Sasquatch Resources Corp. (SASQ:CC;SASQ:CNX) is a Vancouver-based company that operates as a mineral exploration company in Canada. It holds an option to acquire a 100% interest in the Mount Sicker property with one contiguous block of 17 cell mineral claims covering 3,300 hectares located within the Victoria mining division of British Columbia, Canada.

The Birth of Sasquatch

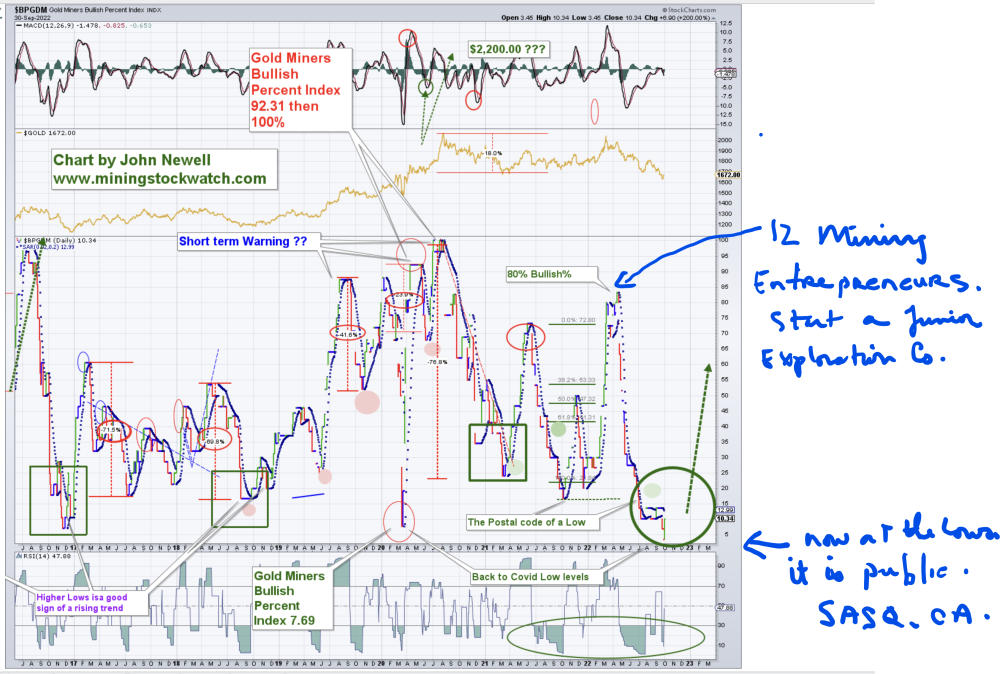

The company was formerly known as Scenc Resources Corp. and changed its name to Sasquatch Resources Corp. in May 2022. Whether it was business acumen, foresight, or just plain good fortune and luck, 12 businessmen realized that base metals and precious metals have been and continue to be in a major bull market, with, of course, sharp natural corrections along the way, wanted to further take advantage of the bull market and start a new company.

Some of the principals behind the company recently had a liquidity event in the recent takeover of Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX), a company they help start and funded early, so they wanted to do it again and deploy some additional capital in the space.

Now, with sentiment numbers back at the covid lows and investors less than 10% bullish, historically near the bottom of past corrections, the timing of the issue looks very advantageous.

Thus, was born Sasquatch Resources Corp, led by Mr. Peter Smith who helped build Less Mess storage from a new company to a half a billion-dollar company. Today he and the team are turning their attention to the undervalued metals sector.

The Plan

The thinking here is that copper-gold exploration is the least risky metal to look for in the high-risk mineral exploration business. Sure, strategic metals and battery metals are highly sought-after minerals, but to find them in economic grade and size is a very tough business.

The management at Sasquatch believes that the required metal for the new economy, the short supplied, copper is an easier exploration play in the vastly under-explored mineral belt of the Western Cordillera of central British Columbia and Vancouver Island, that long ago was part of the lower mainland and the south-central part of the province. The fact that the first project is a group of past producers hopefully further de-risks the project.

The market sentiment at the time the company was formed was bullish, and knowing that violent corrections can happen out of the blue and that they take some time to recover, the window of opportunity to build the company, get a first-class property, and list it would take about a year if everyone worked hard and the exchange listing went well the company would be listed at a potential corrective low.

Things did work out, and Sasquatch was listed under the SASQ:CA last month. Now, with sentiment numbers back at the covid lows and investors less than 10% bullish, historically near the bottom of past corrections, the timing of the issue looks very advantageous.

It is the belief of management that with the potential of metal-producing countries starting to trend toward more nationalistic policies toward their natural resources, supplies of these metals could shrink or become harder to source at today’s price levels.

With that in mind, the management believing the adage that the best place to look for a mine is near an old mine (as was the case with Great Bear Resources), they secured the past-producing Mt. Sicker property and surrounding four other past-producing properties, and for the first time in history, the land block was now held under one company.

The Mt Sicker area and property host five past-producing mines operated between 1890 and 1935 and now can be worked as one.

