The gold bull market has arrived. And strong gold markets give investors the opportunity to make great returns without taking on much risk. Here I'll explain why—and outline three stocks I own that offer up exactly this opportunity.

Gold was already gaining before COVID, based on low real rates, economic uncertainty, high stock prices and geopolitical questions.

Then a global pandemic poured fuel on that smoldering fire.

COVID hammered interest rates, pushing real rates well into negative territory. It shuttered the global economy, creating deep uncertainty about growth going forward. Central banks around the world turned up their printing presses in support, handing cash directly to individuals while also buying oodles of debt, both government and corporate.

It has created an absolutely perfect storm for precious metals. The fact that gold marched up through US$2,000 an ounce in early August to reach a new all-time high like it was nothing is proof.

Two questions now matter:

- How much higher will this market go?

- What stocks are the best bets for those wanting to play this opportunity?

On the first question, I can't quote a number but I can say that gold is going a lot higher. The forces that move gold are all aligned in its favor and none are likely to change any time soon. Can you imagine any central bank in the world raising interest rates? Do you see COVID easing soon and economic confidence around the corner? Do you think the risk that a richly valued stock market will correct is going to disappear? Do you see calm coming from the remainder of Trump's term and the pending presidential election?

Be the first to read Gwen Preston's The Maven Letter by signing up here for a free 30-day trial.

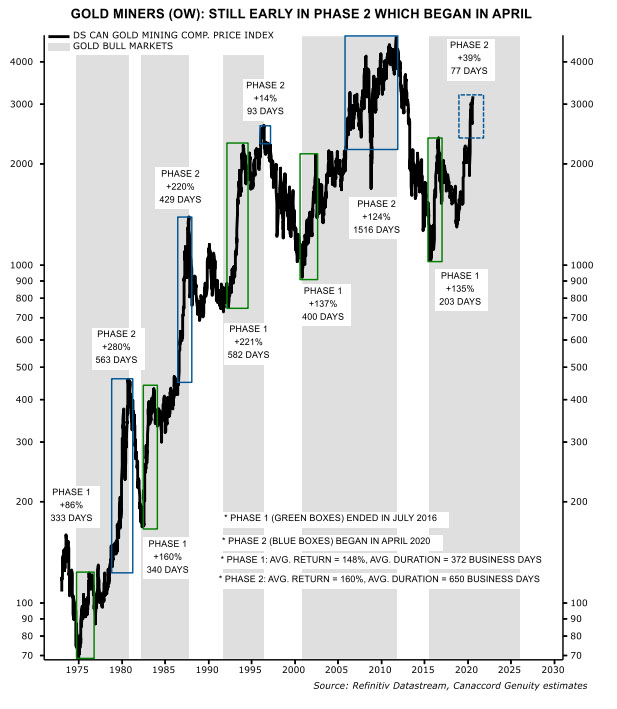

Patterns from past bull markets also say we've got a lot of ground yet to gain. I love this chart from analyst Martin Roberge at Canaccord. It shows that every gold bull market goes through two stages, with a setback in between. We met the mark for Phase 2 just in April. On average, the second phase of a gold bull market generates 160% gains over 650 days. We're some 120 days in and only about 45% up.

Source: Mid-Week Market Observations, Canaccord Genuity Capital Markets Research, 29 July 2020I could spend the entire article going through the gold-bull evidence but I'd instead like to focus on the second question: what should investors who want to profit from this market buy?

It's a tricky one because the best stock for me isn't necessarily the best stock for someone else. I love explorers drilling for new discoveries but those stocks carry a lot of risk and require a lot of attention. You might like the safe leverage of a royalty company or the leverage-plus of a mid-tier producer with organic growth ahead.

As this gold bull gains strength, all of these options will do well.

But some will do better than others, and sooner.

I want to highlight three stocks today that I think will outperform the gold sector—and will do so without carrying a lot of risk.

Importantly, these companies already have gold. They aren't trying to make a discovery; they're demonstrating the scale and economics of discoveries already in hand. And I see a huge amount of upside ahead as they do so.

And that's really the key point here: in a rising gold market you can get exposure to significant upside without taking on immense risk. It doesn't have to be High Risk for High Reward: this is the Low/Medium Risk, High Reward train and you should get on board.

