and down dip. While R1 and R2 trend in a general east-west direction, they occur within a general two kilometer north-northeast trend where significant gold has been intersected in drilling. According to management this indicates potential for further off-setting mineralized structures, parallel to the R1 and R2 structures.

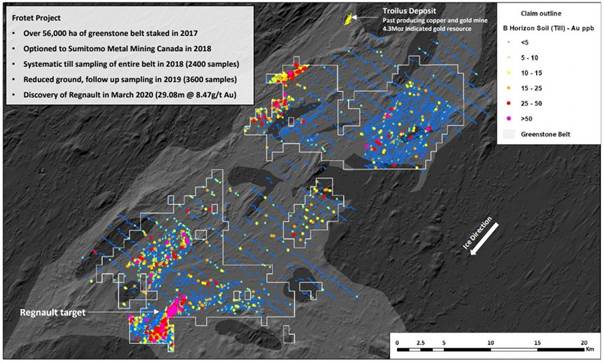

The next phase of exploration begins in mid-July, where the JV is planning up to 20,000m of additional drilling at Regnault as well as further regional exploration within the Frotet Project. This is substantial, as 16,413m of drilling has been completed at Regnault so far. Sumitomo must like what they see over there. The upcoming drill program will primarily focus on infill and step-outs along the R1 structure. A significant number of meters will also be allocated towards continued testing along the R2 structure and follow-up on additional zones of mineralization encountered throughout the Regnault trend. As can be seen below, the Frotet project contains many more target zones:

As a reminder, the Frotet project is located adjacent to the Troilus deposit (7.06Moz Au Indicated and Inferred, owned by Troilus Gold), and Japanese mining giant Sumitomo recently formed the 80/20 JV with Kenorland (which continues as the operator), meaning pro rata funding begins from this point onwards and any party diluted below a 10% interest will convert their interest to a 2% uncapped net smelter royalty. Management has characterized the mineralization as narrow high grade veins, meaning a potential resource will be an underground operation.

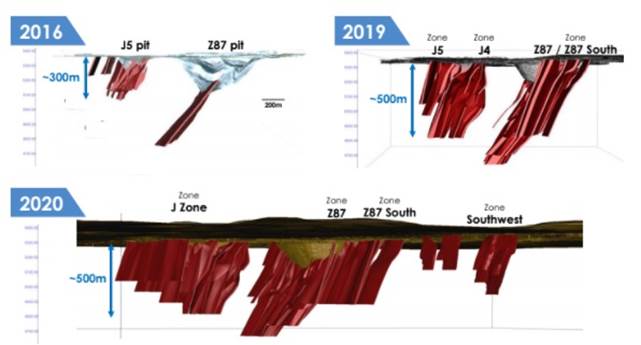

I wondered if the company already had enough drilling data to set up 3D visualizations, indicating lenses or curtain like mineralized envelopes, like the nearby and analogous Troilus Gold deposit:

I also asked Flood if the Troilus-like disseminated bulk-tonnage lower grade mineralization still is a concept they are investigating, besides the high grade veins. He answered that it is still very early days, and there is not enough drilling to create a geologic model, however after the next phase, this will change. The lower grade, bulk tonnage target is valid and will be pursued, as they have encountered broad zones of disseminated mineralization, with no apparent relation to structure.

On a side note, the 3D IP [induced polarization] survey has been completed, and I wondered if there would come a separate news release with nice graphics, and if the survey was done on regions A and B as well, as I always like to compare IP data with actual drill results. Flood answered that the IP has been a useful tool for initially locating mineralization, however now that they are undertaking closer spaced drilling along narrow veins, the geologic and structural model will guide the exploration, rather than geophysics.

On a closing note, the current status on Kenorland's other, much larger but also much more early stage exploration projects, the Tanacross, Healy, Chicobi and Chebistuan projects is as follows according to Flood: "Mapping, geochemistry, geophysics has been completed at Tanacross, drill targets have been defined, but it is likely there will be no drilling this year yet.

Tanacross Project; surface exploration

"We have commenced a 4,000m diamond drill program on the Healy project for 2021, and will target the strongest chargeability anomalies associated with faults and coincident gold in soil anomalies. Drill results from Healy are expected towards the end of this summer.

Healy Project; drilling

"The planned drill holes will closely follow IP lines, which in turn followed the soil anomalies. Kenorland Minerals is also conducting a soil sampling program at Chebistuan Project in Quebec. Besides this, we will have an update on Chicobi within the next month, and we will likely have a budget a plan set with Sumitomo by then. There is a good target for follow up which we will likely be advancing towards initial drill stage. Results are pending and there will potentially be additional work programs on Chebistuan and Chicobi if results warrant."

Lastly, the company disclosed on July 8, 2021 that it had sold the Fox River nickel property to Superior Nickel, a private company, for 2.66 million shares of Superior and a 2% net smelter return royalty.

Conclusion

As Regnault is greenfields exploration, you never know what the drill bit intercepts, no matter how promising the data of reconnaissance exploration (geophysics, sampling) are, and in this case it meant that besides successful drilling in Zones A and B, drilling in Zone C wasn't successful, confining the overall mineralized trend to a still impressive 2.5km instead of 5km. There are many more targets to be explored in the region, and Zone A and B deserve much more infill drilling, as a geological concept akin to nearby Troilus could provide a significant resource for sure. Besides Regnault, Kenorland has started exploration on four other projects, and results are expected soon, altogether making it one of the more interesting hybrid prospect generators out there.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Kenorland Minerals and Troilus Gold. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kenorland Minerals and Troilus Gold, companies mentioned in this article.

Charts and graphics provided by the author.