In vitro diagnostics firm Accelerate Diagnostics Inc. (AXDX:NASDAQ), which specializes in the development of rapid in-vitro diagnostics in microbiology, today announced it has entered into a worldwide commercial collaboration agreement with global medical technology company Becton, Dickinson and Co. (BDX:NYSE).

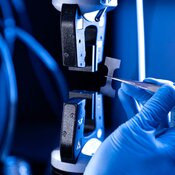

Under the agreement, BD will aid in the marketing and distribution of Accelerate's innovative and advanced rapid testing solution for antibiotic resistance and susceptibility. Accelerate's offerings can return results within hours, compared to traditional laboratory methods, which often take up to one to two days.

The agreement stipulates that "BD will market and sell the Accelerate Pheno® system and Accelerate Arc™ module and associated test kits through its global sales network in territories where products have regulatory approval or registration." This new line of products is expected to be well aligned and highly complementary with BD's current clinical microbiology portfolio, and both companies shared objectives to address the global threat presented by antimicrobial resistance.

BD's President of Integrated Diagnostic Solutions, Brooke Story, remarked, "When a patient is very sick, every minute matters…Rapid testing can quickly determine if an antibiotic should be used for treatment, and if so, which one."

"Through our collaboration with Accelerate Diagnostics, we can help clinicians more quickly, efficiently, and effectively treat patients, which may lead to a reduction in health care costs and help slow the spread of antimicrobial resistance," Story added.

The report stated that "the Accelerate PhenoTest® BC kit is the first test cleared by the U.S. Food and Drug Administration (FDA)." The kits can deliver "rapid identification and phenotypic antibiotic susceptibility results in hours direct from positive blood cultures," which enables medical staff to more quickly select the appropriate antibiotic and dosage for the patient, which ultimately serves to improve patient outcomes.

Accelerate Diagnostics' President and CEO Jack Phillips commented, "With BD's large installed customer base of clinical microbiology systems, this collaboration exponentially increases our global commercial reach and provides numerous ways to increase our market penetration with Pheno and Arc to reach more clinicians and patients."

In a separate news release today, Accelerate Diagnostics Inc. reported financial and operating results for the second quarter of 2022 ended June 30, 2022.

CEO Phillips stated that "the hospital selling environment is improving, and we are firing on all cylinders in R&D and are taking meaningful steps to improve our balance sheet."

The company advised that during Q2/22, it added eight contracted instruments and brought three instruments live in the U.S. market. The firm noted that with these additions, it now has a total of 316 U.S. clinically live and revenue-generating instruments, along with another 78 U.S. contracted instruments in process of being implemented, which are not yet generating revenue.

The company reported that in Q2/22, net sales increased by 39% to $3.9 million, compared to $2.8 million in Q2/21. The firm indicated that the growth was due to increases in both capital and recurring revenues.

For Q2/22, Accelerate posted a net loss of $17.8 million, or a net loss of $0.23 per share.

Accelerate listed that at the end of this most recent quarter, it had cash and other highly liquid assets totaling $36.8 million.

Accelerate Diagnostics is an in vitro diagnostics firm headquartered in Tucson, Ariz., that is focused on providing solutions that address ongoing global challenges of hospital-acquired infections such as antibiotic resistance and sepsis. The company indicated that its fully automated platform offers rapid identification and antimicrobial susceptibility results and is the only FDA-approved solution for use in positive blood culture samples.

Becton, Dickinson is a large $75 billion market cap global med tech co. with over 75,000 employees. The company develops and provides medical discovery, diagnostics, and healthcare technology services and solutions that help advance clinical therapy and processes for both patients and providers.

Accelerate Diagnostics began the day with a market cap of around $168.4 million with approximately 79.44 million shares outstanding and a short interest of about 6.81%. AXDX shares opened 13% higher today at $2.40 (+$0.28, +13.21%) over Friday's $2.12 closing price. The stock has traded today between $2.31 and $2.73 per share and is currently trading at $2.65 (+$0.53, +25.00%).

| Want to be the first to know about interesting Life Sciences Tools & Diagnostics investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosure:

1) Stephen Hytha wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.