Below I outline three stocks that I own for exactly this reason: they offer strong potential for big rewards but do not bear major risk. All three have good discoveries already in hand that they are drilling to expand; all have exploration targets near their defined deposits that offer potential for splashy discovery; two of the three will put out initial mine plans shortly to prove that their assets would make good economic sense as mines already.

These stocks offer the perfect balance in a rising gold market. Their projects are advanced enough to attract the generalist dollars that fuel a gold market but they also offer significant exploration potential. When the gold market goes you don’t need to take on high risk to get high reward—you just need stocks like these.

HighGold Mining Inc. (HIGH:TSX.V; HGGOF:OTCQX)

HighGold checks all the boxes on a Medium Risk, High Reward checklist:

- High-grade gold project with recent "discovery" that is getting its first full season of work right now

- Major discovery potential on the rest of the project

-

- Great jurisdiction (Alaska)

- Top notch board, management and technical abilities

- Tight share structure and lots of cash in hand ($23 million)

- Momentum—still new, strong shareholder registry (including a major mining company), and lots of eyes watching

- Additional good assets in Ontario

HighGold was born a year ago when Constantine Metals (TSX.V: CEM) spun it out to focus on Johnson Tract. CEM had acquired the JT project not long prior, when the Cook Inlet Region Inc. (CIRI), an Alaska Native Corporation, approached Darwin Green about a gold asset they'd been sitting on for years.

Green has worked in Alaska for two decades. When he saw the JT data he could barely believe that such a strong gold system had been forgotten for so long.

CIRI's goal is to monetize the mineral potential of their lands, in a responsible way. Green's reputation meant they chose him to work JT. It's another example of why it pays to follow good people—in this case, because they can lead you to incredible projects.

JT is close to tidewater on Cook Inlet, about 200 km from Anchorage. It saw work from 1981 to 1995 when Westmin drilled out the JT Main deposit. The resource wasn't big but its super high grades meant Westmin pushed it rapidly towards development, completing a pre-feasibility study on a mine at JT that simply shipped ore to Stewart for processing.

That plan looked good but not great because shipping ore elsewhere for processing is always hard. Then the price of gold started to fail and Westmin shifted focus. The project reverted back to CIRI and then sat untouched for 23 years, until CIRI approached Green.

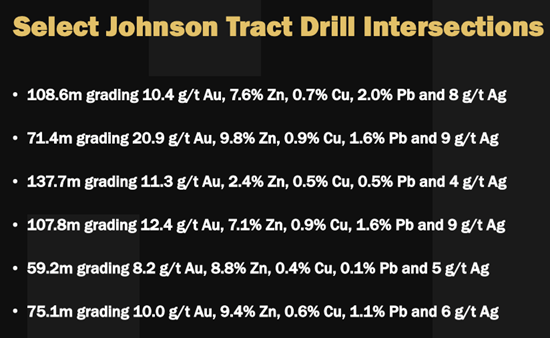

By the time the deal settled, HighGold had only a short window last summer to drill…but they pulled some very high-grade results:

HighGold combined its results with historical data to calculate a resource estimate for JT. It's not big but the grades are stellar. The gold grade puts JT in the top 10% of undeveloped gold projects in North America.

Let me emphasize something here. Grades like this are usually found in vein deposits, which are often narrow and discontinuous. JT is different in the best possible way: it offers vein-like high grade mineralization but in a steep, wide sheet of rock with consistent mineralization. Steep and wide (the JT deposit is 20 to 50 meters wide) are ideal for mining. The JT deposit looks like it was designed to be mined.

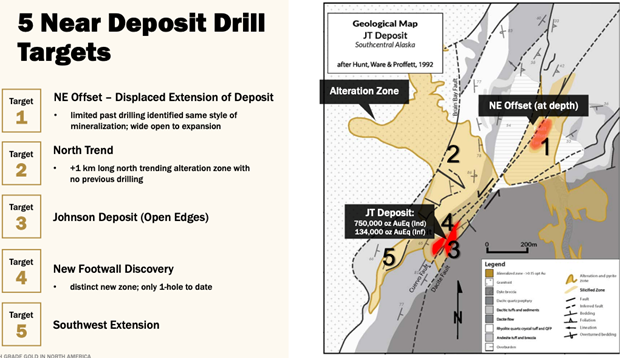

Now HighGold is drilling again. It will do 15,000 meters testing five targets:

This list represents a fantastic mix of high likelihood expansion drilling and riskier drilling for new discoveries. Expanding the JT deposit will grow value for HIGH. Hitting into new discoveries that are at all similar to JT at another target would vault the stock's value.

