Successful companies set goals and reach them. For Quebec Precious Metals Corporation (QPM:TSX.V), the next goal is 2 million ounces (2 Moz).

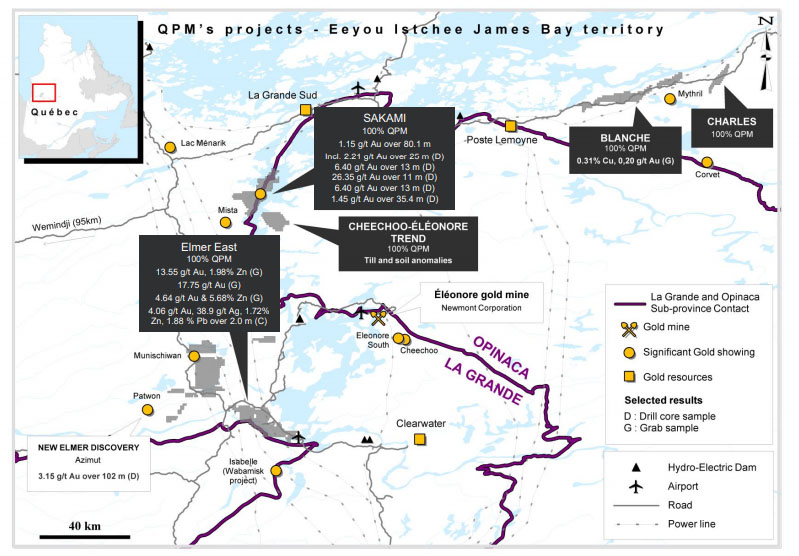

As part of that goal, the junior gold explorer is drilling 14,000 meters into La Pointe and La Pointe Extension, growing gold deposits within its 100%-owned Sakami gold project in Québec's Eeyou Istchee James Bay territory, about 600 km north of Val d'Or, Que.

QPM's summer drill results, in combination with results from previous drilling, will be used to build an initial NI 43-101-compliant mineral resource estimate for Sakami.

Assay results from its 14,000-meter summer drill program should start to reach the market in September, with the preparation of a resource estimate to follow.

"Our goal is two million ounces. That's the threshold. You need to have a deposit of sufficient size and quality to be attractive for a company to come in and develop it," says QPM's CEO, Norman Champigny.

In early June, QPM announced that two holes from winter drilling on the La Pointe Extension intersected mineralization over reasonably wide intervals. Hole PT-21-177 hit 1.83 grams gold per tonne (1.83 g/t gold) over 58.6 meters, including 2.40 g/t gold over 30.9 meters.

About 200 meters northeast, drill hole PT-21-182 assayed 2.15 g/t gold over 42.2 meters, including a sweet spot grading 5.17 g/t gold over 14.5 meters. The mineralization remains open at depth.

In total, three holes from the winter program reported intervals greater than 10 g/t gold over at least 1 meter.

The company is doing some preliminary metallurgical testing on samples taken from the La Pointe Extension.

"The results have been quite encouraging using conventional techniques. You should expect those results to be released over the next few months," says Champigny.

The La Pointe Extension deposit was discovered in April 2020. The junior explorer was drilling step-out holes about 2 km southwest of the La Pointe deposit when it hit 80.1 meters of 1.15 g/t gold, including 2.21 g/t gold over 25 meters.

At the time Champigny called it "the most significant development on the project since the creation of the company."

QPM was formed in June 2018 when Canada Strategic Metals merged with Matamec Explorations. The goal was to form a pure gold exploration company.

"The focus is gold. The focus is James Bay. It's to find a mine there," says Champigny.

Infrastructure in northern Québec is well established: paved roads, powerlines that distribute cheap electricity across eastern North America, three separate agreements with the Cree First Nation that outline the framework for business relationships, 37.5 cents of every hard cash exploration dollar spent comes back to QPM in the form of a tax credit, and an online geological database that has logged historical core from projects across the province (the database was used to build an exploration program that led to the discovery of the vast Malartic open-pit gold mine).

QPM decided to focus on Quebec's Eeyou Istchee James Bay territory largely because several large gold discoveries have been made there over the previous 15 years or so, not the least of which was Newmont Corp.'s (NMC-TSX; NMC-NYSE) Éléonore underground gold mine.

Éléonore was discovered by Virginia Gold Mines in 2004 and the plucky junior drilled more than 200 holes on the project before Goldcorp paid US$425 million for it in 2006. Éléonore reached commercial production in 2014 and will produce about 246,000 ounces of gold this year and similar amounts are projected for many years to come.

QPM added to its Sakami gold holdings in the James Bay area by acquiring several gold properties from Sphinx Resources (SFX-TSX.V), including its 50% stake in the Cheechoo-Éléonore Trend project, as well as the remaining 50% held by Sirios Resources (SOI-TSX.V). QPM now holds 1,093 sq. km in the area.

Goldcorp, before it was acquired by Newmont in January 2019, hopped on board in 2018 with C$3.7 million for a stake in the freshly minted QPM. Newmont has since participated in further financings and owns about 13%.

Québec-government backed Caisse de dépôt et placement du Québec bought in at the same time, at the same terms as Goldcorp. It and other Québec institutions own about 12%. QPM management owns about 6%.

"We've been trying to increase our ownership. We've been active in the market and participated in every financing, " says QPM President Jean-François Meilleur. "We are aligned with shareholders and committed to develop the company, all the shares we own were acquired through the market or private placement; there was no free lunch."

Meilleur, who came to the company from a financial background, says the company has a solid capital structure with about 82 million shares outstanding and no warrants. QPM's current drill program is fully funded, and the company has around C$4 million in the bank.

The junior plans to fund further exploration and most of its mineral resource estimate work by selling non-core assets.

When Canada Strategic Metals merged with Matamec it owned a 20% interest in the La Loutre graphite project, 120 km northwest of Montreal (since sold), as well as stakes in other projects. Matamec, meanwhile, had two gold projects not far from Newmont's Hoyle Pond gold mine near Timmins, Ont.

Matamec held still more projects, including the Vulcain nickel project (since optioned to Fjordland Exploration (FEX:TSX.V) for $50,000 and 1 million shares) and a 68% interest in the advanced-stage Kipawa rare earth elements joint venture.

Champigny believes QPM's 68% stake in Kipawa is worth between C$8 and C$10 million. He says the sale should be complete by the end of the summer.

QPM is also seeking buyers for its gold property in Ontario. All proceeds will be funneled directly to exploration. Management knows it needs to keep drilling to unlock shareholder value.

"The gold mineralized structure is 13 km long and we keep coming up with large gold-bearing thicknesses in drill holes. So that's very encouraging. We have the tail of something even bigger, we don't know what, but tour plan is to keep drilling to find out how many millions of ounces this deposit can hold," says Meilleur.

Add another goal to the list.

[NLINSERT]

Disclosure:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Quebec Precious Metals Corporation. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Quebec Precious Metals Corporation, a company mentioned in this article.