Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) is a company to take note of, given it is delineating a gold-copper resource at one of its Chilean properties that is next to a large company and in a historically prolific mining district, reported Fundamental Research Corp. analyst Siddharth Rajeev in a July 28, 2022 research note. The Canadian explorer is also advancing two of its other projects in Argentina.

Rajeev described Golden Arrow's iron oxide copper-gold project in Chile, called San Pietro, and the company's near-term plan for it, currently being carried out.

The company is well-financed, such that it should be able to continue its work plans into 2024 without having to raise capital, Rajeev pointed out.

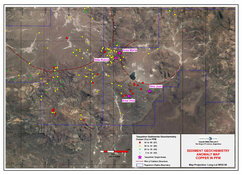

San Pietro spans 18,448 hectares in Chile's Atacama region, between two of Capstone Copper's projects, also iron oxide copper-gold deposits: Mantoverde, an operating open-pit mine, and Santo Domingo, in an advanced development stage, Rajeev said.

"We believe proximity to well-known projects is a major advantage as it can open doors for future mergers and acquisitions events if Golden Arrow is able to delineate an attractive resource estimate," added Rajeev.

Favorable Location, Significant Historical Data

About 34,000-plus meters of historical drilling has been done at San Pietro, the results of which identified four targets (Rincones, Radiss Norte, Rodeo, and Colla) and included numerous high-grade intercepts. Golden Arrow has not yet released this data.

What is known, though, Rajeev relayed, is San Pietro hosts multiple iron oxide copper-gold targets with potential for cobalt, Rincones being the highest priority one.

Work in Progress on Three Projects

After Golden Arrow acquired San Pietro earlier this year, it embarked in June on a field program there, which includes re-logging of historic drill cores, surface sampling, mapping, and geophysical surveys, wrote Rajeev. The company's current objectives there are twofold: develop a maiden resource estimate for the Rincones target, expected by 2024, and evaluate and advance the three other targets.

Rajeev pointed out that Golden Arrow has eight other exploration-stage precious metals projects, one in Chile and the others in Argentina, all located in historical mining districts. One active project is Libanesa, where the company recently completed a 1,700-meter drill program and is awaiting the results. At another of its projects, Flecha de Oro, Golden Arrow is continuing exploration work. Both Libanesa and Flecha de Oro are in Argentina.

The company is well-financed, such that it should be able to continue its work plans into 2024 without having to raise capital, Rajeev pointed out.

Exploration Data Expected Soon

The next catalysts for Golden Arrow are exploration results from San Pietro and drill results from Libanesa.

"As San Pietro will be Golden Arrow's primary near-term focus, we believe results of the ongoing exploration program are crucial," Rajeev noted.

Golden Arrow is currently trading at about CA$0.13 per share.

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Golden Arrow Resources Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures For Fundamental Research Corp, Golden Arrow Resources Corp., July 28, 2022

The opinions expressed in this report are the true opinions of the analyst about this company and industry. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our forecasts will materialize. Actual results will likely vary. The analyst and Fundamental Research Corp. “FRC” does not own any shares of the subject company, does not make a market or offer shares for sale of the subject company, and does not have any investment banking business with the subject company.

Fees were paid by GRG to FRC. The purpose of the fee is to subsidize the high costs of research and monitoring. FRC takes steps to ensure independence including setting fees in advance and utilizing analysts who must abide by CFA Institute Code of Ethics and Standards of Professional Conduct. Additionally, analysts may not trade in any security under coverage. Our full editorial control of all research, timing of release of the reports, and release of liability for negative reports are protected contractually. To further ensure independence, GRG has agreed to a minimum coverage term including an initial report and three updates. Coverage cannot be unilaterally terminated. Distribution procedure: our reports are distributed first to our web-based subscribers on the date shown on this report then made available to delayed access users through various other channels for a limited time.

This report contains "forward looking" statements. Forward-looking statements regarding the Company and/or stock’s performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company's products/services in the marketplace; acceptance in the marketplace of the Company's new product lines/services; competitive factors; new product/service introductions by others; technological changes; dependence on suppliers; systematic market risks and other risks discussed in the Company's periodic report filings, including interim reports, annual reports, and annual information forms filed with the various securities regulators.

By making these forward-looking statements, Fundamental Research Corp. and the analyst/author of this report undertakes no obligation to update these statements for revisions or changes after the date of this report. A report initiating coverage will most often be updated quarterly while a report issuing a rating may have no further or less frequent updates because the subject company is likely to be in earlier stages where nothing material may occur quarter to quarter.

Fundamental Research Corp DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULL RESPONSIBILITY FOR WHATEVER RESULTS THEY OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIAL ADVISOR BEFORE YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE, OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR SECURITY FOR INCLUSION IN YOUR PORTFOLIO.

This REPORT is solely for informative purposes and is not a solicitation or an offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise stated and HAVE NOT BEEN endorsed by the Management of the company which is the subject of this report. Additional information is available upon request.

The information contained in this report is intended to be viewed only in jurisdictions where it may be legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local regulations or which would require any registration requirement within such jurisdiction.