The mineral-rich Pacific Ring of Fire hosts numerous high-grade mines, including some of the largest in the world, Indonesia's Grasberg and Papua New Guinea's Porgera. A company with a large landholding in Fiji along the same Ring of Fire expects to begin trading publicly on Monday, March 1.

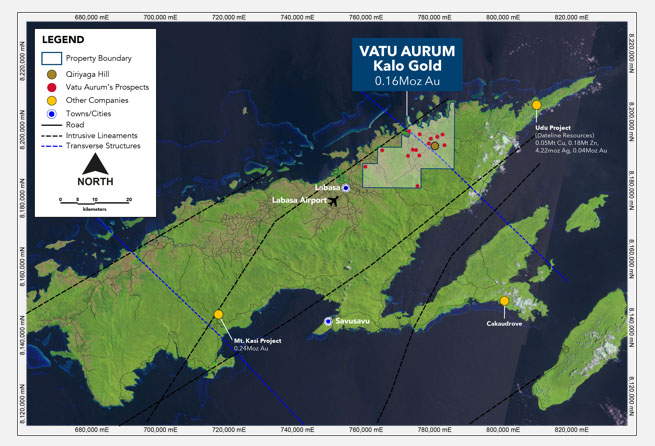

Kalo Gold Holdings Corp. (KALO:TSX.V), which controls the Vatu Aurum gold project on Fiji's north island of Vanua Levu, has announced that it expects to begin trading on the TSX Venture exchange on March 1, under the symbol KALO.

With the closing of the transaction, the company changes its name from E36 Capital Corp. and completes a private placement of common shares for aggregate proceeds of CA$3.718 million. E36 Capital amalgamated with Kalo and former shareholders of Kalo received stock in the new company on a one-to-one basis. At the completion of the transaction, there are approximately 53.8 million shares issued and outstanding on an undiluted basis, insiders hold around 26% of the undiluted shares, and an expected publicly traded float of 6.6 million shares.

Fiji has a long history with mining; the Vatukoula Mine has been producing gold for more than 75 years, with more than 7 million ounces mined and another 3.8 million ounces identified.

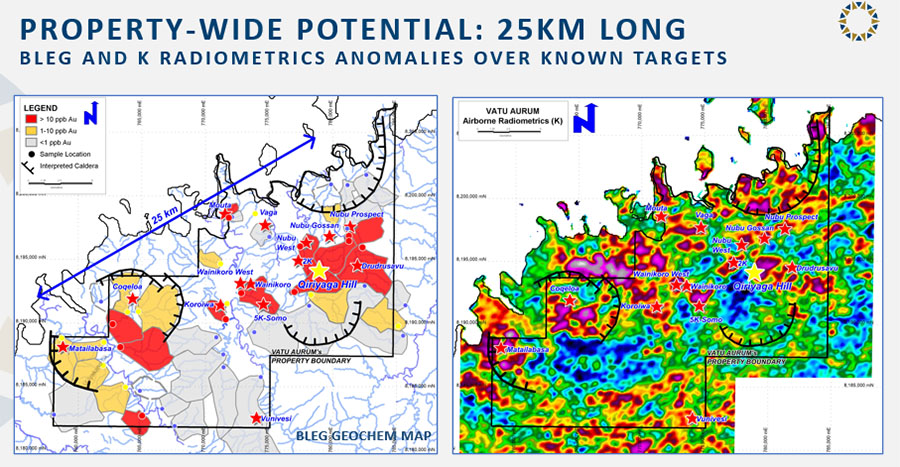

Kalo is looking to find out if it is sitting on a district play. Its 100%-controlled Vatu Aurum gold project covers a large land position of more than 36,000 hectares and is 25 kilometers long. Historical exploration found gold discoveries in all seven targets explored. Historical drill data from 2017 at Qiriyaga Hill shows assays as high as a 1 meter drill core interval at 120 grams per tonne (g/t) gold and a 3 meter drill core interval at 69.03 g/t gold.

The company notes that only 2% of the project has been drilled and Kalo plans to rectify that. In addition to the seven historical prospects, it has identified seven new targets. Its phase 1 exploration program will concentrate on the Qiriyaga Zone where soil sampling found gold over a 2.5 km length.

The company noted that initial exploration will include "drilling in Qiriyaga Hill and Vuinubu Ridge to confirm high grade mineralization at depth and along trend; an induced polarization (IP) geophysical survey to define vertical and lateral extensions of mineralization, soil sampling on areas not yet covered by soil geochemistry, review drill core and surface geology, and laboratory work including spectral, rock and mineral analysis, and fluid inclusions."

Kalo notes that the Qirigaya Hill and Vuinubu Ridge zones "have features exhibiting high potential for gold—near surface, as well as underground."

The company owns a drill rig, which lowers the cost drilling and gives the company flexibility.

Kalo is helmed by an experienced team. CEO Fred Tejada, technical lead for Kalo, is a professional geologist with more than 35 years of international mining experience, including serving as Phelps Dodge Exploration's country manager in the Philippines and VP of exploration for Panoro Minerals and Tirex Resources Ltd. President Kevin Ma, capital markets lead for Kalo, is also a partner at Calibre Capital Corp., a private merchant bank, and has been involved in more than $500 million in corporate financing and M&A transactions. As director of finance at Alexco Resource Corp., he was integral in the development and operations of the Bellekeno silver mine located in the Yukon. Michael Nesbitt, senior in-country manager and a Kalo co-founder, has more than 10 years of experience with projects in Fiji, the South Pacific and Africa.

The company notes that it is further strengthened with a world-class team of directors and advisors—David Whittle (director of Argonaut Gold, former CFO of Alexco Resource Corp.), David Medilek (VP of K92 Mining), Alastair Still (executive VP of Goldmining Inc. and former VP of Goldcorp.) and Russell Fountain (former chairman of Geopacific Resources).

View Visual Capitalist's presentation on Kalo Gold here.

[NLINSERT]

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kalo Gold, a company mentioned in this article.