The JT project is highly unusual. The mineralization is super high grade and doesn't really fit into a common geological bracket. The best analogue is the Hod Maden deposit in Turkey, where a private company is building a mine to tap into ore averaging 8.9 g/t gold and 1.4% copper. Hod Maden is not huge in terms of tonnage but grades like that create a lot of value quickly: Hod Maden carries a $1 billion NPV and should generate a 50% internal rate of return (those are very strong numbers!).

JT is not going to become Hod Maden this summer…but it has that kind of potential. And as the first full season of drilling, this year's work program should start to prove it up.

Drill results will start to flow in mid-September. Lots of eyes are watching HIGH. The share structure is tight and the registry of investors is long and strong. And the gold market is keen for new discoveries, which is what HIGH could well announce If they hit into new zones near the JT deposit.

The JT deposit is designed to be mined. With a standout deposit already defined and likely to grow, oodles of adjacent discovery opportunity, and management driven to make the most of this market, HighGold Mining is designed to perform in this bull market.

Troilus Gold Corp. (TLG:TSX; CHXMF:OTCQB)

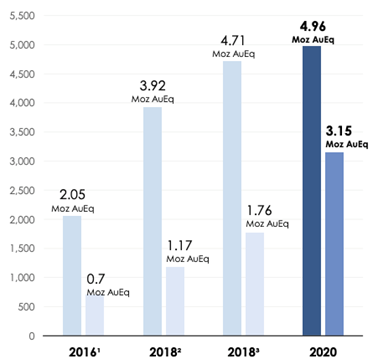

Troilus is named after its project, the Troilus mine, in Quebec. The company bought the project three years ago and have increased the gold count dramatically since—to the point that Troilus now hosts over 8 million ounces of gold.

That's 8 million ounces after already being mined: Troilus operated from 1996 to 2010. The operator, Kennecott, was a copper company; they built and ran a gold mine because surging interest in gold meant the market was giving gold companies higher valuations than copper companies. So they added a gold mine to their portfolio to capture that valuation gap.

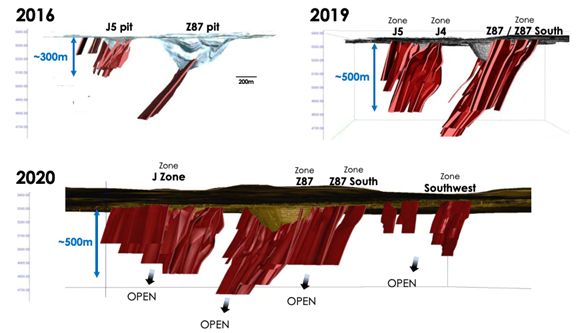

Since Kennecott only wanted the project to tick the "gold mine" box, the company did essentially no exploration. They bought a defined deposit, built a mine, mined the known gold, and then shut it down. Lots of juniors exploring near an old mine will say the old operator left lots of gold behind but it really is true in this case—Kennecott did not drill any holes more than 100 meters from the deposit.

When the gold bear market ended in 2016 a group of investment bankers and geologists who had worked together on various deals for years decided to form a company and find an asset perfectly suited for the bull market they saw coming. The old Troilus mine fit the bill.

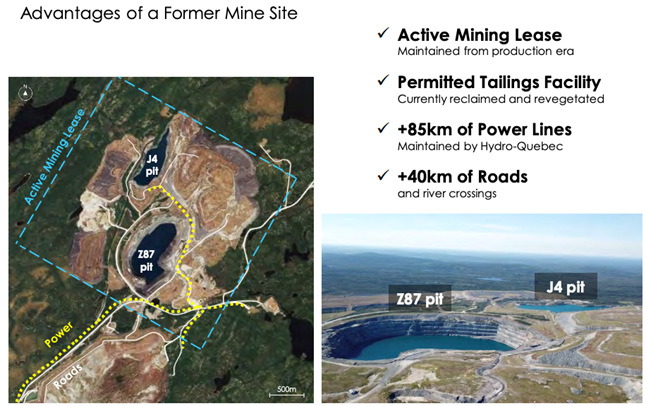

The asset was available to buy because at first glance it didn't seem to offer much. It had a resource but one that was small and low grade for the underground mining needed to tap it. The apparent lack of good defined ounces was the weakest link; other than that, the project had lots going for it.

