Streetwise Reports (SWR): A historic and bipartisan bill by the U.S. Senate Committee on Environment and Public Works approved a bill that includes establishing a U.S. strategic uranium reserve. Can you give us the background and immediate impact for the U.S. uranium sector and Uranium Energy Corp. (UEC:NYSE AMERICAN)?

Amir Adnani (AA): The bill provides strong support for the nuclear energy industry as a whole and would codify the creation of the U.S. Strategic Uranium Reserve. The Biden administration platform has included nuclear power as a component of its clean and low-carbon energy plan to help support its climate and national security goals.

The Uranium Reserve was introduced as a strategy recommendation in the April 2020 Nuclear Fuel Working Group's (NFWG) report published by Department of Energy, "Restoring Americas Competitive Nuclear Advantage." The NFWG recognized that the U.S. had become almost entirely dependent on foreign supply, with more than 40% of requirements being imported from state owned organizations in Russia and other former Soviet Union countries. The establishment of the UR is critical to preserve domestic uranium mining, necessary for U.S. defense applications as well as providing a complete supply chain for the domestic industry.

The Uranium Reserve designed by the NFWG is outlined as a 10-year $1.5 billion program in the White House FY 2021 budget. In December, the U.S. federal government omnibus spending bill passed by Congress includes $75 million for initial funding for the Uranium Reserve. This is a very positive step forward for the domestic uranium mining, with clear bipartisan and bicameral support.

SWR: What would be the procedures for the U.S. Reserve to purchase uranium and how would companies compete?

AA: The Department of Energy has announced in prior communications that the Uranium Reserve program will be sourced through a competitive bid process and we anticipate they will implement it with various prequalification criteria such as requirements for U.S. producers to have all their major permits and domestic ownership.

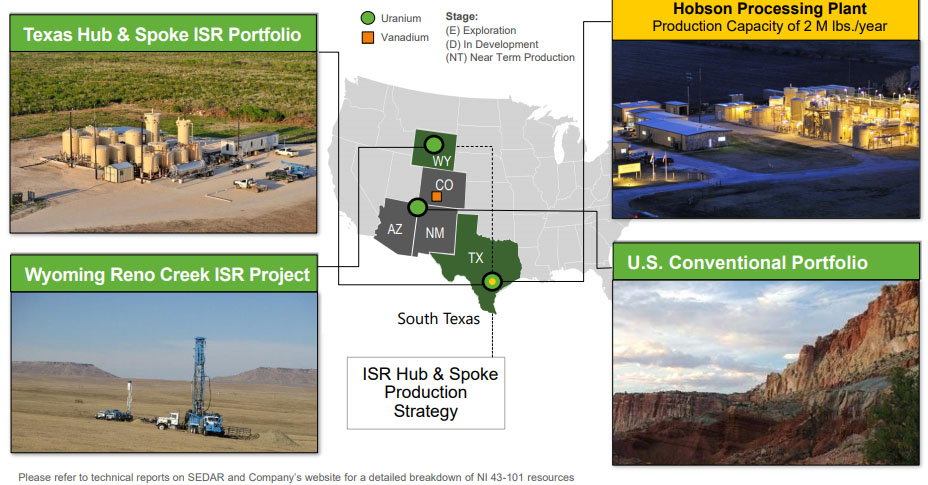

UEC is well positioned to supply the Uranium Reserve with our U.S. low cost in-situ recovery (ISR) projects. We have the largest U.S. resource base of fully permitted ISR projects in Texas and Wyoming and we are looking forward to participating in the program.

SWR: Aside from the strategic reserve, what supply and demand factors favor an increase in the price of uranium?

AA: The long-term fundamentals underlying the market continue to strengthen. Currently, we see an annual gap of about 40 million pounds between uranium production and utility requirements. Current forecasts show this structural deficit persisting at least through 2026 and then expanding further to almost 70 million pounds per year by 2030. While secondary supplies have been filling the void, those supplies are not a sustainable long-term supply source. There are different estimates on timing, but it is clear secondary supply (that includes inventory drawdowns) will be insufficient to fill the projected gap between supply and demand, and new production will be required. As this transition evolves, the market will become more production cost driven as opposed to inventory driven.

Higher priced contracts that have supported high production costs are continuing to roll out of producer and utility supply portfolios. These higher priced contracts are not replaceable with current market prices below production costs for the vast majority of Western producers. This will likely continue the trend of production cuts and deferrals until prices rise sufficiently to sustain long-term mining operations.

In the U.S., some of the foreign state-owned enterprise (SOE) supply is also likely to be reduced. Last year, the U.S. Department of Commerce negotiated an amendment to the Agreement Suspending the Antidumping Investigation on Uranium from the Russian Federation that reduces America's dependence on Russian natural uranium concentrates up to 75% from prior levels. Due to a prolonged weak pricing environment from an influx of price insensitive supply from SOEs, U.S. production is now less than 1% of the U.S. requirements.

