It has been quite a while since I have come out with a new pick in the gold sector. In my last update on gold on August 12, 2022, I said, “Most likely and what I expect is a pullback to around $1760 and start to rally again.”

I commented I was waiting for a pullback to at least $1760 and wanted to see if gold could make a higher low or maybe a double bottom. Gold is up today, so perhaps we have the pullback I was looking for, and we are headed back up.

Perhaps this is just a blip, and we will still head lower. I don't think it will matter much when we can buy a solid, growing junior producer that gives a 5.5% dividend.

The historical average yearly return of the S&P 500 is 9.07% over the last 150 years, as of the end of July 2022.

This assumes dividends are reinvested. Adjusted for inflation, the 150-year average return (including dividends) is 6.82%.

The S&P 500 hasn’t been around for 150 years. The S&P 500 started in 1957. Prior to this, it was the S&P 90, which was introduced in 1928.

Prior to this, other data sources were used.

US Stock Market 150-Year Average Return

|

Annualized Return (including dividends) |

9.07% |

|

Annualized Return (including dividends) Inflation Adjusted |

6.82% |

|

Annualized Return (no dividends) |

4.53% |

|

Annualized Return (no dividends) Inflation Adjusted |

2.37% |

The point, historically, about half the long-term return is dividends 4.53% versus 9.07% without dividends.

In the last 20 years, with the onslaught of the internet and big tech stocks, the dividend return is much lower because these tech companies that are leading the S&P performance, in general, do not pay dividends.

This is one of the two main reasons I started my Millennium index in 2020. I also knew we were headed for a period of low-interest rates, so there would be poor returns on interest-bearing investments.

I strive to keep the yield in the index above the historic average and have basically been keeping the yield in the index between 5% and 6.5%. Currently, it is at 5.1%, and our return so far in 2022 is +27% far far out-beating the markets.

I know I am repeating myself, but I cannot stress enough the importance of a good portion of your portfolio in dividend stocks. And this brings me to today's pick, where we can enjoy a good dividend while waiting for a market turnaround.

GCM Mining Corp.

GCM Mining Corp. (TPRFF:OTCMKTS) has 97.6 million shares outstanding and a Dividend yield of 5.5%.

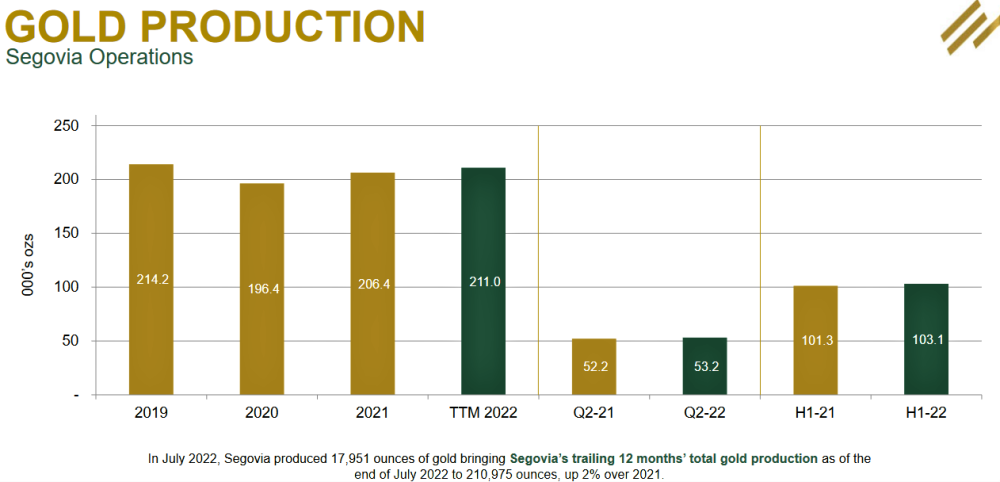

GCM Mining runs a very profitable high-grade mine in Colombia called Segovia. In the last 11 years, under GCM, it has produced over 1.5 million ounces of gold with an average head grade of 13.6 g/t and in 2021 produced 206,389 with an average head grade of 12.8 g/t.