It's road accessible. It's in Quebec, a great province in which to explore and build and operate mines. It has high-voltage power lines running directly to site, where a recently upgraded 50MW power station is ready to go. It is very much a brownfields site, which eases the permitting hurdle, and it has a big tailings facility that still has a fair bit of capacity and can be expanded. The local First Nations supported the old mine and were immediately interested in the idea of a restart.

On top of all that, the new Troilus team saw all kinds of reason to believe the Kennecott had left a lot of ounces behind.

That Troilus has grown the resource 142% in three years proves they were right. Importantly, most of the "new" ounces are near surface and so would be open pittable, which erases the project's other perceived stumbling block—the need for any new Troilus mine to be an underground operation. You can see in the 2016 image below how a lot of the resource was in lens extending down from the bottom of the old Z87 pit. Now, with a new team having drilled 85,000 meters in search of near-surface ounces, the resource starts at surface and stretches along almost 3 km of strike.

I mentioned "perceived stumbling blocks" above because they matter with old assets. And fair enough. Many a company has promoted the undiscovered potential of an old mine...for the potential to actually fall flat or for the issues that ended the old operation to resurface. So investors are often hesitant to believe that an old mine is indeed a good new opportunity.

It's up to the new management to prove their point: to find lots of new ounces and to demonstrate that the community is supportive and the metallurgy works and permitting will be ok.

Troilus has made great strides in this regard, starting with that huge ounce count increase, but I think the key step is coming: a preliminary economic assessment (PEA) that wraps a mine plan around the new ounces and shows that a new Troilus mine would make a lot of economic sense.

When that study comes out later this year, I think it will outline a large operation with a long mine life and low costs, all sitting in one of the best mining jurisdictions in the world. Some investors have already seen this shaping up, which is why TLG shares have more than doubled in recent months from their pre-COVID level.

But I think a PEA outlining just how large and profitable a new Troilus mine would be will attract a lot more attention to this stock. That's why I think the share price is set up to perform in the second half of 2020.

Then there's the exploration upside, which is significant, and the potential for a takeout, which is strong. Miners want big, long-life mines in good jurisdictions that are simple and relatively inexpensive to operate. It's tough to find projects that meet all of those criteria but Troilus does. As such I think Troilus will attract a takeover bid from a major miner during this bull market.

A big, open-pittable deposit in a top jurisdiction with ample infrastructure should support a very strong PEA. A strong PEA based on a big gold resource that just keep growing will reverse any lingering questions around reviving this old asset. That reversal will solidify Troilus' position as one of few big deposits that could—indeed should—get built this cycle. And that will boost TLG's value way above where it currently sits.

Revival Gold Inc. (RVG:TSX.V; RVLGF:OTCQB)

I like the Troilus story for its known gold, potential for scale, great jurisdiction, existing infrastructure, and ample exploration upside.

There are very few assets that check all of those boxes…but Revival Gold's Beartrack-Arnett project is another one that does.

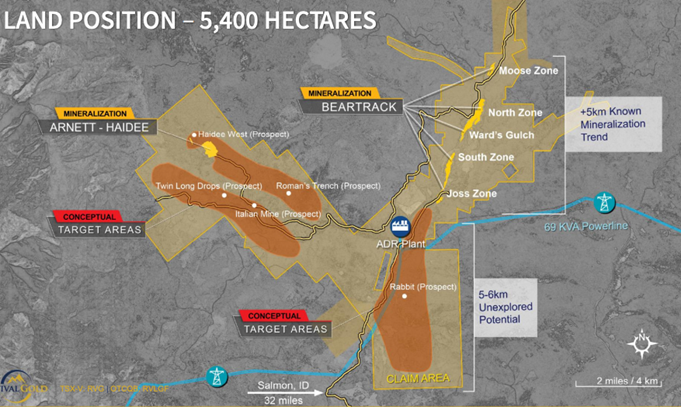

Beartrack-Arnett sit close to the Idaho-Montana border, near the town of Salmon. The Beartrack side of the asset operated as an open pit, heap leach mine from 1995 until 2000, producing 600,000 ounces of gold.

It shut down because gold prices tanked. The project then sat untouched for 16 years, until Revival came along.

