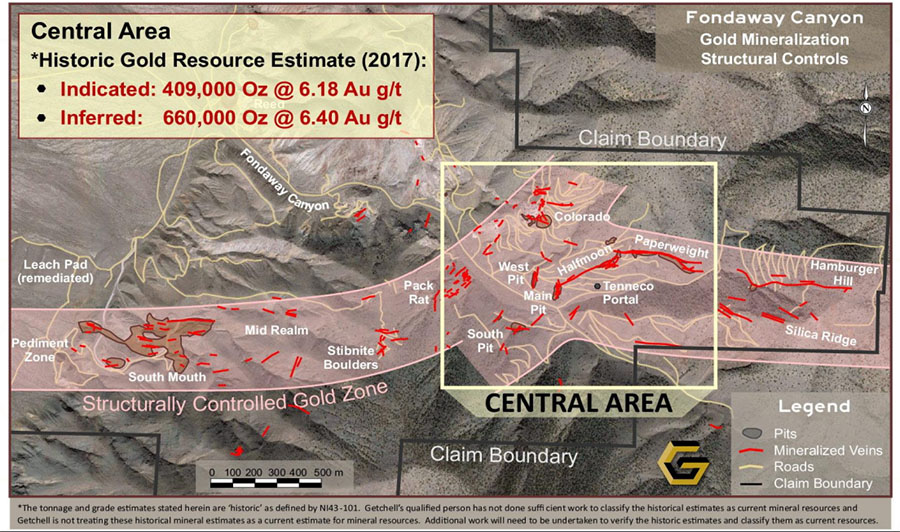

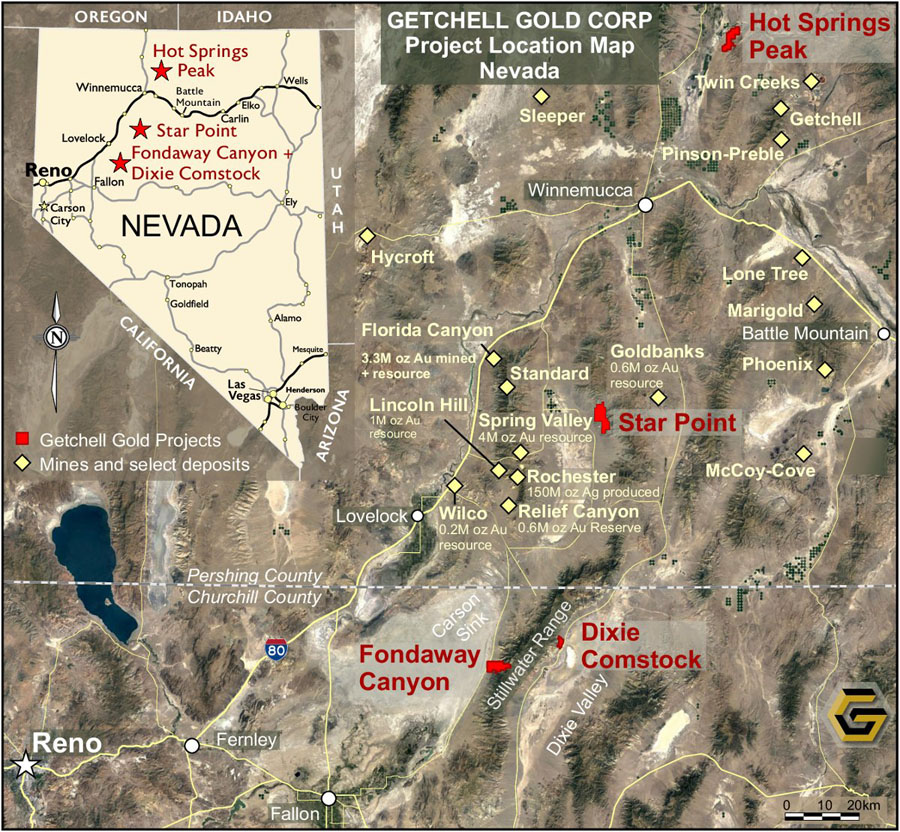

Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) began with a historical 1 million ounce gold resource at its Fondaway Canyon project in Nevada, but the company has set its sights on a larger resource. In the company's 2020, 2,000-meter drill program, five of the six holes focused on the Central Area of Fondaway Canyon, host to the historical resource.