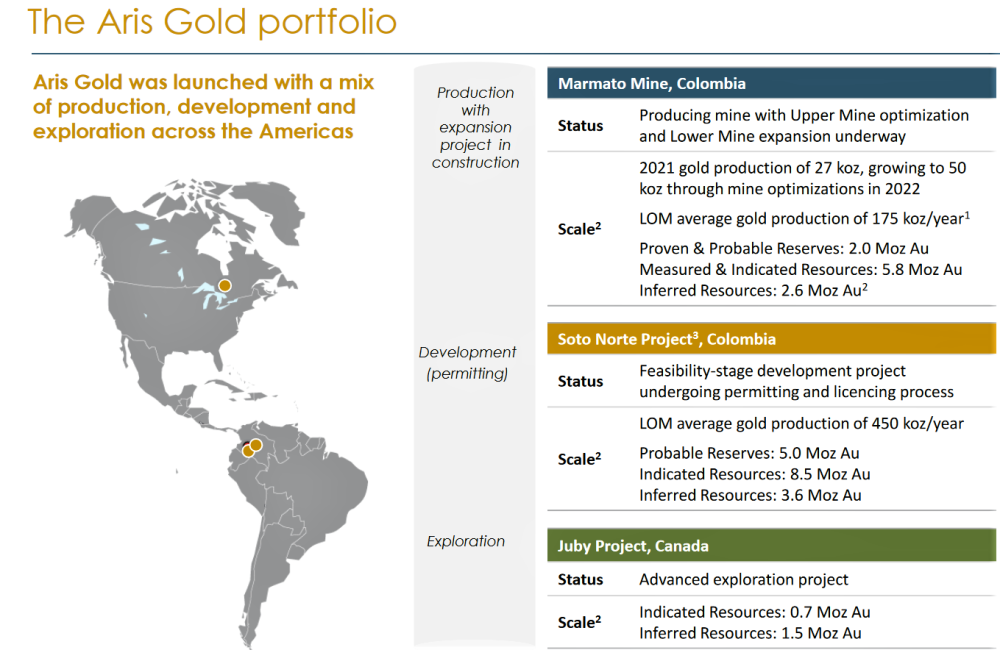

On July 25, GCM Mining and Aris Gold agreed to an all-share deal that would create the largest gold miner in Colombia and one of the bigger producers in the Americas. It is also going to result in a very strong management group with much Latin American experience.

The agreement would see GCM Mining acquire all of Vancouver-based Aris Gold's shares that it does not already own through an exchange at a ratio of 0.5 of a common share of GCM Mining for each common share of Aris Gold.

At close, GCM Mining would own 74% of the combined company, which will be named Aris Gold Corp. Ian Telfer, chairman of Aris Gold, will be the chairman of the new company. Aris chief executive officer Neil Woodyer will head the new company.

Some of you may remember Serafino Iacono from Pacific Stratus, who is the executive chairman of GCM. He has over thirty years of experience in capital markets and public companies and has raised more than four billion dollars for numerous natural resource projects internationally.

He is currently a director and chairman of Western Atlas Resources Inc. and a former co-chairman. He is also an executive director of Pacific exploration and production corporation and the former director of Petromagdalena Energy Corp. Mr. Iacono was also a co-founder of Bolivar Gold Corp and Pacific Stratus Energy, among others, and is involved in numerous resource and business ventures in Latin America, Canada, and theUnited States. He is also a director of Aris.

Ian Telfer is well known and a mining guru. He is the former chairman of Goldcorp Inc. and the World Gold Council. He is the co-founder, director, and a major shareholder of Renaissance Oil Corp. As one of the most influential businessmen in the Canadian financial community, Mr. Telfer has been recognized with special achievement awards by various organizations.

Neil Woodyer is the founder and CEO of both Leagold Mining and Endeavour Mining. He has an extensive history in the mining sector, creating growth strategies, implementing financing plans, leading management teams, and creating shareholder value.

