The beef industry has an environmental problem — more than 1.5 billion tons of manure created annually contributes to the contamination of surface water and rivers.

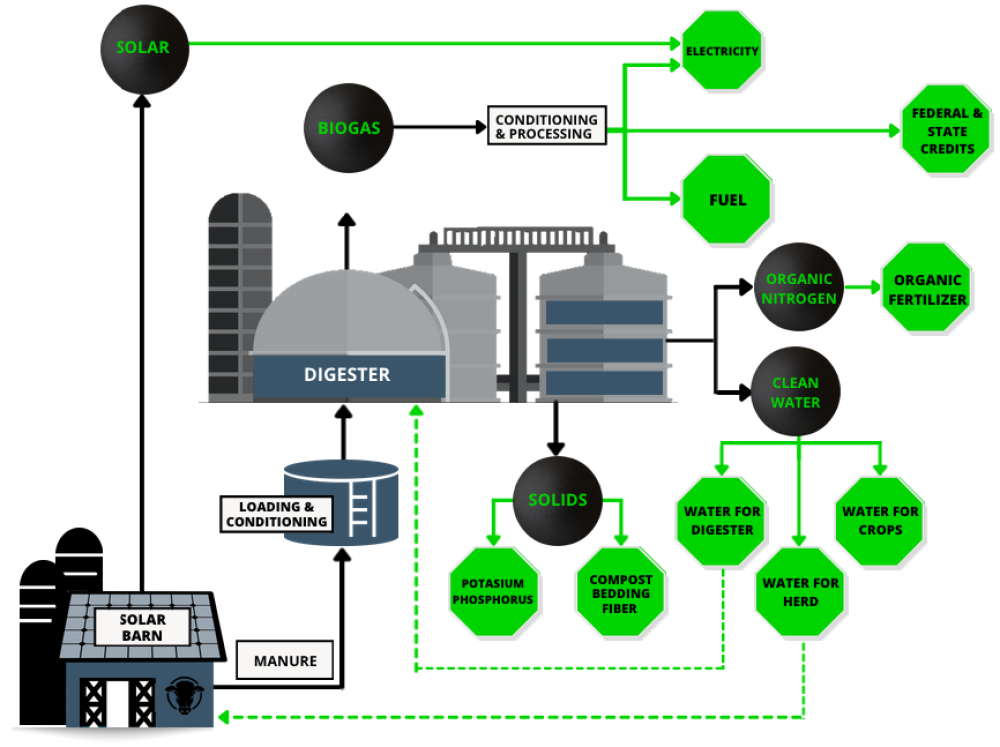

Bion Environmental Technologies Inc.'s (BNET:OTCQB) 3G Tech system transforms that waste into renewable natural gas, organic fertilizer, and clean water. And consumers get what they want, organic grain-fed meat with a pedigree they can trace back to the source.

Bion has signed a letter of intent with Ribbonwire Ranch in the Texas panhandle to build a 15,000-head beef cattle feeding operation using the technology with an option to expand to as many as 180,000 head a year.

Alliance Global Partners analyst Jeffrey Campbell initiated coverage on Bion August 3rd with a Buy rating and a target of US$3.00 per share.

“I just can’t imagine that it won’t take off and go big,” Ribbonwire Ranch co-founder Doug Lathem told Streetwise Reports. “There are going to be some struggles getting it all going. But without a doubt, to me, it’ll happen. And it’s going to change a lot of thinking in this part of the world, and really everywhere.”

On August 3, 2022, Alliance Global Partners analyst Jeffrey Campbell initiated coverage on Bion with a Buy rating and a target of US$3.00 per share.

Technical analyst Clive Maund had predicted a recent uptrend in the stock.

“Recommended ... at $1.05 in July, Bion Environmental Tech is now doing very well as it moves to break out of a gigantic multi-year Cup & Handle base,” Maund told Streetwise Reports.

Possibly giving the company a boost is a dip in the artificial meat market. Beyond Meat, earlier this month, lowered its revenue forecast for the year and said it will trim 4% of its workforce. Tests of its products at McDonald’s, Panda Express, KFC, Pizza Hut, and Taco Bell have yet to lead to a permanent launch.

