Sitka Gold Corp. (SIG:CSE; SITKF:OTCQB; 1RF:FSE) is right now anxiously awaiting drill results from its Cortez Trend project in Nevada.

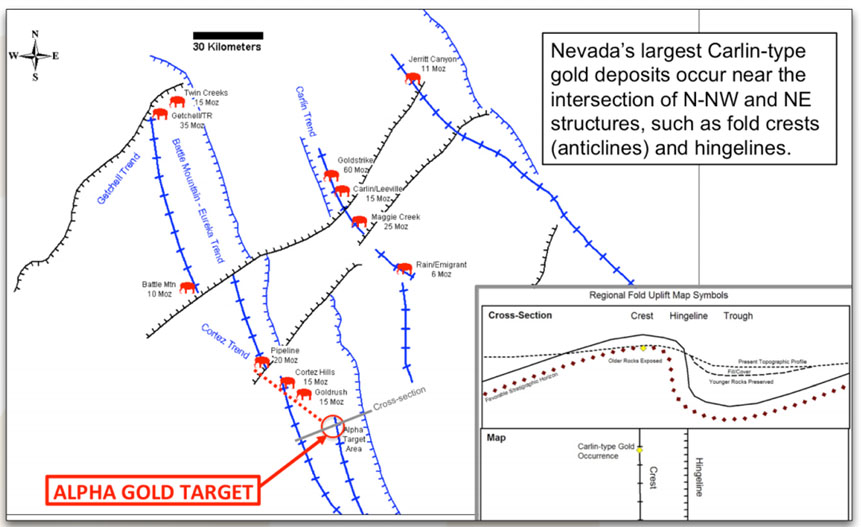

The Alpha Gold Project is located in the heart of the Carlin province. "This started as a conceptual, never-before-drilled project that has now been validated by the initial drilling completed in 2020 and 2021," stated Sitka's CEO and Director, Cor Coe. "The latest drillholes completed at Alpha have intersected the targeted contact zone for the first time and showed there is strong, Carlin-type, alteration and mineralization present at mineable depths. The targeted contact zone is a prime stratigraphic horizon, known as the Webb/Devils Gate contact in the Roberts Mountains, time equivalent to the Horse Canyon/Wenban contact at Goldrush, approximately 40 km to the north along the Cortez Trend."

The first hole, completed in 2020, reached a depth of 549 meters but deflected off course before reaching the contact zone. "However, it provided significant new geological data that confirmed the modeling and returned deeper sections that had several instances of anomalous gold in the drill core interpreted as leakage from the contact target zone at depth," Coe explained.

Based on this information, the company vectored in on a new target several kilometers north. It staked claims to cover that area and drilled a second hole that hit the contact zone at 175 meters. The company then moved the drill 750 meters to the south and again reached the contact zone in a third hole at an even shallower depth. The company noted that both these drill holes exhibited alteration and mineralization characteristic of Carlin-type gold deposits along the Cortez Trend, and more particularly the Goldrush ore deposit, which is located about 40 km away.

The company is now waiting on assays from the two drill holes completed last month with the primary focus on the last drill hole, AG21-03, that exhibited the most intense alteration and mineralization. "This could be the beginning of a new discovery along the Cortez Trend and in Nevada in general," Coe stated. "The name of the game is to see if there is gold associated with this contact zone, and if there is, then it will be time to start using that data to figure out where the heart of the gold system is and then work towards drilling out an initial resource."

"If that happens," Coe continued, "it could pique the interests of majors that are already in the area and very familiar with these deposit types.

Assays are expected in the next week or so.

Alpha is not Sitka's only project. The explorer holds five properties—in addition to Alpha in Nevada, they are located in Arizona, the Yukon and Nunavut—and is actively exploring three of them.

The company was started by the founders of Tundra Copper Corp., which was sold in 2014, just 18 months after it was established.

"After receiving an offer for Tundra that resulted in a significant return to our shareholders, we decided to form Sitka Gold with the aim of acquiring some exceptional assets while the junior market was in a downturn," Coe explained. "Ultimately, that strategy paid off and the company was able to pick up some really good projects that would likely be unavailable or much more expensive in today's environment with the prices of gold, silver and copper where they are now."