In 1988, Mr. Woodyer was the founder of Endeavour Financial, a successful mining merchant banking, and advisory business. In 2009, he and Frank Giustra devised Endeavour’s growth strategy, and as CEO, he led Endeavour Financial’s transition from a financial company into a mine operations and development company, Endeavour Mining.

Endeavour Mining grew through a series of acquisitions, and new mine builds to become one of the largest gold producers in West Africa. In early 2020, after he arranged Leagold Mining’s merger with Equinox Gold, Mr. Woodyer — along with other team members — created Aris Gold to repeat the shareholder value strategies that had previously proven successful at Endeavour Mining and Leagold Mining.

And if that was not enough, Frank Giustra is a strategic advisor to Aris. He was a founder and director of Wheaton River, which became Goldcorp, as well as a director of Endeavour Mining from 2013 to 2016, chairman of Endeavour Financial from 2001 to 2007, chairman of Leagold Mining from 2016 to 2020, and the former CEO of Yorkton Securities.

Basically, we have an all-star team here that, over time, will create a lot of shareholder value which will have more market visibility, trading liquidity, and access to capital with the merged company. It also eliminates cross-ownership because GCM already owned 44% equity interest in Aris.

The combined assets have the potential to drive a top-of-class growth profile: Segovia Operations (206 koz/yr in 2021), Marmato Mine (175 koz/yr 3 ), Toroparu Project (225 koz/yr 3 ) and Soto Norte Project (50% of 450 koz/yr5 ).

Total measured and indicated resources are peer-leading at 18.3 Moz.

This slide from GCM's presentation highlights current and historic production at Segovia. However, there are two important developments. The mine is expanding to 2,000 tpd from 1,500 tpd in August, so throughput and production will rise.

A new polymetallic recovery plant constructed in 2021 at Segovia has been in steady operation through the first half of 2022 and is expected to commence sales of stockpiled zinc and lead concentrates under an offtake contract with an international customer commencing in the third quarter of 2022.

This will be a considerable new source of revenue.

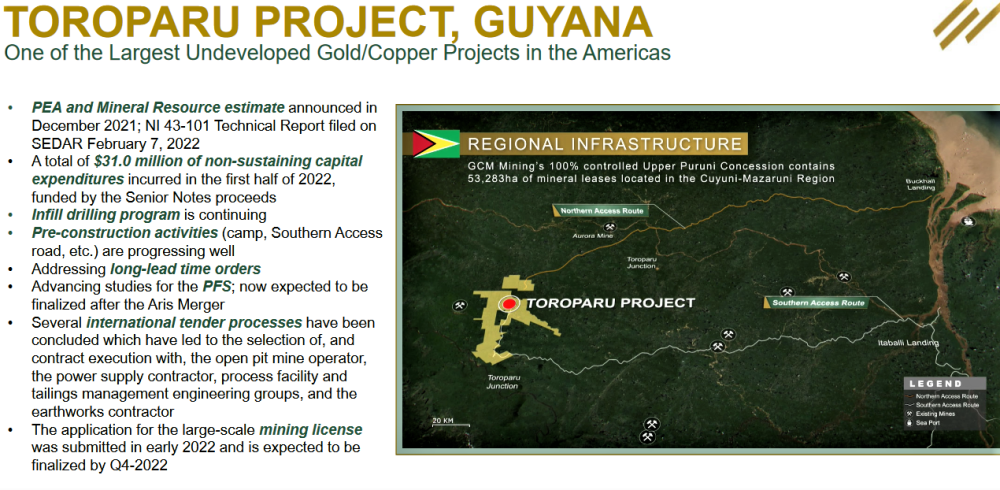

GCM owns the Toroparu Project in Guyana, which contains 8.4 million ounces of gold M&I with 396,000,000 pounds of copper. GCM incurred a total of $31.0 million of non-sustaining capital expenditures NG in the first half of 2022 in connection with its investment in the Toroparu Project in Guyana.