Revival saw Beartrack as a project that deserved much more exploration attention around the mined pits and along strike to the south. And the team saw the opportunity for something bigger by adding on the Arnett side of the project, which has great prospective geology but had long been divided among a few families.

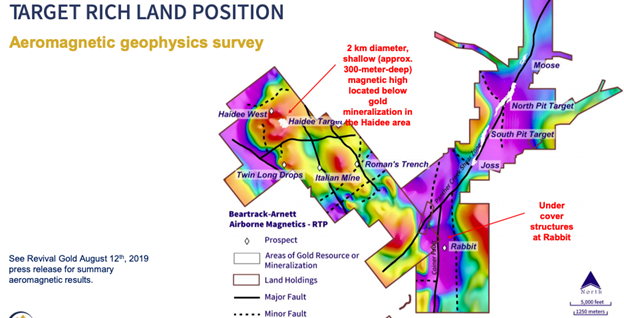

The project is in tan. Yellow on the map marks defined gold. The orange-brown areas are exploration targets. What's key to note is that the past operator only had the Beartrack (right) side of the project and only cared about oxide mineralization right around the known deposits. That means no one has looked for deeper sulphide gold anywhere on the property or for oxide gold on the southern half of Beartrack. At Arnett, meanwhile, fractured ownership means there has never been any big-picture exploration.

And yet this exploration opportunity is on ground on which 3.5 million ounces have been produced or delineated to date. Another unknown amount has been pulled from placer operations along its creeks.

The best place to find gold is where there's already gold. It's cheesy but it's so true. And that is what Revival is doing at Beartrack-Arnett.

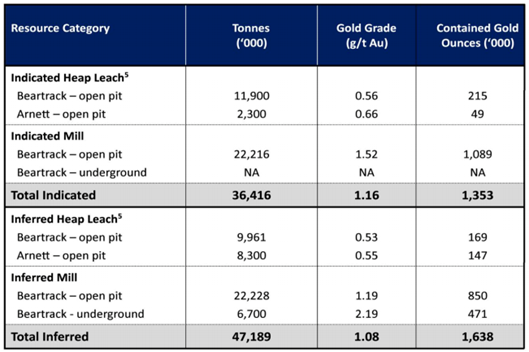

Revival started by using a smattering of deeper historic holes and its own initial drilling to demonstrate the abundance of gold still at this asset. The resulting resource is below:

There are open pit oxide ounces, open pit sulphide ounces, and underground sulphide ounces. It's not ideal to have three different "kinds" of mineralization in one resource but this resource wasn't meant to capture how much gold there is at Beartrack-Arnett.

The resource is just a starting point. And the exploration opportunity suggests there is way more gold to be found.

For instance, with a small drill program Revival outlined 200,000 ounces of oxide gold at the Haidee target on the Arnett side of the project, in rock averaging 0.6 g/t gold. That's a nice grade for oxide gold and it's pit constrained. In short, those are real ounces—and RVG just kicked off a second, a much larger drill program designed to expand that resource.

Then there's the sulphide situation. Beartrack already offers almost 2 million ounces of open pittable sulphide gold around the old pits. And, just like at Haidee, that's just the start of the sulphide opportunity. RVG defined that resource by testing safe targets right beside known or mined gold. Now, with time and groundwork under their belts, they are testing other targets along the gold-bearing shear zone that have never been drilled.

Rabbit is the first and it is getting tested right now. Rabbit is 2 km south of defined gold along the key Panther Creek Shear zone. It's never been drilled, or even sampled because the rocks don't outcrop, but geophysics and structures all point to it as a prime gold target.

Then there's Haidee. Revival is drilling to expand the oxide at Haidee now but there's also an enticing magnetic target just below (sulphide gold would show up that way).

Those are some of the targets. There is also strong opportunity to define ounces between the known deposits, test the 2 km of prospective strike between those deposits and Rabbit, probe the Twin Long-Italian Mine trend that runs parallel to Haidee, and keep drilling under the known gold at Beartrack.

In short, this project has produced gold, currently hosts over 2 million ounces of gold, and has oodles of potential for more gold. And it's being explored by a team that has every ability to turn this old asset into something great—and perhaps more.

Hugh Agro leads the Revival team. Agro is a mining engineer who spent 12 years as executive vice president of strategic development for Kinross. The impact here is significant: with operational leadership for growth initiatives, Agro was part of the executive team that grew Kinross from $1.7 billion to $17 billion in value in 12 years. He saw hundreds of projects in his time there…and Beartrack-Arnett is the one he chose for this mining cycle.