Sasquatch's Initial Goals

The company’s early initial goals are straightforward and a three-pronged approach.

1. Build a comprehensive exploration program on the whole land package of past-producing properties, now that they are all under one company, and use modern geological methods and techniques to thoroughly and systematically carry out modern exploration to see if there is a mineable deposit left behind. As was the case at Goldcorp, when after the Arthur White mine was depleted, under Rob McEwen’s leadership, they proved that another mine existed underneath the old mine and the life extended by 20 years and counting.

2. Mining has changed over the years and what is profitable today was not 100 years ago. The past producers at Mt Sicker and surrounding area miners left five waste dumps with ore grades of 4% plus copper and 8 grams of gold per ton that, in those days, were not profitable to mine. To earn near-term revenue to fund modern exploration, the company plans to engage a remediation company to assess the viability of processing the old high-grade waste and turning it into near-turn revenue. The waste dumps could hold as much as $25-$100 million in in-situ metal value. The other aspect of this is the company is picking up where the past producers left off, by the very act of dealing with and removing this “waste” could also help in restoring the streams and rivers in the area of high levels of metals in the runoff. The company has initiated the process to see if this is economically viable, with the same company that did the highly successful tailings recovery at Wallbridge Resources.

3. The management realizes that mining is risky and to make a company bet on one property, no matter how good the project, is risky, so the company also plans to search and find other similar types of properties in Canada. Currently, after covid and forest fires, many companies and prospectors are behind in property payments and or work commitments, so great properties with tremendous potential could be freed up soon. The management is constantly looking for opportunities in a buyers’ market.

4. Hidden goodwill in the company! For the past three years, the company’s prospector has been posting the results of his outstanding and prospecting work on his YouTube channel with 65,000 subscribers without revealing the property name as the staking was ongoing. Now that the company has finished its property purchase and ground, the prospector is finally going to reveal the name of the property, which so many listeners have been waiting for. Headlines: "Profitable mine remediation saves the Environment and also exposes 100k tonnes of high-grade ore."

Sasquatch currently has ~17,500,000 shares outstanding and ~$600,000 in cash. At least 70% are held by management and strong hands. The company shares SASQ:CA is thinly traded, so investors must be aware of this.

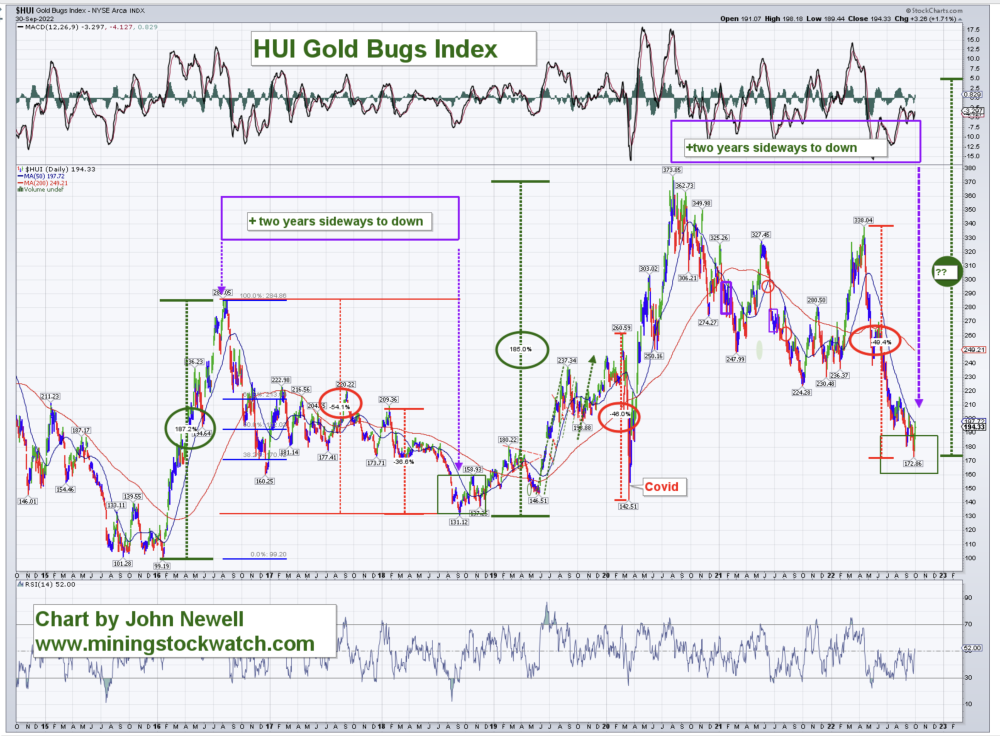

Could be the postal code of a low, after another punishing two-plus year correction? (See charts below.)

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) John Newell: I, or members of my immediate household or family and friends, own shares of the following companies mentioned in this article: Sasquatch Resources Corp. and Great Bear Resources Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None.

Additional disclosures/disclaimer below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sasquatch Resources Corp. and Great Bear Resources Ltd., companies mentioned in this article.