"The property comes with a very sizable historical resource, approximately 400,000 ounces of gold in the Indicated category and 660,000 ounces of gold in the Inferred," Getchell President Mike Sieb told Streetwise Reports. "We identified very early on that the historical resource was overly limited and constrained, since it was modeled on an underground operation employing a very high cut-off grade with a narrow mining width. But when you look at Fondaway Canyon, the mineralization is widespread and it starts at surface."

The company, rather than evaluating for an underground mining operation, began looking at open pit potential, and developed a new model.

"We believe the company could eventually define a ~2M oz deposit at Fondaway Canyon." - Taylor Combaluzier, Red Cloud Securities

"There is a huge halo of low grade gold that is actually quite expansive," Sieb said. "Our drill program did what it was designed to do, to show that there was continuity to the gold and the mineralized zone was extremely thick and broad, a lot more so than what had been delineated in the past."

The 2020 drill program focused on two sections with four holes drilled in one section to test the down-dip extension of the mineralization below the Colorado open pit. The Colorado open pit saw some small scale historical mining in the 1970s and 1980s.

"The results from those four holes came back as good or better than anticipated," Sieb said. Historical drilling had traced the mineralization down approximately 300 meters or so from the surface. "The drilling that we completed in 2020 extended the continuity of that mineralization to about 500 meters from surface. The mineralization is shallowly dipping, and it's well within the realm of a potential open pit."

Sieb noted that one major attribute of Fondaway Canyon is that it has some significant high-grade mineralized structures or conduits. "Due to that high-grade component, it provides the ability to potentially go underground upon the completion of an open pit," Sieb said. "One thing to note is that we definitely proved up the high-grade component; one of our drill holes intersected 22 meters of greater that 6 grams per tonne (g/t) gold material, which is extremely representative of the high-grade attribute that Fondaway Canyon provides."

From the 2020 drill program, Getchell found the mineralization is open laterally and at depth. "And it's not shown to be weakening," Sieb added. "One of our deepest intercepts graded 1.8 g/t gold over 90 meters."

Getchell is looking to build on its 2020 program this year. "We plan to be one of the most aggressive and active junior mining companies in the region," Sieb emphasized. "We're looking at doubling last year's drill meterage. We will begin with a phase 1 drill program of about 4,000 meters that will take us partway through the year. And then depending on the results of that, we will plan where we're going to drill the phase 2 drill program thereafter."

Sieb's optimism is shared by Red Cloud Securities mining analyst Taylor Combaluzier. Writing in an April 8 exploration update, the analyst noted, "Getchell Gold released results from the new geological model completed at its flagship Fondaway Canyon gold project in Nevada. The new model incorporated the results of the highly successful 2020 drill program, consisting of six holes (1,996m), which mainly focused on the Central Area – a nexus for the gold mineralizing system. The updated model shows significantly expanded Au zones, which bodes well for Getchell as it aims to modernize and grow the historical ~1 Moz I&I [Indicated & Inferred] resource. . . we believe the company could eventually define a ~2M oz deposit at Fondaway Canyon."

