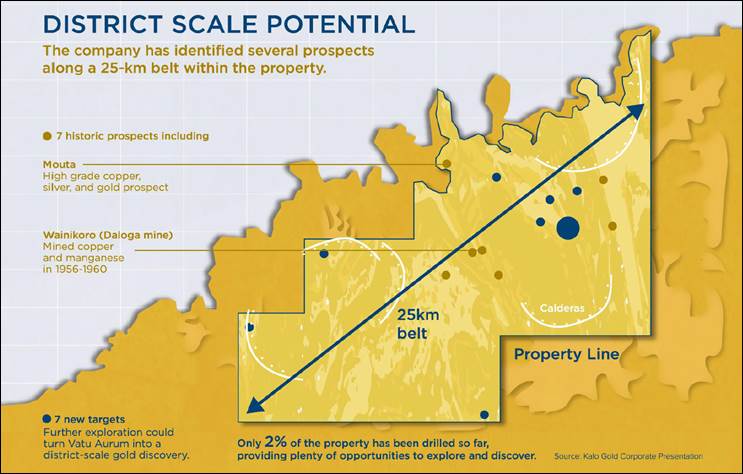

Kalo Gold (KALO:TSX.V) has "District Scale Potential," which is to say it is large (100 X bigger than NYC's Central Park), contains 158,000 inferred historical ounces of gold—and is 98% unexplored.

Since Kalo began trading six weeks ago, gold has gone down USD $100/ounce, while Kalo's stock price has doubled.

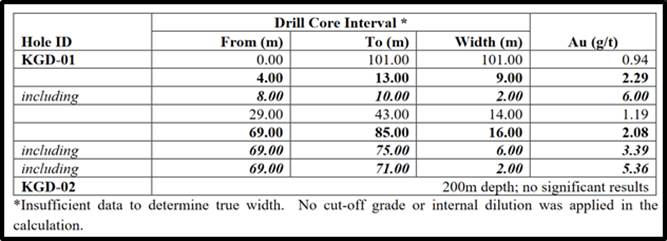

On March 21, 2021, Kalo released initial assay results from the first two holes of the drill program in the Qiriyaga Zone.

Assay Highlights:

- First hole drilled, KGD-01, recorded multiple thick, near surface gold intersections, over an interval of 101 meters averaging 0.94 g/t Au, starting at surface

- KGD-01 intersected multiple higher-grade intersections, including 2 meters at 6.00 g/t Au at 8 meters depth, 16 meters at 2.08 g/t Au at 69m depth including 2 meters at 5.36 g/t Au at 69m depth.

- Two new targets were identified within the 2.5 km Qiriyaga Zone priority area

Kalo's CEO, Fred Tejada, is an exploration veteran with strong track record in epithermal gold and copper exploration. As VP of exploration at Panoro Minerals, he designed drill programs for two major copper projects in Peru.

"Kalo Gold has the potential to be a district scale high grade gold discovery," confirmed Tejada, "We have at least 14 prospects within our property."

With the recent $3.7 million financing, Kalo is well funded to carry out an initial drilling program.

Drill program objectives:

- Confirm high-grade mineralization that contains an inferred historical resource;

- Conduct an expanded soil sampling program and a geophysical survey (IP) over a 2.5 km zone;

- Define the extensions of the known mineralization;

- Confirm the presence of other drill targets

The Kalo exploration team has been on the ground since December, 2020 conducting soil sampling, core review and geological mapping. Kalo is preparing for the next phase of exploration program.

Kalo Gold's President and Director Kevin Ma is a partner at Calibre Capital Corp, a private merchant bank. Ma advised and executed First Cobalt's $103-million three-way merger with Cobalt One and Cobaltech.

At Kalo Gold, Ma is leading corporate finance, capital markets and corporate development.

"We have a very strong shareholder base," Ma told Streetwise Reports, "We built the CPC very closely with our partners at Haywood Securities."

The CPC (Capital Pool Company) is a unique Canadian invention that supports earlier stage private companies to complete a go public transaction," states the TSX. "A Qualifying Transaction is effectively a reverse takeover of a CPC by an operating business."

"Investment bankers and high net worth investors took down chunky bits of the initial Kalo Gold financing," explained Ma. "We're very happy with the quality of our shareholders and their strength and expertise gives us a solid foundation."

Ma concurs that having the shares in "strong hands" is important but the quality of the asset is paramount.

"A good company is always going to be a good company, regardless of where the market's at," stated Ma, "We are cognizant of precious metals prices, as well as the overall economy. Inflation rates, for instance. We are bullish on gold long term."