Bion said meat produced through its system will help allay consumer conscience by creating a sustainable product that also does its part to improve the environment instead of hurting it.

“We’re going to give them the product that they grew up with, the product that they love, we’re just going to take the guilty away, just like Beyond Meat was trying to take the guilt away with a different product,” said Craig Scott, Bion’s director of communications.

Making Things 'A Lot More Profitable'

Right now, 1.5 billion tons of manure is generated annually, according to the company. Absent voluntary cleanup, regulation is coming.

According to the U.S. Environmental Protection Agency, livestock manure nutrients “have real value as a fertilizer” for farmers, gardeners, and landscapers.

However, untreated manure from animal feeding operations can contaminate surface water with pathogens such as E. coli, hormones, antibiotics, and chemicals like nitrates, phosphorous, and ammonia, the Centers for Disease Control stated.

Untreated waste can contribute to greenhouse gases such as methane, cause algae blooms and dead zones in bodies of water, contaminate groundwater, and contribute to antibiotic resistance, Bion said.

The 3G Tech system uses a specially designed barn and separately housed treatment system to apply biological, thermal, and mechanical processes to the animal waste, creating pipeline-quality natural gas, organic fertilizers, clean water, and clean air and water credits.

According to Bion, 136,500 tons of manure can produce more than 83,000 MMBTU of biogas, 9 million gallons of clean water, and 1.4 million pounds of organic fertilizer.

But the main product is blockchain-verified, sustainable, organic meat for the US$66 billion-a-year beef industry.

“We’re going to be making things a lot more profitable,” Chief Executive Officer Bill O’Neill told Streetwise Reports. “But in the meantime, we are actually helping to solve an environmental issue.”

A Bion facility has a capex of US$42.9 million, and adding solar installations on barn roofs increases that to about US$53 million, the company said. But recently passed investment tax credits in the U.S. Inflation Reduction Act for solar energy, anaerobic digesters, and the specialized barns and manure collection system Bion uses could help reduce that amount by as much as US$12.7 million.

O’Neill said Bion's technology can increase EBITDA by as much as 20 times, transforming “a very marginally profitable business (cattle feeding) into a lucrative one by adding several significant revenue streams to their business.”

With or without the government incentives, Chris Temple, editor and publisher of The National Investor said he thinks the time for the company’s concept has long since come.

“There is very clearly a need, especially if you get into larger sized farms, to find better and more efficient ways to keep a vital industry providing food for us all from doing a lot of environmental damage,” Temple told Streetwise Reports.

Catalysts Expected Soon

Transparency and brand premium will be key, O’Neill said. The animals and their lifecycles are tracked from the barns to retailers’ counters and will be scannable by consumers.

Then “the consumer knows what they get,” including where the animals came from and their diet, Lathem said. “Nobody has been doing that on the scale that these guys want to do it.”

That, combined with its sustainability, could help meat companies repair their image in the eyes of consumers.

Bion expects to announce a major catalyst as soon as next month, such as a new distribution agreement, offtake agreement, or partnership.

Bion expects to announce a major catalyst as soon as next month, such as a new distribution agreement, offtake agreement, or partnership.

Ribbonwire Ranch co-founder Chad Schoonover said they are definitely “sold on it” when it comes to Bion’s approach.

“The cattle are kind of a bad guy right now, as far as the waste stream is concerned,” Schoonover said. “Any step we can take to get ahead of what’s coming, I think from an investment standpoint, is going to be huge.”

Reuters reports that Chief Operating Officer Dominic Bassani and his family own about 32% or 13.76 million shares, and Christopher B. Parlow owns around 14% or 6.26 million shares. Other institutional shareholders include Centerpoint Corp., Howard Capital Management, Independent Financial Partners, and Litman Gregory Asset Management LLC.

Bion has a market cap of US$65.19 million, 43 million shares outstanding, about 88 million fully diluted, and 17.8 million shares free floating. It trades in a 52-week range of US$1.80 and US$0.80.

| Want to be the first to know about interesting Agriculture and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Bion Environmental Technologies Inc. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Bion Environmental Technologies Inc., a company mentioned in this article.