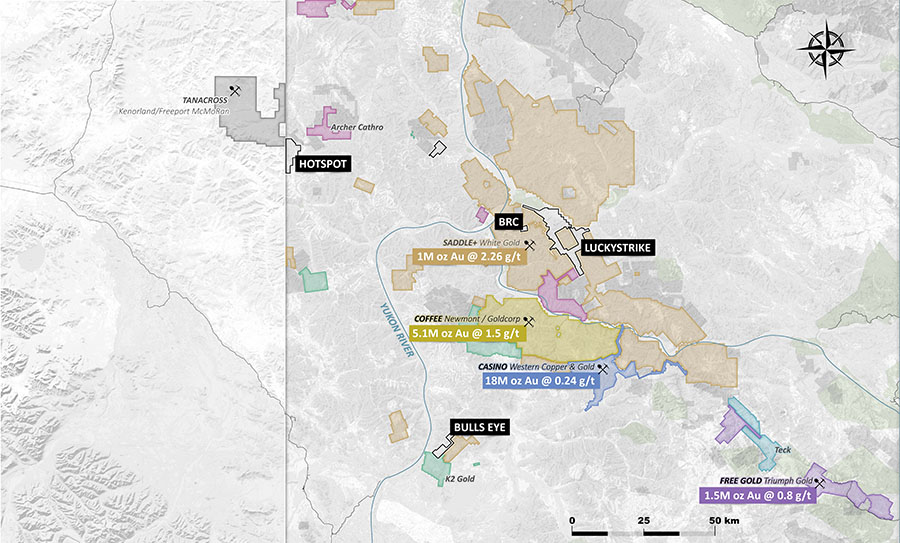

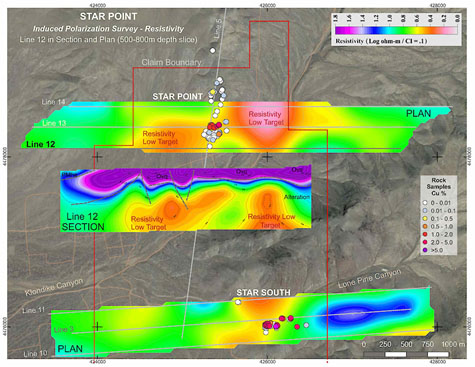

Getchell is also looking 60 kilometers to the north of Fondaway Canyon at the company's high grade copper-gold-silver Star project, which will see a maiden drill program in 2021 as well. The Star project is made up of two main mineralized occurrences, the past-producing Star Point copper mine and the high grade Star South copper-gold-silver prospect located 2 kilometers to the south.

The company also has two other properties in Nevada, Dixie Comstock and Hot Springs Peak.

Red Cloud has a Buy rating and CA$1 target price on Getchell Gold. On May 19 the firm noted, "Following the very positive results from the 2020 drill program and updated geological model, we continue to believe that ongoing positive drill results and a resource estimate at Fondaway Canyon (H2/21) could help drive Getchell's share price higher." Getchell shares are currently trading at around CA$0.52.

Getchell has approximately 83.4 million shares issued and outstanding, plus approximately 21.3 million warrants and 5.8 million stock options, for a total of approximately 110 million shares fully diluted. The company just closed an oversubscribed non-brokered private placement that raised aggregate total proceeds of CA$2.7 million. Each unit cost CA$0.45 and included one-half of a warrant; a whole warrant was for acquiring one common share at $0.65 and is good for a two-year period from the closing date.

Getchell also announced that it raised approximately $646,730 from the exercise of 2,586,921 share purchase warrants at the exercise price of CA$0.25, a 98.9% conversion rate for the warrants issued with a private placement that closed on May 17, 2019. Along with the private placement, the company received aggregate gross proceeds of CA$3,356,855. According to the company, these funds ensure it "is well financed for a very active 2021 exploration season."

[NLINSERT]

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Getchell Gold. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold, a company mentioned in this article.

Additional Disclosures

Disclosures from Red Cloud Securities for Getchell Gold

Part of Red Cloud Securities Inc.'s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services.

Company Specific Disclosure Details

3. In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services and has been retained under a service or advisory agreement by the issuer.

4. In the last 12 months, a partner, director or officer of Red Cloud Securities Inc., or the analyst involved in the preparation of the research report has received compensation for investment banking services from the issuer.

Analyst Certification

Any Red Cloud Securities Inc. Analyst named on the report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst’s personal views about the companies and securities that are the subject of this report. In addition, no part of any research analyst's compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.