The Sitka team spent the next few years flushing out assets. While strategizing on what kind of junior mining company they wanted to create, diversification of commodities was a top criterion. The goal was to create a commodity hedge so they would not be bound by the uncontrollable, macroeconomic events that can take whatever commodity you're chasing and tank the demand for it.

"We looked at gold and silver as our precious metals target as we believed the likelihood for an upcoming bull market there was strong, but we also looked for a really good copper property to provide some risk mitigation for our shareholders and hedge against any unforeseen bust in the precious metals sector," Coe noted.

Next, the founders looked to expand across different jurisdictions. "In the U.S., we are in Nevada and Arizona, which are known to be very mining friendly," Coe said. "And we are also in Canada in Yukon and Nunavut; both these areas have been proven as jurisdictions where you can get things done and bring projects through development to a mine stage. It also allows us to stay active year-round, with a busy summer field season in northern Canada and projects in the U.S. that we can increase our focus on through the colder months."

Another criterion was diversification of the development stage of an asset, ranging from a greenfields property to one with a historical NI 43-101 compliant resource estimate with significant expansion potential. "We've got several different horses in the race that have different kinds of strengths. That increases the odds of success while reducing risks and becomes a compelling reason for investors to put some capital to work with this company," Coe noted.

Sitka is one of the newest junior explorers on the block, having only gone public with an IPO in 2018.

"Since then, we've raised around $12 million and have done a lot of development on the projects," Coe explained.

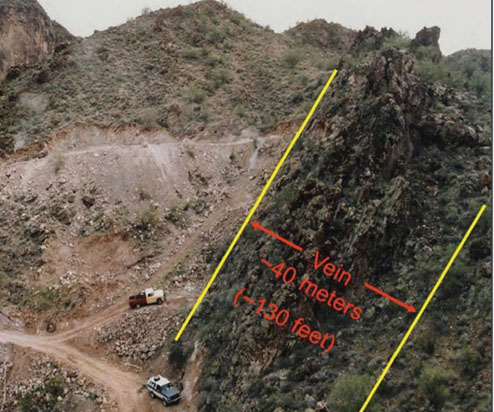

On the other end of the development spectrum from Alpha is the Burro Creek Silver-Gold Deposit, situated in Arizona, with a historical resource of 5 million ounces of silver and 120,000 ounces of gold. Of a projected strike length of 1.5 km, only about 10% has been drill tested. "We've done some preliminary expansion drilling to see if the mineralization is continuing along a surface signature of anomalous gold and silver results that we uncovered, and it looks like it's all correlated and coming together. We're pretty confident that the gold mineralization continues for over an additional kilometer of strike length that has never been drilled," Coe said.

The company has applied for permits to continue its stepout drilling on to Bureau of Land Management ground. "The existing deposit is on private property on patented mining claims that are already zoned for mining activity, so it has the potential to be fast-tracked toward production for that existing deposit area," Coe explained. "As others in Arizona have done, it's possible to begin production on private land while working through the permitting process for federal land."

Burro Creek offers good infrastructure. "It is road accessible and located just 1 km off the highway, it's got high power tension lines, it's in an area where other mines are already off and running." Coe noted.