GCM owns the Toroparu Project in Guyana, which contains 8.4 million ounces of gold M&I with 396,000,000 pounds of copper. GCM incurred a total of $31.0 million of non-sustaining capital expenditures NG in the first half of 2022 in connection with its investment in the Toroparu Project in Guyana.

At this time, the company is well advanced in the various activities, including additional infill drilling, to advance the studies for the Toroparu Project to a PFS-level technical report.

In light of the proposed Aris merger, it is now expected that the PFS will not be finalized until after the closing of the transaction.

Financial

GCM is in great financial shape with strong liquidity and capital resources at the end of the first half of 2022 with a cash position of $265.5 million and future advance deposits amounting to $138.0 million still expected to come under the Wheaton PMPA that came with the Gold X acquisition to fund the construction of the Toroparu Project in Guyana.

GCM's long-term debt as of June 30, 2022, consisted of the $300.0 million principal amount (carrying value of $296.9 million, including $8.1 million of accrued interest) of the Senior Notes and the CA$18.0 million principal amount (carrying value of $14.0 million) of Convertible Debentures.

Other than the payment of interest, neither of these debt instruments require any other payments, including principal, in the next 12 months. In Q2, announced on August 8, 2022, consolidated revenue amounted to $101.4 million in the second quarter of 2022, up 5% over the second quarter last year on the strength of the production increase and a 3% increase in realized gold prices, bringing revenue for the first half of 2022 to $202.7 million, up from $198.3 million in the first half of 2021 (which included $5.1 million from Aris prior to the loss of control of Aris on February 4, 2021).

Adjusted EBITDA NG amounted to $45.9 million for the second quarter of 2022 compared with $48.0 million in the second quarter of last year. For the first half of 2022, adjusted EBITDA amounted to $91.1 million compared with $94.3 million in the first half of last year.

This brings the trailing 12 months' total adjusted EBITDA at the end of June 2022 to $168.4 million compared with $171.6 million in 2021. Net cash provided by operating activities in the second quarter of 2022 increased to $31.5 million from $12.8 million in the second quarter last year, benefiting from the receipt of pending VAT refunds from 2021 and lower income tax payments this year.

For the first half of 2022, net cash provided by operating activities was $55.7 million compared with $26.4 million in the first half of last year (which was a net of $10.1 million used by Aris prior to the loss of control in early 2021).

This brings the trailing 12 months' net cash provided by operating activities at the end of June 2022 to $109.9 million, up from $80.6 million in 2021.

GCM is paying a dividend of $0.015 per month or 18 cents per year.

For the first half of 2022, the dividend amounted to $7 million in payments to shareholders, so $14 million for the year.

You can see above that GCM has plenty of cash flow to cover this.

Also, consider that cash flow will increase with the mine expansion and the selling of zinc in lead in the second half of 2022 from the new polymetallic plant.

The Aris acquisition will bring a producing mine, Marmato, that is ramping up to 50,000 ounces per year and an advanced project Soto Norte, both in Colombia.

The shareholder meeting on the acquisition is on September 19, 2022, and the merger is expected to close by the end of September.

Currently, GCM has 1.6 million ounces M&I at their Segovia mine and 8.4 million ounces at Toroparu, for a total of 10 million.

The current market cap is $3.30 X 97.6 = $322 million plus $35 million (300M debt – 265M cash) for an enterprise value of C$357 million or US$ $275 million. This equates to a value of $27.5 per ounce of M&I gold resources.

Very very cheap!

The chart setup is near perfect. There is no good reason why this stock has come down to the 2020 Covid crash levels or to lows not seen since 2019.

Sure, gold has corrected about $230 from highs earlier this year, but it is still $250 higher than the March 2020 lows and $450 above the 2019 lows, around $1280.

The stock is yielding 5.5% and is screaming at you as buy buy buy.

We have a double bottom recently that is also the lows of the 2020 Covid crash and also the 2019 lows.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Struthers Stock Report Disclaimers

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate.

The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information.

Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Disclosures

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company release.