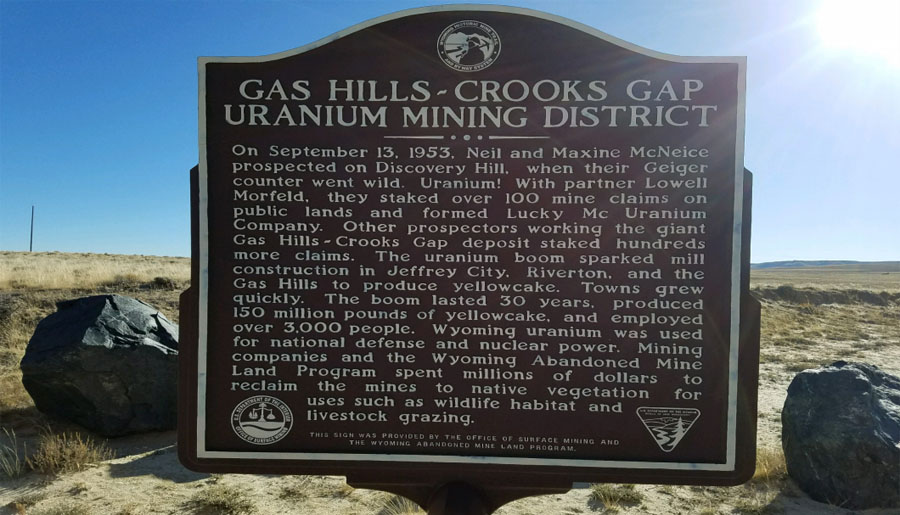

In a June 30 research note, analyst Mitch Vanderydt reported that Eight Capital increased its target price on Azarga Uranium Corp. (AZZ:TSX; AZZUF:OTCQB) to CA$0.50 per share from CA$0.45 after including the results of the Gas Hills preliminary economic assessment (PEA) in its model on the company. Azarga's share price today is about CA$0.23.

Vanderydt discussed how the PEA links Azarga's Gas Hills and Dewey Burdock in-situ recovery (ISR) projects, treating the former as a satellite of the latter, and why this matters.

First, the PEA has uranium ISR feed, which is mined at Gas Hills in Wyoming, being trucked to Dewey Burdock in South Dakota for processing. Doing this would double annual U3O8 production at Dewey Burdock, taking it to 2 million pounds, Vanderydt noted.

Second, the PEA's "combining" Gas Hills and Dewey Burdock versus keeping Gas Hills an independent secondary project benefits Azarga, Vanderydt highlighted. Instead of Gas Hills getting discounted by investors, which usually happens with secondary projects, it should boost Azarga's stock price given its strong economics. Those Gas Hills economics, according to the PEA, include an after-tax net present value at an 8% discount of US$102.6 million, or US$55 per U3O8 pound. Forecast capex is US$26 million.

To process Gas Hills' feed, Dewey Burdock's plant would need enlarging, to the tune of US$15 million–$20 million, Vanderydt indicated.

That being the case, Azarga's plan is to build Dewey Burdock once it receives a mine permit from South Dakota, the last permit it needs. Azarga could have it in hand as early as the end of this year, Eight Capital purports.

Receipt of this permit could "re-rate the stock and possibly lead to Azarga being taken out by the operators of the neighbouring ISR plants, namely Cameco, Energy Fuels, Peninsula Energy, Uranium 1 or URE," Vanderydt wrote.

Once Dewey Burdock construction is completed, Azarga would bring the project online, around late 2022 or early 2023. Then, roughly three years after the operation start, Eight Capital estimates, the uranium miner would pursue getting the necessary permits amended to allow for a plant expansion.

"This would free up additional plant capacity for [Gas Hills] to be developed," Vanderydt wrote.

Eight Capital has a Buy rating on Azarga Uranium.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Azarga Uranium. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Azarga Uranium, a company mentioned in this article.

Disclosures from Eight Capital, Azarga Uranium Corp., June 30, 2021

Conflicts of Interest: Eight Capital has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research and other businesses. The compensation of each Research Analyst/Associate involved in the preparation of this research report is based competitively upon several criteria, including performance assessment criteria, the quality of research and the value of the services they provide to clients of Eight Capital. The Research Analyst compensation pool includes revenues from several sources, including sales, trading and investment banking. Research analysts and associates do not receive compensation based upon revenues from specific investment banking transactions.

Eight Capital generally restricts any research analyst/associate and any member of his or her household from executing trades in the securities of a company that such research analyst covers, with limited exception.

Research Analyst Certification

Each Research Analyst and/or Associate who is involved in the preparation of this research report hereby certifies that:

• the views and recommendations expressed herein accurately reflect his/her personal views about any and all of the securities or issuers that are the subject matter of this research report;

• his/her compensation is not and will not be directly related to the specific recommendations or views expressed by the Research Analyst in this research report;

• they have not affected a trade in a security of any class of the issuer whether directly or indirectly through derivatives within the 30-day period prior to the publication of this research report;

• they have not distributed or discussed this Research Report to/with the issuer, investment banking at Eight Capital or any other third party except for the sole purpose of verifying factual information; and

• they are unaware of any other potential conflicts of interest.

The Research Analyst involved in the preparation of this research report does not have any authority whatsoever (actual, implied or apparent) to act on behalf of any issuer mentioned in this research report.

IIROC Rule 3400 Disclosures: A link (here) is provided in all research reports delivered by electronic means to disclosures required under IIROC Rule 3400, including disclosures for sector research reports covering six or more issuers.