Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) has finished its diamond drilling infill and exploration program at its Wicheeda rare earth element (REE) deposit in British Columbia and is expecting assay results as soon as next month.

Noble Capital Partners analyst Mark Reichman rated the stock Outperform with a CA$0.70 target price.

The company has now begun geotechnical drilling to optimize the open pit slope design for the site, which it hopes will produce as much as 10% of the world’s light REEs to compete with China, which has about 85% of the world’s REE processing capacity.

Results from this year’s drilling and holes sunk last year will form the basis of a preliminary feasibility study (PFS) in early 2023.

“The Wicheeda project benefits from several competitive advantages, including an existing resource, a mining-friendly location, well-developed infrastructure, and a strong technical team,” Noble Capital Markets Senior Research Analyst Mark Reichman said in an updated note on August 10, 2022. “We anticipate interest in offtake agreements and/or strategic partnerships to grow as the company advances toward a PFS.”

Reichman rated the stock Outperform with a CA$0.70 target price.

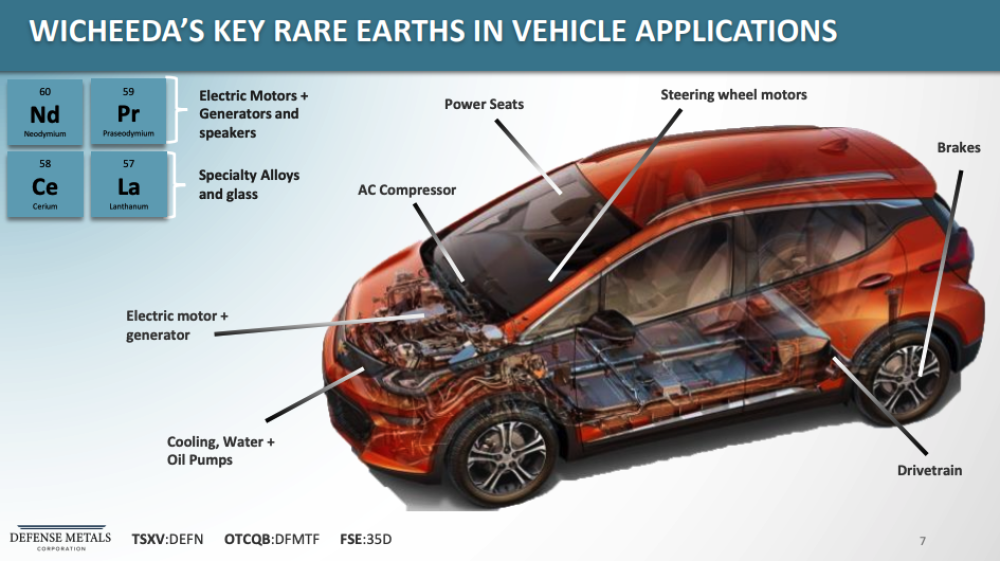

REEs are used in purifying water, MRIs, fertilizers, weapons, research, wind turbines, computers, and permanent magnet motors for electric vehicles, and the new green economy is demanding more of them.

“The issue is that China supplies most of these elements and related downstream technologies, making the rest of the world dependent on China,” Defense Metals President and Director Luisa Moreno told Streetwise Reports. “China-Taiwan-U.S. issues (put) the supply of rare earth metals at risk. Defense Metals will bring a sustainable and ethical supply of rare earth metals to the market.”

Timing Is Critical

A total of 12 diamond drilling holes reaching over 3,500 meters have been drilled so far this year within Wicheeda’s northern and central areas. A total of five geotechnical holes targeting the walls of the mine pit are planned.

The northern area of the deposit returned some of the highest-grade intercepts in 2021. Two holes returned 3.79% total rare earth oxides (TREO) over 150 meters, including 4.77% TREO over 60 meters extending 80 meters beyond the current mineral resource and 40 meters beyond the constraining pit shell.

This interval included 12 meters averaging 8.06% and contained the highest combined neodymium-praseodymium (NdPr) oxide value to date at Wicheeda of 1.41% NdPr oxide at 10% TREO.

The company is also testing an acid bake extraction process for the REEs that could lower capital and operating costs. High-temperature concentrated sulfuric acid is used to convert the REEs to water-soluble sulfates, which can then dissolve during a water leach. A precipitation process is then used to recover the REEs.

“It takes time to develop mines and supply chains. According to EV demand forecasts, the critical years are from 2027 onwards. We are hopeful to be able to supply rare earths to the market by then, as demand for critical materials picks up.”

—Defense Metals President and Director Luisa Moreno

The process is expected to allow for a more than 95% recovery rate for the REEs, compared to less than 90% with the alternative caustic cracking process. Testing for the new process will likely be finished by the end of the third quarter.

A preliminary economic assessment (PEA) for the project in 2021 showed an after-tax net present value of CA$512 million for Wicheeda. Its 43-101 technical report showed a 5 million tonne indicated resource at 2.95% TREO and a 29.5 million tonne inferred resource averaging 1.83% TREO from 4,000 meters of drilling.

Realizing the importance of the elements, the U.S. government in February announced a US$35 million grant to MP Materials Corp. to process REEs at its California facility. The company has agreed to invest US$700 million to create more than 350 jobs in the permanent magnet sector by 2024.

The timing of bringing these resources to market is critical.

“It takes time to develop mines and supply chains,” Moreno said. “According to EV demand forecasts, the critical years are from 2027 onwards. We are hopeful to be able to supply rare earth metals to the market by then, as demand for critical materials picks up.”

Three money managers — Marquest Asset Management, U.S. Global Investors, and Probity/Qwest Funds — own a small percentage of the company. The rest is retail.

Defense metals has a market cap of CA$34.84 million with 183.4 million shares outstanding, 140.3 million of them free floating. It trades in a 52-week range of CA$0.36 and CA$0.17.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Defense Metals Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Defense Metals Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp., a company mentioned in this article.