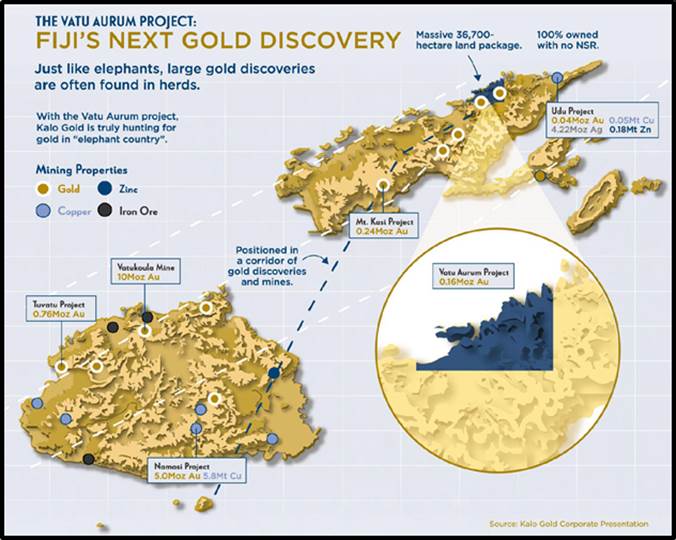

Mention "Fiji" and most people think of beaches and palm trees, but in fact Fiji is a mature mining jurisdiction that generates about 15% of its GDP from extraction industries.

"Compared to other nearby jurisdictions, such as Papua New Guinea, Fiji is more favorable and mining friendly," confirmed Tejada. "Kalo's founders have been operating in Fiji for over twenty years. Internally, we have very strong relationship with the local community and the government.

"One of the founders of Kalo Gold, Michael Nesbitt, remains with us—as our Senior In-Country Manager—so there is continuity with those relationships," added Tejada.

Nesbit has 10 years of exploration and development experience of mineral properties in Fiji, South Pacific and Africa. The Nesbitt Family developed a bauxite mine and have JV'd the mining operations to a major Chinese mining conglomerate.

Kalo Gold's land package sits on the Pacific Ring of Fire—a 40,000 kilometer-long, horseshoe-shaped chain of mineralized belts and trenches that stretches from the tip of Chile all the way to Alaska.

These systems host epithermal gold, copper porphyry and volcanogenic massive sulfide (VMS) deposits, including the world's largest Grasberg gold mine in Indonesia, operated by Freeport-McMoRan (FCX:NYSE).

"The Pacific Ring of Fire hosts copper and gold deposits in Chile and significant gold deposits in Japan, the Philippines, Indonesia and Papua New Guinea" confirms Tejada. "These deposits tend to have geological similarities, which is beneficial to our exploration program."

"We have drilled less than 2% of the property," stated Tejada, "There is enormous exploration upside. We are able to move more quickly and efficiently because we own a drill rig, operated by local drillers who are employees of Kalo Gold."

Ma confirms it's a significant advantage for an explorer to own its own rig.

"It saves us the expense and hassle of mobilizing a rig from another part of the world," states Ma. "It was one of the cost-savings factors and efficiencies that attracted us to this project."

"We are dedicating $1.5–2 million to the phase one program. We're well-funded for phase one, and once complete, we'll immediately start planning for phase two."

"We've also attracted solid board of advisors to Kalo Gold," stated Ma.

Alastair Still is a Kalo Gold Special Advisor. Executive VP and Chief Development Officer of GoldMining Inc., he has also worked for major gold miners such as Newmont, Goldcorp, Placer Dome, Agnico Eagle and Kinross Gold.

David Medilek is a Kalo Gold Special Advisor. In addition to serving as VP of Business Development for gold producer K92 Mining, Mr. Medilek is a director of Minaurum Gold and Northern Superior Resources.

David Whittle, CPA, CA, is a Kalo Gold director. With over 25 years of senior executive experience in the mining industry, he was formerly the CFO at Alexco Resource, which operated a high-grade silver mine in the Yukon.

Cam Grundstrom is a Kalo Gold co-founder and director. A mining engineer by trade, he has worked at Placer Dome (Papua New Guinea), BHP, Ekati, Island Copper, OK Tedi and Suncor. Prior to securing the Kalo licenses, Grundstrom conducted and extensive review of the top 10 prospective areas of Fiji.

Dr. Russell Fountain, PhD, is a Kalo Gold Special Advisor. The founder of Exsolutions Pty. Ltd., a mineral exploration consultancy that specializes in gold and base metals. He was also a director of Geopacific Resources that held the largest mining concessions in Fiji, including five copper/gold projects

We ask Ma if he perceived Bitcoin to be in competition with gold for investor dollars.

"I invest in crypto companies," stated Ma, "But I think gold will always have its own investor base. We are very long on precious metals. Gold will attract different investors than Bitcoin."

Kalo is now drilling the third hole, KGD-03, about 130 meters northwest of KGD-01, at a targeted depth of approximately 350 meters.

The planned exploration program consists of eight confirmation and step-out diamond drill holes totaling 1,800 metres in the Qiriyaga zone targeting Qiriyaga Hill and Vuinubu Ridge areas, as well as soil sampling and Induced Polarization (IP), a ground geophysics survey .

Qiriyaga Hill's historical drilling results confirmed the presence of several high-grade zones with selective drill intersections including 8.75m at 36.02 g/t Au (61.25m to 80m) and 10m at 27.18 g/t Au (76m-86m) including 120 g/t Au between 80m to 83m in drill hole KCD-17.

The soil sampling program in Qiriyaga Zone was recently completed and the assay results are pending and the IP survey started April 5.

Kalo has approximately 53.7 million shares issued, and 58.9 million fully diluted. Management and founders own approximately 30%.

View Visual Capitalist's presentation on Kalo Gold here.

[NLINSERT]

Disclosure:

1) Lukas Kane compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Kalo Gold. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kalo Gold, a company mentioned in this article.