He chose it for geology, for sure, but also for jurisdiction (miners are in love with Idaho at the moment) and because this historical mine offers oodles of infrastructure and active permits.

The mine left behind a functional ADR plant (the facility that pulls gold from leach solution onto carbon columns and, after a few steps, turns it into gold bars) with an active cyanidation permit. There's a power line with inexpensive power and a well-maintained road. There's a huge core logging and storage facility. There's space and plans for a new heap leach pad. And the waste dumps and old heap leaches have been nicely rehabilitated, enough that they are often covered in grazing elk.

And the area is keen for the mine to restart. There's not a lot of economic activity in this part of Idaho save ranching, hunting and recreation. I asked people I encountered while there how they would feel about the Beartrack mine starting up again and got only positive responses.

This is an old mine where the legacy is indeed a major advantage.

And for all of this, you even get a tight share structure and a full bank account. RVG has only 70 million shares outstanding and has $15 million in the bank.

Finally: the team at RVG are miners and entrepreneurs who want to build another mid-tier mining company. Agro is open to being taken out, buying another asset, merging with a synergistic partner, or some other M&A deal—as long as it creates value for shareholders in this rising gold market. If you trust that vision, this is an inexpensive entry point into a company being built on one strong asset but with a larger view to grow with this gold market. Whichever way this plays out, I see ample low-risk upside in the Revival story.

Wrap Up

One of the great things about a strong gold market is that investors do not have to take on immense risk to get great rewards. As the gold price rises the market evolves: investors flock to companies with standout deposits, exploration upside and strong management for their growing tangible value and their takeout potential.

It's a low risk, high return setup, which is the ideal investment. Such stocks and projects are hard to find, of course, but they share certain traits:

- Known gold: exploration is to grow a good, known discovery and to test nearby targets.

- Scale: major miners buy big assets.

- Simplicity: miners like straightforward mines. Discoveries that can be open-pitted and then processed using conventional methods are preferred.

- Stable, pro-mining jurisdiction: Idaho, Quebec and Alaska in the right parts are just about as good as they get.

- Catalytic events ahead: HIGH is drilling to expand an incredible deposit and hopefully makes another discovery. Troilus is pushing towards a PEA to demonstrate that a new Troilus mine would make a lot of sense (and money), while drilling non-stop to keep growing the resource. Revival just kicked off its largest drill program (by far) at Beartrack-Arnett and will simultaneously prep a PEA that shows how economic the asset is already. These events are pending…which means the stocks are not fully valued yet.

- A rising gold market means increased M&A: major miners are short on ounces in the future. A focus on balance sheet strength means they haven't done a lot of deals yet…but when it starts the M&A action will ramp up as operators compete for the best projects. This will push investors into stocks they think majors will target.

Get the best of both worlds—growing foundational value and exploration excitement—from projects offering the suite of characteristics that majors want, that define clear value, and that are hard to find.

Gwen Preston is the Resource Maven. Her independent letter chronicles her thoughts, buys, and sells in the world of mineral exploration, development, and mining. Gwen has a strong network of contacts, almost 15 years of site visits and due diligence under her belt, a solid grasp of macroeconomics and how they shape metals price moves, and a track record of finding opportunity and managing risk in the metals and mining sector. Click HERE to sign up for a free trial subscription.

[NLINSERT]Read what other experts are saying about:

Resource Maven EDITORIAL POLICY AND COPYRIGHT: Companies are selected based solely on merit; fees are not paid. This document is protected by copyright laws and may not be reproduced in any form for other than personal use without prior written consent from the publisher.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Resource Maven (Maven) nor its affiliates assume any responsibility to update this information. Maven is not registered as a securities broker-dealer or an investment adviser in any jurisdiction. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Maven cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Maven in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Maven accepts no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Maven does not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites. Maven has not reviewed the Internet website of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website's users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of or may have participated in the financings of some or all of the companies mentioned in this publication.

Disclosure:

1) Gwen Preston: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Troilus Gold, HighGold and Revival Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Resource Maven disclosures above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Troilus Gold, HighGold and Revival Gold. Click here for important disclosures about sponsor fees. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Troilus Gold, HighGold and Revival Gold. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.