Awakn Life Sciences Corp. (AWKN:NEO; AWKNF:OTCQB) was the subject of an email alert before the opening yesterday that read as follows…

”There is big news out on AWAKN this morning that is thought likely to get the stock moving. The chart shows that, after its retreat of recent weeks, it may be double bottoming with its late June lows. Rated an immediate speculative buy at or soon after the open this morning. We will review its chart later in an article with links to the news.

Awaken Life Sciences Corp. closed at CA$0.53, $0.42 on 12th August.”

In the event the stock opened up CA$0.02 but then went on to close up CA$0.09 cents for a good percentage gain on the day, so it was worth buying it early. The reason that the stock rose in big volume was the big news that Awakn licensed AUD therapy treatment to Revitalist and the stock started to turn last month in anticipation of the very positive news that the company is to receive 66% funding support from the UK government for the development of its ketamine-assisted therapy treatment for alcohol use disorder (AUD). This big government support for a Phase 3 trial is believed to be a “first.”

Here is an article that provides fundamental background on the company entitled Healthcare Co. Enters US Alcohol Addiction Treatment Market. Amongst the points of interest in this article, we see that there are 27 million shares in issue, and importantly all but 6 million of these are tightly held. Another positive is that the company is aiming to get listed on the NASDAQ market, which will, of course, broaden its appeal.

One potentially worrying point is that it indicates that the company will soon need to raise money, but with regards to this, the price of any funding is likely to be close to the current stock price, and it is thought likely that it will be oversubscribed, and the prospect of funding may explain the current low price of the stock, a situation which is therefore thought to present a buying opportunity.

Another brief but interesting article on the company appeared just yesterday entitled Co. Pursuing Ketamine for Addition Forms Partnership.

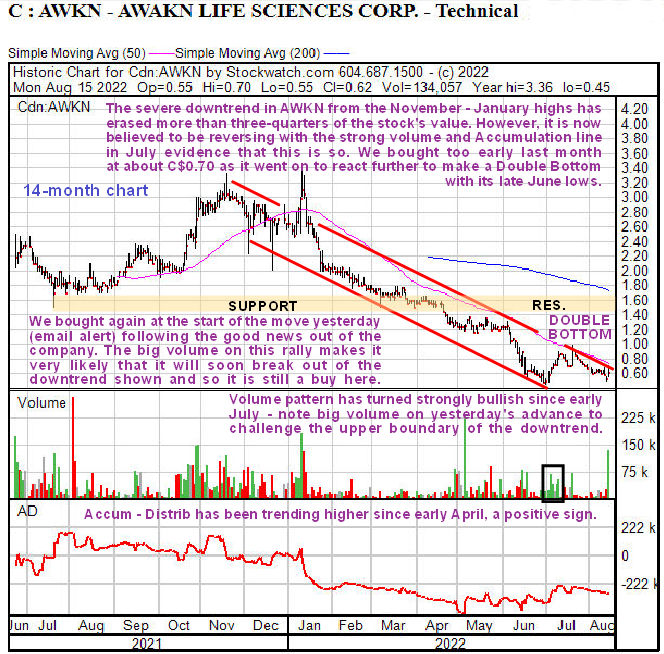

On the latest 14-month chart, we can see that we were a little too enthusiastic about buying it at about CA$0.70 at the time of the July news release as it then went on to react back toward its early July lows, so it seems it wanted to make a Double Bottom with those lows.

It didn’t quite get to these lows and now doesn’t look like it will after yesterday’s good news and rally. However, it now looks like we bought it again at a very good point yesterday after the open as it closed well up on big volume, and it is worth noting that it rose on its biggest volume since January on the U.S. market.

As we can see, it is now within a whisker of breaking out of the downtrend in force from last November through January, and yesterday’s price/volume action suggests that it will soon do so.

In conclusion, a glance at the chart shows that there is still everything to go for with AWAKN as it is now in a position to break out of its downtrend into a new bull market, and since it closed off its highs yesterday, it is still at a very good entry point, and thus it continues to be rated a strong buy here.

AWKN Life Sciences Corp website.

AWKN Life Sciences Corp. closed at CA$0.62, $0.53 on August 15, 2022.

Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Awakn Life Sciences Corp. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Awakn Life Sciences Corp., a company mentioned in this article.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.