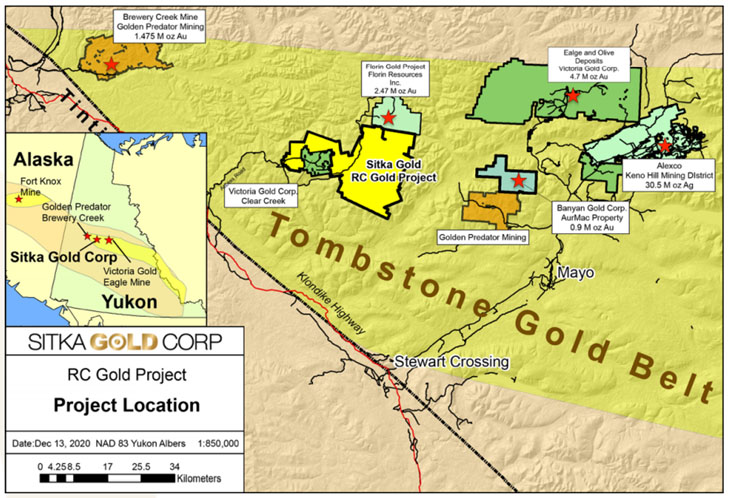

Sitka's third core project is the RC Gold Project in Yukon. "This is a district scale land package with several intrusion-related gold targets located in the heart of the Tombstone Gold Belt that is inside the larger Tintina Gold Belt," Coe explained. "We have a dominant, 376 sq. km. consolidated land position in this gold corridor with the largest contiguous claim block between the only 2 permitted gold mines in Yukon."

"There's a new mine just to the east of us, Victoria Gold's Eagle Gold Mine, that just got its mine into commercial production; its deposit is exactly what these low-grade intrusion related deposits look like. Victoria Gold is proving that it's economical to mine an intrusion-related gold deposit in this area of the Yukon at a 0.63 g/t average resource grade," Coe explained.

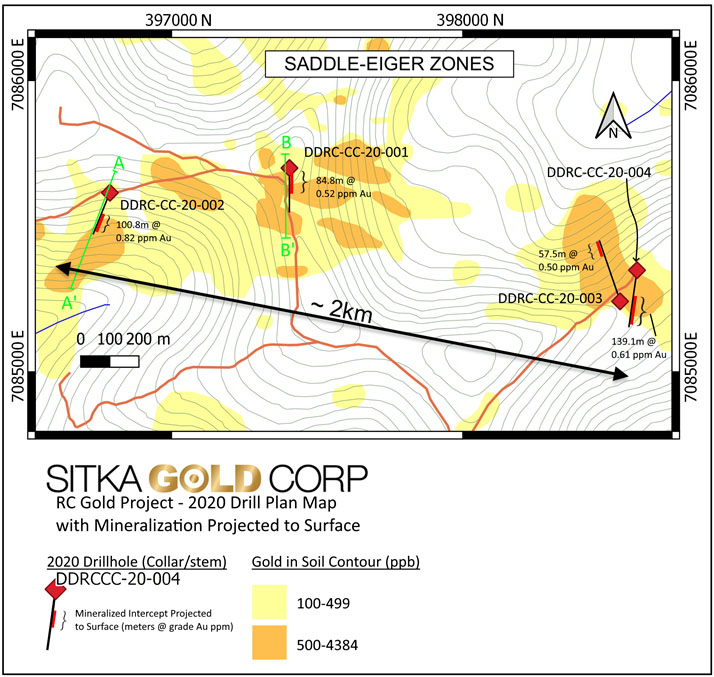

Sitka's drilling in 2020, using diamond drilling, resulted in three new gold discoveries at RC Gold: the Saddle-Eiger Zone, where intercepts included 100.8 meters of 0.82 g/t gold and 37 meters of 1.0 g/t gold; Barney Ridge, where trenching uncovered 7 meters of 0.65 g/t gold; and the Big Creek Zone, where the first drill hole resulted in 1.2 meters of 2.47 g/t gold and 23.2 g/t silver. The main focus in 2021 is to further define the scope of mineralization at the Saddle-Eiger Zone, which is approximately 2km x 500m in size and open in all directions.

"We now know that not only is there a large intrusion-related gold system present here, it is also producing major intercepts with grades that are comparable to or better than the average grade at the neighboring Eagle Gold mine. There's a massive gold system here and it's looking like it could have the size and grades necessary to host an economic gold deposit," Coe said.

The company just secured a drill contractor and will begin this year's 10,000-meter drill program at RC Gold shortly.

Sitka also holds the massive Coppermine River property in Nunavut, consisting of 125,000 acres, where samples have run as high as 41.54% copper, as well as the OGI silver-zinc-gold property in the Yukon. Additional exploration work is also planned at these properties over the upcoming summer.

The company recently closed a $6.4 million financing and is fully financed for all of its 2021 exploration plans. There is currently around 109 million shares issued and outstanding with management owning approximately 10%.

Read what other experts are saying about:

[NLINSERT]

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Sitka Gold. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sitka Gold, a company mentioned in this article.