Clean copper producer Ero Copper Corp. (ERO:NYSE), which is engaged in mining and development operations in the established mining states of Bahia, Mato Grosso, and Pará in Brazil, yesterday announced "the discovery of a regional nickel sulfide system within the Curaçá Valley over an initial strike length of five kilometers."

The company advised that the newly found Umburana system displays multiple surface expressions of nickel mineralization that extend outward in all directions.

Ero Copper reported that it conducted first-pass drilling at two of the newly identified areas referred to as the VB and Lazaro (LZ) Zones.

The firm advised that initial drill results from Hole VB-17 at the VB zone intersected 16.5m (meters) of 1.37% Ni eq (nickel equivalent) consisting of 1.22% Ni, 0.17% Cu (copper), and 0.03% Co (cobalt). These results included one 3.8m segment measuring 3.92% Ni eq that consisted of 3.60% Ni, 0.22% Cu, and 0.09% Co, which included an even higher 1.5m interval of 7.11% Ni eq.

A second hole at the VB Zone, VB-25, returned 30.4m of 0.72% Ni eq that included 5.1m of 2.28% Ni eq. and a 1.4m interval of 5.30% Ni eq.

Ero Copper additionally reported data from three initial holes drilled at the LZ Zone. The firm indicated that Hole LZ-03 returned 24.1m of 0.97% Ni eq, Hole LZ-06 intercepted 22.5m of 1.02% Ni eq, and Hole LZ-07 intersected 17.7m of 1.14% Ni eq.

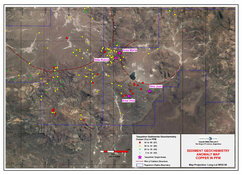

The company noted that the newly uncovered nickel system is called the Umburana system. Umburana is located about 20km from Ero's current Caraíba processing operations. The firm advised that it discovered this new system during its 2021 and 2022 exploration programs using detailed field mapping, soil geochemistry testing, and airborne electromagnetic surveys.

"We believe today's results confirm the Curaçá Valley's potential to be a globally significant magmatic sulfide district for both copper and nickel," CEO Strang added.

The firm stated that its "first-pass" drill program was comprised of 48 drill holes designed to target areas where ultramafic rocks were mapped at surface.

The company indicated that it has discovered nickel mineralization outcrops at surface and that there is evidence of continuation in trenches and below. Ero Copper noted that it is currently operating four exploration drill rigs at the site and that, so far, it has only drilled to vertical depths of about 300m.

Ero Copper's CEO David Strang remarked, "This is a significant and pivotal moment for the company and, more broadly, for the region. To think that copper in the Curaçá Valley was first documented in the late 1700s and we are just now discovering nickel sulfide mineralization not far from where copper has been mined for over 40 years is truly remarkable."

"We believe today's results confirm the Curaçá Valley's potential to be a globally significant magmatic sulfide district for both copper and nickel," CEO Strang added.

The company's Chief Geological Officermike Richard commented, "From my perspective, this is the most significant development in the Curaçá Valley's regional exploration program to date … Based upon results to date, we have good geological evidence to support the "key" signatures for nickel potential that we expect will vastly enhance our nickel exploration program in the months and years ahead."

Ero Copper Corp. is headquartered in Vancouver, B.C, and is focused on the exploration, development, and production of high-margin copper projects in Brazil. The company owns a 99.6% interest in Brazilian copper mining company CSA and is the sole owner of the Caraíbamining complex in the State of Bahia in Brazil. The firm also owns interests in underground and open pit copper mines in Pará, Brazil, and owns approximately 98% of NX Gold S.A., which is focused on production at a gold and silver mine in Mato Grosso, Brazil.

Ero Copper started yesterday with a market cap of around $938.2 million, with approximately 90.74 million shares outstanding. ERO shares opened 2% higher yesterday at $10.65 (+$0.23, +2.21%) over the previous day's $10.42 closing price. It traded between $10.65 and $11.42 per share yesterday and closed for trading at $11.18 (+$0.76, +7.29%).

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Stephen Hytha wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any companymentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees ormembers of their families, as well as persons interviewed for articles and interviews on the site,may have a long or short position in securitiesmentioned. Directors, officers, employees ormembers of their immediate families are prohibited frommaking purchases and/or sales of those securities in the openmarket or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.