On the demand side of the equation, further upside market pressure also appears likely to evolve as utilities return to a longer-term contracting cycle to replace expiring contracts. Over the longer term, there continues to be underlying and increasing demand building, as the globe continues a push towards carbon free energy goals. Those goals will require the 24-7, base load, clean energy that nuclear power provides as part of the overall supply mix. A good example of that policy messaging came from Japan's energy minister recently, who said he considers nuclear energy "indispensable" if the country is to meet its net-zero carbon emission goals.

Exacerbating the overall supply picture is lead times for new production typically range from seven to 10 years or longer. The market appears to be within the time frames required for investment to bring new supply online to meet those lead times. However, prices are not yet at levels that incentivize future production, increasing the probability of the potential for less supply than the market is currently pricing in. All things considered, we believe the supply and demand fundamentals should continue to exert upward pressure on uranium prices.

SWR: UEC has the Hobson central processing plant in Texas and several properties located in the vicinity of the plant. What is your near-term production plan when uranium prices improve?

AA: Hobson is the centerpiece in UEC's hub and spoke production strategy with our low-cost satellite ISR operations all within relatively short trucking distance. The plant is fully licensed and currently on standby with an annual production capacity of 2 million pounds of U3O8. The spokes of our strategy include the Palangana, Burke Hollow, Goliad, Salvo and Longhorn ISR projects. With an improvement in uranium prices that justify production, we plan to restart the plant with uranium loaded resins originating first from Palangana and then followed by Burke Hollow. We have applied for a license amendment with the Texas Commission on Environmental Quality to increase the Hobson production capacity to 4 million pounds per year.

SWR: Palangana is a past-producing mine; what are the advantages associated with this project?

AA: Our Palangana ISR project is fully permitted and has operated successfully with cash costs at $21.77 per pound U3O8 that should be indicative of our other South Texas ISR projects with similar geology. With the short lead times associated with this project, when market conditions warrant, we are planning to turn this project on first for delivery of uranium loaded resins to the Hobson Processing Plant for the production of U3O8.

SWR: UEC recently announced that it is going to advance the Burke Hollow project. What is UEC's goal to achieve there this year?

AA: Fully licensed, Burke Hollow's initial production area in South Texas is the newest and largest ISR wellfield being developed in the U.S. We recently announced the restart of wellfield development and resource delineation drilling to advance and expand the project's resources. In this year's drilling campaign, we will also complete the Production Area Authorization #1 (PAA-1) monitor well ring to include the two newly identified trends from the last campaign.

In total there are now five fronts or trends within PAA-1 that we have identified. We estimate that approximately 45 additional exterior monitoring wells will be installed to accommodate the trend extensions, complementing the 76 monitor wells previously installed. We plan to drill at least 30 exploration and delineation holes to further define the five mineralized fronts in PAA-1.

Advancing and expanding Burke Hollow's resources strategically dovetails with our plans to participate in supplying the U.S. Uranium Reserve as outlined in earlier sections of this interview.

SWR: What is the status of the Reno Creek property in Wyoming?

AA: Our fully permitted Reno Creek project in Wyoming has Measured and Indicated resources that total 26 million pounds U3O8 and Inferred resources that total another 1.49 million pounds. This project has all of its major permits and is the largest permitted, pre-construction ISR uranium project in the U.S. We are expecting to bring this project online after the Burke Hollow project, depending upon market conditions.

SWR: Is there anything else you would like investors to know about Uranium Energy Corp.?

AA: UEC is unique in being a 100% unhedged developer that will offer leverage and reward to our shareholders as the uranium price appreciates. We intentionally avoided restrictive contracting and did not deplete our resources during the bottom of the price cycle and instead used the time to expand our portfolio with accretive acquisitions.

We now have the largest U.S. resource base of fully permitted ISR projects in Texas and Wyoming of any U.S. based producer. UEC is positioned as the U.S. leader in low-cost, environmentally friendly and fully permitted ISR projects with a production profile of 4 million pounds per year. The low-impact, low cost ISR method of uranium recovery is the most environmentally friendly way to mine uranium, which is now responsible for approximately 50% of global production.

While we have a solid balance sheet and great projects, the bedrock of the company is a highly regarded senior management and production team, possessing a wealth of experience in both U.S. and international uranium mining as well as government policy. Spencer Abraham, our chairman, served as the tenth U.S. Energy Secretary in the George W. Bush Administration, devising and successfully implementing the first national energy policy in the U.S. since the 1980s. Our Executive VP, Scott Melbye, is the newly elected president of the Uranium Producers of America and has over three decades of industry experience with uranium majors.

We are excited about the company prospects in 2021 with our Burke Hollow Production Area development, looking forward to the Department of Energy procurement process for the strategic Uranium Reserve and eager to see the market adapt to the large structural deficit that currently exists.

SWR: Thank you for your insights.

Read what other experts are saying about:

[NLINSERT]

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: Uranium Energy Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Amir Adnani is the president and CEO of Uranium Energy Corp. and owns securities in the company. He had the opportunity to review the interview for accuracy as of the date of the interview and is responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Uranium Energy Corp., a company mentioned in this article.